- Home

- »

- Nutraceuticals & Functional Foods

- »

-

Human Milk Oligosaccharides Market Size Report, 2030GVR Report cover

![Human Milk Oligosaccharides Market Size, Share & Trends Report]()

Human Milk Oligosaccharides Market (2024 - 2030) Size, Share & Trends Analysis Report By Type (2’FL, 3’FL, 3’SL, 6’SL, LNT), By Application (Infant Formula), By Region, And Segment Forecasts

- Report ID: 978-1-68038-608-0

- Number of Report Pages: 146

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Human Milk Oligosaccharides Market Summary

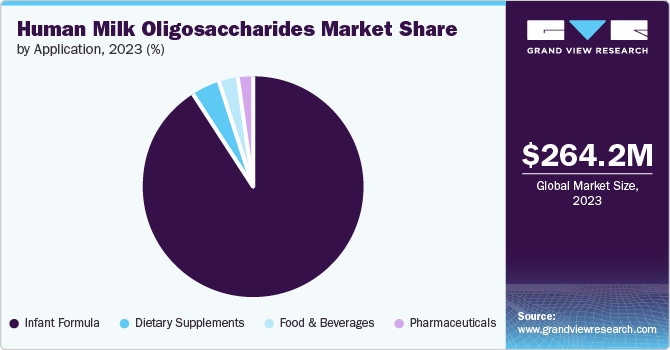

The global human milk oligosaccharides market size was estimated at USD 264.20 million in 2023 and is projected to reach USD 732.23 million by 2030, growing at a CAGR of 13.8% from 2024 to 2030. The rising interest in infant nutrition, increasing R&D supporting the health benefits of human milk oligosaccharides (HMOs), technological advancements in HMO production, and favorable regulatory frameworks are propelling the market growth.

Key Market Trends & Insights

- The human milk oligosaccharides market in North America captured a revenue share of 13.2% in 2023.

- The U.S. human milk oligosaccharides market accounted for a revenue share of 79.8% in 2023.

- Based on type, 2’FL human milk oligosaccharide accounted for a revenue share of 44.6% in 2023.

- Based on application, the infant formula segment accounted for a revenue share of 90.7% in 2023.

- Based on application, the dietary supplements segment is expected to grow at a CAGR of 18.3% from 2024 to 2030.

Market Size & Forecast

- 2023 Market Size: USD 264.20 million

- 2030 Projected Market Size: USD 732.23 million

- CAGR (2024-2030): 13.8%

- Europe: Largest market in 2023

- Asia Pacific: Fastest growing market

Consumers are also becoming more health-conscious and seeking products with functional benefits, such as gut health and immune system support. HMOs are recognized for their prebiotic properties and potential to promote a healthy gut microbiome, driving their demand in functional foods and supplements. There has been a significant rise in awareness of the importance of proper infant nutrition. Parents are becoming more conscious of nutrition's role in their child’s development, leading to an increased demand for HMO-based products. Manufacturers are developing formulas with specific HMO blends to mimic breast milk's immune-boosting properties, enhance gut health, and potentially aid brain development.

For instance, in November 2023, Nestlé introduced its inaugural infant formula incorporating human milk oligosaccharides (HMOs) into the Chinese market, marketed under the Wyeth Illuma brand. The product includes two primary types of HMOs found in breast milk-2'Fucosyllactose (2'FL) and Lacto-N-(neo)tetraose (LNnT)-alongside beneficial lipids and proteins.

The ability to efficiently synthesize HMOs has spurred extensive industry R&D. Biotechnology companies and research institutions are now able to explore a broader range of HMOs and their potential health benefits. For instance, ongoing research is investigating the role of various HMOs in modulating the gut microbiome, enhancing immune function, and preventing infections. This expanded R&D effort is not only increasing the understanding of HMOs but also leading to the development of new and innovative HMO-based products. In January 2024, Kyowa Hakko Bio partnered with Singapore's Agency for Science, Technology, and Research (A*STAR) to advance research on Human Milk Oligosaccharides (HMOs). The collaboration aims to deepen understanding of HMOs and their potential applications in promoting health across the lifespan. Key objectives include exploring the benefits of HMOs in supporting immune regulation and promoting a healthy gut microbiome.

Technological advancements and innovation in the biotechnology sector further catalyze the HMO market. The development of cost-effective methods for synthesizing HMOs on a large scale has made it feasible for manufacturers to incorporate these ingredients into a wider array of products. This has opened up new opportunities for food and beverage companies to enhance their product offerings with the health benefits of HMOs, thereby increasing market penetration and growth.

Regulatory approvals from bodies, such as the FDA and EFSA, have facilitated its widespread adoption, particularly in infant formula. In 2023, 2’-Fucosyllactose (2’-FL) and Lacto-N-neotetraose (LNnT) were officially approved as new food nutrition enhancers in China, marking a significant regulatory milestone for human milk oligosaccharides (HMOs), which are globally recognized as essential nutrients. Following this approval, other HMOs are advancing through the regulatory process. In May 2024, the Center for Food Safety Assessment (CFSA) issued a draft and reopened the public consultation period for 2’-FL and LNnT.

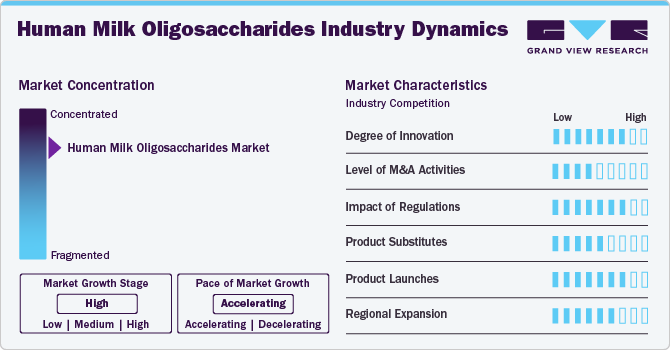

Industry Dynamics

The market is characterized by a high level of innovation, driven by the growing understanding of HMOs' health benefits and the development of new technologies for their production and application. Moreover, ongoing research in the field of HMOs also continues to contribute to innovation. Scientists are studying the structure-function relationships of different HMOs and their potential applications in areas such as immunity, gut health, allergy prevention, and cognitive development. These findings drive innovation and the development of new HMO-based products.

The mergers and acquisitions are in the range of low to medium in the market. Companies undergoing mergers and acquisitions seek strategic partnerships to enhance their product portfolios, expand their market presence, and leverage each other’s strengths.

The regulatory scrutiny and impact of regulations for HMOs are high due to their classification as novel foods. Novel foods are subject to strict safety assessment and approval processes before marketing. The European Food Safety Authority (EFSA) and Food and Drug Administration (FDA) assess the potential risks and benefits of novel foods and novel food ingredients to ensure they do not pose a threat to consumer health. This rigorous regulatory process is in place to protect consumers and maintain the integrity of the food supply.

Despite the challenges in replicating HMOs due to their unique composition and structural complexity, some product substitutes or alternatives have been developed to mimic certain HMO functionalities. These substitutes can be broadly classified into prebiotics and functional oligosaccharides. Prebiotics such as FOS and GOS promote beneficial gut microbiota but lack the specificity observed in HMOs. Functional oligosaccharides like 2’-FL and 6’-SL target specific components of HMO function but do not fully replicate their overall complexity or functionality.

The level of product launches in the human milk oligosaccharides market has been notable, with a wide range of HMO-based products being introduced to meet the growing market demand and capitalize on the potential benefits of these unique ingredients. For instance, in November 2023, Nestlé’s Wyeth Illuma brand launched its first product containing HMOs for early life nutrition in mainland China.

The market is experiencing notable regional expansion. The expansion is primarily driven by the use of HMO as ingredients in functional foods and infant formula due to their properties that support inflammation and immune regulation and aid in infant neurological development.

Type Insights

2’FL human milk oligosaccharide accounted for a revenue share of 44.6% in 2023. There is an increasing demand for infant formula and other human milk substitutes for various reasons, such as maternal health issues, professional commitments, and convenience. As 2'FL is a prominent component of human milk, its inclusion in infant formula and other products aims to mimic the benefits of human milk, driving the market. Additionally, regulatory approvals from bodies like the FDA and EFSA have facilitated its widespread adoption, particularly in infant formula. In 2023, 2’-Fucosyllactose (2’-FL) and Lacto-N-neotetraose (LNnT) were officially approved as new food nutrition enhancers in China, marking a significant regulatory milestone for human milk oligosaccharides (HMOs), which are globally recognized as essential nutrients. Following this approval, other HMOs are advancing through the regulatory process. In May 2024, the Center for Food Safety Assessment (CFSA) issued a draft and reopened the public consultation period for 2’-FL and LNnT.

The DFL HMOs segment is expected to witness a CAGR of 20.0% from 2024 to 2030. DFL has the potential to confer health benefits to infants. It contributes to the development of a healthy gut microbiome, supports immune function, and potentially has antimicrobial properties. As more research is conducted and evidence of its health benefits emerges, an increased demand for DFL-based products is anticipated.

Application Insights

The infant formula segment accounted for a revenue share of 90.7% in 2023. The demand for HMOs in infant formula is steadily rising owing to their similarity to breast milk and acknowledged health benefits. As complex carbohydrates naturally occur in breast milk, HMOs are vital in bolstering infants' immune systems, fostering healthy gut development, and shielding against infections. Manufacturers are capitalizing on these advantages by integrating HMOs into infant formula, thereby enriching the nutritional profile and emulating the benefits of breast milk more closely. This integration has spurred innovation in various infant foods. In December 2023, Wyeth Nutrition launched the new Illuma Growing-up Infant Formula across China. This formula, part of the Illuma series, is designed to support the nutritional needs of toddlers and young children. It includes advanced ingredients like structured lipids and 2'-fucosyllactose (2'-FL) to enhance digestive health and immune support.

The dietary supplements segment is expected to grow at a CAGR of 18.3% from 2024 to 2030. The demand for HMOs in dietary supplements is increasing, propelled by their recognized health benefits and versatility. These naturally occurring complex carbohydrates, primarily found in breast milk, support immune function, gut health, and cognitive development. As consumers increasingly prioritize digestive health and overall wellness, manufacturers are seizing the opportunity to incorporate HMOs into various supplements, driving innovation in the industry. In July 2021, Layer Origin Nutrition, a U.S.-based nutrition start-up, introduced seven new supplements featuring HMOs. These additions complemented the company’s existing PureHMO gut health line introduced in 2020, and encompass products addressing irritable bowel syndrome (IBS), boosting immunity, and catering to children's health needs.

Regional Insights

The human milk oligosaccharides market in North America captured a revenue share of 13.2% due to the popular trend of personalized nutrition and focus on gut health among adults, technological advancements & innovation in the biotechnology sector, and favorable regulatory support & policies.

U.S. Human Milk Oligosaccharides Market Trends

The U.S. human milk oligosaccharides market accounted for a revenue share of 79.8% in 2023. The U.S. has a large infant population, leading to increased demand for infant formula products fortified with HMOs. Moreover, major players in the market are actively forming partnerships and collaborations to expand their product portfolios, enhance R&D capabilities, and strengthen their market position. In August 2023, DSM-Firmenich, a leading innovator in health, nutrition, and beauty, received "no questions" response letters from the U.S. FDA for three new HMO ingredients. This marks the first time globally that lacto-N-fucopentaose I with 2′-fucosyllactose (LNFP-I/2’-FL) can be commercialized in the formula for infants and young children, as well as other food applications. The FDA approvals also include the first commercial availability of a pentasaccharide (LNFP-I) in the U.S. market.

The human milk oligosaccharides market in Canada is expected to grow with a CAGR of 17.4% from 2024 to 2030. Consumer interest in HMOs is increasing due to growing awareness of their benefits for early nutrition. This is leading manufacturers to invest in consumer education initiatives to differentiate their products in the Canadian market. In November 2022, Royal DSM's human milk oligosaccharide GlyCare 2’-fucosyllactose (2FL) received regulatory approval in Canada for use in infant and toddler formula. This approval allows DSM to expand its portfolio of early-life nutrition products, providing health benefits similar to those found in breast milk.

Europe Human Milk Oligosaccharides Market Trends

The Europe human milk oligosaccharides market accounted for a revenue share of 78.5% in 2023, due to the expansion of HMO applications beyond infant nutrition. While infant formula remains the primary application, HMOs are finding new uses in dietary supplements, functional foods, and even cosmetics in Europe. Their prebiotic, anti-inflammatory, and antimicrobial properties drive this expansion into new product categories.

The human milk oligosaccharides market in the UK accounted for a share of 15.6% in 2023. HMO suppliers and infant formula companies are partnering and collaborating to develop innovative HMO-based products for the UK market. For example, in January 2023, FrieslandCampina Ingredients partnered with Triplebar Bio Inc. to develop and scale cell-based protein production using precision fermentation. This partnership aims to meet global protein demand with sustainable, nutritious solutions. Leveraging their expertise in dairy protein and biotechnology, the companies intend to produce bioactive proteins beneficial for human health across different life stages. This initiative underscores their dedication to nutritional innovation while reducing environmental impact.

The France human milk oligosaccharides market is expected to grow at a CAGR of 12.7% from 2024 to 2030. According to the National Library of Medicine, in France, in 2023, more than half of formula-fed infants consumed probiotic-enriched formula. Infant formulas containing HMOs, such as 2'-fucosyllactose (2'FL) and lacto-N-neotetraose (LNnT), are gaining popularity to mimic the benefits of breastmilk.

APAC Human Milk Oligosaccharides Market Trends

The human milk oligosaccharides market in Asia Pacific is expected to grow at a CAGR of 20.5% from 2024 to 2030. This can be attributed to the high prevalence of chronic ailments like gut diseases, diabetes, high blood pressure, and rickets, leading to an increasing demand for functional foods and beverages containing HMOs.

The Vietnam human milk oligosaccharides market held a share of 56.4% in 2023. The awareness of the health benefits of breastfeeding is rising, leading to a growing interest in replicating these benefits through infant nutrition. This awareness can drive the demand for HMOs as parents become more conscious about providing optimal nutrition to their infants.

The human milk oligosaccharides market in Singapore is expected to grow at a CAGR of 20.2% from 2024 to 2030. Singapore has a thriving R&D landscape. Collaborations between research institutions, industry players, and healthcare professionals are increasingly contributing to the development of innovative HMO-based products and scientific evidence to support their use. This R&D ecosystem is driving market growth and adoption of HMOs.

Middle East & Africa Human Milk Oligosaccharides Market Trends

The Middle East & Africa human milk oligosaccharides market is anticipated to witness a CAGR of 15.0% from 2024 to 2030. The market growth is mainly driven by the prevalent issue of vitamin deficiency among women and children in Africa. HMOs, with their potential to address these deficiencies, are becoming increasingly sought after in the region. As the scientific community continues to uncover the numerous health benefits of HMOs, both for infants and adults, the market is poised to expand further in the coming years. Manufacturers and researchers are working to develop innovative HMO-enriched products that cater to the specific needs of the MEA population, driving the regional market growth.

Central & South America Human Milk Oligosaccharides Market Trends

The human milk oligosaccharides market in Central & South America is expected to witness a CAGR of 16.4% from 2024 to 2030. The rising popularity of functional foods and beverages with prebiotic properties is fueling the demand for HMOs among health-conscious adults in this region. Consumers are seeking natural, holistic solutions to support overall health and wellness, and HMOs are seen as valuable ingredients that can enhance the nutritional profile of various food and drink products.

Key Human Milk Oligosaccharides Company Insights

Key market players, such as Glycom A/S, Kyowa Hakko Europe GmbH, Kyowa Hakko Europe GmbH, and BASF SE, contribute significantly to the innovation and growth of the market by utilizing tactics, such as forging partnerships, making agreements, and expanding production capacity.

Key Human Milk Oligosaccharides Companies:

The following are the leading companies in the human milk oligosaccharides market. These companies collectively hold the largest market share and dictate industry trends.

- Glycom A/S

- Chr. Hansen Holding A/S

- Kyowa Hakko Europe GmbH

- FrieslandCampina Ingredients

- BASF SE

- Dextra Laboratories Limited

- Inboise N.V.

- Biosynth Limited

- ELICITYL S.A.

- ZuChem Inc.

- RAJVI ENTERPRISE

Recent Developments

-

In March 2024, Chr. Hansen passed the biosafety review by China's Ministry of Agriculture and Rural Affairs for all five single HMOs of its MyOli blend. This positioned the company well for infant formula innovation in China, offering a comprehensive mix of HMOs known to support immune system development and gut microbiome health, including the particularly noteworthy 3-FL, which aligns with empirical studies of Chinese mothers' breastmilk

-

In January 2024, FrieslandCampina Ingredients received approval from Thai regulators for using its 2’FL in infant and follow-up formula. This made the company Thailand's exclusive supplier of HMO components. It created opportunities for the company to make new formulas that include HMOs

-

In January 2024, Chr. Hansen A/S merged with Denmark-based Novozymes A/S to form Novonesis. This new company aimed to be a leader in sustainable solutions with a focus on health, food, and reducing environmental impact. The company has ESG goals of carbon neutrality by 2050

Human Milk Oligosaccharides Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 337.68 million

Revenue forecast in 2030

USD 732.23 million

Growth rate

CAGR of 13.8% from 2024 to 2030

Actuals

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million, Volume in tons and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, application, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Spain; Italy; China; India; Japan; Taiwan; South Korea; Vietnam; Indonesia; Philippines; Malaysia Singapore; Brazil and South Africa

Key companies profiled

Glycom A/S; Chr. Hansen Holding A/S; Kyowa Hakko Europe GmbH; FrieslandCampina Ingredients; BASF SE; Dextra Laboratories Limited; Inboise N.V.; Biosynth Limited; ELICITYL S.A.; ZuChem Inc. and RAJVI ENTERPRISE

Customization scope

Free Report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Human Milk Oligosaccharides Market Report Segmentation

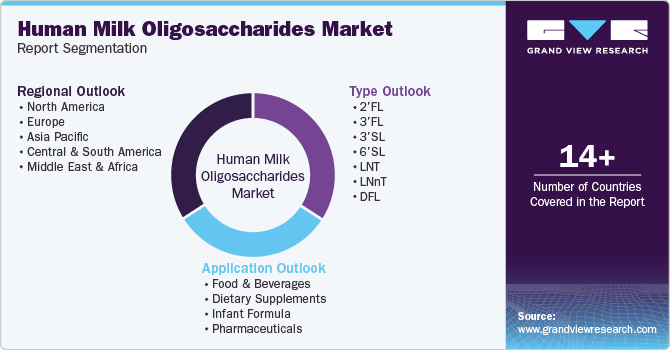

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global human milk oligosaccharides market report based on type, application, and region:

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

2’FL

-

3’FL

-

3’SL

-

6’SL

-

LNT

-

LNnT

-

DFL

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Food & Beverages

-

Dietary Supplements

-

Infant Formula

-

Pharmaceuticals

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Spain

-

Italy

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Taiwan

-

South Korea

-

Vietnam

-

Indonesia

-

Philippines

-

Malaysia

-

Singapore

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

Frequently Asked Questions About This Report

b. The global human milk oligosaccharides market size was estimated at USD 264.20 million in 2023 and is expected to reach USD 337.68 million in 2024.

b. The global human milk oligosaccharides market is expected to grow at a compound annual growth rate of 13.8% from 2024 to 2030 to reach USD 732.23 million by 2030.

b. Europe dominated the human milk oligosaccharides market with a share of 78.5% in 2023. This is attributable to the presence of numerous prominent infant formula and baby food manufacturers along with technological advancements.

b. Some key players operating in the human milk oligosaccharides market include Inbiose NV, Elicityl S.A., Jennewein Biotechnologie GmbH, Medolac Laboratories, Glycom A/S, ZuChem Inc., Glycosyn LLC, Abbott, Dextra Laboratories Ltd, and DuPont.

b. Key factors that are driving the human milk oligosaccharides market growth include increasing concerns among consumers regarding gut health and the growing consumption of dietary supplements by end-users.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.