- Home

- »

- Plastics, Polymers & Resins

- »

-

Hot Drinks Packaging Market Size, Industry Report, 2030GVR Report cover

![Hot Drinks Packaging Market Size, Share & Trends Report]()

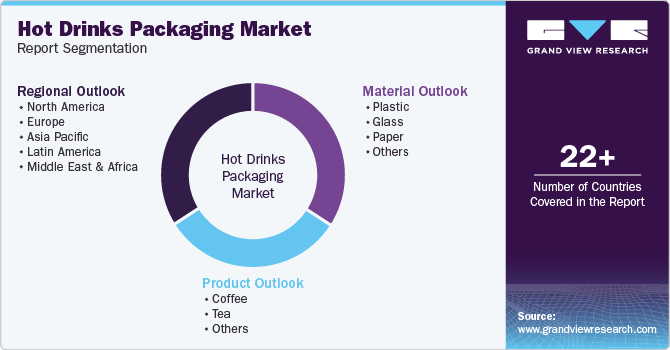

Hot Drinks Packaging Market (2024 - 2030) Size, Share & Trends Analysis Report By Material (Plastic, Glass, Paper), By Product (Coffee, Tea), By Region (North America, Europe, APAC, Latin America, MEA), And Segment Forecasts

- Report ID: GVR-3-68038-294-5

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Hot Drinks Packaging Market Size & Trends

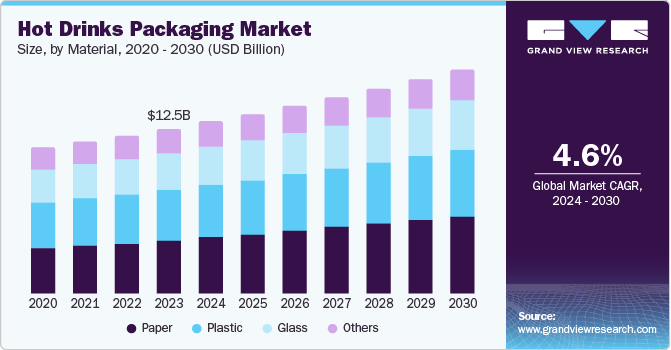

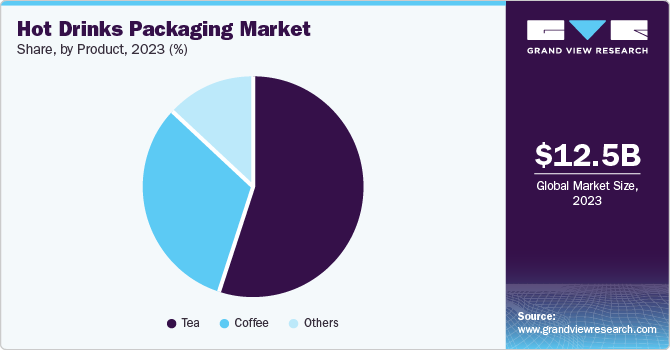

The global hot drinks packaging market size was valued at USD 12.55 billion in 2023 and is projected to grow at a CAGR of 4.6% from 2024 to 2030. Factors influencing market growth include the increasing popularity of hot beverages, convenience of packaged products, adoption of eco-friendly materials, improved shelf life through technological advancements, e-commerce expansion, growing health awareness, and global diversification of hot drinks consumption.

The global consumption of hot beverages, including coffee, tea, and hot chocolate, is experiencing a surge in demand. This trend is driven by the growing preference for specialty coffee drinks and other specialty products, mirroring the broader shift towards consuming premium and unique food and beverage options. The proliferation of café-style coffee shops and tea houses has also contributed to this phenomenon.

The fast-paced nature of modern lifestyles has led consumers to seek convenient and portable packaging solutions that can accommodate their on-the-go needs. As a result, manufacturers are prioritizing the development of single-serve packaging options, such as pods for coffee machines or single-serve ready-to-drink (RTD) formats. This emphasis on convenience is driving innovation in packaging design, with manufacturers seeking to create solutions that balance portability with product quality.

Packaging has evolved to play a critical role in extending the shelf life of hot beverages while maintaining their quality. Techniques such as vacuum packaging and smart packaging technologies ensure that products remain fresh during transportation and storage. These technologies also offer brands an opportunity to differentiate themselves through exclusive packaging solutions, further enhancing the consumer experience and brand loyalty.

Material Insights

Paper packaging dominated the market with a revenue share of 31.8% in 2023. Paper packaging is a versatile medium, allowing for creative design and printing options to enhance product visibility on shelves. Moreover, treatments and coatings can make paper resistant to moisture and heat, making it suitable for hot beverages such as coffee and tea, providing a reliable and effective packaging solution.

Glass packaging is expected to register the second-fastest CAGR of 4.3% during the forecast period. Glass packaging offers unparalleled performance, with its non-porous and non-reactive properties guaranteeing the integrity of hot beverages. As consumer demand for eco-friendly products grows, companies are embracing sustainable practices, making glass packaging a compelling choice for responsible businesses seeking to deliver high-quality products while minimizing environmental impact.

Product Insights

The tea segment held the largest market share of 55.6% in 2023, comprising several varieties such as black tea, green tea, herbal teas, and specialty blends. Customized packaging solutions cater to diverse consumer preferences, allowing manufacturers to segment the market effectively. Technological advancements, including vacuum packaging, have further enhanced the packaging of tea products.

Coffee is expected to register significant growth with a CAGR of 4.0% during the forecast period. The coffee industry has experienced significant growth, driven by consumer demand for high-quality and specialty coffee. The global trend towards premium coffee has led to an increased demand for innovative packaging solutions, ensuring the integrity and freshness of coffee products. This demand is likely to continue, fueled by consumer preference for superior quality.

Regional Insights

Asia Pacific hot drinks packaging market dominated the global hot drinks packaging market with a market share of 36.5% in 2023. The Asia-Pacific region, with a population of over 4 billion, remains a substantial market for hot beverages. Urbanization has led to changing consumption patterns, with increasing demand for portable, on-the-go hot drinks. As a result, manufacturers are investing in innovative packaging solutions, such as single-serve coffee pods and ready-to-drink products, to meet this evolving demand.

The hot drinks packaging market in China led the Asia Pacific hot drinks packaging market with a market share of 26.0% in 2023. China's robust manufacturing infrastructure enables large-scale production of packaging materials at competitive costs, significantly lower than those in Western countries. With a strong domestic supply chain and pronounced export capabilities, Chinese manufacturers can deliver packaging solutions in bulk, resulting in lower costs per unit and enhanced efficiency.

Latin America Hot Drinks Packaging Market Trends

Latin America hot drinks packaging market is expected to register the second-fastest CAGR of 4.9% in the forecast period. The region's cultural affinity for hot beverages drives a significant demand for packaging solutions. In countries such as Brazil, Argentina, and Uruguay, hot drinks are an integral part of daily life. As a leading coffee producer, with Brazil and Colombia being major producers, the region presents a reliable market for packaging companies catering to these beverages.

The hot drinks packaging market in Brazil is expected to grow lucratively during the forecast period. Brazil's large population and cultural affinity for hot beverages, particularly coffee, create a substantial domestic market demand for packaging solutions. As a major coffee exporter, Brazilian companies can leverage this expertise to capitalize on international markets, further expanding their reach and opportunities for growth in the packaging industry.

North America Hot Drinks Packaging Market Trends

North America hot drinks packaging market held substantial market share in 2023. The region's growth in demand for ready-to-drink (RTD) beverages drove innovation in packaging to support this trend. Moreover, consumer focus on healthy living has led to increased demand for organic and specialty teas and coffees, driving adoption of environment-friendly packaging solutions that align with these preferences.

U.S. Hot Drinks Packaging Market Trends

The hot drinks packaging market in the U.S. expected to grow in the forecast period. The country's robust economy, boasting a high per capita disposable income, enables consumers to indulge in premium products. The strong economy also fosters investment and innovation in packaging solutions that enhance product appeal, driving demand for attractive and user-friendly packaging options.

Europe Hot Drinks Packaging Market Trends

Europe hot drinks packaging market held significant revenue share in the 2023. European consumers have heightened expectations for high-quality hot drinks packaging, driving demand for eco-friendly solutions. In response, the European Union has implemented strict regulations on plastic pollution and recyclable products. As a result, companies are shifting towards sustainable packaging options, such as biodegradable bags and recyclable boxes, to meet consumer demands.

The hot drinks packaging market in UK is expected to grow in the forecast period. Packaging design and materials in the country have been at the forefront of technological advancements. The country's strong regulatory environment prioritizes sustainability, driving eco-friendly practices in the food and beverage industry, including hot drinks packaging. This competitive landscape, where established brands coexist with innovative newcomers, fuels innovation and growth in the sector.

Key Hot Drinks Packaging Company Insights

Some key companies in the hot drinks packaging market include Bemis Manufacturing Company; Sonoco; Mondi; Amcor plc; Crown; Stora Enso; and others. Market players are responding to heightened competition by adopting strategies such as product innovation, channel expansion, and geographic diversification.

-

Sonoco offers a range of innovative and eco-friendly products for hot drinks packaging. The company's portfolio includes products suitable for coffee, tea, and other hot beverages supplied worldwide.

-

Stora Enso specializes in renewable material solutions, serving various market segments including paper, packaging, wood products, and biomaterials. The company offers a range of sustainable packaging solutions for the beverage industry, particularly targeting the coffee, tea, and hot beverages sectors with innovative eco-friendly products.

Key Hot Drinks Packaging Companies:

The following are the leading companies in the hot drinks packaging market. These companies collectively hold the largest market share and dictate industry trends.

- Bemis Manufacturing Company

- Sonoco

- Mondi

- Amcor plc

- Crown

- Stora Enso

- Ball Corporation

- Graham Packaging

- O-I Glass

- Printpack

- Silgan Holdings Inc.

- Veritiv Corporation

- AptarGroup, Inc.

Recent Developments

-

In July 2024, Silgan Holdings Inc announced it had entered into a sale and purchase agreement to acquire Weener Plastics Holdings B.V.

-

In May 2024, Mondi introduced TrayWrap, a new secondary paper packaging solution, replacing plastic shrink film as the industry standard. The innovative packaging was used by a coffee brand for transporting 12-packs in Sweden.

-

In April 2024, Veritiv Corporation acquired Ameripac, LLC, and Ameripac Pennsylvania, LLC, a leading contract packaging provider, enhancing its global presence and innovation capabilities in the packaging sector.

-

In February 2024, Amcor plc announced its R&D team is dedicated to pioneering breakthrough and advanced technologies, especially in the field of sustainable packaging solutions.

Hot Drinks Packaging Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 13.09 billion

Revenue forecast in 2030

USD 17.10 billion

Growth Rate

CAGR of 4.6% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Report updated

January 2025

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Material, product, region

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country scope

U.S., Canada, Mexico, UK, Germany, France, Italy, Spain, China, Japan, India, Australia, Brazil, Argentina, South Africa, Saudi Arabia, UAE

Key companies profiled

Bemis Manufacturing Company; Sonoco; Mondi; Amcor plc; Crown; Stora Enso; Ball Corporation; Graham Packaging; O-I Glass; Printpack; Silgan Holdings Inc.; Veritiv Corporation; AptarGroup, Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Hot Drinks Packaging Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global hot drinks packaging market report based on material, product, and region.

-

Material Outlook (Revenue, USD Billion, 2018 - 2030)

-

Plastic

-

Glass

-

Paper

-

Others

-

-

Product Outlook (Revenue, USD Billion, 2018 - 2030)

-

Coffee

-

Tea

-

Others

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia

-

-

Latin America

-

Brazil

-

Argentina

-

-

MEA

-

South Africa

-

Saudi Arabia

-

UAE

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.