- Home

- »

- Homecare & Decor

- »

-

Hostel Market Size, Share And Growth Analysis Report, 2030GVR Report cover

![Hostel Market Size, Share & Trends Report]()

Hostel Market (2024 - 2030) Size, Share & Trends Analysis Report By Accommodation Type (Dormitory Rooms, Private Rooms, Family Rooms), By Guest Type, By Booking Mode, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-482-0

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Hostel Market Summary

The global hostel market size was estimated at USD 7.21 billion in 2023 and is projected to reach USD 11.04 billion by 2030, growing at a CAGR of 6.5% from 2024 to 2030. The market has experienced remarkable growth over the past decade, driven by several key factors that reflect changing consumer preferences and the evolution of travel dynamics.

Key Market Trends & Insights

- Europe dominated the hostel market with the largest revenue share of 35.98% in 2023.

- The hostel market in the U.S. is expected to grow at the fastest CAGR of 6.1% from 2024 to 2030.

- Based on accommodation type, the dormitory rooms led the market with the largest revenue share of 64.75% in 2023.

- Based on guest type, the backpackers and solo travelers segment led the market with the largest revenue share of 55.53% in 2023.

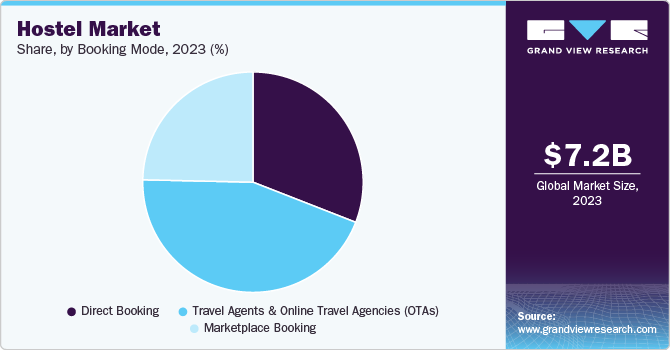

- Based on booking mode, the travel agents and online travel agencies (OTAs) segment led the market with the largest revenue share of 44.41% in 2023.

Market Size & Forecast

- 2023 Market Size: USD 7.21 Billion

- 2030 Projected Market Size: USD 11.04 Billion

- CAGR (2024-2030): 6.5%

- Europe: Largest market in 2023

Originally perceived as budget accommodations primarily for backpackers and young travelers, hostels have diversified significantly to cater to a broader demographic, including families, business travelers, and even older generations seeking affordable and social travel options. This diversification has enabled hostels to capture a substantial share of the global lodging market, with many properties evolving to provide enhanced amenities and unique experiences that appeal to a wide range of guests.

A notable aspect contributing to the expansion of the hostel sector is the rise of the "experiential travel" trend. According to Bloomberg, a significant 86% of millennials express a preference for traveling to engage with experiences and cultural immersion, highlighting the importance of their destination. Furthermore, 60% of this demographic believe that authentic cultural experiences are essential to their travel journeys. Modern travelers increasingly seek authentic experiences that foster cultural immersion and social interaction. Hostels, traditionally designed to promote communal living and shared spaces, perfectly align with this demand. By offering opportunities for social engagement through communal kitchens, lounges, and organized events, hostels have positioned themselves as ideal environments for travelers looking to forge connections with others, thereby enhancing their travel experience.

The growing popularity of digital nomadism has further propelled the market growth. With more professionals working remotely, there is an increasing demand for flexible and affordable accommodations that allow for both work and leisure. Many hostels have adapted to this trend by providing reliable Wi-Fi, co-working spaces, and facilities catering to long-term stays. This shift not only attracts a new demographic of guests but also fosters a community of like-minded individuals who value collaboration and networking opportunities.

The rise of online travel agencies (OTAs) and peer-to-peer booking platforms has also played a crucial role in the market growth. These platforms have made it easier for travelers to discover and book hostel accommodations, enhancing visibility and accessibility. The integration of user-generated reviews and ratings has further strengthened consumer confidence, encouraging travelers to consider hostels as viable alternatives to traditional hotels. As a result, the increased online presence of hostels has contributed to their rising popularity and market share.

Moreover, sustainability and eco-conscious travel practices are increasingly influencing consumer choices, prompting hostels to adopt environmentally friendly practices. Many modern hostels prioritize sustainability through initiatives such as using energy-efficient appliances, reducing waste, and sourcing local products. By aligning with the values of environmentally conscious travelers, these establishments not only attract a dedicated clientele but also contribute positively to the communities in which they operate, enhancing their brand reputation and appeal.

According to statistics published by UN Tourism, the total number of international tourist arrivals globally reached 1.3 billion in 2023, reflecting a substantial increase of 33.4% compared to 2022. This surge in international travel presents significant opportunities for the market worldwide. As more travelers seek budget-friendly accommodations, hostels are well-positioned to cater to the rising demand for affordable lodging options. The influx of tourists not only enhances the visibility of hostels but also encourages operators to diversify their offerings, thereby attracting a broader range of clientele. In addition, the growing trend of experiential travel aligns seamlessly with the market's emphasis on community engagement and cultural immersion, making hostels an appealing choice for a diverse demographic of travelers.

Accommodation Type Insights

Based on accommodation type, the dormitory rooms led the market with the largest revenue share of 64.75% in 2023. The demand for dormitory rooms within the hostel industry is experiencing notable growth due to several interrelated factors. The dormitory accommodations appeal primarily to budget-conscious travelers, particularly younger generations such as millennials and Gen Z, who prioritize affordability in their travel experiences. By offering shared sleeping spaces, hostels can provide lower-priced options that are particularly attractive for solo travelers or groups. In addition, dormitory setups foster a communal atmosphere that encourages social interaction and cultural exchange among guests from diverse backgrounds.

The private rooms segment is anticipated to grow at the fastest CAGR of 8.0% from 2024 to 2030. The increasing demand for private rooms in hostels can be attributed to a diversification of the target demographic and changing consumer preferences. While hostels traditionally cater to budget travelers, there is a growing segment of individuals, including couples, families, and business travelers, who seek the affordability and community aspects of hostels while also desiring the privacy and comfort associated with private accommodations. Private rooms provide an attractive alternative, offering a balance between cost-effectiveness and personal space. Moreover, the post-pandemic landscape has heightened travelers' concerns about health and safety, prompting many to prefer private lodging options to minimize contact with others.

Guest Type Insights

Based on guest type, the backpackers and solo travelers segment led the market with the largest revenue share of 55.53% in 2023. As per the statistics published by The Broke Backpacker, about 45 million backpacking trips are taken annually. The increasing demand for hostels among backpackers and solo travelers is largely driven by the affordability and social atmosphere that these accommodations provide. Backpackers, who often prioritize budget constraints, find hostels to be an economical choice that allows them to allocate more of their financial resources towards experiences and activities rather than accommodation costs. Hostels typically offer shared dormitory rooms and communal spaces that foster interaction, making them ideal for solo travelers looking to meet like-minded individuals. This communal environment not only enhances the travel experience through cultural exchanges but also creates a sense of belonging, which is particularly appealing to those exploring unfamiliar destinations alone.

The students and interns segment is anticipated to grow at the fastest CAGR of 7.5% from 2024 to 2030. Many students and interns are often navigating tight budgets, making hostels an appealing option that allows them to stretch their finances while still enjoying travel opportunities. In addition, hostels are typically situated in prime locations that provide easy access to educational institutions, internship opportunities, and local attractions, thereby enhancing their convenience for this demographic. The communal living environment of hostels also supports social interaction, enabling students and interns to connect with peers from diverse backgrounds, which can enrich their overall experience. Furthermore, hostels often provide essential amenities such as study areas and Wi-Fi, catering specifically to the needs of students who require conducive environments for both work and relaxation. As this demographic increasingly seeks affordable and enriching travel experiences, hostels continue to emerge as an ideal solution.

Booking Mode Insights

Based on booking mode, the travel agents and online travel agencies (OTAs) segment led the market with the largest revenue share of 44.41% in 2023. The growth of hostel bookings by travel agents can be attributed to the rising demand for affordable, experience-driven accommodations among younger travelers and budget-conscious consumers. Hostels offer a unique blend of affordability, social interaction, and local immersion, aligning well with the preferences of millennial and Gen Z travelers. Travel agents, recognizing this shift in consumer behavior, are increasingly including hostels in their portfolio to cater to a broader client base. In addition, the flexibility of hostel accommodations, coupled with competitive commission structures, makes it a viable and profitable segment for travel agents to tap into.

The marketplace booking segment is projected to grow at the fastest CAGR of 7.3% from 2024 to 2030. Hostel bookings are growing through marketplaces due to the convenience, transparency, and global reach these platforms offer. Marketplaces like Hostelworld and Booking.com aggregate listings, allowing users to easily compare prices, amenities, and locations, making them attractive for cost-conscious travelers. They also offer user reviews and ratings, building trust and improving decision-making. The digitalization of travel planning has expanded access to hostels in remote or niche locations, catering to diverse traveler preferences. In addition, these platforms often provide deals or exclusive offers, incentivizing bookings. Their mobile-friendly interfaces and integrated payment systems further enhance the booking process, leading to increased adoption by younger, tech-savvy travelers who prioritize ease and flexibility.

Regional Insights

The North America hostel market accounted the revenue share of 19.62% in 2023. In North America, beyond the U.S., the demand for hostels is being driven by the rise in adventure and eco-tourism, particularly in countries like Canada and Mexico. These countries offer access to natural landscapes, and budget-conscious travelers prefer hostels for their affordability and proximity to nature. In addition, growing interest in backpacking and sustainable travel is boosting demand for hostels that provide eco-friendly accommodations. The expansion of hostel chains and independent operators in these regions is further facilitating access to affordable lodging for travelers looking to explore the cultural diversity and outdoor offerings of North America.

U.S. Hostel Market Trends

The hostel market in the U.S. is expected to grow at the fastest CAGR of 6.1% from 2024 to 2030. The demand for hostels in the U.S. is growing as younger travelers, especially millennials and Gen Z, increasingly prioritize budget-friendly, social accommodation options. As domestic tourism and solo travel rise, hostels provide affordable lodging while offering a unique cultural experience through communal spaces that encourage interaction. Furthermore, the rise of digital nomadism, supported by flexible work policies, has led to a demand for more cost-effective long-term stays. This trend is reflected in the performance of Hostelling International USA (HI USA), a leading hostel service provider, which reported a 10% occupancy increase in 2022 and a significant 360% increase from 2021. U.S. hostels are also adapting to global standards with enhanced amenities and modernized facilities, making them more attractive to both international and domestic travelers seeking value-driven options.

Asia Pacific Hostel Market Trends

The hostel market in Asia Pacific accounted for a revenue share of 29.48% in 2023. In the Asia Pacific region, the growing demand for hostels is largely attributed to the influx of young international travelers, particularly backpackers and gap-year students, seeking affordable and social accommodations. Emerging markets such as Thailand, Vietnam, and Indonesia have seen a surge in budget tourism, with hostels serving as the preferred lodging option for those exploring the region's cultural and natural diversity. In addition, the rise of intra-regional travel, driven by increasing disposable incomes and affordable transportation options, has further propelled hostel demand. Many hostels in the Asia Pacific also offer modern amenities at lower price points, making them highly competitive against traditional hotels.

Europe Hostel Market Trends

Europe dominated the hostel market with the largest revenue share of 35.98% in 2023. Europe has long been a hotspot for budget travel, and the demand for hostels is increasing due to the region's extensive network of low-cost transportation and rich cultural heritage. Hostels offer affordable lodging for students, backpackers, and cultural tourists exploring multiple countries on a single trip. In addition, the rise of experiential travel is driving demand for hostels that offer unique social experiences, including local tours and events. Hostel operators in Europe are innovating with hybrid models, offering private rooms and co-working spaces, thus appealing to a broader demographic, including digital nomads and budget-conscious professionals. The robust growth of the sector is evident in the performance of Berlin-based A&O Hotels and Hostels, which reported record earnings for the first half of 2023, with year-over-year sales increasing by 47%. This underscores the continued expansion and profitability of the market in Europe.

Key Hostel Company Insights

The competitive landscape of the global market is becoming increasingly dynamic, driven by the growing demand for affordable, social, and experience-based accommodations. Hostel chains are expanding their footprint globally, leveraging technology to improve booking efficiency, offering unique experiences to attract younger travelers, and enhancing amenities to compete with budget hotels.

The market is characterized by a mix of large multinational chains, regional operators, and boutique hostels that cater to diverse traveler preferences. Key competitive strategies include digital marketing, partnerships with travel platforms, flexible pricing models, and incorporating sustainability practices to appeal to eco-conscious travelers. In this evolving landscape, brand reputation, customer service, and location are critical factors that differentiate market leaders.

Key Hostel Companies:

The following are the leading companies in the hostel market. These companies collectively hold the largest market share and dictate industry trends.

- Hostelling International (HI)

- a&o Hotels and Hostels GmbH

- Generator Hostels

- St Christopher's Inns

- Meininger Hotels

- Selina Hostels

- Wombat’s Hostels

- CLINK Hostels

- Safestay Hotels & Hostels

- The Youth Hostels Association (YHA)

Recent Developments

-

In April 2024, Safestay Hotels & Hostels announced plans to launch a new 225-bed hostel in Edinburgh, strategically located on the historic Cowgate, one of the city’s oldest and most renowned streets. Scheduled to open in June 2024, the property will be housed in a prestigious Grade A listed building, combining modern accommodations with the charm of Edinburgh’s architectural heritage. This new hostel is set to enhance Safestay's portfolio, offering guests a unique blend of history, comfort, and accessibility in the heart of the Scottish capital

-

In August 2024, a&o Hotels and Hostels GmbH expanded its presence in the UK with the opening of its second property, marking its 39th location across Europe. The newly launched a&o Brighton Palace Pier, situated in the heart of Brighton’s iconic seaside resort, offers stunning views of the renowned pier. The property features 50 rooms and 186 beds, complemented by a Victorian-style lobby bar and a distinctive restaurant. Located in a historic Regency-era listed building, which originally operated as a hotel dating back to 1819, the site holds historical significance, having hosted notable figures such as Charles Dickens

Hostel Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 7.57 billion

Revenue forecast in 2030

USD 11.04 billion

Growth rate

CAGR of 6.5% from 2024 to 2030

Historical data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion, and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Hostel type, guest type, booking mode, region

Regional scope

North America: Europe; Asia Pacific; Central & South America; and Middle East & Africa

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; China; India; Japan; Australia & New Zealand; South Korea; Brazil; and South Africa

Key companies profiled

Hostelling International (HI); a&o Hotels and Hostels GmbH; Generator Hostels; St Christopher's Inns; Meininger Hotels ; Selina Hostels; Wombat’s Hostels ; CLINK Hostels; Safestay Hotels & Hostels; and The Youth Hostels Association (YHA)

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Hostel Market Report Segmentation

This report forecasts revenue growth at global, regional & country levels and provides an analysis of the latest trends and opportunities in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global hostel market report based on accommodation type, guest type, booking mode, and region.

-

Accommodation Type Outlook (Revenue, USD Billion, 2018 - 2030)

-

Dormitory Rooms

-

Private Rooms

-

Family Rooms

-

Others

-

-

Guest Type Outlook (Revenue, USD Billion, 2018 - 2030)

-

Backpackers and Solo Travelers

-

Students and Interns

-

Families

-

Business Travelers

-

Others

-

-

Booking Mode Outlook (Revenue, USD Billion, 2018 - 2030)

-

Direct Booking

-

Travel Agents & Online Travel Agencies (OTAs)

-

Marketplace Booking

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia & New Zealand

-

South Korea

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa (MEA)

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global hostel market was estimated at USD 7.21 billion in 2023 and is expected to reach USD 7.57 billion in 2024.

b. The global hostel market is expected to grow at a compound annual growth rate of 6.5% from 2024 to 2030 to reach USD 11.04 billion by 2030.

b. Europe dominated the hostel market with a share of 35.98% in 2023. Europe has long been a hotspot for budget travel, and the demand for hostels is increasing due to the region's extensive network of low-cost transportation and rich cultural heritage. In addition, the rise of experiential travel is driving demand for hostels that offer unique social experiences, including local tours and events.

b. Some of the key players operating in the hostel market include Hostelling International (HI), a&o Hotels and Hostels GmbH, Generator Hostels, St Christopher's Inns, Meininger Hotels, Selina Hostels, Wombat’s Hostels, CLINK Hostels, Safestay Hotels & Hostels, and The Youth Hostels Association (YHA).

b. The hostel market has witnessed significant growth in recent years, driven by a rising demand for budget accommodations primarily among backpackers and young travelers, and the emergence of hostels that provide enhanced amenities and unique experiences that appeal to a wide range of guests.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.