Hospital Revenue Cycle Management Market Size, Share & Trends Analysis Report By Product (Software, Services), By Type (Integrated, Standalone), By Delivery Mode, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-346-3

- Number of Report Pages: 100

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Healthcare

Market Size & Trends

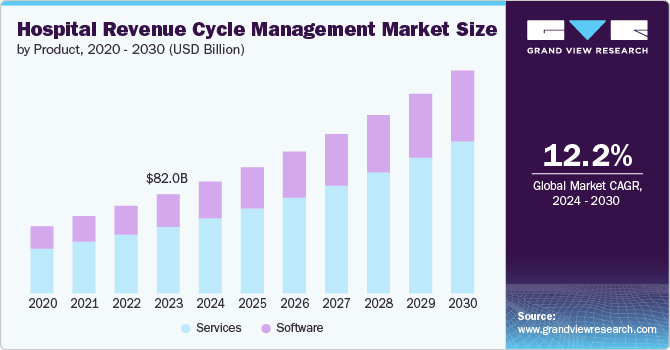

The global hospital revenue cycle management market size was estimated at USD 82.01 billion in 2023 and is expected to grow at a CAGR of 12.17% from 2024 to 2030. The market is expected to experience significant growth, driven by the need to improve financial and operational efficiency in the healthcare industry. This increasing demand is leading to a rise in the use of comprehensive revenue cycle management (RCM) solutions that focus on improving billing, coding, and reimbursement processes to ensure timely and accurate payments. Several factors, such as the move toward value-based care models, strict regulatory requirements, and advancements in technology, are contributing to this expected growth. Innovations in AI, automation, and cloud computing are transforming RCM systems, allowing healthcare providers to streamline workflow, reduce errors, and prioritize high-quality patient care.

The increasing practice of outsourcing healthcare revenue cycle management (RCM) solutions is creating high demand in the hospital RCM market. This demand is driven by the need for improved value addition, better business prospects, and enhanced financial management. As healthcare costs rise and the number of established healthcare facilities increases, the focus on advanced healthcare IT facilities is expected to increase. Furthermore, the emphasis on strengthening patient-provider relationships further drives the adoption of outsourced RCM solutions, making them a critical component in the changing healthcare landscape.

Market players are focusing on strengthening revenue cycle platforms through the integration of artificial intelligence, electronic health records systems, and data analytics, which contributes to reducing administrative burdens, streamlining workflows, and profit growth. For instance, in August 2023, NXGN Management, LLC and Luma Health expanded their alliance to provide nationwide AI-enhanced patient communication solutions for outpatient organizations. Through NextGen Patient Engage and NextGen Self-Scheduling powered by Luma, patients conveniently interact with their care providers in over 20 languages via mobile devices. These solutions seamlessly integrated into NextGen Enterprise EHR and enabled patients to manage appointments, communicate with staff, submit documents, and complete intake forms remotely, enhancing convenience & accessibility.

Additionally, technological advancements such as artificial intelligence and automation, are further propelling the market, offering hospitals the tools to optimize revenue cycles and focus more on patient care. For instance, in February 2024, Iodine Software, a healthcare AI solution provider, launched a solution designed to streamline hospital utilization management programs and strength revenue management, AwareUM. This launch showcases Iodine's ability to leverage AI to enhance clinical resource efficiency and automate complex workflows.

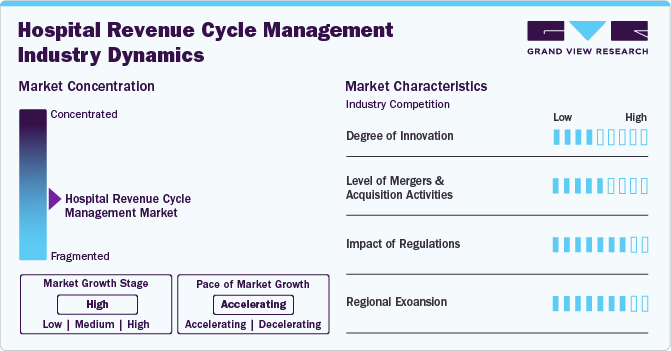

Market Concentration & Characteristics

The chart below illustrates the relationship between market concentration, market characteristics, and market participants. The x-axis represents the level of market concentration, ranging from low to high. The y-axis represents various market characteristics, including industry competition, degree of innovation, level of mergers & acquisition activities, impact of regulations, and regional expansion. For instance, the hospital revenue cycle management industry is fragmented, with many small players entering the market and launching new innovative products. The degree of innovation is moderate, and the level of mergers & acquisitions activities is moderate. The impact of regulations on the market is high, and the regional expansion of the market is high.

The degree of innovation in the market is moderate, due to several industry players launching new products to improve their industry penetration. For instance, in September 2022, AGS Health, a provider of RCM solutions, launched the AGS AI Platform. This solution utilizes automation and AI to offer expert assistance in maximizing revenue cycle performance.

The level of mergers & acquisitions in the market is moderate due to several private and public providers engaging in acquisition and merger activities to expand their market presence. For instance, in January 2024, Veradigm LLC acquired Koha Health, a full-service revenue cycle management (RCM) service provider. This acquisition aims to strengthen Veradigm and enhance its range of offerings and expertise to serve the needs of the market better.

The impact of regulations on the market is high. The hospital revenue cycle management (RCM) market is significantly impacted by regulations. Healthcare providers are required to navigate a complex landscape of federal, state, and local regulations that govern billing, coding, patient privacy, and reimbursement processes. Providers need to comply with regulations such as the Health Insurance Portability and Accountability Act (HIPAA), the Affordable Care Act (ACA), and the guidelines set by the Centers for Medicare & Medicaid Services (CMS) to avoid penalties and ensure proper reimbursement.

The hospital revenue cycle management (RCM) market is experiencing high levels of regional expansion. This growth is driven by the increasing globalization of healthcare services and the rising demand for efficient RCM solutions across different regions. Healthcare providers in various countries are adopting advanced RCM systems to improve financial performance, comply with local regulations, and enhance patient care.

Product Insights

The services segment dominated the market with a revenue share of 67.2% in 2023 and is expected to grow at the fastest CAGR during the forecast period. The growth of this segment is attributed to the increase in the number of companies providing outsourcing services to hospitals. Furthermore, various strategic initiatives are undertaken by established market players to gain a competitive edge. For instance, in January 2024, EqualizeRCM, a healthcare provider focused on increasing company reimbursements, invested in TrilogyRCS, an RCM service provider. The investment aims to improve TrilogyRCS's services, from scheduling to the final resolution of claims for its clients. It aims to help TrilogyRCS expand its reach across the U.S.

The software segment is anticipated to grow at a significant CAGR from 2024 to 2030, owing to the increasing demand for digitalization and the streamlining of operational workflows to enhance patient care in hospitals. The growing need for revenue cycle management software has created numerous opportunities for both established players and startups in the market. Market players are taking initiatives such as mergers, acquisitions, partnerships, and other strategic initiatives to increase their market presence is anticipated to drive the growth of the software segment. For instance, in October 2023, Access Healthcare, a provider of healthcare and RCM services, acquired Envera Health, Inc., a provider of patient engagement services. This acquisition enhances its end-to-end RCM services delivery and improves its process intelligence platform and proprietary workflows.

Type Insights

The integrated type segment dominated the market in 2023 with a revenue share of 73.1% and is anticipated to grow at the fastest CAGR during the forecast period. Integrated software is expected to revolutionize the Hospital revenue cycle management market by offering a unified approach to financial and administrative processes within healthcare organizations. By combining tasks such as patient registration, claims management, billing and payment processing into a single system, integrated software promises to streamline operations and enhance efficiency.

The standalone revenue cycle management software market segment is expected to witness significant growth in the forthcoming years. Standalone RCM software designed for tasks such as billing and coding gives healthcare organizations flexible and focused solutions. Companies such as CareCloud, athenahealth and Medusind offer standalone RCM software with features automatic billing, managing claims, and analyzing data, enabling hospitals to streamline their revenue cycle processes and improve financial performance.

Delivery Mode Insights

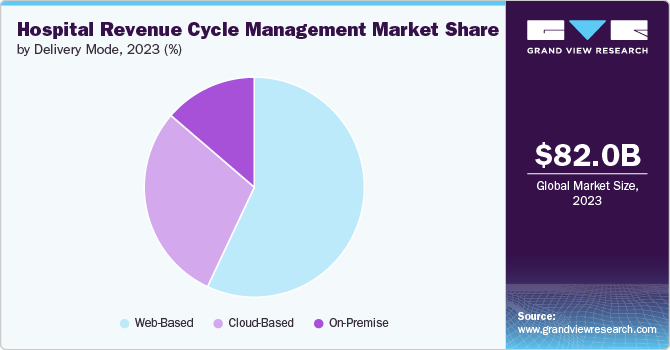

The web-based delivery mode segment dominated the market in 2023 with a revenue share of 56.98%. The growth is attributed to the benefits offered, such as affordable pricing and easy deployment, which do not require any extra hardware and storage. Web-based RCM systems offer enhance interoperability, easy integration with existing hospital systems, and improved data security. Additionally, the rise in telehealth services and the need for remote access to RCM tools are further propelling the adoption of web-based solutions.

The cloud-based segment is expected to grow at the fastest rate during the forecast period. This growth is driven by the increasing need for flexible, scalable, and cost-effective solutions to enhance financial operations and data management. Cloud-based RCM systems allow real-time access to critical financial data, streamline billing processes, and ensure compliance with regulatory standards. The ability to seamlessly integrate with existing healthcare IT infrastructure and provide robust data security and backup solutions makes cloud-based RCM highly attractive.

Regional Insights

North America region held the largest revenue share of 46.21% in 2023. This is attributed to rising healthcare expenses, expanding government initiatives aimed at RCM system implementation, and the rising adoption of healthcare information technology (HIT) systems. The growing use of RCM in hospitals to streamline operations and enhance efficiency is expected to lead to an increase in RCM automation. For instance, according to the AKASA survey in December 2023, around 74% of hospitals in U.S. have implemented some RCM.

U.S. Hospital Revenue Cycle Management Market Trends

The hospital revenue cycle management market in the U.S. held the largest revenue share in 2023 due to the growing integration of healthcare IT solutions, an increased focus on providing value-based care and reducing healthcare expenditures, and the rising outsourcing of health information technology services.

Europe Hospital Revenue Cycle Management Market Trends

The market in Europe is anticipated to grow significantly due to the increasing adoption of digital health technologies and healthcare IT systems in hospitals across the region. This adoption is driven by the need to improve operational efficiencies, enhance patient care quality, and comply with stringent regulatory requirements such as GDPR (General Data Protection Regulation) in data handling.

The hospital revenue cycle management market in Germany held the largest share in 2023. This is due to the presence of a large number of hospitals and support from government and private initiatives, which are expected to drive market growth.

The UK hospital revenue cycle management market is expected to grow significantly over the forecast period. The presence of established infrastructure, increasing per capita income, and rising healthcare costs has led to the increase in demand for hospital RCM solutions.

Asia Pacific Hospital Revenue Cycle Management Market Trends

Asia Pacific is poised to experience the highest growth rate in the forecast period, driven by the expansion and modernization of healthcare infrastructure. Increased investments in healthcare facilities and technologies throughout the region are fueling heightened demand for hospital revenue cycle management (RCM) solutions.

Japan hospital revenue cycle management market held the largest share in 2023, owing to the increasing patient volume and health insurance claims due to an aging population and rising chronic diseases, along with growing adoption of cloud-based RCM solutions for their cost-effectiveness and improved flexibility are expected to the growth of market.

The growth of hospital revenue cycle management market in India is driven by factors such as increasing adoption of healthcare information technology (HIT) systems; hospitals in India are seeking advanced RCM solutions to ensure compliance with regulatory standards. Moreover, the rising healthcare expenditure, growing number of healthcare facilities, and emphasis on improving operational efficiencies further contribute to the demand for comprehensive RCM systems in the Indian healthcare sector.

Latin America Hospital Revenue Cycle Management Market Trends

The hospital revenue cycle management market in Latin America is anticipated to grow significantly due to the growing adoption of cloud-deployed RCM solutions due to their higher flexibility and cost-effectiveness for end-users in the private healthcare sector.

The Brazil hospital revenue cycle management market is anticipated to grow significantly due to the growing foreign investment in private hospitals. This trend underscores a strategic focus on capitalizing the expanding market for private healthcare organizations in the country.

Middle East & Africa hospital revenue cycle management market

The hospital revenue cycle management market in the Middle East and Africa is anticipated to grow significantly due to the increasing government investment and adoption of health insurance.

The Saudi Arabia hospital revenue cycle management market is anticipated to grow significantly due to the country's ongoing healthcare sector reforms and digital transformation initiatives. As Saudi Arabia continues to invest in modernizing its healthcare infrastructure and systems, there is a growing emphasis on adopting advanced RCM solutions.

Key Hospital Revenue Cycle Management Company Insights

The market is highly fragmented, with the presence of many country-level service providers. Increasing healthcare costs and the rise in the shift towards value-based care are driving the market growth. To stay ahead of the competition, companies are adopting various strategies such as collaborations, acquisitions, partnerships, and launching new products. Some of the emerging players include FinThrive, Change Healthcare, and avadynehealth.

Key Hospital Revenue Cycle Management Companies:

The following are the leading companies in the hospital revenue cycle management market. These companies collectively hold the largest market share and dictate industry trends.

- CareCloud Corporation

- Epic Systems Corporation

- Evident

- NXGN Management, LLC

- OncoSpark, Inc.

- Oracle

- R1 RCM, Inc.

- The SSI Group, LLC

- Veradigm LLC

Recent Developments

-

In April 2024, Arkansas Heart Hospital partnered with Oracle to implement Oracle Patient Accounting and Health EHR solutions within two hospitals and its network of ambulatory clinics. This implementation aims to enhance patients' outcomes by providing health data interoperability.

-

In October 2023, Omega Healthcare introduced the Omega Digital Platform (ODP) to enhance healthcare organizations, reduce administrative burdens, and improve financial performance.

-

In June 2022, Midwest Orthopaedic Center opted for eClinicalWorks' Cloud EHR and Revenue Cycle Management solutions to increase patient engagement.

-

In February 2020, Waystar Health launched Hubble, an AI/RPA integrated platform used for automating the revenue cycle process. The platform uses predictive analytics and advanced machine learning algorithms to increase revenue capture. It automatically identifies missing charges, coding variances, and DRG anomalies based on an organization’s previous billing practices. The Hubble platform aims to provide a seamless financial experience for patients and helps assess patients’ ability and likelihood to pay.

Hospital Revenue Cycle Management Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2024 |

USD 92.57 billion |

|

Revenue forecast in 2030 |

USD 184.35 billion |

|

Growth Rate |

CAGR of 12.17% from 2024 to 2030 |

|

Actual data |

2018 - 2023 |

|

Forecast period |

2024 - 2030 |

|

Quantitative units |

Revenue in USD million/billion and CAGR from 2024 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Product, type, delivery mode, region |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; MEA |

|

Country scope |

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; Norway; Denmark; Sweden; China; Japan; India; South Korea; Australia; Thailand; Brazil; Argentina; Saudi Arabia; South Africa; UAE; Kuwait |

|

Key companies profiled |

The SSI Group, LLC; Veradigm LLC; Oracle; Athenahealth, Inc.; Epic Systems Corporation; NXGN Management, LLC; CareCloud Corporation; R1 RCM, Inc.; OncoSpark, Inc.; Evident |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Hospital Revenue Cycle Management Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global hospital revenue cycle management market report based on product, type, delivery mode, and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Software

-

Services

-

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Integrated

-

Standalone

-

-

Delivery Mode Outlook (Revenue, USD Million, 2018 - 2030)

-

On-Premise

-

Web-Based

-

Cloud-Based

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa (MEA)

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global hospital revenue cycle management market is expected to grow at a compound annual growth rate of 12.17% from 2024 to 2030 to reach USD 184.35 billion by 2030.

b. North America dominated the market, with a share of over 46.21% in 2023. This is attributed to rising healthcare expenses, expanding government initiatives aimed at RCM system implementation, and the rising adoption of healthcare information technology (HIT) systems.

b. Some key players operating in the hospital revenue cycle management market include The SSI Group, LLC, Veradigm LLC, Oracle, Athenahealth, Inc., Epic Systems Corporation, NXGN Management, LLC, CareCloud Corporation, R1 RCM, Inc., OncoSpark, Inc., Evident

b. Key factors that are driving the hospital revenue cycle management market growth include increase in outsourcing of RCM, adoption of integrated EHR/RCM system, technological advancement

b. The global hospital revenue cycle management market size was estimated at USD 82.01 billion in 2023 and is expected to reach USD 92.57 billion in 2024.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."