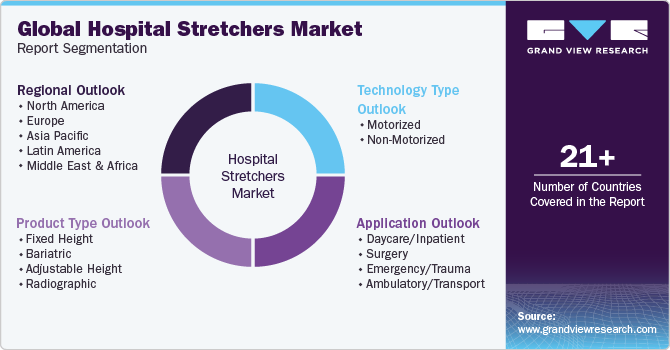

Hospital Stretchers Market Size, Share & Trends Analysis Report By Product Type (Adjustable Height, Bariatric), By Technology Type (Motorized, Non-motorized), By Application, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68039-633-5

- Number of Report Pages: 300

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Healthcare

Hospital Stretchers Market Size & Trends

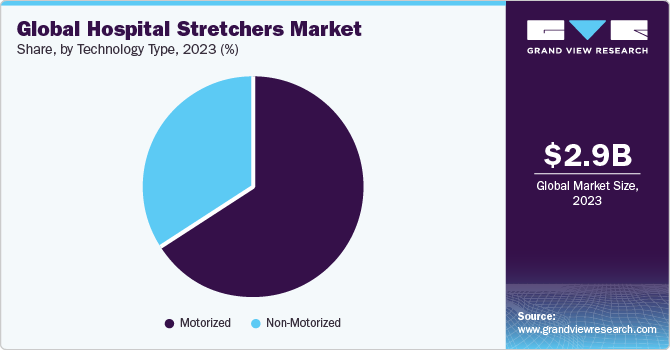

The global hospital stretchers market size was estimated at USD 2.90 billion in 2023 and is expected to grow at a CAGR of 6.0% from 2024 to 2030. Increasing prevalence of chronic disorders, growing geriatric population, and increasing cases of road accidents are major driving factors for market growth. Moreover, a rise in surgical and medical procedures performed is also projected to drive product demand over the forecast period.

According to America’s Health Rankings 2023 annual report, approximately 43% of the U.S. population, a total of 133 million people, was suffering from one or more chronic illnesses in 2022. Moreover, in the same year, more than 29 million adults were reported to be suffering from three or more chronic conditions. These chronic conditions, including arthritis, asthma, chronic kidney disease, Chronic Obstructive Pulmonary Disease (COPD), cardiovascular disease, cancer, depression, and diabetes, collectively contribute to the rising need for hospitalization. Such factors propel the industry’s growth.

Factors, such as the adoption of unhealthy & sedentary lifestyles, rising cases of obesity, and increased alcohol consumption and smoking, contribute to the prevalence of chronic diseases. Heart disease is one of the foremost causes of death worldwide. For instance, according to the WHO, every year, approximately 17.9 million people die owing to CVDs. Also, as per the CDC, every year, 805,000 Americans have a heart attack and about 655,000 Americans die from heart disease.

Furthermore, the rising prevalence of cancer is further driving the demand for hospital stretchers. For instance, according to the article published in 2022 by National Library of Medicine, projected incidence of cancer cases in India for year 2022 reached 1,461,427, with a crude rate of 100.4 cases per 100,000 population. This indicated a significant burden of cancer in the country. Furthermore, prevalence is such that approximately one in every nine individuals in India is anticipated to experience a cancer diagnosis during their lifetime. Thus, an upsurge in chronic diseases is the significant factor driving the market growth.

High geriatric population, which has a lower immune level and is more susceptible to chronic illnesses, will drive the market in the U.S. According to the WHO, by 2050, global population aged 60 years and above is estimated to total 2 billion. Moreover, 80% of all elderly population will live in low - middle-income nations by 2050. In addition, as per CDC, it has been observed that people aged 65 years and above are at a higher risk of developing heart disease, chronic obstructive pulmonary disease (COPD), diabetes, cancer, neurological disorders, and other chronic conditions. Patients suffering from such diseases need emergency as well as non-emergency hospital services. Hence, the increasing geriatric population is anticipated to be one of the major drivers for market growth.

Furthermore, a rise in a number of cases of road accidents and fatalities might necessitate emergency medical assistance and medical services. As per the data reported by U.S. Department of Transportation’s Traffic Safety Facts Sheet of New Jersey, in 2022, there were 701 deaths due to car accidents, accounting for 1.64% of 42,795 traffic-related fatalities reported nationwide. Moreover, New Jersey witnessed an increase in fatality rate related to automobile accidents between the years 2021 and 2022.

Road accident victims necessitate instant medical attention and ambulance services to transport casualties to hospitals. Also, these injured/traumatized patients are often handled in a stretcher that comprises accessories, such as head/spine immobilizer, lifting bridles, toe clamp, wrist rest, lifting harness, shoulder harness, footboard, and even floatation accessories. Thus, increasing incidence of road accidents is anticipated to drive market growth over the estimated study period.

Moreover, stretchers provide a dependable yet cost-effective alternative in several countries where patient bedding is in low supply owing to the severe impacts of the COVID-19 pandemic. Stretchers might prove to be a temporary replacement for hospital beds by adding attachments like operating table extensions, ventilator, and other device support extensions, patient harnesses, remote patient monitoring accessories, and others. This factor is expected to support market growth.

Market Concentration & Characteristics

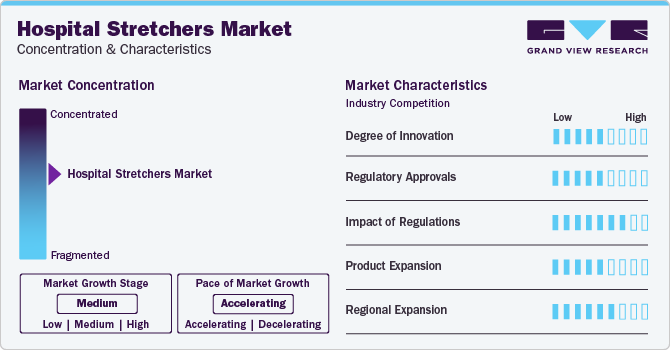

The market growth stage is medium, and pace of the market growth is accelerating. The market is characterized by a medium degree of growth owing to rising cases of road accidents, increasing prevalence of chronic diseases coupled with a focus on improving patient outcomes.

Key strategies implemented by players in market are new product launches, expansion, acquisitions, partnerships, and other strategies. In July 2022, Wideblue, a product-design company, entered a collaborative venture with SME Science to Business and the East Anglian Air Ambulance (EAAA) to develop a novel patient transfer device. Notably, this joint initiative has secured financial support from the National Institute for Health and Care Research (NIHR). The product under development incorporated a heating element, fueled by a rechargeable battery, strategically targeting the torso and shoulder regions. Its primary objective is to facilitate patient transfer, ensuring a seamless transition between pre- and in-hospital scenarios. In addition, the device serves the dual purpose of providing warmth when necessary. A notable attribute of this transfer device is its padded design, meticulously crafted to furnish a plush surface. This not only enhances patient comfort during prolonged usage but also mitigates the risk of pressure sore development. The device boasts a lightweight and foldable construction, enabling compatibility with various emergency vehicles such as ambulances, air ambulances, and first-responder vehicles.

Integration of smart technologies, IoT connectivity, and remote monitoring capabilities are potential areas for differentiation. Manufacturers are developing stretchers with features that enhance patient comfort, safety, and dignity.

Hospital stretchers are medical devices subject to strict regulatory standards. Regulatory bodies, such as U.S. FDA in United States or CE (Conformité Européene) marking in Europe, set guidelines and standards to ensure the safety, effectiveness, and quality of these devices. Innovation in hospital stretcher design, materials, and features often requires regulatory approvals. Manufacturers are required to navigate the regulatory landscape to ensure that new and improved products meet the necessary standards.

Regulatory bodies set quality and safety standards for medical equipment, including hospital stretchers. Compliance with these standards is essential for manufacturers to ensure the safety of patients during transportation. In addition, regulations may require manufacturers to adhere to eco-friendly practices in the production and disposal of hospital stretchers.

Market players in different regions are involved in developing ergonomic designs and features to enhance patient comfort and reduce the strain on healthcare providers during transport. Manufacturers may explore the customization of stretchers to cater to specific medical needs, such as bariatric patients or those requiring specialized orthopedic support.

The market caters to various specialties and patient needs, leading to a wide range of product offerings. Many small-scale businesses operate in specific areas, targeting local markets or providing budget-friendly options. These businesses often align with local rules, cultural preferences, and pricing strategies, leading to a fragmented market landscape.

Regional expansion scenarios in the market are propelled by factors such as population growth, healthcare expenditure, regulatory environments, and the overall development of healthcare infrastructure.

Product Type Insights

The bariatric segment dominated the market with the largest revenue share in 2023. Bariatric stretchers include larger frames, outsized wheels, winch attachments, and pull & push handles for safe transporting. Stretchers of this sort are typically used to carry obese patients. Obesity is a major health concern that leads to numerous related chronic diseases or complications, such as diabetes, cardiovascular diseases, and cancer. Thus, increasing prevalence of obesity leading to hospitalization is increasing the demand for bariatric stretchers. For instance, reports published in the article Obesity Across America: Geographic Variation in Disease Prevalence, and Treatment Options in 2022 stated that obesity rate is higher among females in U.S. In addition, as per reports published by Centre for Disease Control and Prevention in 2022, in U.S., West Virginia, Louisiana, and Oklahoma, over 40% of people are dealing with obesity. Bariatric stretchers are designed to support weights of up to 700 pounds. In addition, utilizing powered hi/low stretchers can be beneficial for easier patient transfer & positioning. This makes the current increase in the obese population a significant factor contributing to the market growth of this segment.

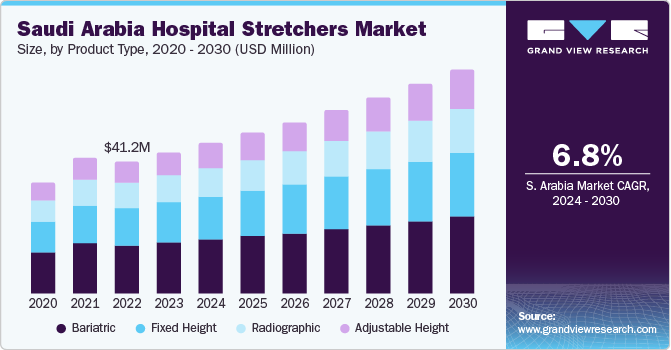

The adjustable segment is expected to grow at the fastest CAGR of 6.8% during the forecast period, owing to the increasing demand for innovative and automated hospital stretchers by multi-specialty and super-specialty hospitals. Adjustable stretchers are motorized and technologically advanced. Moreover, these stretchers provide ease of operation to healthcare providers. They are featured with a crank mechanism and robust and adjustable backrest. Fixed-height stretchers are usually less complicated and lighter as compared to adjustable-height stretchers. However, adjustable stretchers can match the elevation of other surface levels, providing easier and safer patient transfers.

Application Insights

In terms of application, the emergency/trauma segment dominated the market with the revenue share in 2023. Segment growth is credited to rising number of road traffic crashes or emergency trauma cases. In addition, work-related injuries are prevalent in emergency services. As the number of patients increases, demand for hospital stretchers for emergency cases is expected to grow at a rapid pace. In addition, patient transfer processes through emergency/trauma stretchers are smooth even in the presence of a crowd. Moreover, most of these stretchers are highly affordable and might not require skilled caregivers to handle patients. Such factors are further propelling market growth.

The ambulatory/transport segment is expected to grow at the fastest CAGR of 6.8% during the forecast period. Ambulatory stretchers are gaining popularity across the globe and are majorly used at emergency service centers. Cost-effective services, easy-to-use ambulance stretchers, a high level of comfort, safety, and patient-centered care are likely to boost segment growth. New hybrid devices are also being used that coordinate functionality of a stretcher, reclined chair, and treatment table into one piece of equipment. For instance, hybrid systems, such as Power-PRO XT Cot with Performance-LOAD Fastener System, manufactured by Stryker are facilitated with enhanced features and mobility.

Furthermore, market is experiencing a novel trend of renting out stretchers for a small duration that helps hospitals to easily operate and received funding throughout the year. In addition, key players are introducing novel products with innovative compact designs of ambulance stretchers, and effectual workflow with patient safety, in emerging nations to acquire more market share. Newly manufactured ambulance/transport stretchers exhibit enhanced adherence to the traditional manufacturing guidelines.

Technology Type Insights

Based on technology type, the motorized segment held the market with the largest revenue share in 2023. The segment’s growth is owing to the growing investment by key players to launch cutting-edge and innovative products. Motorized stretchers, also referred to as electric stretchers or powered stretchers, utilize a motorized mechanism to aid the movement & adjustment of the stretcher. This enhances the stretcher's functionality, offering extra features and advantages compared to manual stretchers. Most motorized stretchers have adjustable height options, allowing healthcare professionals to position them at the desired level. This makes transferring patients to and from beds, operating tables, and medical equipment more convenient. In addition, new technology assessment in hydraulic and pneumatic-based stretchers is boosting the demand in developed regions.

The segment is further expected to grow at the fastest CAGR of 6.0% during the forecast period. Electric-powered and hydraulic stretchers are gaining more traction amongst hospitals and emergency service providers. For instance, the Prime Series stretchers by Stryker feature innovative mobility alternatives, such as zoom motorized drive or big wheel system, electric-powered base & lift, and chaperone stretcher alarm system with incorporated scale. In addition, motorized stretchers are easy to carry within remote locations as compared to non-motorized stretchers. Electric stretchers might include extra functionalities like Trendelenburg/reverse Trendelenburg adjustments, automatic leveling, and built-in scales for weighing patients. The modern motorized stretchers are equipped with rechargeable batteries, allowing them to be used continuously being constantly plugged into power outlets. Moreover, electric stretchers equipped with controlled movement features help reduce the chances of unintended falls when transferring individuals, especially those who are more susceptible to accidents, such as the elderly or children.

Regional Insights

North America dominated the hospital stretchers market with the revenue share of 40.83% in 2023, and is expected to continue its dominance over the forecast period. Increased awareness within the healthcare community and the patients regarding the importance of early diagnosis & treatment for chronic disorders may positively influence the demand for hospital stretchers. For instance, the Centers for Medicare & Medicaid Services (CMS) projected that health spending in the U.S. was 7.5% in 2022. In 2023, it was expected to surpass USD 1 trillion for the first time. In addition, high disposable income in developed economies & skilled professionals are some factors responsible for the large share of the market of the country. Hence, the increasing healthcare infrastructure and better healthcare facilities are expected to boost the market growth in this region.

U.S. Hospital Stretchers Market Trends

The hospital stretchers market in the U.S. is expected to grow at the fastest CAGR over the forecast period. The increasing prevalence of chronic conditions, rising hospitalization and traffic accidents are the major driving force behind the market growth in the U.S. For instance, as per the annual report published by America’s Health Rankings 2023, in 2022, around 43% of the U.S. population, which is approximately 133 million people, suffered with one or more chronic illnesses. Furthermore, an increasing geriatric population in this region is a major factor contributing to market growth.

Europe Hospital Stretchers Market Trends

The hospital stretchers market in Europe is expected to grow at the fastest CAGR over the forecast period. European countries often embrace advanced medical technologies. Hospital stretchers with features such as electronic controls, motorized adjustments, and integration with patient monitoring systems have been in demand. Technological advancements focus on improving patient safety, comfort, and ease of use.

The UK hospital stretchers market is expected to grow at the fastest CAGR over the forecast period, due to hospital administrators and healthcare providers increasingly prioritizing patient safety and comfort. This includes features in stretchers that prevent falls, reduce infection risks, and enhance overall patient well-being thus propelling the market growth in near future.

The hospital stretchers market in France is expected to grow at the fastest CAGR over the forecast period, owing to rising geriatric population in this region propelling the market growth.

The Germany hospital stretchers market is expected to grow at a steady CAGR during the forecast period, owing to the increasing demand for better healthcare facilities and equipment. In addition, the aging population and growing prevalence of chronic diseases are driving the demand for hospital stretchers.

Asia Pacific Hospital Stretchers Market Trends

The hospital stretchers market in Asia Pacific region is anticipated to grow at the fastest CAGR over the forecast period. An increasing number of hospitals and escalating hospital admission for emergency care are key factors fueling the market growth in this region. Moreover, increasing cases of road traffic accidents resulting in a rising patient population is another key driver for market growth. For instance, as per the data reported by Department for Transport (2023)Great Britain, a total of 1,766 individuals lost their lives in road accidents, with 1,711 fatalities occurring in Britain and 55 in Northern Ireland. In addition, 28,941 people sustained serious injuries, with 28,031 in Britain and 910 in Northern Ireland, as a result of these incidents. Road accident victims need instant medical attention and hospital services. Thus, rising incidence of road accidents is likely to drive the market growth over the forecast period. In addition, evolving healthcare infrastructure, supportive government initiatives, and increasing awareness regarding early diagnosis and treatment have the market in Asia Pacific to grow at a substantial rate.

The China hospital stretchers market is expected to grow at the fastest CAGR over the forecast period,owing to need for advanced medical equipment and the increasing number of hospitals and healthcare centers in the country. In addition, the government's initiatives to improve healthcare infrastructure and provide better medical facilities to the citizens are also contributing to the market growth in China.

The hospital stretchers market in India is expected to grow at the fastest CAGR over the forecast period. India has been making significant investments in healthcare infrastructure. The expansion and development of hospitals and healthcare facilities are likely to contribute to the growing demand for modern and advanced hospital stretchers.Government initiatives and schemes aimed at improving healthcare access and quality, such as the Ayushman Bharat program, may lead to increased demand for hospital equipment, including stretchers.

The Japan hospital stretchers market is expected to grow at the fastest CAGR over the forecast period. Japanese healthcare emphasizes patient-centered care, driving the demand for stretchers that prioritize comfort, safety, and dignity thus propelling the industry growth.

Middle East And Africa Hospital Stretchers Market Trends

The hospital stretchers market in Middle East and Africa is expected to witness at the significant CAGR over the forecast period, due to increasing investments in healthcare infrastructure, rising prevalence of chronic diseases, and growing demand for advanced medical equipment. The market is also expected to be driven by the adoption of innovative and technologically advanced stretchers that offer enhanced patient safety and comfort.

The Saudi Arabia hospital stretchers market is expected to grow at the fastest CAGR over the forecast period, due to increasing investments in healthcare infrastructure, growing number of hospitals and clinics, and rising demand for advanced medical equipment.

The hospital stretchers market in Kuwait is expected to grow at the fastest CAGR over the forecast period due to escalating prevalence of chronic conditions and rising healthcare expenditure.

Key Hospital Stretchers Company Insights

Tianjin Bright Shine Medical Equipment Co., Ltd., Gems Quality Medical Equipment Private Limited are some of the emerging players in the global market. The market has been witnessing notable trends that are impacting the activities of emerging players in the industry. One prominent trend is increasing focus on incorporating advanced technologies into stretcher designs. The demand for smart hospital stretchers equipped with features such as electronic controls, patient monitoring systems, and IoT connectivity is growing. These technological advancements aim to enhance patient care, improve workflow efficiency, and provide real-time data for healthcare professionals. Emerging players are actively engaging in research and development to introduce innovative solutions that cater to these technological trends, thereby differentiating themselves in a competitive market landscape.

Moreover, there is a growing emphasis on ergonomic designs and patient comfort, reflecting the industry's commitment to improving the overall patient experience. Moreover, there is a rise in the use of materials that make products durable, easy to move around, and effective in preventing infections. As healthcare facilities strive to enhance patient outcomes and optimize operational processes, emerging players are aligning their activities to meet these evolving market demands.

Key Hospital Stretchers Companies:

The following are the leading companies in the hospital stretchers market. These companies collectively hold the largest market share and dictate industry trends.

- Hill-Rom Holdings, Inc.

- Stryker

- MAC Medical, Inc.

- FU SHUN HSING TECHNOLOGY CO., LTD

- Narang Medical Limited

- Royax

- Pedigo Products

- Ferno-Washington, Inc.

- Wy’East Medical

- TAYLOR HEALTHCARE PRODUCTS, INC.

- Champion Manufacturing, Inc.

- GF Health Products, Inc.

Recent Developments

-

In September 2023, at the Emergency Nursing 2023 event in San Diego, California, Stryker unveiled Prime Connect, a new smart and connected hospital stretcher designed to enhance fall prevention protocols across facilities. With increasing patient demand and limited nursing staff, the management of hospital bed exit alarms has become a challenging task. Addressing these issues, Prime Connect, equipped with audible and visual bed exit alarms, seamlessly communicates with various hospital systems, including the nurse call dome light

-

In October 2022, Champion Manufacturing, LLC announced a ceremonial groundbreaking event for a substantial 54,000 square-foot expansion to their existing Ocala facility. This expansion is expected to increase the number of employees and foster innovation within operations and production, especially for their high-quality & hand-crafted chairs. The facility, currently producing Winco and TransMotion (TMM Stretcher-Chairs) products, will further diversify its offerings by introducing Champion Chairs on-site upon the completion of the expansion

-

In May 2022, LINET introduced a novel “Sprint 200" emergency & transportation stretcher, an adjustable stretcher. This stretcher has cutting-edge features such as IV poles and an easy brake system that elevate the overall experience in patient transportation and care

-

In December 2021, Baxter International, Inc., a global provider of medical technology, acquired Hill-Rom. This strategic merger brings together two prominent medical technology firms with a shared goal of enhancing patient care and transforming healthcare on a global scale. The intention is to expand historical Welch Allyn and Hill-Rom products into new foreign markets, extending the aggregate portfolio of products and services to reach more patients & providers worldwide

Hospital Stretchers Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2024 |

USD 3.06 billion |

|

Revenue forecast in 2030 |

USD 4.33 billion |

|

Growth rate |

CAGR of 6.0% from 2024 to 2030 |

|

Base year for estimation |

2023 |

|

Historical data |

2018 - 2022 |

|

Forecast period |

2024 - 2030 |

|

Report updated |

April 2024 |

|

Quantitative units |

Revenue in USD million/billion and CAGR from 2024 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, trends, and volume analysis |

|

Segments covered |

Product type, technology type, application, region |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; MEA |

|

Country Scope |

U.S.; Canada; UK; Germany; Italy; France; Spain; Denmark; Sweden; Norway; Japan; China; India; South Korea; Australia; Thailand; Brazil; Mexico; Argentina; South Africa; Saudi Arabia; UAE; Kuwait |

|

Key companies profiled |

Baxter (Hill-Rom Holdings, Inc.); Stryker; MAC Medical, Inc.; FU SHUN HSING TECHNOLOGY CO., LTD; Narang Medical Limited; Royax; Pedigo Products; Ferno-Washington, Inc.; Wy’East Medical; TAYLOR HEALTHCARE PRODUCTS, INC; Champion Manufacturing, Inc.; GF Health Products, Inc. |

|

Customization scope |

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Hospital Stretchers Market Report Segmentation

This report forecasts revenue growth at regional and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global hospital stretchers market report based on product type, technology type, application, and region.

-

Product Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Fixed Height

-

Bariatric

-

Adjustable Height

-

Radiographic

-

-

Technology Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Motorized

-

Non-Motorized

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Daycare/Inpatient

-

Surgery

-

Emergency/Trauma

-

Ambulatory/Transport

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Thailand

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global hospital stretchers market size was estimated at USD 2.9 billion in 2023 and is expected to reach USD 3.06 billion in 2024.

b. The global hospital stretchers market is expected to witness a compound annual growth rate of 6.0% from 2024 to 2030 to reach USD 4.33 billion by 2030.

b. North America held the largest market share in 2023 with a market share of more than 40.83% owing to increasing patient volume in hospitals, rising incidence of cardiovascular diseases and growing number of bariatric patients.

b. Some key players operating in the hospital stretchers market include Hill-Rom Holdings, Inc., Stryker, MAC Medical, Inc., FU SHUN HSING TECHNOLOGY CO., LTD, Narang Medical Limited, Royax, Pedigo Products, Ferno-Washington, Inc.

b. Key factors that are driving the hospital stretchers market growth are growing geriatric population, increasing prevalence of cardiovascular diseases, rising medical tourism, and favorable reimbursement policies.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."