- Home

- »

- Consumer F&B

- »

-

Human Grade Pet Food Market Size & Share Report, 2030GVR Report cover

![Human Grade Pet Food Market Size, Share & Trends Report]()

Human Grade Pet Food Market (2025 - 2030) Size, Share & Trends Analysis Report By Type (Wet Food, Dry Food), By Distribution Channel (Convenience Stores, Online), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-391-4

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Human Grade Pet Food Market Summary

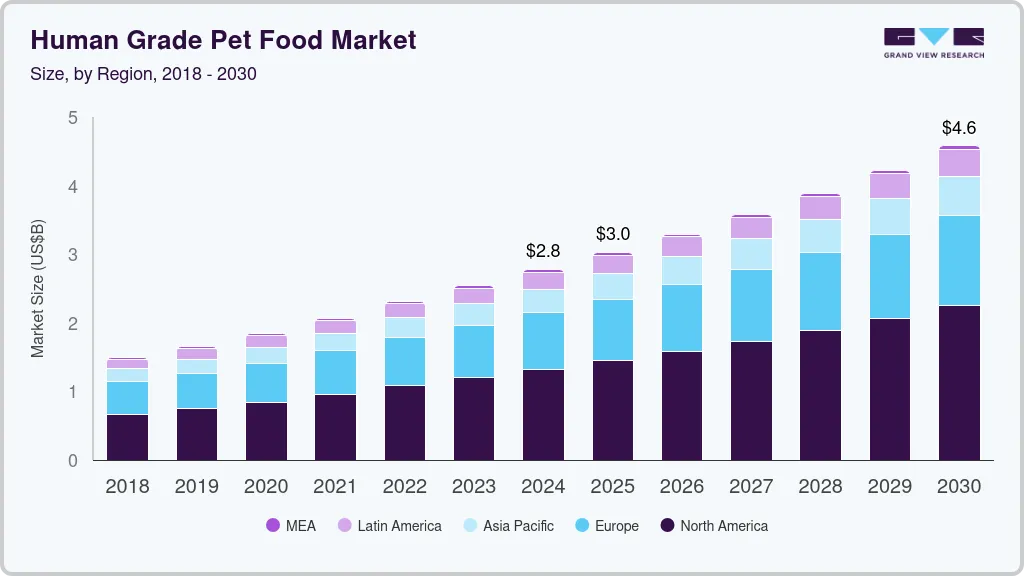

The global human grade pet food market size was estimated at USD 2.77 billion in 2024 and is projected to reach USD 4.58 billion by 2030, growing at a CAGR of 8.6% from 2025 to 2030. The driving factors include a desire to provide pets with nutrition similar to human diets, believing it promotes better health and longevity.

Key Market Trends & Insights

- North America accounted for a market share of 30.61% in 2023.

- By type, the wet food accounted for a market share of 33.50% of the global revenues in 2023.

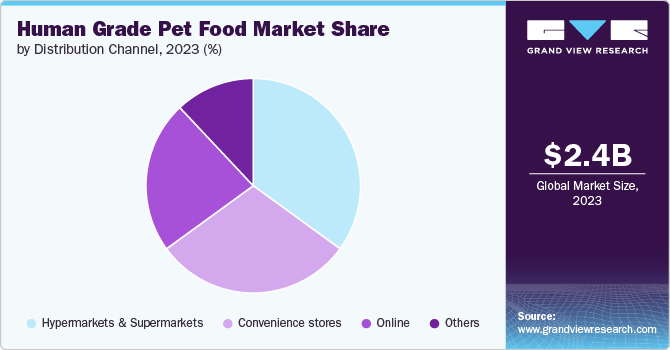

- By distribution channel, the supermarkets & hypermarkets accounted for a share of 35.00% in 2023.

Market Size & Forecast

- 2024 Market Size: USD 2.77 Billion

- 2030 Projected Market Size: USD 4.58 Billion

- CAGR (2025-2030): 8.6%

- North America: Largest market in 2023

Concerns over food allergies and sensitivities also influence this choice, as human-grade foods often avoid common allergens and additives in regular pet foods. In addition, the trend reflects a broader humanization of pets, where owners consider pets as family members deserving of the same nutritional standards humans enjoy.

The demand for human grade pet food is on the rise, driven by several influential factors shaping the pet food industry today. One significant trend is the humanization of pets, where pets are increasingly viewed as integral family members. This shift in perception prompts pet owners to seek pet foods that meet human-grade standards, ensuring that their pets receive nutrition comparable to what they consume. This trend is closely tied to concerns over pet health and wellness, with owners prioritizing foods that are perceived to be healthier and safer, often free from artificial additives and lower-quality ingredients commonly found in non-human-grade options.

Another key factor driving the popularity of human-grade pet food is the growing demand for transparency and trust in pet food manufacturing. Consumers are becoming more vigilant about understanding the ingredients and production processes behind the foods they feed their pets. Human-grade pet foods typically provide clear labeling and detailed information about sourcing and manufacturing practices, enhancing transparency and building confidence among pet owners.

The premiumization of pet products also plays a pivotal role in the increasing availability and adoption of human-grade pet foods. As pet owners become more willing to invest in higher-quality products, the market for human-grade pet foods expands. These foods often command higher prices due to their superior ingredients and production standards, appealing to affluent consumers seeking the best for their pets.

Furthermore, regulatory standards are evolving to align more closely with human food safety regulations, encouraging the development and promotion of human-grade pet foods. This regulatory environment ensures that pet foods meet stringent quality and safety criteria, further bolstering consumer trust and driving demand.

Educational efforts by pet food manufacturers and advocacy groups also contribute to human-grade pet food sales growth. These initiatives educate pet owners about the benefits of human-grade ingredients and the potential risks associated with lower-quality alternatives, empowering consumers to make informed choices about their pets' nutrition.

Type Insights

Wet food accounted for a market share of 33.50% of the global revenues in 2023. Human-grade wet food is often perceived to have higher quality and safety standards than pet-grade food. Pet owners may prefer feeding their pets food that meets the same standards as food meant for human consumption, believing it to be healthier and safer. Moreover, wet food often has a higher moisture content and can be more palatable for pets, especially those with dental issues or picky eaters. Human-grade options may offer more variety and flavors that pets enjoy.

Snacks & treats are expected to grow at a CAGR of 7.5% from 2024 to 2030. Many human-grade snacks and treats are formulated with wholesome ingredients that provide nutritional benefits for pets. This can include higher protein content, essential vitamins, and minerals that support overall health and well-being. Also, some pet owners prefer human-grade snacks because they resemble foods that humans consume. This makes them feel more comfortable and confident about the ingredients and nutritional value being provided to their pets. In April 2024, Wet Noses, a natural pet brand, partnered with Pet Food Experts (PFX), a distributor of pet products to independent retailers. Through this partnership, PFX will offer Wet Noses' human-grade oven-baked dog food and treats to its network of over 6,000 independent pet retailers across 39 U.S. states. Wet Noses' flagship product is its Organic Crunchy Treats, made with limited ingredients and human-grade sourcing. The brand has also launched a new line of "Moments" treats in fun shapes and flavors, like cheddar pretzels and apple cinnamon bears.

Distribution Channel Insights

Sales of human grade pet food through supermarkets & hypermarkets accounted for a share of 35.00% of the global revenues in 2023. Supermarkets provide easy access to a variety of human-grade pet foods, making it convenient for pet owners to purchase these products along with their regular groceries. In addition, these stores typically offer a wide variety of pet food, styles, and sizes, catering to diverse tastes and preferences. Customers can choose from traditional options to specialty or seasonal flavors.

Sales through the online channel are expected to grow at a CAGR of 7.4% from 2024 to 2030. The convenience offered by online shopping has played a pivotal role in the industry's growth. Customers can explore diverse human-grade pet food flavours and brands from their homes, eliminating the necessity of visiting brick-and-mortar stores. This accessibility has expanded their appeal to a wider audience, including those in regions where access to premium products may be limited.

Regional Insights

The human grade pet food market in North America accounted for a market share of 30.61% in 2023. The primary factor is the perceived health and nutritional benefits, as these products are made with ingredients that meet human food standards, ensuring higher quality and safety. This appeals to pet owners concerned about potential contaminants and the overall well-being of their pets. The transparency and trust associated with human-grade pet food brands, which often provide detailed information about their ingredients and sourcing, also play a crucial role.

U.S. Human Grade Pet Food Market Trends

The human grade pet food market in the U.S. is expected to grow significantly over the forecast period. Consumers in the U.S. are increasingly purchasing human-grade pet food for their pets. There is a rising trend towards the humanization of pets, with many pet owners viewing their pets as integral family members deserving of the same high-quality food standards as humans. This perception drives a preference for human-grade pet food, which is considered safer and more nutritious.

Europe Human Grande Pet Food Market Trends

The human grade pet food market in Europe accounted for a market share of 24.41% in 2023. Europeans are increasingly interested in human-grade pet food due to its health and safety benefits, higher-quality ingredients, and superior nutritional value. The transparency and trust provided by stringent standards and clear ingredient listings appeal to pet owners. Ethical and sustainability considerations also play a significant role, as consumers prefer brands that use responsibly sourced ingredients and eco-friendly packaging.

Asia Pacific Human Grade Pet Food Market Trends

The market in Asia Pacific is expected to grow at a CAGR of 7.7% from 2024 to 2030. Exposure to Western trends and lifestyles, including pet care practices, influences consumer preferences in the Asia-Pacific region, leading to a greater acceptance and demand for human-grade pet food.Urbanization has contributed to the rise in pet ownership. As more people in urban areas adopt pets, there is an increased demand for convenient, high-quality pet food products.

Key Human Grade Pet Food Company Insights

The market includes both international and domestic participants. Brand market share analysis indicates that key market players focus on strategies such as new product launches, partnerships, mergers & acquisitions, and global expansion. Some of the largest human-grade pet food manufacturers, including JustFoodForDogs, NomNomNow Inc., Nestlé S.A., and Mars, have entered the market. Along with that, to improve their efficiency and use the international distribution channel, the companies have been ruling the industry.

Key Human Grade Pet Food Companies:

The following are the leading companies in the human grade pet food market. These companies collectively hold the largest market share and dictate industry trends.

- JustFoodForDogs

- NomNomNow Inc.

- Spot & Tango

- The Honest Kitchen

- Ollie

- Pet Plate

- Darwin's Natural Pet Products

- The Farmers Dog, Inc.

- Nestlé S.A.

- Mars (Champion Pet foods)

Recent Developments

-

In January 2024, Wiggles. Inc., an Indian preventive pet care brand, launched a new product called Wiggles Wet Food for Dogs. This 100% human-grade wet food is designed to provide a complete and balanced meal for dogs of all ages. Wet food contains high-quality ingredients like chicken, chicken liver, and vegetables such as pumpkin, carrots, and green peas. It is also infused with herbs like Brahmi, Ashwagandha, Rosemary, Moringa, and Chicory Root Extract, known for their therapeutic benefits, and Omega 3 & 6 Fatty Acids.

-

In February 2024, ButcherBox, a direct-to-consumer meat and seafood brand, announced the launch of its ButcherBox for Pets line, which includes dry food, treats, and hip and joint supplements for dogs. The products are sourced from humanely raised, sustainably sourced beef and chicken and are developed within a clinical vet environment with the same high-quality standards as ButcherBox's human products.

-

In June 2023, PetPlate introduced FreshBaked, a new line of dry dog food featuring crunchy clusters made from human-grade ingredients. Similar to their existing FreshCooked entrees, these recipes prioritize nutrition and palatability. The FreshBaked line includes two flavors: Trail Blazin' Beef Morsels Recipe and grain-free Roost Rulin' Chicken Nugget Recipe. The clusters are gently baked at low temperatures to preserve vitamins and minerals, offering pet owners a nutritious and appealing option for their dogs' diets.

-

In January 2023, The Honest Kitchen, a San Diego-based producer of natural, human-grade pet foods, launched a new line of functional toppers for dogs. A veterinary nutritionist created these pourable stews and included added nutrients to support various aspects of canine health. The new line of Functional Pour Overs is available for USD 3.29 across various distribution channels, including the company's website, independent pet supply stores, Petco, Amazon, and Chewy.

Human Grade Pet Food Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 3.02 billion

Revenue forecast in 2030

USD 4.58 billion

Growth rate

CAGR of 8.6% from 2025 to 2030

Actual data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, distribution channel, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S; Canada; Mexico; Germany; UK; Spain; Italy; France; China; India; Japan; South Korea; Australia & New Zealand; Brazil; UAE

Key companies profiled

JustFoodForDogs; NomNomNow Inc.; Spot & Tango; The Honest Kitchen; Ollie; Pet Plate; Darwin's Natural Pet Products; The Farmers Dog, Inc.; Nestlé S.A.; Mars (Champion Pet foods)

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Human Grade Pet Food Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global human grade pet food market based on type, distribution channel, and region:

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Snacks & Treats

-

Wet Food

-

Dry Food

-

Others

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Hypermarkets & Supermarkets

-

Convenience Stores

-

Online

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

Spain

-

Italy

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia & New Zealand

-

South Korea

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global human grade pet food market size was estimated at USD 2.41 billion in 2023 and is expected to reach USD 2.56 billion in 2024.

b. The global human grade pet food market is expected to grow at a compounded growth rate of 6.6% from 2024 to 2030 to reach USD 3.77 billion by 2030.

b. Wet food accounted for a share of 33.5% in 2023. Human-grade wet food typically contains higher quality ingredients and is formulated to provide balanced nutrition, which can be appealing to pet owners who prioritize their pets' diet and health.

b. Some key players operating in human grade pet food market include JustFoodForDogs, NomNomNow Inc., Spot & Tango, The Honest Kitchen, and others

b. Key factors that are driving the market growth include rising demand for growth in the pet food industry, and urbanization and changing lifestyles.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.