- Home

- »

- Beauty & Personal Care

- »

-

Hotel Toiletries Market Size, Share & Growth Report, 2030GVR Report cover

![Hotel Toiletries Market Size, Share & Trends Report]()

Hotel Toiletries Market Size, Share & Trends Analysis Report By Product (Hand Wash, Hand Sanitizer, Shampoo & Conditioner, Soap & Body Wash, Lotions & Moisturizers), By End User, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-462-8

- Number of Report Pages: 110

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Consumer Goods

Hotel Toiletries Market Size & Trends

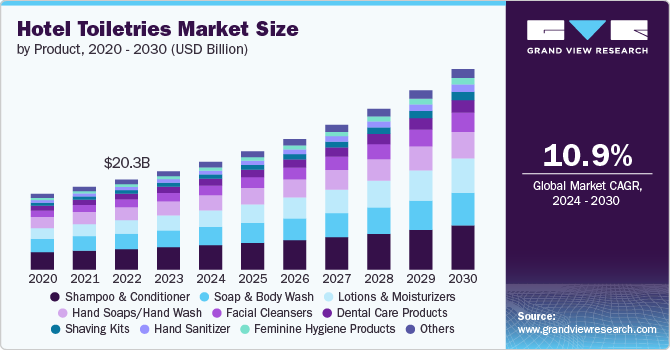

The global hotel toiletries market size was estimated at USD 22.19 billion in 2023 and is expected to grow at a CAGR of 10.9% from 2024 to 2030. This growth is driven by increasing global travel, rising demand for premium and eco-friendly personal care products, and a greater focus on guest experience in hospitality. Additionally, expanding tourism in emerging markets contributes to the growing demand for toiletries in hotels.

The trend of wellness-focused amenities is gaining momentum. Hotels are now incorporating therapeutic and wellness-oriented toiletries into their offerings, catering to guests' health-conscious preferences. Brands like Elemis are leading this shift by providing products infused with essential oils and natural extracts aimed at stress relief and relaxation. For example, luxury resorts such as Six Senses use bespoke aromatherapy blends in their guest rooms to promote well-being, reflecting a broader industry move towards integrating holistic wellness into the hospitality experience.

In the evolving landscape of the hotel toiletries market, recent trends highlight a shift towards sustainable and luxury amenities, innovative partnerships, and technological advancements that enhance the guest experience. For instance, in February 2022, Soho House, a members club for guest accommodation introduced its Soho Skin amenity kits, offering a curated selection of seven products from its new skincare range. Members and guests were invited to test these products and provide feedback before their full retail launch. By July 2022, the line became available for purchase online and at Soho House’s Cowshed spas and Bloomingdale’s stores.

Some U.S. states such as New York are announcing bans on single use hotel toiletries. The impending ban on single-use toiletries in New York hotels with more than 50 rooms, set to take effect on January 1, 2025, showcases a significant shift in environmental regulations aimed at reducing plastic waste. This move, following similar legislation in California and Washington, underscores a growing trend toward sustainability in the hotel industry. While the transition to wall-mounted dispensers and refillable containers may face some resistance from guests accustomed to single-use products, it presents an opportunity for the market to innovate and adapt. Hotels and toiletry providers can capitalize on this shift by developing high-quality, eco-friendly alternatives that not only comply with new regulations but also enhance guest satisfaction through premium, sustainable products.

Product Insights

Shampoo & conditioner sales accounted for a share of 22.80% in 2023. This is attributed to the essential nature of these products in guest personal care routines. Hotels increasingly emphasize offering high-quality hair care products to enhance guest satisfaction, with a growing preference for premium, eco-friendly, and customized formulations. The steady demand for these essentials, coupled with rising tourism and hotel stays, continues to drive the market growth.

Lotions & moisturizer sales are projected to grow at a CAGR of 12.9% from 2024 to 2030, driven by increasing consumer demand for skin care products that provide hydration and comfort during travel. Hotels are catering to this trend by offering high-quality, luxury lotions and moisturizers as part of their amenities, especially in premium and eco-conscious segments. Additionally, growing awareness of skincare benefits, combined with the rise in wellness tourism, is contributing to the surge in demand for these products.

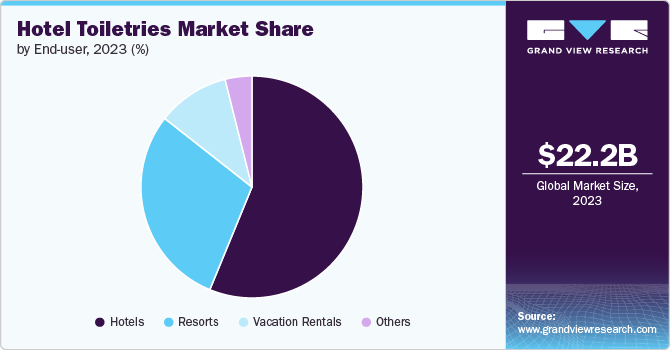

End User Insights

Hotel toiletries saw an increased demand in hotels, accounting for over 56.20% of the global market revenue in 2023. This is largely driven by the expansion of global tourism and the hospitality industry’s emphasis on enhancing guest experiences. Hotels across all segments—economy, upscale, and luxury—are offering higher-quality toiletries to meet rising consumer expectations for premium and personalized amenities. Additionally, the growing trend of wellness and eco-friendly travel is influencing hotels to provide sustainable and sensitive skin-friendly toiletries, further boosting demand.

Luxury and upscale hotels, such as Marriott, Hilton, and Four Seasons, are leading this demand surge by offering branded and eco-conscious toiletries to appeal to discerning travelers. These high-end hotels are focused on providing premium hair and skincare products, aligning with global trends toward sustainability and wellness. Meanwhile, economy hotels are also contributing by offering upgraded basic amenities to remain competitive, but the most significant demand comes from the upscale and luxury segments.

The demand for hotel toiletries in resorts is expected to grow at a CAGR of 11.7% from 2024 to 2030, driven by the increasing popularity of luxury and wellness-focused resort stays. As resorts enhance their guest experience with premium and eco-friendly toiletries, they cater to the growing expectations for high-quality, sustainable amenities.

For instance, resorts like Six Senses and Aman are integrating high-end, eco-friendly toiletries into their offerings to enhance the guest experience. Additionally, brands like Anantara and Banyan Tree are incorporating organic and sustainable products into their amenities, catering to guests who prioritize both luxury and environmental responsibility.

Regional Insights

The hotel toiletries market in North America accounted for a share of 34.70% of the global market revenue in 2023, driven by the region's strong focus on premium and sustainable products. High-end hotel chains such as Four Seasons and Ritz-Carlton, which are prevalent in North America, emphasize luxury toiletries to enhance guest experiences. Additionally, the growing trend towards eco-friendly amenities, seen in brands like Westin's "Heavenly Bath" products, aligns with consumer demand for sustainable and high-quality options.

U.S. Hotel Toiletries Market Trends

Hotel toiletries market in the U.S. is expected to grow at a CAGR of 10.5% from 2024 to 2030. Leading hotel chains like Marriott and Hilton in the U.S. are enhancing their guest experience with high-quality, sustainable toiletries, such as Marriott’s partnership with the eco-conscious brand, The White Company. This trend reflects the broader shift towards luxury and environmental responsibility in U.S. hospitality.

Europe Hotel Toiletries Market Trends

Hotel toiletries market in Europe accounted for a share of over 29% of the global market revenue in 2023. European hotel groups like Accor and Best Western International Inc are setting standards with high-end amenities and eco-friendly solutions. For instance, Accor’s Sofitel brand uses products from the eco-luxury brand Atelier Cologne, emphasizing Europe’s commitment to both quality and sustainability in hotel amenities.

Asia Pacific Hotel Toiletries Market Trends

The Asia Pacific hotel toiletries market is expected to grow at a CAGR of 12.0% from 2024 to 2030, High-end resorts like those in the Banyan Tree and Six Senses chains are leading this growth by incorporating luxurious and sustainable toiletries. For example, Banyan Tree’s use of locally sourced and environmentally friendly products aligns with the region’s rising demand for premium and eco-conscious toiletries.

Key Hotel Toiletries Company Insights

The hotel toiletries market is fragmented in nature. Key players are focusing on premiumization and sustainability to differentiate themselves. Companies like Kimrica and Aesop are partnering with high-end hotels to provide exclusive, eco-friendly products that enhance the guest experience. These brands emphasize luxury, using high-quality ingredients and stylish packaging to appeal to upscale travelers.

Kimirica, one of the key players in the market, focuses on delivering a luxurious and serene guest experience by offering a wide range of premium, vegan hotel toiletries with unique fragrances. As India’s largest manufacturer of luxury amenities, Kimirica partners with major international hotel chains like Marriott and Hilton, emphasizing natural formulations, pure essential oils, and paraben-free preservatives to enhance guest satisfaction and brand prestige.

Key Hotel Toiletries Companies:

The following are the leading companies in the hotel toiletries market. These companies collectively hold the largest market share and dictate industry trends.

- Kimirica Hunter

- Vanity Group Pty Ltd

- Essential Amenities, Inc.

- Unilever PLC

- La Bottega S.P.A.

- Pineapple Hospitality

- Guest Supply

- Endeavor Czech s.r.o.

- HD Fragrances

- Molton Brown Limited

Recent Developments

-

In June 2022, IHG Hotels & Resorts partnered with Unilever to replace bathroom miniatures with bulk amenities in over 4,000 hotels. This initiative, which includes full-size Dove products, supports IHG's goal to eliminate single-use items by 2030. The switch is expected to save 850 tonnes of plastic annually in the Americas. This move is part of IHG’s broader sustainability plan and Unilever’s commitment to reducing plastic waste and promoting circular economy practices.

-

In August 2022, HSM introduced Aesop as the new global bath amenity provider for Waldorf Astoria Hotels & Resorts. This partnership highlights a commitment to sustainability and high-quality amenities, featuring Aesop's vegan and cruelty-free products in large-format bottles to reduce single-use plastics by over 50%. The initiative not only enhances the guest experience but also streamlines operations with bulk dispensers, while offering competitive pricing and exclusive scents. The rollout will be supported by comprehensive service from HSM, ensuring a smooth transition and continued quality control.

-

In March 2024, Hotel Emporium announced a partnership with Kenneth Cole to provide premium, eco-friendly amenities for Wyndham Destinations. The new collection, which includes bulk dispensers and pump bottles of shampoo, conditioner, hand wash, body lotion, and body wash, will be featured in 854 Presidential Reserve Suites across the U.S., St. Thomas, and Bali. This collaboration reflects a commitment to sustainability and high-quality guest experiences, enhancing Wyndham’s eco-conscious offerings while leveraging Kenneth Cole’s stylish and functional products.

Hotel Toiletries Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 24.30 billion

Revenue forecast in 2030

USD 45.29 billion

Growth rate

CAGR of 10.9% from 2024 to 2030

Actuals

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, end user, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; China; Japan; India; Australia; Brazil; South Africa; UAE

Key companies profiled

Kimirica Hunter; Vanity Group Pty Ltd.; Essential Amenities, Inc.; Unilever PLC; La Bottega S.P.A.; Pineapple Hospitality; Guest Supply; Endeavor Czech s.r.o.; HD Fragrances; Molton Brown Limited

Customization

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Hotel Toiletries Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the global hotel toiletries market based on product, end user, and region:

-

Product Outlook (Revenue, USD Billion, 2018 - 2030)

-

Hand Soaps/Hand Wash

-

Hand Sanitizer

-

Shampoo & Conditioner

-

Soap & Body Was

-

Facial Cleansers

-

Lotions & Moisturizers

-

Shaving Kits

-

Feminine Hygiene Products

-

Dental Care Products

-

Others

-

-

End User Outlook (Revenue, USD Billion, 2018 - 2030)

-

Hotels

-

Economy Hotels

-

Upscale Hotels

-

Luxury Hotels

-

-

Resorts

-

Vacation Rentals

-

Others

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

South Africa

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global hotel toiletries market size was estimated at USD 22.19 billion in 2023 and is expected to reach USD 24.30 billion in 2024.

b. The global hotel toiletries market is expected to grow at a compound annual growth rate of 10.9% from 2024 to 2030 to reach USD 45.29 billion by 2030.

b. The hotel toiletries market in North America accounted for a share of 34.70% of the global market revenue in 2023, driven by the region's strong focus on premium and sustainable products.

b. Some of the key players operating in the hotel toiletries market include Kimirica Hunter, Vanity Group Pty Ltd, Essential Amenities, Inc., Unilever PLC, and La Bottega S.P.A.

b. Key factors that are driving the market growth include increasing global travel, rising demand for premium and eco-friendly personal care products, and a greater focus on guest experience in hospitality

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."