- Home

- »

- Next Generation Technologies

- »

-

Human Resource Management Market Size Report, 2030GVR Report cover

![Human Resource Management Market Size, Share & Trends Report]()

Human Resource Management Market (2025 - 2030) Size, Share & Trends Analysis Report By Component (Software, Service), By Deployment, By Enterprise Size, By End-use, By Region, And Segment Forecasts

- Report ID: GVR-2-68038-295-2

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Human Resource Management Market Summary

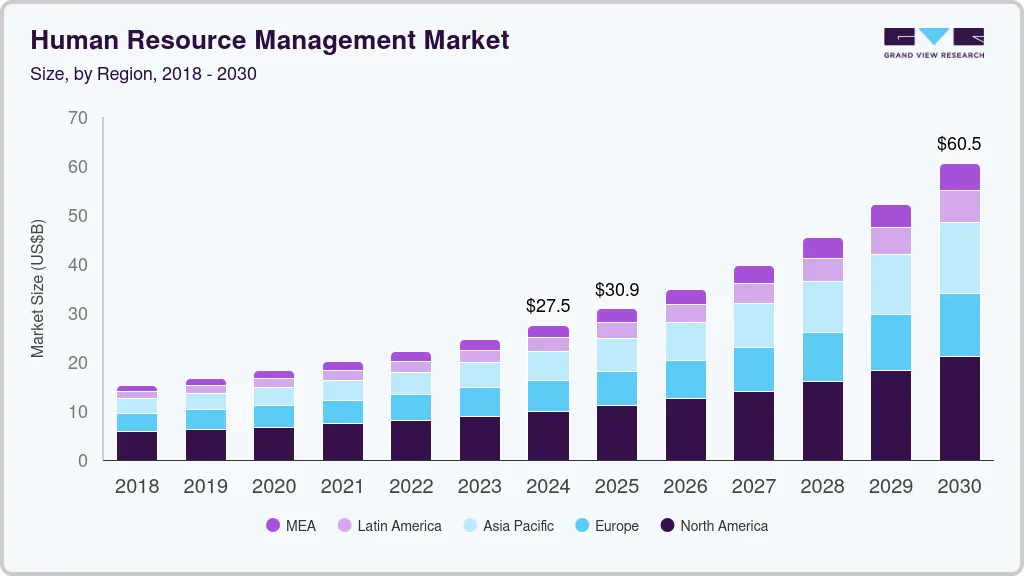

The global human resource management market size was estimated at USD 27.51 billion in 2024 and is projected to reach USD 60.52 billion by 2030, growing at a CAGR of 14.4% from 2025 to 2030. The market growth is being driven by the increasing adoption of cloud-based HR solutions, AI-powered automation, and workforce analytics.

Key Market Trends & Insights

- North America dominated the human resource management market with the largest revenue share of 36.21% in 2024.

- The human resource management market in the U.S. is witnessing tremendous growth.

- Based on component, the software segment led the market with the largest revenue share of 67.3%.

- Based on the deployment, the on-premise segment accounted for the largest revenue share in 2024.

- Based on end use, the IT & telecom segment accounted for the largest revenue share in 2024.

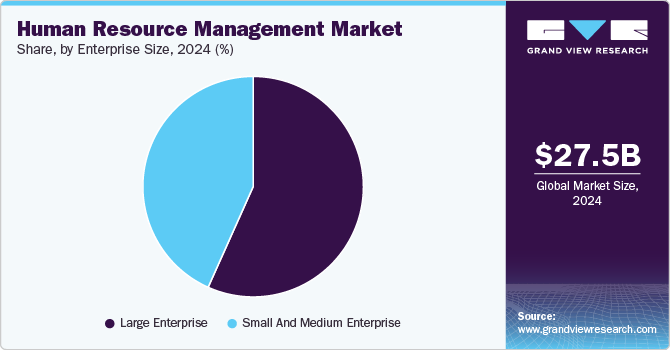

- Based on enterprise size, the large enterprise segment accounted for the largest market revenue share in 2024.

Market Size & Forecast

- 2024 Market Size: USD 27.51 Billion

- 2030 Projected Market Size: USD 60.52 Billion

- CAGR (2025-2030): 14.4%

- North America: Largest Market in 2024

Companies are placing greater emphasis on enhancing employee experience, automating HR processes, and ensuring regulatory compliance. The rising demand for efficient talent acquisition, payroll processing, and performance management has fueled the market for integrated HRM software. In addition, the shift to remote and hybrid work models has spurred investments in digital HR solutions, including self-service portals, AI-driven recruitment, and employee engagement tools, further accelerating market growth. As businesses focus on workforce optimization, HRM solutions remain a critical component of corporate strategies.One significant trend in the global market is the growing use of artificial intelligence (AI) and machine learning (ML) in HR functions. HR technology powered by AI offers predictive analytics for workforce planning, resume screening through automation, and AI-based chatbots for employee assistance. Organizations are using AI-based insights to enhance decision-making, minimize recruitment bias, and optimize overall HR effectiveness. In addition, the employment of generative AI is transforming talent management by allowing customized learning and development initiatives, supporting employee retention planning, and enhancing workplace productivity through automated HR processes.

Another significant change is the rapid adoption of cloud-based HRM solutions. Organizations of all sizes are moving from on-premise HR systems to cloud-based platforms to benefit from better accessibility, scalability, and cost efficiency. Cloud HRM systems provide real-time data insights, facilitate remote workforce management, and allow for seamless integration with third-party applications such as payroll processing and benefits administration. The demand for flexible, subscription-based HR software is rising, especially among small and medium enterprises (SMEs), as they look for cost-effective solutions that offer comprehensive HR functionalities while reducing IT infrastructure costs.

Leading HRM solution providers like SAP, Workday, Oracle, and ADP are continually expanding their offerings through AI-driven improvements, targeted acquisitions, and strategic collaborations. Organizations are integrating advanced workforce analytics, employee wellness solutions, and compliance management modules into their HR platforms to meet evolving business needs. In addition, HR technology companies are focusing on industry-specific HRM solutions tailored for sectors such as healthcare, retail, and IT, which further enhances innovation. With ongoing advancements in automation, self-service HR software, and AI-driven career planning, major players in the HRM sector are consistently investing in the latest technologies to strengthen their market position.

Component Insights

Based on component, the software segment led the market with the largest revenue share of 67.3% and is projected to grow at a significant CAGR during the forecast period. Organizations are increasingly using Human Resources Management (HRM) software to automate workforce processes such as recruitment, payroll, performance management, and employee engagement. Cloud HRM solutions are becoming more popular owing to their scalability, ease of integration, and affordability. Moreover, the integration of artificial intelligence (AI) and automation into HRM platforms is improving decision-making and efficiency. While firms keep giving digital transformation precedence, the demand for end-to-end HRM software will be on the rise due to its capacity to maximize HR functions and enhance the overall productivity of the workforce.

On the other hand, the service segment is expected to grow at the fastest CAGR during the forecast period. As firms implement HRM solutions, the demand for implementation, consulting, training, and support services is growing. Firms need specialist expertise to tailor software solutions as per their respective requirements so that they integrate perfectly with existing infrastructures. Increased usage of cloud-based HRM solutions also means the need for continuous support and maintenance services. Further, contracting out HR processes like payroll processing and administration of employee benefits is fueling growth in this sector. As the adoption of HRM software continues to grow, the need for professional and managed services is likely to increase tremendously.

Deployment Insights

Based on the deployment, the on-premise segment accounted for the largest revenue share in 2024. Most larger organizations are more inclined towards on-premise Human Resources Management (HRM) solutions because they have more control over data security, compliance, and system customizability. Financial institutions, healthcare providers, and government agencies are some of those industries that use on-premise deployment for fulfilling heavy regulatory demands and safeguarding sensitive employee information. Business organizations with complex HR workflows and integration requirements also go for on-premise solutions so that they do not face any interoperability issues. Though the use of cloud-based solutions is on the rise, on-premise HRM systems are still in common usage because of their stability, advantages of data ownership, and the fact that they can function regardless of internet connectivity.

The hosted segment is projected to grow at a rapid CAGR during the forecast period. Companies are moving towards cloud-based HRM solutions increasingly because of cost savings, scalability, and remote access. Cloud HRM solutions provide real-time analytics of data, automated reporting, and integration with other enterprise software, which improves efficiency and decision-making. Small and medium-sized businesses (SMEs) are especially leading the adoption of cloud computing, as it does away with the requirement for large IT infrastructure and lowers initial costs. Moreover, the increasing application of artificial intelligence (AI) and automation in HR activities also contributes to the growth of cloud-based HRM solutions. As companies continue to focus on digital transformation, the cloud segment will see substantial growth.

End-use Insights

Based on end use, the IT & telecom segment accounted for the largest revenue share in 2024 and is expected to grow at the fastest CAGR during the forecast period. The IT & telecom industry has an extremely dynamic and competitive workforce that requires effective HRM solutions for talent attraction, workforce planning, payroll management, and employee engagement. With a high percentage of remote work adoption, organizations operating in this industry rely on online HR platforms to automate recruitment, performance management, and compliance tracking. Moreover, the availability of multinational IT companies and the necessity for frictionless global HR operations also enhance the demand for sophisticated HRM solutions in this industry.

On the other hand, the retail segment is expected to register at the fastest CAGR during the forecast period. The rapid expansion of e-commerce, omnichannel retailing, and seasonal workforce hiring has increased the demand for flexible and scalable HRM solutions in the retail sector. Retail companies require automated HR tools to manage high employee turnover, scheduling, training, and payroll processing across multiple locations. The adoption of AI-driven HR solutions, mobile-based workforce management apps, and cloud-based HRM platforms is expected to drive growth in this segment. As the retail industry continues evolving with digital transformation, the demand for efficient HRM solutions is set to rise significantly.

Enterprise Size Insights

Based on enterprise size, the large enterprise segment accounted for the largest market revenue share in 2024. Large enterprises operate with complex organizational structures, requiring advanced human resource management (HRM) solutions for talent acquisition, payroll processing, workforce planning, and compliance management. These companies often invest in AI-driven HR analytics, cloud-based platforms, and automation tools to enhance employee experience and optimize HR workflows. In addition, multinational corporations require scalable HRM systems that can manage diverse workforces across multiple locations, which further drives the adoption of enterprise-grade HR solutions.

On the other hand, the small and medium-sized enterprises (SME) segment is anticipated to experience at a significant CAGR between 2025 and 2030. SMEs are increasingly adopting cloud-based and AI-powered HRM solutions to streamline their HR operations, reduce administrative burdens, and improve employee engagement. Cost-effective, subscription-based HRM platforms are becoming popular among SMEs, enabling them to access essential HR functionalities without the need for significant upfront investment. Furthermore, the growing awareness of HR compliance, workforce analytics, and remote work management is promoting the adoption of HRM solutions in this segment. As SMEs continue to expand and digitize their HR processes, they are anticipated to witness substantial growth.

Regional Insights

North America dominated the human resource management market with the largest revenue share of 36.21% in 2024. The growth is driven by the widespread adoption of cloud-based HR solutions, increasing investments in AI-driven workforce management, and a strong focus on employee experience. The U.S. leads the region, with major companies such as Workday, SAP, and ADP offering HR technology solutions that streamline payroll, benefits administration, and talent management. The demand for HR analytics and automation is rising as businesses seek to improve workforce planning and employee engagement. In additional, evolving labor laws and compliance requirements, including diversity and inclusion initiatives, are prompting companies to adopt advanced HR solutions. The expansion of remote and hybrid work models has further fueled demand for cloud-based Human Capital Management (HCM) platforms.

U.S. Human Resource Management Market Trends

The human resource management market in the U.S. is witnessing tremendous growth, fueled by the rising adoption of AI-driven HR technology, payroll and benefits administration automation, and a sharp focus on employee experience. Organizations are embracing cloud-based Human Capital Management (HCM) platforms to simplify workforce planning and compliance management. The increasing adoption of remote and hybrid work arrangements further fueled the need for HR software enabling digital collaboration, talent recruitment, and performance management. Further, changes in labor regulations, diversity and inclusion efforts, and workforce analytics implementations are informing HR strategies and are causing firms to invest in cutting-edge HR technologies to gain efficiency.

Europe Human Resource Management Market Trends

The human resource management market in Europe is being spurred by digital transformation, automation, and changing labor laws. Businesses are embracing AI-driven HR tools for recruitment, workforce planning, and employee engagement. The increasing popularity of remote and hybrid work patterns has further fueled demand for cloud-based Human Capital Management (HCM) solutions. Stringent labor regulations and data protection laws like GDPR are molding HR strategies, compelling businesses to invest in HR technology that focuses on compliance. Furthermore, the focus on diversity, equity, and inclusion (DEI) and employee well-being programs continue to impact HR policies, making technology-driven HR solutions essential for European businesses.

The UK human resources management market is transforming with AI-powered recruitment, cloud-based services, and compliance-oriented workforce software. Firms are embracing automation for payroll, employee tracking, and performance management to aid hybrid work arrangements. Brexit has compounded labor shortages, which are driving talent acquisition demand for predictive analytics. Diversity, equity, and inclusion (DEI) programs are fueling technology adoption. Organizations are focusing on employee well-being with mental health initiatives and flexible work arrangements. As policies change, organizations invest in automation and workforce analytics to enhance efficiency compliance, while elevating employee experience and retention in an uncertain labor market.

The human resources management market in Germany is influenced by stringent labor regulations, workforce automation, and digital change. Organizations are implementing AI-based recruitment software, payroll automation, and cloud platforms to enhance efficiency. The aging population fuels the need for upskilling and succession planning initiatives. Employee engagement continues to be high, with companies putting money into initiatives of well-being and flexible working. Labor regulatory compliance affects company strategies, boosting workforce analytics adoption and automated report tools. Talent retention forces companies to give more importance to employer branding as well as online self-service technologies, maintaining both efficiency and German compliance in shifting employment dynamics.

Asia Pacific Human Resource Management Market Trends

The human resource management market in the Asia Pacific is growing as a result of accelerated digitalization, automation of the workforce, and changing labor laws. Cloud-based HR solutions, artificial intelligence-powered recruitment, and workforce analytics are extensively used as firms pursue efficiency and scalability. Growth in remote and hybrid work arrangements boosts demand for payroll automation and employee self-service solutions. China, India, and Japan are spending on HR technology to increase productivity and adherence. In addition, increasing emphasis on employee well-being, diversity, and talent development is influencing HR strategies, with companies using technology to enhance workforce engagement and operational effectiveness.

The China human resources management market is evolving as companies adopt digital HR solutions and AI-based recruitment tools. The size of the country's workforce and changing labor laws create demand for payroll automation, compliance management, and workforce analytics. Government policies focusing on local talent creation and employment laws impact HR strategies. Firms are increasingly leveraging big data to drive employee engagement and retention. The growth of gig and flexible work also compels businesses to implement cloud-based Human Resources Management solutions, guaranteeing agility and compliance. Multinational firms in China are also investing in HR platforms to meet global workforce management standards.

The human resources management market in India is transforming at a fast pace with digitalization, AI-based hiring, and an analytics-driven workforce. The nation's growing gig economy and hybrid workplace culture require automating payroll processing, performance management, and tracking compliance. Labor reforms by the government prompt organizations to implement organized workforce solutions to enhance transparency and efficiency. Upskilling and reskilling are becoming increasingly popular as organizations respond to skills shortages in an intense job market. The growing emphasis on employee wellness and engagement has resulted in higher usage of AI-driven HR chatbots, self-service portals, and mental health support initiatives, transforming Human Resources Management practices.

Middle East & Africa Human Resource Management Market Trends

The human resource management market in the Middle East & Africa is growing steadily because of growing digital transformation and cloud-based HR solutions adoption. Firms are giving utmost importance to automation in workforce management, compliance, and payroll for enhanced efficiency and compliance with changing labor regulations. The use of AI-powered talent acquisition, employee engagement platforms, and workforce analytics is increasing because companies are trying to optimize human capital. Government policies aimed at localization and nationalization of the workforce, including Saudization and Emiratization, are compelling businesses to invest in formal Human Resources Management systems. The gig economy and hybrid work arrangements are also transforming workforce strategies.

The UAE human resources management market is transforming at a fast pace owing to the nation's emphasis on digital innovation and regulatory reforms. The adoption of AI-powered HR tools, payroll automation, and workforce analytics is growing as organizations rationalize operations. Emiratization policies compel businesses to promote hiring and training locals. Furthermore, the UAE's open work visa policies and rising expat labor force propel the need for cutting-edge Human Resources Management platforms. Organizations are deploying AI-driven hiring, employee experience platforms, and compliance management software to address changing labor laws and workforce expectations in a more digital and competitive business landscape.

The human resources management market in Saudi Arabia is growing as Vision 2030 reforms propel nationalization of the workforce and digital transformation. The Saudization program requires local recruitment, and thus demand for automated HR solutions that help with compliance and workforce planning rises. Firms are spending money on cloud HR solutions, artificial intelligence-powered hiring, and learning management software in order to retain and recruit staff. With the increasing emphasis on employee engagement and performance management, organizations are bringing in advanced analytics and self-service portals. Also, the country's emerging gig economy and flexible work policies propel the use of digital Human Resources Management solutions to enhance workforce efficiency and compliance.

Key Human Resource Management Company Insights

Some of the key players in the AdTech market include Accenture, ADP, Inc., Cegid, and Ceridian HCM Holding, Inc.

-

Accenture provides HR technology consulting, digital transformation of the workforce, and cloud HR solutions. Accenture enables companies to leverage AI-powered HR tools, automate talent management for optimization, and enhance employee experience through analytics and automation.

-

ADP, Inc. offers a comprehensive range of human capital management (HCM) solutions, ranging from payroll processing and benefits administration to talent acquisition and workforce management. Its platforms, like ADP Workforce Now and ADP Vantage HCM, serve companies across all sizes, achieving compliance and efficiency in HR processes.

-

Cegid is a cloud-based HR and payroll software company that targets small to mid-sized companies and enterprises. Its products range from talent acquisition to performance management, time tracking, and regulatory compliance, with a large presence in the European market.

-

Ceridian HCM Holding, Inc. provides Dayforce, a cloud-based human capital management platform that combines payroll, workforce management, HR, talent acquisition, and employee engagement. The platform has a continuous calculation engine that provides real-time payroll and workforce insights.

IBM, Mercer LLC, Oracle, and PwC are some of the emerging market participants in the market.

-

IBM offers AI-based HR solutions via IBM Watson, including talent acquisition, workforce analytics, and employee engagement. IBM also offers HR transformation consulting to assist companies in optimizing their workforce strategies with AI-powered automation.

-

Mercer LLC is an international HR consulting company that offers services in employee benefits, compensation strategy, talent mobility, and workforce transformation. Mercer's HR technology solutions assist companies in optimizing their workforce strategies through data-driven insights and automation.

-

Oracle provides Oracle Cloud HCM, a complete suite including payroll, workforce analytics, performance management, and AI-based automation of HR processes. The system is integrated with Oracle's overall cloud ecosystem to enable smooth HR and finance processes.

-

PwC offers HR consulting services in the areas of digital workforce transformation, HR process optimization, and compliance management. PwC assists companies in deploying cloud-based HR systems and using analytics for workforce planning and decision-making.

Key Human Resource Management Companies:

The following are the leading companies in the human resource management market. These companies collectively hold the largest market share and dictate industry trends.

- Accenture

- ADP, Inc.

- Cegid

- Ceridian HCM Holding, Inc.

- Cezanne HR

- IBM

- Mercer LLC

- Oracle

- PwC

- SAP SE

- UKG, Inc.

- Workday, Inc.

Recent Developments

-

In 2024, Workday solidified its leadership in the Human Resources Management market, by growing its Workday Human Capital Management (HCM) adoption among large retailers to attract and retain high-performing frontline employees. The company also deepened its workforce management capabilities, such as scheduling, talent optimization, and payroll, to enhance employee engagement, productivity, and operational efficiency.

-

In 2024, ADP introduced "ADP Assist," a generative AI-enabled HR assistant that simplifies payroll, benefits, and compliance work. The solution offers real-time insights, automates responses to employee questions, and enhances decision-making for HR professionals, making them more productive and engaged.

-

In 2024, SAP launched AI-powered innovations in its SuccessFactors HCM suite to advance talent management and workforce planning. The new features include a sophisticated talent intelligence hub that combines third-party skills data for a single employee skills profile, enhancing career development and strategic workforce planning. The new SAP SuccessFactors Career and Talent Development solution also enables employees to connect career growth objectives to organizational requirements. AI-driven capabilities, including AI-supported 360-degree feedback and onboarding support through SAP's AI copilot Joule, also enhance employee experience and decision-making.

Human Resource Management Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 30.90 billion

Revenue forecast in 2030

USD 60.52 billion

Growth rate

CAGR of 14.4% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion, and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Component, deployment, enterprise size, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; UK; France; China; India; Japan; South Korea; Australia; Brazil; Saudi Arabia; UAE, South Africa

Key companies profiled

Accenture; ADP, Inc.; Cegid; Ceridian HCM Holding, Inc.; Cezanne HR; IBM; Mercer LLC; Oracle; PwC; SAP SE; UKG, Inc.; Workday, Inc.

Customization scope

Free report customization (equivalent to up to 8 analyst working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options Global Human Resource Management Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global human resource management market report based on the component, deployment, enterprise size, end-use, and region:

-

Component Outlook (Revenue, USD Million, 2018 - 2030)

-

Software

-

Core HR

-

Employee Collaboration & Engagement

-

Recruiting

-

Talent Management

-

Workforce Planning & Analytics

-

Others

-

-

Service

-

Integration & Deployment

-

Support & Maintenance

-

Training & Consulting

-

-

-

Deployment Outlook (Revenue, USD Million, 2018 - 2030)

-

Hosted

-

On-Premise

-

-

Enterprise Size Outlook (Revenue, USD Million, 2018 - 2030)

-

Large Enterprise

-

Small and Medium Enterprise

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Academia

-

BFSI

-

Government

-

Healthcare

-

IT & Telecom

-

Manufacturing

-

Retail

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East & Africa (MEA)

-

Saudi Arabia

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global human resource management market size was estimated at USD 27.51 billion in 2024 and is expected to reach USD 30.90 billion in 2025.

b. The global human resource management market is expected to grow at a compound annual growth rate of 14.4% from 2025 to 2030 to reach USD 60.52 billion by 2030.

b. North America dominated the human resource management market in 2024 with a revenue share of over 36%.

b. Some key players operating in the HRM market include Accenture PLC, Automatic Data Processing (ADP), Inc., Cezanne HR Ltd., Ceridian HCM, Inc., IBM Corporation, Kronos Incorporated, Mercer LLC, NetSuite, Inc., Oracle Corporation, SAP SE, Talentsoft, Ultimate Software, and Workday, Inc.

b. Key factors that are driving the HRM market growth include advancements in the field of Information Technology (IT) coupled with the introduction of predictive analytics in the field of HR processes. Furthermore, it is helping in retaining human capital, aligning organizational strategies with individual goals, and managing human resources in a manner that results in organizational growth.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.