- Home

- »

- Consumer F&B

- »

-

Hummus Market Size, Share & Growth Analysis Report, 2030GVR Report cover

![Hummus Market Size, Share & Trends Report]()

Hummus Market Size, Share & Trends Analysis Report By Product (Classic Hummus, Roasted Garlic Hummus, White Bean Hummus, Black Olive Hummus), By Packaging, By Distribution Channel, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-483-9

- Number of Report Pages: 80

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Consumer Goods

Hummus Market Size & Trends

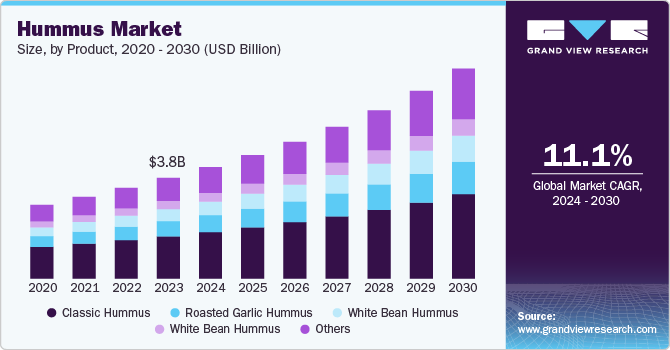

The global hummus market size was estimated at USD 3.85 billion in 2023 and is expected to grow at a CAGR of 11.1% from 2024 to 2030. The market is experiencing robust growth, driven by several key factors that reflect changing consumer preferences and lifestyle trends. This expansion is primarily driven by increasing health consciousness among consumers, who are gravitating towards nutritious, plant-based foods. Hummus, rich in protein and fiber, has become a favored option for those adopting vegetarian and vegan diets, further fueled by the rising awareness of its health benefits. This trend is particularly pronounced among millennials and health-focused individuals who seek convenient yet nutritious options in their diets.

Another notable trend is the diversification of flavors and product offerings. Classic hummus remains popular due to its versatility, but there is a growing demand for innovative varieties such as roasted garlic and red pepper hummus, appealing to adventurous palates13. The convenience of ready-to-eat hummus products available in supermarkets and online platforms has also contributed to its widespread adoption.

Moreover, the growing popularity of plant-based diets has significantly contributed to the market's expansion. As more consumers adopt vegan or vegetarian lifestyles, hummus has emerged as a staple due to its versatility and health benefits. The product's appeal is further enhanced by its ability to serve as a flavorful accompaniment to various dishes, making it a preferred choice for those looking to enhance their meals with healthy ingredients.

The rise of e-commerce and digital shopping platforms has also played a crucial role in the hummus market's growth. With increasing internet penetration, consumers are now more inclined to purchase food products online, benefiting from the convenience of home delivery and a wider variety of options. This shift has prompted traditional retailers to enhance their online presence, thereby expanding their reach and catering to the evolving shopping habits of consumers.

In addition, mass merchandisers have become significant players in the distribution of hummus. These retailers offer attractive discounts and promotions on bulk purchases, which not only incentivizes consumers but also ensures that they have access to fresh and high-quality products. As these stores continue to dominate the market share, they are expected to further drive sales growth through enhanced shopping experience.

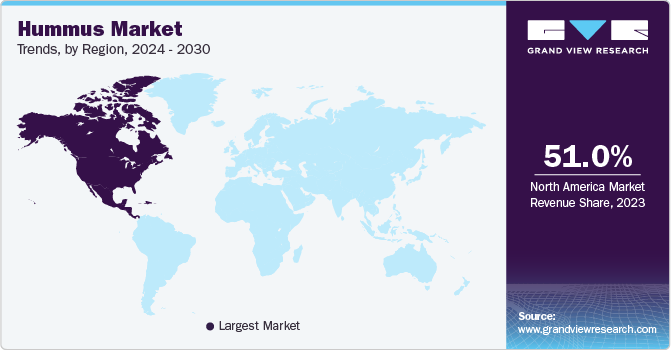

Regional dynamics also influence the hummus market. Asia Pacific is anticipated to witness the fastest growth due to urbanization, rising disposable incomes, and an increasing acceptance of diverse culinary practices. Countries like India, Australia, and China are leading this trend as consumers become more adventurous with their food choices.

The market faces several significant restraints that could hinder its growth trajectory in the coming years. One of the primary challenges is product adulteration, which has emerged as a major concern. Reports of contaminated hummus, often due to the inclusion of harmful artificial ingredients or improper labeling, have led to product recalls and a decline in consumer trust. For instance, notable cases of salmonella contamination and undeclared allergens have prompted recalls from major brands like Sabra and Wegmans, negatively impacting consumer confidence and sales in the industry.

The increased competition from alternative plant-based dips, such as tahini and salsa, poses another challenge. As consumers explore diverse options for healthy snacking, these alternatives may divert attention and sales away from hummus products.

Product Insights

Classic hummus was the largest product category for the market with revenue of USD 1.62 billion in 2023. The biggest driver for classic hummus is its versatility. It can be used as a dip, spread, or ingredient in various dishes. This adaptability makes it a staple in many households and a popular choice in restaurants and food service establishments. Its familiar taste resonates with a broad audience, contributing to its sustained popularity across diverse culinary contexts.

The increasing globalization and appreciation for Middle Eastern cuisine have led to a rise in the availability and consumption of classic hummus worldwide. As cultural exchanges expand, classic hummus has found its way into grocery stores and menus globally, further solidifying its market presence.

Manufacturers are responding to consumer demands by introducing innovative flavors and healthier ingredients into their hummus products. This includes the incorporation of organic ingredients and enhancements such as flaxseed oil to boost nutritional value. The continuous innovation in flavors also appeals to adventurous consumers looking for new culinary experiences.

The expansion of distribution channels, particularly through mass merchandisers and online platforms, has made classic hummus more accessible to consumers. This increased availability is crucial as it aligns with the rising trend of snacking and the demand for convenient food options.

Roasted garlic hummus and white bean hummus are some of the other popular hummus categories available in the market. Hummus, particularly varieties like roasted garlic, is rich in vitamins, proteins, and minerals, making it an attractive choice for health-focused diets. Additionally, the demand for unique flavors is propelling the roasted garlic segment specifically. Consumers are eager to explore new taste experiences, and roasted garlic offers a milder, sweeter alternative to raw garlic, appealing to a broader audience. The global shift towards veganism has significantly impacted the demand for plant-based foods.

White bean hummus serves as an excellent alternative to traditional dairy dips, catering to the needs of vegan consumers who prioritize nutrient-dense snacks. Advancements in packaging are another important reason for market growth. Advanced packaging technologies, such as Modified Atmosphere Packaging (MAP) and vacuum sealing, have been instrumental in extending the shelf life of white bean hummus without compromising its quality. These methods help preserve freshness and flavor, addressing concerns related to perishability and food waste. By maintaining product integrity over longer periods, brands can reduce logistical challenges and improve customer satisfaction.

Lentil hummus is one of the fastest growing types of hummus globally. The current market for lentil hummus is small as compared to the other variants, it has tremendous potential for growth over the forecast period. Increasing consumer awareness of the health benefits associated with lentils plays a significant role in the rising demand for lentil hummus. Lentils are recognized for their high protein and fiber content, making them a nutritious alternative to traditional chickpea-based hummus. As consumers become more environmentally conscious, there is a growing preference for clean-label and sustainable food products. Lentil hummus is often viewed as a more sustainable option compared to other types of hummus, as lentils require less water and resources to grow than many other crops.

Distribution Channel Insights

Supermarket and hypermarkets were the most preferred distribution channel for the hummus market and are expected to account for over 55% of product sales. Supermarkets serve as a crucial distribution channel for hummus, driven by several factors that enhance consumer accessibility and market growth. Firstly, supermarkets attract high foot traffic, providing brands with the opportunity to reach a large and diverse audience. This extensive reach is complemented by strategic product placements, where hummus is often featured prominently on shelves, making it easy for consumers to discover various flavors and types.

Additionally, the convenience of one-stop shopping in supermarkets allows consumers to purchase hummus alongside other grocery items, integrating it into their regular shopping habits. Supermarkets also typically offer competitive pricing and promotional deals, which appeal to cost-conscious shoppers and encourage bulk buying. The availability of fresh, refrigerated products in these stores ensures that consumers can trust the quality and freshness of the hummus they purchase.

Supermarkets engage in effective in-store marketing initiatives, such as product sampling and demonstrations, which help educate consumers about the versatility of hummus as a dip or ingredient and drive trial among those who may be unfamiliar with it. Overall, these factors collectively contribute to the growth of hummus sales through supermarket distribution channels, positioning them as a key player in the expanding market for hummus.

The online sales of hummus has been consistently rising and is expected to grow at a CAGR of 11.5% from 2024 to 2030. The rise of e-commerce has transformed shopping habits, with more consumers opting for the convenience of purchasing groceries online. This shift is particularly beneficial for health-conscious individuals who may seek out specific products like hummus from the comfort of their homes, especially in regions where access to specialty food stores is limited. Additionally, online platforms allow manufacturers to reach a broader geographical audience, enabling them to connect directly with target consumers and offer personalized shopping experiences through detailed product information and customer reviews. This accessibility promotes increased awareness and adoption of various hummus options, including innovative flavors and formulations.

The online sales channel enhances inventory management and distribution efficiency for manufacturers, allowing them to respond quickly to changing consumer preferences and market trends. The convenience of home delivery further appeals to busy consumers, making it easier for them to include hummus in their diets without the hassle of in-store shopping. As digital penetration continues to grow, alongside a rising preference for convenient and personalized shopping experiences, online sales are expected to remain a significant market growth driver. This channel not only supports consumer demand but also offers manufacturers a valuable platform for expanding their reach and engaging with health-focused audiences.

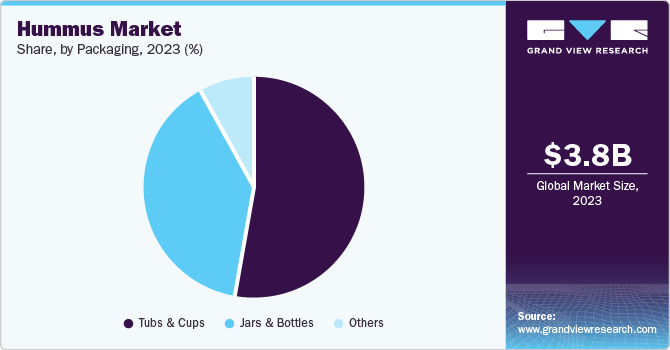

Packaging Insights

Tubs & cups were the most preferred packaging form for hummus and accounted for a market share of over 50% in 2023. Tubs and cups offer a practical solution for consumers seeking convenient, ready-to-eat options. Single-serving cups are particularly appealing for on-the-go snacking, allowing consumers to easily incorporate hummus into their busy lifestyles. This aligns with the rising demand for portable food items that can be consumed quickly, making them ideal for professionals and students alike.

Individual-sized cups facilitate portion control, which is increasingly important to health-conscious consumers. This feature helps manage calorie intake while providing a satisfying snack option. Tubs, on the other hand, cater to households that frequently use hummus, allowing for larger quantities that can be shared or used in various meals. Many tubs come with resealable lids, enhancing convenience by allowing consumers to store leftover hummus without compromising freshness. This feature encourages repeated use and reduces food waste, appealing to environmentally conscious shoppers.

Jars and bottles were the second largest packaging form for hummus and is expected to grow at a CAGR of 11.1% from 2024 to 2030. One of the primary factors contributing to the popularity of jars and bottles is their potential for reusability and recyclability. As consumers become increasingly environmentally conscious, they are drawn to packaging that minimizes waste. Glass jars are favored for their sustainability attributes, allowing consumers to repurpose them after use or recycle them easily.

Jars and bottles offer transparency, allowing consumers to see the product inside. This visual appeal can enhance consumer trust and encourage purchases, as shoppers can assess the freshness and quality of the hummus before buying. Eye-catching designs and labeling can further attract attention on store shelves, making these packaging options effective marketing tools.

Advances in packaging technology have improved the shelf life of hummus stored in jars. Techniques such as High Pressure Processing (HPP) help maintain product quality while extending freshness. This is particularly important for consumers who prioritize longer-lasting products without preservatives, making jarred hummus an attractive option.

Regional Insights

North America was the largest hummus market and is expected to account for nearly USD 1.95 billion in 2023. There is a significant shift towards health-conscious eating, with consumers increasingly seeking nutritious, protein-rich foods. Hummus, known for its high fiber and protein content, aligns perfectly with these dietary goals, making it an attractive option for those adopting plant-based diets. The rising popularity of Mediterranean cuisine has also contributed to the acceptance of hummus as a staple in American and Canadian households, further enhancing its market presence.

Additionally, the demand for diverse flavor profiles is fueling innovation within the hummus sector. Manufacturers are responding to consumer tastes by introducing a variety of flavors, such as roasted garlic and red pepper, which cater to adventurous eaters. This continuous product innovation not only meets consumer expectations but also drives sales growth. The convenience of ready-to-eat hummus packaged in user-friendly formats has made it a popular choice for on-the-go snacking, appealing to busy lifestyles.

Moreover, advancements in food processing and packaging technologies have improved the shelf life and quality of hummus products, facilitating wider distribution across supermarkets and online platforms. These developments enable brands to maintain freshness while expanding their reach to a broader audience. The strong retail presence in North America, particularly in the U.S., supports this growth by providing easy access to a variety of hummus options.

U.S. Hummus Market Trends

The U.S. hummus market is expected to grow at a CAGR of 10.6% from 2024 to 2030 primarily driven by increasing consumer acceptance for healthy products which have high protein content. Hummus, known for its high fiber and protein content, aligns well with these dietary goals, making it an attractive option. The rising popularity of Mediterranean cuisine is expected to keep hummus demand high, as consumers appreciate both its health benefits and flavorful profiles.

Red pepper hummus is a popular choice in the U.S. As the American consumers become more adventurous in their culinary choices, they are eager to explore new flavors that provide a unique taste experience. The sweet and smoky flavor of roasted red peppers complements the creamy texture of hummus, making it a versatile dip that can be enjoyed with pita bread, fresh vegetables, or as a spread on sandwiches.

Key Hummus Company Insights

The competitive landscape in the hummus market is characterized by intense rivalry among established players and emerging brands, driven by increasing consumer demand for healthy, plant-based snacks. Companies are leveraging strategies such as innovation in flavors and packaging, partnerships with retailers and food service providers, and strong marketing campaigns to enhance brand visibility and market share.

Key Hummus Companies:

The following are the leading companies in the hummus market. These companies collectively hold the largest market share and dictate industry trends.

- Bakkavor Group Plc

- Cedar’s Mediterranean Foods, Inc.

- Haliburton International Foods

- Strauss Group

- Tribe Hummus

- Hope Foods, LLC

- Fountain of Health

- Hummus Goodness

- Boar’s Head Brand

- Lantana Foods

- Sabra Dipping Company, LLC

- Blue Moose of Boulder

- Hormel Foods Corporation

- Fontaine Santé Foods Inc.

- Ithaca Cold-Crafted

- Mediterranean Organic

- Roots Hummus

- Delighted By Hummus

Hummus Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 4.27 billion

Revenue forecast in 2030

USD 8.03 billion

Growth rate

CAGR of 11.1% from 2024 to 2030

Actual data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion, and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, packaging, distribution channel, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; China; Japan; India; Australia & New Zealand; South Korea; Brazil; Saudi Arabia

Key companies profiled

Bakkavor Group Plc; Cedar’s Mediterranean Foods, Inc.; Haliburton International Foods; Strauss Group; Tribe Hummus; Hope Foods, LLC; Fountain of Health; Hummus Goodness; Boar’s Head Brand; Lantana Foods; Sabra Dipping Company, LLC; Blue Moose of Boulder; Hormel Foods Corporation; Fontaine Santé Foods Inc.; Ithaca Cold-Crafted; Mediterranean Organic; Roots Hummus; Delighted By Hummus

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options Global Hummus Market Report Segmentation

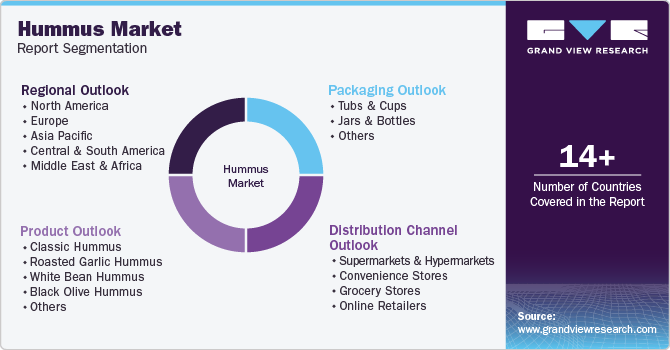

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the global hummus market report based on product, packaging, distribution channel, and region:

-

Product Outlook (Revenue, USD Billion, 2018 - 2030)

-

Classic Hummus

-

Roasted Garlic Hummus

-

White Bean Hummus

-

Black Olive Hummus

-

Others

-

-

Packaging Outlook (Revenue, USD Billion, 2018 - 2030)

-

Tubs & Cups

-

Jars & Bottles

-

Others

-

-

Distribution Channel Outlook (Revenue, USD Billion, 2018 - 2030)

-

Supermarkets & Hypermarkets

-

Convenience Stores

-

Grocery Stores

-

Online Retailers

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia & New Zealand

-

South Korea

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

Saudi Arabia

-

-

Frequently Asked Questions About This Report

b. The global hummus market size was estimated at USD 3.85 billion in 2023 and is expected to reach USD 4.27 billion in 2024.

b. The global hummus market is expected to grow at a compound annual growth rate of 11.1% from 2024 to 2030 to reach USD 8.03 billion by 2030.

b. Classic hummus was the largest product category for the market with revenue of USD 1.62 billion in 2023. The biggest driver for classic hummus is its versatility. It can be used as a dip, spread, or ingredient in various dishes. This adaptability makes it a staple in many households and a popular choice in restaurants and food service establishments. Its familiar taste resonates with a broad audience, contributing to its sustained popularity across diverse culinary contexts.

b. Key companies profiled • Bakkavor Group Plc • Cedar’s Mediterranean Foods, Inc. • Haliburton International Foods • Strauss Group • Tribe Hummus • Hope Foods, LLC • Fountain of Health • Hummus Goodness • Boar’s Head Brand • Lantana Foods • Sabra Dipping Company, LLC • Blue Moose of Boulder • Hormel Foods Corporation • Fontaine Santé Foods Inc. • Ithaca Cold-Crafted • Mediterranean Organic • Roots Hummus • Delighted By Hummus

b. The hummus market is experiencing robust growth, driven by several key factors that reflect changing consumer preferences and lifestyle trends. This expansion is primarily driven by increasing health consciousness among consumers, who are gravitating towards nutritious, plant-based foods. Hummus, rich in protein and fiber, has become a favored option for those adopting vegetarian and vegan diets, further fueled by the rising awareness of its health benefits. This trend is particularly pronounced among millennials and health-focused individuals who seek convenient yet nutritious options in their diets.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."