- Home

- »

- Automotive & Transportation

- »

-

Hub Motor Market Size, Share, Trends Analysis Report, 2030GVR Report cover

![Hub Motor Market Size, Share & Trends Report]()

Hub Motor Market (2023 - 2030) Size, Share & Trends Analysis Report By Motor Type (Geared, Gearless), By Power Output (Below 3 KW, 3-5 KW), By Installation Type, By Sales Channel, By Vehicle Type, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-142-6

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2017 - 2021

- Forecast Period: 2023 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Hub Motor Market Size & Trends

The global hub motor market size was estimated at USD 12.26 billion in 2022 and is expected to expand at a compound annual growth rate (CAGR) of 4.8% from 2023 to 2030. A primary driver for market growth is the rising demand for electric vehicles. As EVs continue to evolve, there is a rising emphasis on improving their efficiency, power, and overall performance. Hub motors, with their direct power delivery to the wheels, offer various advantages, including providing instant torque and enabling quick acceleration and responsive handling, thus improving the overall driving experience.

The integration of advanced control systems and regenerative braking technology with hub motors enables better energy efficiency and longer battery life. These technological advancements, along with the rising availability of high-capacity batteries, have led to a greater range and reliability for EVs equipped with hub motors. Thus, consumers are increasingly preferring these vehicles for their superior performance and driving dynamics, further driving market growth.

Hub motors play a vital role in the ongoing global shift toward clean and green transportation solutions. Unlike traditional internal combustion engines that emit harmful pollutants, hub motors, when used in EVs and e-bikes, produce zero direct emissions. This eco-friendly feature of hub motors aligns perfectly with the growing environmental awareness and concerns about air quality and climate change among consumers.

Hub motors generally have fewer moving parts compared to traditional internal combustion engines, resulting in reduced maintenance needs and longer lifespans. This helps save money for consumers while also reducing raw material demand and the energy needed for manufacturing and maintaining complex engine components. In conclusion, sustainability is a major driving force behind the market's growth, as it addresses pressing environmental concerns while providing long-term economic benefits.

Another growth factor is the presence of government incentives and regulations. Governments understand the need for transitioning to cleaner and more sustainable transportation alternatives. To encourage EV adoption, they implement measures such as tax credits, grants, rebates, and subsidies. These initiatives aim to make EVs more affordable and attractive for consumers. For instance, the Indian government is offering incentives of up to 40% of the cost of two-wheeler EVs through its Faster Adoption and Manufacturing of (Hybrid &) Electric Vehicles (FAME) scheme.

COVID-19 Impact

The COVID-19 pandemic had a significant market impact, particularly in countries such as China, being a center for manufacturing hub motors. The pandemic and lockdown measures led to disruptions in the supply chain, impacting the production as well as distribution of hub motors. China, being a leader in the manufacturing of these motors, witnessed a substantial slowdown in production during the initial phase of the pandemic. Strict lockdown measures resulted in a temporary closure of factories as well as manufacturing facilities. As a result, the supply of these motors was severely affected, causing delays in fulfilling orders and meeting customer demands.

On the demand side, there was a temporary dip in consumer interest in EVs, including e-bikes and electric scooters, as economic uncertainties prompted cautious spending. However, as the pandemic continued and people sought safer and more eco-friendly transportation options, the demand for these motor-equipped vehicles rebounded strongly. The increased focus on personal mobility and the need for socially distant commuting options drove renewed interest in e-bikes and electric scooters, ultimately benefiting the target market.

Motor Type Insights

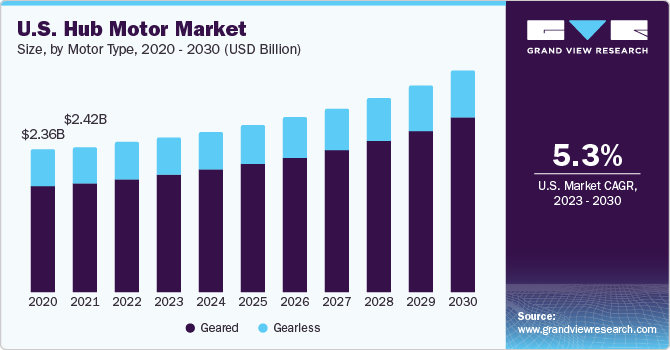

Based on motor type, the market is segmented into geared and gearless categories. The geared segment dominated with a revenue share of 74.8% in 2022. It is anticipated to continue its dominance with a CAGR of 5.4% during the projection period. A geared hub motor deploys a system of gears to transfer motor power and force to the wheels. This type of motor remains vital for reducing the higher speed at which a motor spins by fixing the spinning of the motor and allowing the wheel to spin at a suitable speed. Its case is connected to the stator through a planetary gear reduction system. The motor inside the enclosure spins much faster than the wheel at every rotation, thereby allowing the exertion of the motor at higher and more efficient speeds. Geared hub motors are usually smaller and lighter. They play a niche role in increasing the range of EVs as they offer higher torque.

Power Output Insights

Based on power output, the market is classified into below-3 KW, 3-5 KW, 5-10 KW, and above-10 KW segments. The 3-5 KW segment contributed with the highest revenue share of 50.8% in 2022 and is further poised to be the fastest-growing segment during the projection period. This power output range offers an optimal balance between power and efficiency for electric two-wheelers. These motors provide adequate power to ensure smooth acceleration and a comfortable riding experience, while also being efficient enough to maximize battery life. As electric two-wheelers gain popularity as a sustainable and eco-friendly mode of transportation, consumers are increasingly looking for vehicles that offer a good balance between power and range.

The 3-5 KW hub motors are suitable for commuting in urban areas, which is a key segment for electric two-wheelers. In densely populated cities, where limited parking spaces and traffic congestion are common issues, electric two-wheelers offer a practical solution. 3-5 KW hub motors offer sufficient power to navigate city streets, ensuring a smooth ride. Moreover, these hub motors are lightweight and compact, making them ideal to move through traffic and find parking in tight spaces. As per a report by an industry expert, India alone witnessed the sale of approximately 846,976 units of electric two-wheelers during 2022-2023.

Sales Channel Insights

Based on sales channel, the market is classified into OEM and aftermarket segments. The OEM segment held the largest revenue share of 85.7% in 2022 and is expected to grow with the highest CAGR over the forecast period, as the majority of the end-users prefer to buy electric vehicles with company-fitted electric motors. OEMs have established strong partnerships and collaborations with electric vehicle manufacturers, allowing for seamless integration of their hub motors into vehicle designs.

In February 2023, Flash, an electric component manufacturer, partnered with Gem Motors, a Slovakia-based company, to manufacture these motors for EVs. This partnership aims to improve Flash's EV products by using the expertise of Gem Motors in motor technology. The partnership showcases the importance of strategic partnerships in the EV sector to ensure innovation and meet the strong demand for electric mobility solutions. This level of integration offers competitive advantage and results in optimal performance and compatibility. OEMs also offer quality assurance and warranty that aftermarket sales channels may not provide, giving manufacturers confidence in the reliability and longevity of the hub motors.

Moreover, OEMs offer technical expertise and support, guiding manufacturers through the process of installation, maintenance, and troubleshooting. This kind of support is crucial during the integration of complex drivetrain systems. Furthermore, OEMs have efficient supply chain networks and manufacturing capabilities for addressing high-volume demands, ensuring on-time delivery to manufacturers. Overall, OEMs' partnerships, quality assurance, technical support, and supply chain efficiency make them the preferred choice for electric vehicle manufacturers when sourcing these motors.

Vehicle Type Insights

Based on the type of vehicle, the market is classified into e-bikes, E-motorcycles, E-scooters, electric passenger vehicles, electric utility vehicles, electric heavy-duty vehicles, and others. The e-bike segment led the market in 2022 with a revenue share of 28.7%. The primary application of hub motors is in electric bicycles, primarily on account of their ability to offer higher speed and power, greater torque, and extended range on a single charge. Moreover, their lightweight design contributes to better vehicle handling for existing as well as new electric bicycles. For example, the expected increase in support from regulatory authorities in Norway and France, along with the efforts of OEMs to expand their current electric bicycle offerings, is projected to boost electric bicycle sales throughout the forecasted period.

The electric scooter segment is anticipated to exhibit a CAGR of 5.7 % from 2023 to 2030. This can be attributed to the growing sales of these vehicles, fueled by various government initiatives in the form of incentives and subsidies. For instance, in the U.S., the goal of the Governor of California to reach 1.5 million zero-emission vehicles by 2025 is contributing to the regional demand. The U.S. is expected to emerge as a favorable adopter of electric scooters as new products are being introduced and various large-scale manufacturers, such as Mahindra GenZe, have entered the U.S. market.

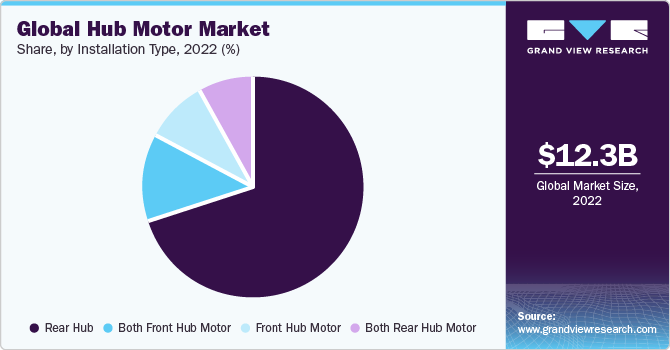

Installation Type Insights

Based on installation type, the market is classified into front hub motor, rear hub motor, both front hub motor, and both rear hub motor. The rear hub motor segment held the maximum revenue share of 70.2% in 2022 and is expected to grow with the highest CAGR over the forecast period. One key factor is the advantage they offer in terms of traction control. Major EV manufacturers prefer installing hub motors in the rear wheel to take advantage of the traction control capabilities. By placing the motor in the rear hub, the weight distribution of the electric bike is improved, allowing for better traction and stability, especially when accelerating or climbing hills.

Another reason for the segment's dominance is the widespread use of rear hub motors in electric bikes. These vehicles are becoming more popular as a sustainable and efficient transportation mode, and rear hub motors are prominently used in these bikes. The rear hub motor design provides a compact and integrated solution, making it convenient for manufacturers to incorporate them into their electric bike designs. Moreover, rear hub motors offer a smoother and more natural riding experience. The power delivery from a rear hub motor is generally more seamless and responsive as compared to other types of motor. This results in a comfortable and enjoyable riding experience for users, thus driving the demand for rear hub motors.

Regional Insights

Asia Pacific led the overall market in 2022, with a revenue share of 34.3%. The region commands the largest share in the industry, which can be attributed to several factors. The regional countries, particularly India and China, have massive populations, driving strong demand for two-wheeler EVs that are equipped with hub motors, as an affordable and efficient mode of transportation. Also, robust urbanization in the region, along with highly congested city streets, have resulted in a pressing need for compact and eco-friendly personal mobility vehicles, aligning perfectly with the advantages presented by these motors.

Additionally, proactive government policies, subsidies, and incentives aimed at promoting electric mobility have stimulated both production and consumer adoption of hub motor technology, fostering market growth. Lastly, the presence of extensive manufacturing infrastructure in Asia Pacific economies enables cost-effective production, making hub motor-equipped vehicles accessible to a wide spectrum of consumers.

North America is poised to expand at the fastest CAGR of 5.4% during the forecast period. The presence of leading EV manufacturers and tech companies such as General Motors and Tesla in the region has played a vital role in driving the target market expansion. These companies are investing heavily in the R&D of EV technologies, including hub motors, to meet the rising demand for electric mobility. Their focus on developing advanced and efficient hub motor solutions that are customized to the specific needs of the North American market is expected to boost demand growth in the coming years.

The region has a well-established electric charging infrastructure, which is supported by a network of charging stations that provides convenience to EV owners, making electric mobility very accessible. As the charging infrastructure continues expanding, the demand for these motors is expected to grow substantially. The region's strong automotive sector and manufacturing capabilities contribute to the progress of the hub motor industry. North American companies have the expertise and resources to produce these motors at large scales, ensuring a steady supply to meet the increasing demand. The presence of a robust supply chain and manufacturing ecosystem positions North America as a key player in the target market, driving its anticipated growth in the region.

Key Companies & Market Share Insights

The market is competitive and has the presence of several key players. These players are adopting strategies such as partnerships and collaborations to gain a competitive edge. For instance, in August 2022, Elaphe Ltd. announced a collaboration with designing user-centric E-kickscooters & business models for enhancing intermodality (DREEM) projects to design and test e-motors. The project aims to develop a reliable and modular 350W gearless hub motor for 3-wheel e-kickscooters enabled with improved, foldable, and modular safety features.

Key Hub Motor Companies:

- Robert Bosch GmbH

- Schaeffler AG

- QS MOTOR LTD.

- NTN Corporation

- Heinzmann GmbH & Co. KG

Hub Motor Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 12.60 billion

Revenue forecast in 2030

USD 17.50 billion

Growth rate

CAGR of 4.8% from 2023 to 2030

Base year for estimation

2022

Historic year

2017 - 2021

Forecast period

2023 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, trends

Segments covered

Motor type, power output, installation type, sales channel, vehicle type, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; UK; Germany; France; China; India; Japan; South Korea; Australia; Brazil; Mexico; Kingdom of Saudi Arabia (KSA); UAE; South Africa

Key companies profiled

QS MOTOR LTD.; Schaeffler AG; Elaphe LTD.; NTN Corporation; TDCM; Robert Bosch GmbH; Bafang Electric (Suzhou) Co., Ltd.; Heinzmann GmbH & Co. KG; Leaf Motor; Cutler MAC (Shanghai) Brushless Motor Co., Ltd.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Hub Motor Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the global hub motor market report based on motor type, power output, installation type, sales channel, vehicle type, and region:

-

Motor Type Outlook (Revenue, USD Million, 2017 - 2030)

-

Geared

-

Gearless

-

-

Power Output Outlook (Revenue, USD Million, 2017 - 2030)

-

Below 3 KW

-

3 - 5 KW

-

5-10 KW

-

Above 10 Kw

-

-

Installation Type Outlook (Revenue, USD Million, 2017 - 2030)

-

Front Hub

-

Rear Hub

-

Both Front Hub Motor

-

Both Rear Hub Motor

-

-

Sales Channel Outlook (Revenue, USD Million, 2017 - 2030)

-

OEM

-

Aftermarket

-

-

Vehicle Type Outlook (Revenue, USD Million, 2017 - 2030)

-

E-bike

-

E-motorcycle

-

E-scooter

-

Electric Passenger Vehicles

-

Electric Utility Vehicles (incl. LCV)

-

Electric Heavy-duty Vehicles

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

Mexico

-

-

Middle East & Africa

-

Kingdom of Saudi Arabia (KSA)

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global hub motor market size was estimated at USD 12.26 billion in 2022 and is expected to reach USD 12.60 billion in 2023.

b. The global hub motor market is expected to grow at a compound annual growth rate of 4.8% from 2023 to 2030 to reach USD 17.50 billion by 2030.

b. In the motor type segment, the geared sub-segment accounted for the largest market share of 74.8% in 2022.

b. Some key players operating in the hub motor market include QS MOTOR LTD, Schaeffler AG, Elaphe LTD, NTN Corporation, TDCM, and Robert Bosch GmbH

b. Key factors that are driving the market growth include the Increasing demand for electric vehicles (EVs), growing awareness of sustainability, and Increasing urbanization & the need for efficient, compact mobility solutions

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.