Human Augmentation Market Size, Share & Trends Analysis Report By Product (Wearable Devices, AR), By Functionality (Body-worn, Non Body-worn), By Technology, By End-use (Consumer, Commercial), By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-316-5

- Number of Report Pages: 100

- Format: PDF, Horizon Databook

- Historical Range: 2017 - 2023

- Forecast Period: 2024 - 2030

- Industry: Technology

Human Augmentation Market Size & Trends

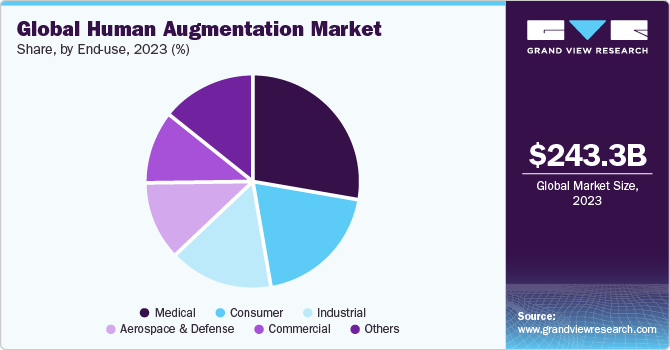

The global human augmentation market size was estimated at USD 243.30 billion in 2023 and is expected to grow at a CAGR of 17.3% from 2024 to 2030. Advanced technologies such as Virtual Reality (VR) and Augmented Reality (AR) are driving the growth of the global market. These technologies play a crucial role in boosting training, simulation, and live data visualization. They enable users to engage with digital data and objects, enriching their abilities and experiences across various sectors including healthcare, education, and workplace training. This, in turn, broadens the scope and utilization of human augmentation technologies.

The emphasis on incorporating advanced technologies into the healthcare sector is intensifying, as innovations in prosthetics, exoskeletons, and brain-computer interfaces enhance rehabilitation results and mobility for individuals with disabilities. Other industries such as manufacturing and logistics are witnessing a rise in the adoption of products such as wearable robotics and exosuits, which amplify the strength and stamina of workers, thereby elevating productivity and reducing the incidence of injuries at work. Additionally, the growing interest of consumers in AR and Virtual Reality (VR) experiences is driving technological advancements in sensory augmentation, finding applications across various domains from gaming and entertainment to training and education.

Market players are conducting research and development on advanced augmentation technologies, methods, systems, and devices in response to the growing need for human augmentation. For instance, in the medical sector, the use of near-infrared spectroscopy for brain mapping and imaging is becoming increasingly popular due to its cost-effectiveness, sophistication, and durability compared to traditional techniques. These advancements in human augmentation are set to enhance business efficiency and competitiveness, creating vast opportunities for market growth and profitability. Additionally, technological progress is expanding the potential uses of human augmentation across various industries, including biotechnology, defense, aerospace, and manufacturing.

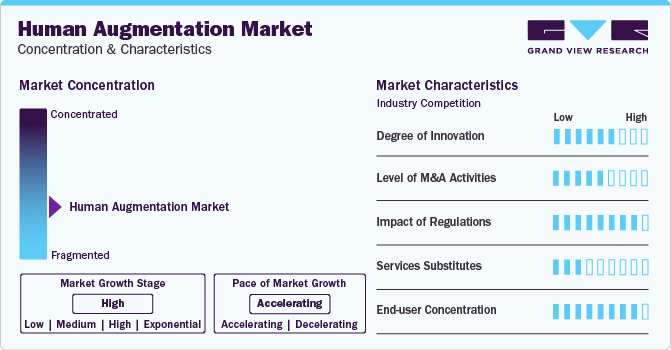

Market Characteristics & Concentration

The human augmentation market is characterized by a high degree of innovation. Constant advancements in fields such as artificial intelligence (AI), robotics, neuroscience, and materials science are creating new opportunities for human augmentation. For instance, brain-computer interfaces (BCIs) are being explored to directly connect the brain with devices, potentially enhancing cognitive abilities or controlling prosthetics.

The market is characterized by a high level of merger and acquisition (M&A) activity by the leading players. Companies in this space have expertise in specific areas of human augmentation. By merging, they can combine their expertise. For instance, a company specializing in BCIs can merge with a firm that excels in prosthetics. This could lead to the development of next-generation thought-controlled prosthetics.

Regulatory bodies around the world are actively working on developing more comprehensive frameworks for the market. Collaboration among governments, industry players, and ethicists is crucial to establish effective and responsible regulations. Various regulatory bodies focus on specific areas within human augmentation. For instance, the US Food and Drug Administration (FDA) has specific guidelines for cochlear implants and deep brain stimulators.

There are low substitutes for human augmentation products. Natural skill development through practice and learning can be considered as substitute for human augmentation products, for instance, exercise programs for physical strength instead of exoskeletons.

End-user concentration is a significant factor in the market. Assistive technologies such as smart glasses with voice control or advanced prosthetics with improved dexterity are empowering people with disabilities to live more independently. Smartwatches and fitness trackers are widely used by end users for health monitoring, sleep tracking, and activity goals. AR glasses are being explored for various applications, from navigation and information access to entertainment and gaming.

Product Insights

The wearable devices segment led the market in 2023, accounting for 34.0% share of the global revenue. Factors such as enhanced situational awareness, reduced driver fatigue, and improved focus and reaction time are the factors driving the growth of the segment. Wearable AR glasses could project real-time information onto the windshield, such as upcoming traffic signals, blind spot warnings, or pedestrian alerts. Moreover, wearables could monitor driver drowsiness and provide alerts or even initiate corrective actions, such as engaging autopilot features to prevent accidents.

The Augmented Reality devices segment is expected to register the fastest CAGR during the forecast period. AR can create immersive training simulations for various professions, such as pilots and firefighters. This allows for safer and more realistic training experiences. Moreover, AR devices can be combined with other human augmentation technologies, such as BCIs, to assist people with disabilities. A person with limited vision can receive visual cues or navigation instructions through AR glasses controlled by a BCI.

Functionality Insights

The body-worn segment accounted for the largest market revenue share in 2023. The convergence of fields such as AI, neuroscience, and robotics is creating opportunities for more sophisticated and integrated human augmentation solutions. Moreover, consumer's increasing interest in self-improvement, health optimization, and enhanced performance is driving the demand for the segment. Furthermore, integration with advanced health trackers and biosensors can provide real-time data on vitals, sleep patterns, and activity levels. This data, combined with AI-powered analytics, can offer personalized health insights and interventions.

The non body-worn segment is predicted to foresee significant growth in the coming years. Non-body-worn human augmentation products enhance human capabilities without the need for wearables or implanted devices. Advancements in Neuroscience are creating opportunities for advanced technologies such as brain-computer interfaces (BCIs) that don't require physical implants.

Technology Insights

The AI Integration segment accounted for the largest market revenue share in 2023. AI can analyze data from sensors in augmentation products, personalize settings, and optimize performance in real-time. An exoskeleton can adjust its power output based on the wearer's exertion, or a prosthetic limb that learns the user's movement patterns for a more natural feel. Moreover, AI can analyze data from body sensors and environmental factors to provide real-time recommendations and to take corrective actions. This is essential for applications such as health monitoring, where AI can detect early signs of a medical issue or can trigger automated emergency responses.

The biohacking & bio-augmentation segment is predicted to foresee significant growth in the coming years. Biohacking techniques often involve low-cost, readily available tools, making them more accessible than advanced medical-grade bio-augmentation technologies. Moreover, medical advancements, such as breakthroughs in gene editing, tissue engineering, and implantable devices are creating new avenues for treating diseases, restoring lost functions, and enhancing human capabilities through well-researched and tested methods.

End-use Insights

The medical segment led the market in 2023. Human augmentation products such as advanced prosthetics, implantable devices, and bio-engineered tissues can improve the lives of people with chronic illnesses. Moreover, wearable health trackers and implantable sensors can provide real-time data on vital signs, sleep patterns, and other health metrics, enabling earlier disease detection and better treatment management. Further, advancements in bioprinting and genetic engineering personalize implants and augmentation techniques that cater to individual needs and conditions.

The commercial segment is anticipated to exhibit a substantial growth rate over the forecast period. AR overlays can project information onto a worker's field of view, providing real-time instructions, schematics, or maintenance manuals. This can improve efficiency, reduce errors, and facilitate faster training. Furthermore, exoskeletons wearable suits can provide workers in physically demanding jobs with increased strength, endurance, and support, reducing fatigue and preventing injuries. Thus, construction workers can lift heavier materials, or warehouse staff can handle more boxes with less strain.

Regional Insights

North America dominated the market with a revenue share of 33.0% in 2023. North America is a hub for innovation in robotics, AI, biotechnology, and materials science. This ongoing R&D fuels the development of advanced human augmentation technologies. Moreover, government agencies in the US and Canada are increasingly investing in research related to prosthetics, neural interfaces, and other human augmentation technologies, particularly for military and medical applications.

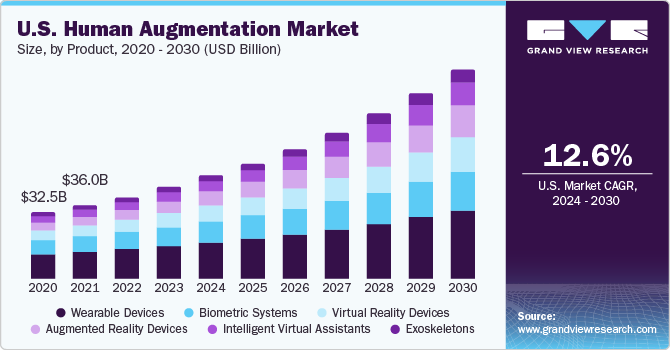

U.S. Human Augmentation Market Trends

The U.S. human augmentation market is expected to grow at a CAGR of 12.6% from 2024 to 2030. Federal agencies such as the National Institutes of Health (NIH) and the Defense Advanced Research Projects Agency (DARPA) are investing heavily in research related to prosthetics, neural interfaces, and other human augmentation technologies, particularly for medical and military applications. Moreover, advancements in miniaturization of electronics and biocompatible materials in the country are leading to lighter, more comfortable, and more seamlessly integrated human augmentation products.

Canada human augmentation market held a significant share in the North American region. Canada's regulatory framework for medical devices often aligns with the US FDA, allowing for a smoother path to market for Canadian-developed human augmentation technologies. Moreover, Canadian regulatory bodies prioritize safety and ethical considerations during the approval process for human augmentation products.

Mexico human augmentation market is projected to grow substantially over the forecast period. Mexico faces a growing burden of chronic diseases such as diabetes, obesity, and cardiovascular issues. Human augmentation technologies such as prosthetics, implants, and bio-wearables for monitoring health vitals can play a role in managing these conditions.

Europe Human Augmentation Market Trends

Europe human augmentation market held a significant share in the global market. Europe is known for its innovative approach to new technologies, with a strong emphasis on ethical considerations and robust regulatory frameworks. This is reflected in the development and implementation of human augmentation technologies in the region.

UK human augmentation market held a significant share in the European region. The UK has a strong presence in VR and AR development, with companies such as, Ultrahaptics and Magic Leap leading the way. These immersive technologies are finding applications in various fields such as, healthcare, education, and training, enhancing user experiences and capabilities.

The Germany human augmentation market is expected to grow at a significant CAGR from 2024 to 2030. Germany boasts a thriving research ecosystem with renowned universities and research institutions such as, the Fraunhofer Institute and the Max Planck Society actively contributing to advancements in human augmentation technologies.

The France human augmentation market is expected to grow at a lucrative pace from 2024 to 2030. France has a strong healthcare system and a growing focus on medical technology innovation. This fosters the development and adoption of human augmentation technologies in areas such as prosthetics, and exoskeletons.

Asia Pacific Human Augmentation Market Trends

The market in Asia Pacific region is anticipated to register the highest CAGR over the forecast period. Various countries such as China, Japan, and South Korea are known for their rapid technological advancements. This fosters innovation in human augmentation technologies such as robotics, exoskeletons, and wearable devices.

India human augmentation marketheld a substantial share in the Asia Pacific region. The Indian government is increasingly supporting R&D in human augmentation through initiatives like the Atmanirbhar Bharat (Self-Reliant India) program and the National Mission on Robotics and Automation.

China human augmentation market held a significant share in the Asia Pacific region. The government across the country are investing in research and development of key technologies such as AI, robotics, and advanced materials, which are crucial for human augmentation advancements.

Japan human augmentation market is expected to grow modestly over the forecast period. Japan has a rapidly aging population, creating a demand for technologies that can improve mobility, independence, and health outcomes for the elderly. Moreover, Japan has a highly skilled workforce with a strong engineering and technology background, readily adaptable to new technologies like human augmentation.

South Korea human augmentation market is witnessing rapid digital transformation and is actively adopting and integrating new technologies. This creates a strong ground for the development and application of human augmentation technologies across various sectors.

Australia human augmentation market has a strong sporting culture, creating interest in human augmentation technologies that can enhance athletic performance and recovery.

Middle East & Africa Human Augmentation Market Trends

The Middle East & Africa (MEA) region is anticipated to thrive over the forecast period. Increasing disposable income, particularly in urban areas, fuels consumer demand for wearable devices and other human augmentation technologies. Moreover, the region is seeing significant investments in medical technology, leading to the development and adoption of human augmentation solutions like prosthetics, exoskeletons, and brain-computer interfaces.

UAE human augmentation market is anticipated to witness a significant growth rate over the forecast period. The UAE government actively supports the development of human augmentation technologies through initiatives like the UAE Strategy for Artificial Intelligence and the National Innovation Strategy. This fosters research and development in areas like robotics, AI, and bioengineering.

KSA human augmentation market held a significant share in the MEA region. The KSA has a highly skilled and tech-savvy workforce, readily adaptable to new technologies like human augmentation. The KSA's robust manufacturing sector provides a strong ground for the testing and implementation of human augmentation technologies, particularly in areas like exoskeletons for industrial applications.

South Africa human augmentation market held a substantial share in the MEA region.The use of VR and AR technologies is increasing in various fields like healthcare, education, and training, with potential for further growth and integration with human augmentation applications in the country.

Key Human Augmentation Company Insights

Key human augmentation companies include Daifuku Co., Ltd., ABB, and BALYO Companies active in the AMR market are focusing aggressively on expanding their customer base and gaining a competitive edge over their rivals. Hence, they pursue various strategic initiatives, including partnerships, mergers & acquisitions, collaborations, and new product/ technology development. For instance, in January 2023, NTT DOCOMO, INC., mobile phone operator, announced The FEEL TECH system, a new Technology that leverages a Human-Augmentation Platform to Exchange Haptic Information among Individuals. The FEEL TECH system, considered by DOCOMO to be the first of its kind globally for sharing haptic information, includes a device that captures an individual's sensory condition, a "driving" device which recreates this state in another individual physically, and a human-augmentation platform that facilitates the exchange of this information across networked devices. The system quantifies haptic information as vibrations akin to human touch, detected using a device comparable to a Piezoelectric sensor.

Key Human Augmentation Companies:

The following are the leading companies in the human augmentation market. These companies collectively hold the largest market share and dictate industry trends.

- Apple Inc.

- Ekso Bionics

- Google LLC

- Magic Leap, Inc.

- Microsoft Corporation

- NVIDIA Corporation

- Panasonic Holdings Corporation

- SAMSUNG Electronics Co Ltd

- Sony Corporation

- Vuzix

Recent Developments

-

In January 2024, Neuralink, a neurotechnology company, achieved a significant breakthrough by successfully implanting a brain chip into a human for the first time. In 2023, the company obtained clearance from the U.S. Food and Drug Administration (FDA) for its inaugural trial to evaluate brain chips in humans, marking a critical milestone for the startup.

-

In December 2023, Verve, Inc., a developer of exoskeletons, secured $20 million in Series B financing, with Safar Partners and Cybernetix Ventures spearheading the round, alongside additional contributions from current investors. This capital is intended to support the scaling of the company's soft exoskeleton, "SafeLift".

-

In May 2023, Vuzix Corporation, provider of technology devices, partnered with TeamOpenSmartGlasses to create ChatGPT AI applications for their smart glasses, aiming to enrich and advance interactions and meetings within the business sector.

Human Augmentation Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2024 |

USD 283.69 billion |

|

Revenue forecast in 2030 |

USD 739.59 billion |

|

Growth Rate |

CAGR of 17.3% from 2024 to 2030 |

|

Base Year |

2023 |

|

Actual data |

2017 - 2023 |

|

Forecast period |

2024 - 2030 |

|

Quantitative units |

Revenue in USD billion, and CAGR from 2024 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Product, functionality, technology, end-use, region |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

|

Country scope |

U.S.; Canada; Mexico; Germany; UK; France; China; Japan; India; Australia; South Korea; Brazil |

|

Key companies profiled |

Apple Inc.; Ekso Bionics; Google LLC; Magic Leap, Inc.; Microsoft Corporation; NVIDIA Corporation; Panasonic Holdings Corporation; SAMSUNG Electronics Co Ltd; Sony Corporation; Vuzix |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Human Augmentation Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the global human augmentation market report based on product, functionality, technology, end-use, and region.

-

Product Outlook (Revenue, USD Billion, 2017 - 2030)

-

Wearable Devices

-

Augmented Reality Devices

-

Virtual Reality Devices

-

Exoskeletons

-

Biometric Systems

-

Intelligent Virtual Assistants

-

-

Functionality Outlook (Revenue, USD Billion, 2017 - 2030)

-

Body-worn

-

Non Body-worn

-

-

Technology Outlook (Revenue, USD Billion, 2017 - 2030)

-

AI Integration

-

Quantum Computing Augmentation

-

Biohacking & Bio-augmentation

-

-

End-use Outlook (Revenue, USD Billion, 2017 - 2030)

-

Consumer

-

Commercial

-

Medical

-

Aerospace & Defense

-

Industrial

-

Others

-

-

Regional Outlook (Revenue, USD Billion, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

-

South America

-

Brazil

-

-

Middle East and Africa (MEA)

-

UAE

-

KSA

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global human augmentation market size was estimated at USD 243.30 billion in 2023 and is expected to reach USD 283.69 billion in 2024.

b. The global human augmentation market is expected to grow at a compound annual growth rate of 17.3% from 2024 to 2030 to reach USD 739.59 billion by 2030.

b. North America dominated the market in 2023, accounting for over 33.0% of global revenue. North America is a hub for innovation in robotics, artificial intelligence (AI), biotechnology, and materials science. This ongoing R&D fuels the development of advanced human augmentation technologies.

b. Some key players operating in the human augmentation market include Apple Inc., Ekso Bionics, Google LLC, Magic Leap, Inc., Microsoft Corporation, NVIDIA Corporation, Panasonic Holdings Corporation, SAMSUNG Electronics Co Ltd, Sony Corporation, and Vuzix.

b. Key factors driving the growth of the human augmentation market include the growth in AR & VR technologies and the increasing adoption of wearable devices.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."