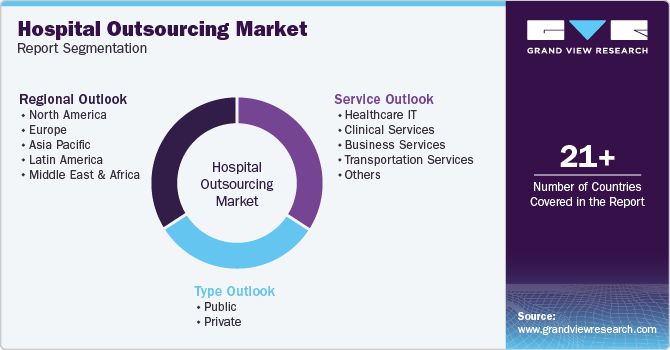

Hospital Outsourcing Market Size, Share & Trends Analysis Report By Service (Healthcare IT, Clinical Services, Business Services, Transportation Services), By Type (Public, Private), By Region, And Segment Forecasts, 2025 - 2030

- Report ID: GVR-4-68039-210-4

- Number of Report Pages: 100

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Healthcare

Hospital Outsourcing Market Size & Trends

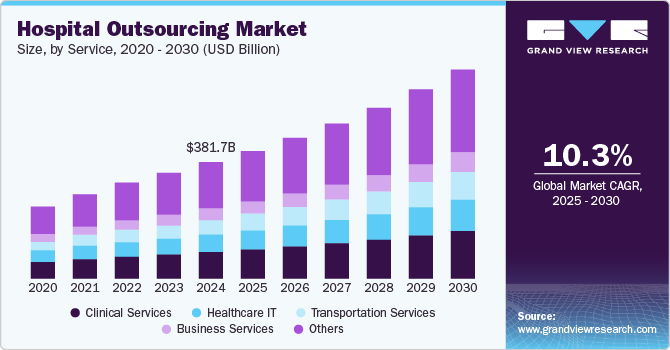

The global hospital outsourcing market size was estimated at USD 381.7 billion in 2024 and is projected to grow at a CAGR of 10.3% from 2025 to 2030. As hospitals increasingly strive to minimize operational costs while preserving the quality of care, outsourcing non-core functions such as billing and IT services becomes a strategic solution. Specialized expertise in these areas allows healthcare facilities to achieve significant cost savings, reallocating funds to critical services directly impacting patient care and outcomes.

The aging population is creating an unprecedented demand for healthcare services, particularly in developed countries. With the global population of 65 and older projected to reach 1.5 billion by 2050, hospitals face escalating patient volumes and complex care needs. Outsourcing healthcare services allows institutions to effectively manage these challenges, ensuring they can respond adequately to the requirements of an aging demographic without overwhelming their internal resources.

Technological advancements also significantly influence the outsourcing landscape. Innovations in healthcare, including telemedicine and electronic health records (EHR), necessitate specialized management skills and infrastructure. Hospitals can leverage outsourced services to implement these cutting-edge solutions without incurring the costs associated with extensive in-house resources. According to the Centers for Medicare & Medicaid Services (CMS) projections, national health expenditures in the U.S. are expected to rise from USD 4.8 trillion in 2023 to USD 7.7 trillion by 2032, highlighting the urgent need for efficiency and expertise in managing healthcare technology.

Furthermore, the increasingly complex regulatory environment is a driving force behind hospital outsourcing. With revised General Pharmaceutical Legislation and new Medical Device Regulations, healthcare providers must ensure robust compliance with evolving standards. For instance, the EU’s Health Technology Assessment will implement joint clinical assessments for oncology and gene therapies starting in January 2025, necessitating adaptive compliance strategies. As hospitals navigate these complex regulations, outsourcing compliance functions to specialized firms becomes essential to ensure adherence to laws and maintain market access.

Service Insights

Clinical services dominated the market with a revenue share of 21.5% in 2024. The increasing complexity of healthcare delivery and the need for specialized expertise compels hospitals to outsource clinical functions, allowing a focus on core patient care activities. Moreover, the aging population and the prevalence of chronic diseases require expanding clinical services, which outsourcing can effectively address. The intricate ICD-10 coding system exemplifies this trend, as hospitals seek to enhance billing accuracy and compliance while optimizing internal resources through partnerships with specialized coding firms, ultimately improving operational efficiency.

Transportation services are expected to grow lucratively over the forecast period. Hospitals prioritize patient-centric care, which demands efficient logistics for patient transfers, medical supplies, and equipment. The growth of telehealth and home healthcare services further necessitates reliable transportation solutions. Regulatory compliance and cost containment pressures drive hospitals to outsource transportation services to specialized providers, enhancing operational efficiency and enabling more effective resource allocation.

Type Insights

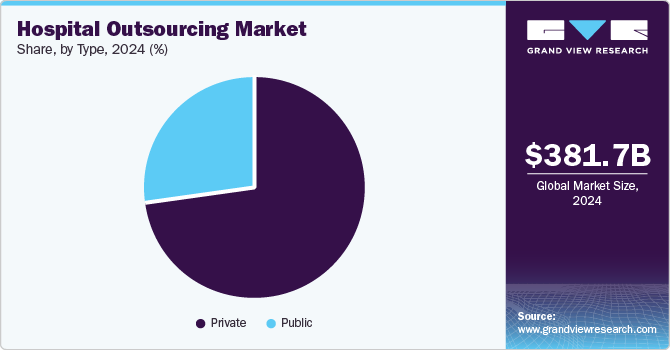

Private hospitals led the market and accounted for a share of 72.8% in 2024, as they encountered budget constraints and pursued cost-effective solutions to sustain high-quality services. Outsourcing non-core functions such as billing and IT enables them to concentrate on patient care while lowering operational costs. This trend and increasing regulatory complexity make outsourcing appealing for enhancing operational flexibility and service delivery.

The public hospitals segment is projected to grow rapidly over the forecast period. Public hospitals face budget constraints while striving to deliver high-quality care cost-effectively. Outsourcing non-core functions such as billing, IT, and facility management enables a focus on patient care. Increasing regulatory complexity and rising patient populations further drive public hospitals to seek external partners for compliance and efficient service delivery.

Regional Insights

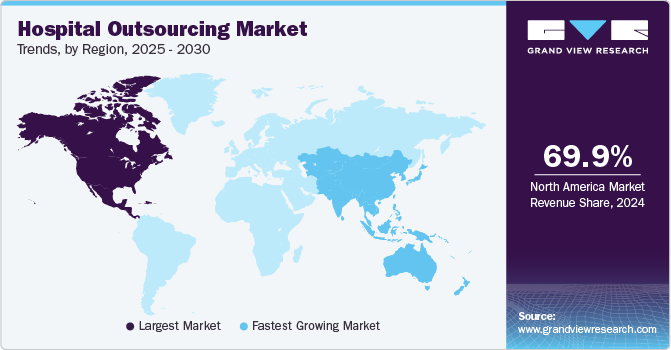

North America hospital outsourcing market dominated the global market with a revenue share of 69.9% in 2024. North America’s healthcare facilities encounter rising operational costs and regulatory pressures, driving a shift toward outsourcing for cost-effective solutions. The COVID-19 pandemic intensified the demand for efficient resource management, leading to increased outsourcing of non-core functions such as billing and IT, while technological advancements enhance service delivery and operational efficiency.

U.S. Hospital Outsourcing Market Trends

The U.S. hospital outsourcing market dominated North America with a significant revenue share in 2024. The rising complexity of healthcare regulations, including ICD-10 coding, compels hospitals to outsource specialized functions for compliance and efficiency. Hospitals prioritize core activities while delegating administrative tasks to enhance patient care and operational performance. The abundance of established outsourcing firms in the U.S. provides access to advanced technologies and expertise.

Europe Hospital Outsourcing Market Trends

Europe hospital outsourcing market held a substantial market share in 2024. The growing complexity of regulations and the demand for high-quality care compel hospitals to outsource non-core functions, such as IT and billing. Furthermore, the aging population in Europe is amplifying healthcare demands, prompting providers to pursue external partnerships to manage patient loads and enhance operational capabilities while prioritizing quality patient care.

The hospital outsourcing market in the UK is expected to grow significantly over the forecast period. The National Health Service (NHS) confronts funding and resource allocation challenges due to pressures on public health budgets and a shift towards patient-centered care. To improve efficiency and reduce costs, hospitals are outsourcing administrative functions. Moreover, regulatory changes and technological advancements necessitate specialized expertise that external providers can deliver, enhancing service delivery.

Asia Pacific Hospital Outsourcing Market Trends

Asia Pacific hospital outsourcing market is expected to register the fastest CAGR of 11.9% over the forecast period. Governments are enacting policies that favor privatization and outsourcing in healthcare, driving demand for external service providers. Rising chronic disease prevalence and an aging population require efficient resource management, prompting hospitals to explore specialized outsourcing solutions. Adopting advanced technologies further facilitates this trend, enhancing operational efficiency and patient care outcomes in the Asia Pacific region.

The hospital outsourcing market in Japan dominated the Asia Pacific hospital outsourcing market in 2024. Japan’s aging population is resulting in heightened demand for healthcare services, compelling hospitals to enhance operational efficiency by outsourcing non-core functions, such as administrative and IT services. Regulatory changes imposing stringent compliance standards further necessitate partnerships with specialized outsourcing firms. This strategic approach enables Japanese hospitals to concentrate on delivering high-quality patient care while effectively managing escalating operational challenges.

Key Hospital Outsourcing Company Insights

Some key companies operating in the market include Allscripts, Cerner Corporation, The Allure Group, Integrated Medical Transport, and Sodexo. Key players pursue mergers and acquisitions to enhance service offerings, while investments in technology drive demand for specialized outsourcing, enabling tailored, high-quality, patient-centric healthcare solutions.

-

Cerner Corporation offers healthcare information technology solutions, focusing on EHR, revenue cycle management, and data analytics. By outsourcing IT functions, Cerner helps hospitals streamline operations and improve patient care through enhanced data management and interoperability among healthcare systems.

-

Aramark Corporation provides integrated support services such as food service, facilities management, and patient logistics within healthcare environments. By outsourcing non-clinical services, Aramark improves operational efficiency, enabling hospitals to concentrate on patient care while maintaining high-quality nutrition and facility maintenance services.

Key Hospital Outsourcing Companies:

The following are the leading companies in the hospital outsourcing market. These companies collectively hold the largest market share and dictate industry trends.

- Allscripts

- Cerner Corporation

- The Allure Group

- Integrated Medical Transport

- Sodexo

- Aramark Corporation

- LogistiCare Solutions, LLC (ModivCare)

- Flatworld Solutions Inc.

- Abbott

- ABM INDUSTRIES INCORPORATED

Recent Developments

-

In October 2024, Bellin Health partnered with Protera Health to provide innovative virtual musculoskeletal care to its self-insured employees, integrating Protera’s advanced solution into its wellness and benefits programs.

-

In September 2024, Flatworld Solutions opened a new office in Ahmedabad, India. It enhanced its service delivery capabilities and addressed client demands by leveraging the city’s mobile and eCommerce development talent pool.

Hospital Outsourcing Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2025 |

USD 419.7 billion |

|

Revenue forecast in 2030 |

USD 686.3 billion |

|

Growth rate |

CAGR of 10.3% from 2025 to 2030 |

|

Base year for estimation |

2024 |

|

Historical data |

2018 - 2023 |

|

Forecast period |

2025 - 2030 |

|

Report updated |

November 2024 |

|

Quantitative units |

Revenue in USD million/billion and CAGR from 2025 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, trends |

|

Segments covered |

Service, type, region |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

|

Country scope |

U.S., Canada, Mexico, UK, Germany, France, Italy, Spain, Denmark, Sweden, Norway, China, Japan, India, Australia, South Korea, Thailand, Brazil, Argentina, South Africa, Saudi Arabia, UAE, Kuwait |

|

Key companies profiled |

Allscripts; Cerner Corporation; The Allure Group; Integrated Medical Transport; Sodexo; Aramark Corporation; LogistiCare Solutions, LLC (ModivCare); Flatworld Solutions Inc.; Abbott; ABM INDUSTRIES INCORPORATED |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Hospital Outsourcing Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global hospital outsourcing market report based on service, type, and region:

-

Service Outlook (Revenue, USD Million, 2018 - 2030)

-

Healthcare IT

-

Clinical Services

-

Business Services

-

Transportation Services

-

Others

-

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Public

-

Private

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."