- Home

- »

- Electronic Devices

- »

-

Household Vacuum Cleaners Market, Industry Report, 2030GVR Report cover

![Household Vacuum Cleaners Market Size, Share & Trends Report]()

Household Vacuum Cleaners Market (2024 - 2030) Size, Share & Trends Analysis Report By Product (Canister, Central, Robotic, Drum, Upright, Wet & Dry), By Distribution Channel (Online, Offline), By Power Source (Corded, Cordless), By Region, And Segment Forecasts

- Report ID: 978-1-68038-553-3

- Number of Report Pages: 60

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Semiconductors & Electronics

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Household Vacuum Cleaners Market Summary

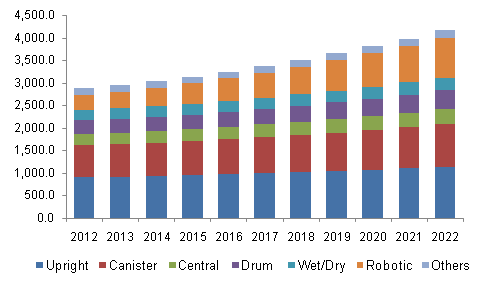

The global household vacuum cleaners market size was estimated at USD 6.57 billion in 2023 and is projected to reach USD 13.33 billion by 2030, growing at a CAGR of 10.8% from 2024 to 2030. The growth is owing to the increasing emphasis on hygiene and cleanliness.

Key Market Trends & Insights

- The household vacuum cleaner market in Asia Pacific (APAC) region held 32.9% share in 2023.

- The North America household vacuum cleaner market held 28.9% of the global share in 2023.

- Based on product, the canister segment held the dominant share of 26.9% in 2023.

- Based on distribution channel, the online segment dominated the market in 2023.

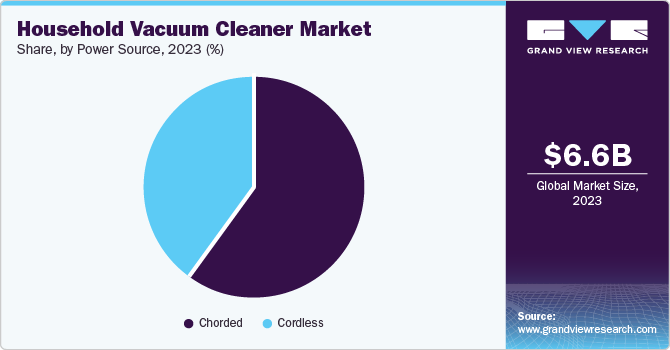

- Based on power source, the corded segment led the market with a dominant share of 59.7% in 2023.

Market Size & Forecast

- 2023 Market Size: USD 6.57 Billion

- 2030 Projected Market Size: USD 13.33 Billion

- CAGR (2024-2030): 10.8%

- Asia Pacific: Largest market in 2023

The heightened awareness of the importance of maintaining a clean living environment has led to a surge in demand for efficient and effective cleaning solutions, including vacuum cleaners.

Moreover, factors such as changing lifestyles, high disposable incomes, and a growing working population have enhanced the outlook of the overall vacuum cleaner market further. The growth of the market has been largely influenced by the rapid technological developments facilitating ease of usage and lesser human intervention. A prominent example of such development is the advent of robotic vacuum cleaners that efficiently clean spaces without human intervention. For instance, in September 2023, several vacuum cleaner manufacturers showcased their offerings at the IFA 2023 tech trade show in Berlin. At this event, Ecovacs unveiled the upgraded version of its robot vacuum Deebot X2 Omnia, comprising a fully automated all-in-one cleaning station that can operate autonomously with greater efficiency.

In addition, the growing prevalence of e-commerce and online retail platforms has significantly impacted the vacuum cleaner market. Online channels provide consumers with a wide range of options, competitive pricing, and the convenience of home delivery, making it easier for them to purchase vacuum cleaners.

Furthermore, environmental concerns and the demand for sustainable products have led manufacturers to innovate and develop eco-friendly vacuum cleaners. These products are designed to be energy-efficient, have lower emissions, and use recyclable materials, catering to environmentally conscious consumers.

Product Insights

Canister vacuum cleaners held the dominant share of 26.9% in 2023 owing to their versatility and efficiency. These devices are known for their powerful suction and ability to clean various surfaces, including carpets, hardwood floors, and upholstery. Their compact design and maneuverability allow users to clean hard-to-reach areas, making them a preferred choice for many households. The growth of this segment has been further propelled by the availability of canister vacuum cleaners equipped with a HEPA filter, which are highly effective in trapping dust, allergens, and other microscopic particles, improving indoor air quality. For instance, PUPPYOO offers the T12 Plus Rinse vacuum cleaner featuring an advanced 6-stage HEPA filter designed to prevent air pollution.

The robotic segment is expected to record the fastest CAGR over the forecast period, with increasing adoption of smart home technology. These devices offer convenience and efficiency, allowing users to schedule cleaning sessions, control the vacuum remotely via smartphone apps, and integrate with voice assistants including Alexa and Google Assistant. Robotic vacuum cleaners simplify and speed up the cleaning process through automation. Unlike conventional vacuum cleaners, these vacuum cleaners can work independently and navigate through hard-to-reach areas and corners.

Distribution Channel Insights

Online distribution channels dominated the market in 2023 owing to the convenience and accessibility offered by online shopping. These channels help consumers browse a wide range of vacuum cleaners from the comfort of their homes, compare prices, read reviews, and make informed decisions. Such ease of access is particularly appealing in the modern fast-paced world, where time-saving solutions are highly valued. Furthermore, the expansion of e-commerce platforms and the increasing penetration of the internet have significantly contributed to the growth of the online distribution channel. Major e-commerce giants such as Amazon, Alibaba, and regional players have made it easier for consumers to purchase vacuum cleaners online. These platforms often offer attractive discounts, promotions, and bundled deals, making online shopping a cost-effective option for many consumers.

Offline distribution channels are expected to grow at a CAGR of 9.9% over the forecast period owing to the wide availability of vacuum cleaners across retail stores. Retail channels offer tangible shopping experiences that help consumers assess the product’s performance, inbuilt quality, and features firsthand. This experience can significantly influence purchasing decisions, especially for high-investment appliances including vacuum cleaners. Moreover, in-store staff have offered personalized recommendations, demonstrated product usage, and provided immediate answers to customer queries, enhancing the overall shopping experience.

Power Source Insights

Corded vacuum cleaners led the market with a dominant share of 59.7% in 2023 owing to the superior suction power. Unlike their cordless counterparts, corded vacuums are directly connected to a power source, allowing them to maintain consistent and powerful suction throughout the cleaning process. This makes them particularly effective for deep cleaning tasks, such as removing embedded dirt and pet hair from carpets and upholstery. Moreover, the corded models are less expensive which makes them an attractive option for budget-conscious consumers. Additionally, they often have a longer lifespan due to fewer battery-related issues, providing better value over time.

The cordless segment is anticipated to expand at the fastest CAGR over the forecast period. The growth can be attributed to the growing popularity of cordless vacuum cleaners as they offer greater convenience and portability, and they are easy to move. Without the restriction of a power cord, users can easily maneuver these devices around their homes, reaching tight spaces and cleaning multiple rooms without needing to switch outlets. Moreover, modern cordless vacuums are equipped with high-capacity lithium-ion batteries that provide longer run times and faster charging capabilities. These improvements ensure that cordless vacuums can handle extensive cleaning tasks on a single charge, making them more practical for everyday use.

Regional Insights

The household vacuum cleaner market in Asia Pacific (APAC) region held 32.9% share in 2023 fueled by the rising disposable incomes and improving living standards across the region. As more households attain higher income levels, the market witnessed a greater willingness to invest in premium and technologically advanced home appliances. This trend is evident in both urban and suburban areas, where economic growth and urbanization have contributed to increased consumer spending on home appliances.

North America Household Vacuum Cleaner Market Trends

The North America household vacuum cleaner market held 28.9% of the global share in 2023 due to the increasing emphasis on hygiene and cleanliness. The COVID-19 pandemic has heightened awareness about the importance of maintaining clean living environments, leading to a surge in demand for efficient cleaning solutions. This trend is particularly strong in urban areas where busy lifestyles necessitate quick and effective cleaning methods.

The household vacuum cleaner market in the U.S. is driven by increasing consumer awareness about indoor air quality, the need for efficient and effective cleaning products, and technological advancement. Moreover, the trend toward smart home automation is further expected to contribute to the market's growth in the coming years.

Europe Household Vacuum Cleaner Market Trends

The Europe household vacuum cleaner market accounted for 24.3% of the global revenue share in 2023. This is attributed to the rising environmental concerns and the demand for sustainable products that have led manufacturers to innovate and develop eco-friendly vacuum cleaners. These products are designed to be energy-efficient, have lower emissions, and use recyclable materials. This push for sustainability aligns with global efforts to reduce carbon footprints and promote green technologies.

Key Household Vacuum Cleaner Company Insights

The global household vacuum cleaner market is intensely competitive. Key participants include BISSELL Inc., Dyson, Samsung Electronics Co., Ltd, and others. These companies have majorly focused on product development with technological advancements for enhanced user experience.

-

Dyson is a technology company renowned for its high-end, innovative vacuum cleaners and other household appliances. The company offers bagless cyclonic technology, which provides powerful suction and efficient cleaning.

Key Household Vacuum Cleaners Companies:

The following are the leading companies in the household vacuum cleaners market. These companies collectively hold the largest market share and dictate industry trends.

- BISSELL Inc.

- Dyson

- AB Electrolux

- Haier Inc.

- Frootle India Pvt Ltd

- iRobot Corporation

- Koninklijke Philips N.V.

- LG Communication Center, HSAD.

- Miele

- Panasonic Life Solutions India Pvt. Ltd.

- Samsung Electronics Co., Ltd.

Recent Developments

-

In August 2024, LG Electronics announced its latest stick vacuum cleaner, the LG CordZero All-in-One Tower Combi, at IFA 2024, along with its latest robot vacuum and mop. The Tower Combi revolutionizes charging, storage, and aesthetics, making daily cleaning more efficient by integrating the CordZero A9X stick vacuum with CordZero R5 robot vacuum.

-

In June 2023, Samsung Electronics Co., Ltd. announced the forthcoming global release of the Samsung Bespoke Jet AI, which boasts up to 280W of suction power. This advanced vacuum features an enhanced and self-emptying All-in-One Clean Station and incorporates AI functionality.

-

In April 2023, The Electrolux Group introduced a new range of stick vacuum cleaners featuring a paint-free surface to minimize environmental impact with six colors. These colors are derived from innovative recycled plastics, and the range incorporates between 43% to 49% recycled material depending on nozzles and colors.

Household Vacuum Cleaner Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 7.21 billion

Revenue forecast in 2030

USD 13.33 billion

Growth Rate

CAGR of 10.8% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, Distribution Channel, Power Source, and Region

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country scope

U.S., Canada, Mexico, UK, Germany, France, China, Japan, India, Australia, South Korea, Brazil, South Africa, Saudi Arabia, UAE.

Key companies profiled

BISSELL Inc., Dyson; AB Electrolux; Haier Inc.; Frootle India Pvt Ltd; iRobot Corporation; Koninklijke Philips N.V.; LG Communication Center, HSAD.; Miele; Panasonic Life Solutions India Pvt. Ltd.; Samsung Electronics Co., Ltd.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Household Vacuum Cleaner Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global household vacuum cleaner market report based on product, distribution channel, power source, and region.

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Canister

-

Central

-

Drum

-

Robotic

-

Upright

-

Wet & Dry

-

Others

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Online

-

Offline

-

-

Power Source Outlook (Revenue, USD Million, 2018 - 2030)

-

Chorded

-

Cordless

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

-

Middle East and Africa (MEA)

-

South Africa

-

Saudi Arabia

-

UAE

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.