- Home

- »

- Pharmaceuticals

- »

-

Human Immunodeficiency Virus Therapeutics Market Report, 2030GVR Report cover

![Human Immunodeficiency Virus Therapeutics Market Size, Share & Trends Report]()

Human Immunodeficiency Virus Therapeutics Market Size, Share & Trends Analysis Report By Drug Type, By Drug Class (Entry & Fusion Inhibitors, Protease Inhibitors, Integrase Inhibitors), By Region, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-1-68038-210-5

- Number of Report Pages: 75

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Healthcare

Report Overview

The global human immunodeficiency virus therapeutics market size was valued at USD 10.33 billion in 2022 and is anticipated to expand at a compound annual growth rate (CAGR) of 1.5% from 2023 to 2030. Key drivers for market growth include an increase in HIV infection cases, particularly among youth, due to unprotected sexual practices, exposure to needles or syringes contaminated with infected bodily fluids or tissues, and a lack of understanding about transmission risk factors. The market growth can be linked to the surging incidence rate of HIV-1 infection, which, unlike the death rate from this viral infection, has not changed substantially over the years, as per the Institute for Health Metrics and Evaluation.

According to the World Health Organization (WHO), HIV is a major global public health issue, having claimed 40.4 million lives so far globally, with an estimated 38.4 million people living with the condition at the end of 2021. However, only half of this patient population has access to antiretroviral treatments for disease management. Between the human immunodeficiency virus strains, HIV-1 is more prominent and accounts for around 95% of all infections worldwide.

The number of people contracting this viral infection is rapidly increasing worldwide. The disease has affected developing and underdeveloped countries on a larger scale due to inadequate prevention measures and treatment facilities. Although there is no permanent cure for HIV, it can be controlled with proper medical care and drug therapy.

Medical treatment for this debilitating disease enables patients to live a normal life by reducing the intensity of the disease and increasing the survival time. Patients are rapidly diagnosed due to technological advancements in point-of-care testing for HIV. This enables early interventions to prevent disease progression to an advanced stage. Advancements in Antiretroviral Therapy (ART) have revolutionized the treatment of HIV in recent years. The development of Highly Active Antiretroviral Therapy (HAART) and combination therapies have significantly improved patient outcomes.

Factors responsible for the growing prevalence include unprotected sex, contaminated needles or syringes, and the lack of awareness about the transmission mode. A vital factor driving the HIV-1 market growth is the concerted efforts by governments and NGOs to provide at-risk individuals with greater accessibility to disease testing and treatment for infected persons. Companies such as Cipla, Inc. and Gilead Sciences, Inc. have adopted patient education programs to reduce the adverse consequences of the infection. The future growth of this market largely depends upon the unmet diagnostic and treatment needs present in African and Asian countries.

The expanded use of Pre-exposure prophylaxis (PrEP), a preventive approach for individuals at high risk of HIV infection, contributes to the market growth. The widespread adoption of PrEP has increased the demand for antiretroviral drugs. Biosimilars, which are generic equivalents of branded and expensive medications, have seen a rising demand in the market. For instance, Suvizumab is an anti-HIV-1 mAb biosimilar widely used in the treatment of HIV. This trend is expected to help expand the human immunodeficiency virus therapeutics market.

Technological advancements, such as long-lasting injectables and implants, have enhanced the delivery and effectiveness of HIV therapeutics. As per an article published by the National Institutes of Health (NIH) in March 2020, long-acting injectable nanoformulations of cabotegravir and rilpivirine used for HIV therapy were in phase III clinical trials. Cabotegravir was in advanced clinical development for HIV pre-exposure prophylaxis, and these formulations are expected to give results equivalent to traditional medicines.

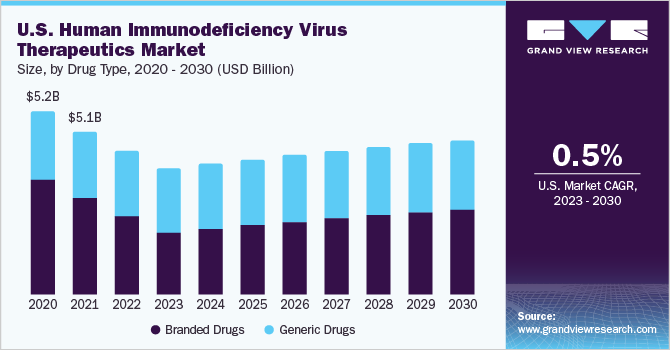

Drug Type Insights

Based on drug type, the branded drugs segment dominated the market in 2022. Pharmaceutical companies are investing in R&D activities to introduce advanced and more productive branded antiretroviral drugs for HIV treatment. This approach is expected to be pivotal in expanding the branded HIV therapeutics market. Additionally, the advancing healthcare infrastructure, growing disposable income levels, and enhanced accessibility to medical facilities in developing nations drive the demand for these critical medications, which are instrumental in saving lives and mitigating the impact of HIV/AIDS.

On the other hand, the generic drugs segment is expected to expand at the fastest CAGR over the forecast period. Generic drugs, being bioequivalent to their branded counterparts, provide cost-effective alternatives for patients, healthcare systems, and governments. Thus, they significantly contribute to enhanced accessibility to HIV medications. Additionally, awareness campaigns and government initiatives have played a vital role in the early identification and diagnosis of HIV infections, leading to a significant increase in patients seeking treatment. This surge in demand is attributed to proactive measures promoting early intervention and treatment-seeking behavior.

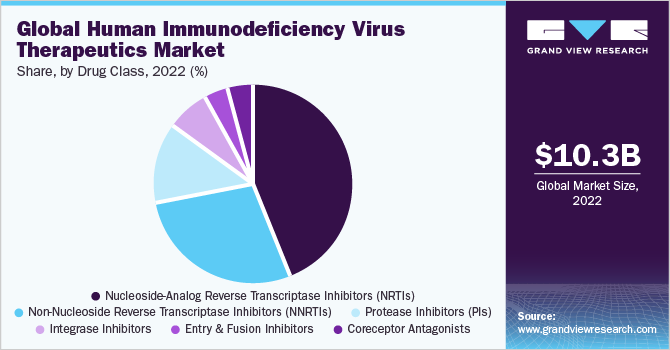

Drug Class Insights

The nucleoside-analog reverse transcriptase inhibitors segment dominated the market with the largest revenue share of 43.8% in 2022. Most antiretroviral drugs belong to the NRTIs group, thus rendering it the largest class of drugs. NRTIs inhibit reverse transcriptase activity and ultimately arrest viral replication. Generally, the antiretroviral regimen employed to treat HIV patients involves a combination of antiretroviral agents belonging to different drug classes, wherein the primary goal is to reduce the viral load.

NRTIs are active against both HIV-1 and HIV-2, which makes them effective against multiple strains of the virus. They also inhibit the reverse transcriptase enzyme, thereby stopping the virus's replication cycles. They are available in oral formulations, allowing easy administration. Additionally, NRTIs can delay the emergence of drug resistance when combined with other ARTs and are more affordable when compared to other classes of antiretroviral drugs. These factors act as driving forces for the growth of the market.

Based on drug class, the HIV therapeutics market is segmented into nucleoside-analog reverse transcriptase inhibitors, non-nucleoside reverse transcriptase inhibitors, entry and fusion inhibitors, protease inhibitors, integrase inhibitors, and coreceptor antagonists. Of these classes, the non-nucleoside reverse transcriptase inhibitors segment is expected to advance at the fastest CAGR of 3.6% over the forecast period.

NNTRIs bind directly to the reverse transcriptase enzyme of the virus and inhibit its function and replication. This mechanism is different from all other drug classes, and hence it works as an alternative treatment option for patients who may have developed a resistance to NRTIs. Additionally, NNTRIs have a favorable pharmacokinetic profile that enables convenient once-daily dosage with fewer drug interactions than protease inhibitors (PIs). These factors contribute to the lucrative growth of this segment.

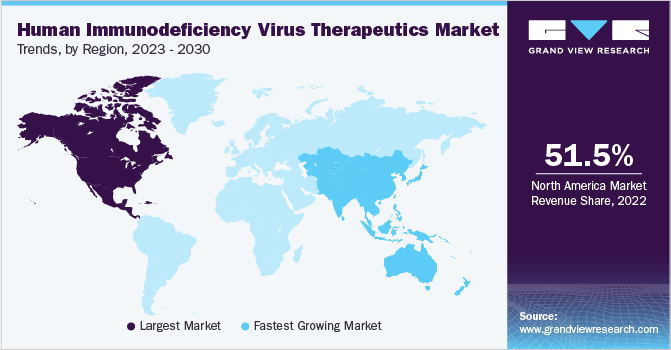

Regional Insights

North America dominated the market with the largest revenue share of 51.5% in 2022, owing to the high treatment expense, increasing disease prevalence, and introduction of drugs with improved efficacy, such as Complera by Gilead Sciences, Inc. The region has a high prevalence of HIV infection, with an estimated 1.7 million people living with HIV in the U.S. alone. North America has a robust healthcare infrastructure and well-established regulatory frameworks, which facilitate the development, approval, and distribution of innovative HIV medications. Additionally, strong collaborations between pharmaceutical companies, academic institutions, and government agencies contribute to this region's market growth.

Asia Pacific is expected to expand at the fastest CAGR of 4.8% over the forecast period from 2023 to 2030 due to a significant increase in the number of HIV patients. The growing patient population, increasing awareness, and improved access to healthcare are expected to fuel market growth. The governments in the Asia Pacific region are taking proactive measures to combat HIV by implementing national programs. For instance, NACP Phase-V is a Central Sector Scheme wholly sponsored by the Government of India with a budget of USD 1,885.4 million.

Key Companies & Market Share Insights

Market participants use strategies such as product launches, innovations, strategic acquisitions, etc., to maintain and grow their global reach. For instance, in June 2023, AbbVie announced the phase I clinical trial of ABBV-1882 to treat human immunodeficiency virus (HIV) infections. The therapeutic candidate is a mix of ABBV-181 (anti-PD1) and ABBV-382 (anti-a4b7 mAb). It works by targeting the alpha4-beta7 integrin (A4B7) and PD1.

Similarly, in August 2022, Gilead announced the first global regulatory approval of Sunlenca (Lenacapavir) injections and tablets by the European Commission (EC) for the treatment of HIV infection, in conjunction with other antiretroviral(s), in people with multi-drug resistant HIV infection. Following are some of the major participants in the global human immunodeficiency virus therapeutics market:

-

AbbVie Inc.

-

Boehringer Ingelheim International GmbH

-

Bristol-Myers Squibb Company

-

Cipla Inc.

-

Genentech, Inc.

-

Gilead Sciences, Inc.

-

Merck & Co., Inc.

-

ViiV Healthcare

Human Immunodeficiency Virus Therapeutics Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 10.19 billion

Revenue forecast in 2030

USD 11.34 billion

Growth rate

CAGR of 1.5% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Report updated

September 2023

Quantitative units

Revenue in USD million and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Drug type, drug class, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; U.K.; Germany; France; Italy; Spain; Denmark; Sweden; Norway; China; Japan; India; Australia; South Korea; Thailand; Brazil; Mexico; Argentina; Saudi Arabia; South Africa; UAE; Kuwait

Key companies profiled

AbbVie Inc.; Boehringer Ingelheim International GmbH; Bristol-Myers Squibb Company; Cipla Inc.; Genentech, Inc.; Gilead Sciences, Inc.; Merck & Co., Inc.; ViiV Healthcare

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Human Immunodeficiency Virus Therapeutics Market Repot Segmentation

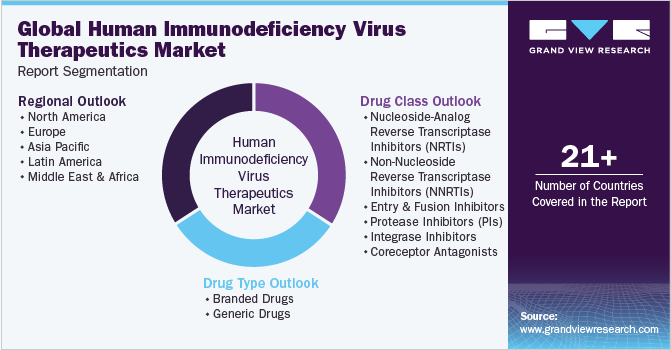

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the global human immunodeficiency virus therapeuticsmarket report based on drug type, drug class, and region:

-

Drug Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Branded Drugs

-

Generic Drugs

-

-

Drug Class Outlook (Revenue, USD Million, 2018 - 2030)

-

Nucleoside-Analog Reverse Transcriptase Inhibitors (NRTIs)

-

Non-Nucleoside Reverse Transcriptase Inhibitors (NNRTIs)

-

Entry and Fusion Inhibitors

-

Protease Inhibitors (PIs)

-

Integrase Inhibitors

-

Coreceptor Antagonists

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

U.K.

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

Thailand

-

South Korea

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global human immunodeficiency virus therapeutics market size was estimated at USD 10.33 billion in 2022 and is expected to reach USD 10.19 billion in 2023.

b. The global human immunodeficiency virus therapeutics market is expected to grow at a compound annual growth rate of 1.5% from 2023 to 2030 to reach USD 11.34 billion by 2030.

b. North America dominated the human immunodeficiency virus therapeutics market with a share of 51.50% in 2022. This is attributable to rising adoption of early diagnosis & treatment and awareness among patients.

b. Some key players operating in the human immunodeficiency virus therapeutics market include AbbVie, Inc., Boehringer Ingelheim GmbH, Bristol-Myers Squibb Company, Cipla, Inc., Genentech, Inc., Gilead Sciences, Inc., Merck & Co., Inc., and ViiV Healthcare.

b. Key factors that are driving the market growth include surging incidence rate of HIV-1 infection, technological advancements, rising efforts of the government and various NGOs to provide at-risk individuals with greater accessibility to disease testing and treatment for infected persons.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."