- Home

- »

- Healthcare IT

- »

-

Hospital Electronic Health Records Market Size Report, 2030GVR Report cover

![Hospital Electronic Health Records Market Size, Share, & Trends Report]()

Hospital Electronic Health Records Market Size, Share, & Trends Analysis Report By Deployment, By Type, By Business Model, By Product, By Hospital Size, By Application, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-326-1

- Number of Report Pages: 100

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Healthcare

Market Size & Trends

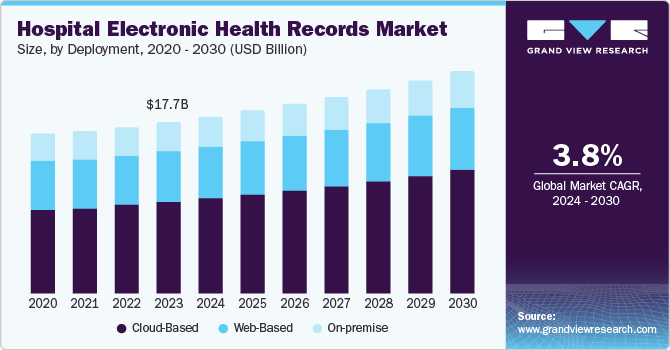

The global hospital Electronic Health Records market size was estimated at USD 17.69 billion in 2023 and is expected to grow at a CAGR of 3.84% from 2024 to 2030. The market demand is attributed to the rise in the adoption of Electronic Health Records (EHR) in hospitals for improving clinical, financial & administrative efficiency, along with the increasing need for enhanced information systems in hospitals. Moreover, the shift from volume-based care to value-based care is expected to increase the demand for the systems in hospitals. According to the Office of the National Coordinator for Health Information Technology (ONC), EHR adoption in U.S. hospitals increased from 9% in 2008 to 96% adoption in 2021.

With the increasing demand for EHR in hospitals, governments are implementing regulations to ensure that systems work together effectively. In the U.S., the Centers for Medicare & Medicaid Services (CMS) and the Office of the National Coordinator for Health Information Technology (ONC) oversee privacy, security, and standards for EHRs used by providers and health IT developers. In July 2021, the Interoperability and Patient Access Rule was introduced. This rule needs CMS-regulated payers to break down industry barriers and support the use of Patient Access API, Provider Directory API, and Payer-to-Payer Data Exchange to improve the exchange of information within the healthcare system while still complying with the existing Health Insurance Portability and Accountability Act (HIPAA) requirements.

Major players in the industry are undertaking strategic initiatives to increase their market share through partnerships with medical practices and hospital facilities. These initiatives are intended at expanding their reach and improving their service offerings. For instance, in September 2023 , The Georgian Bay Information Network (GBIN), a collaboration of six Ontario healthcare organizations, announced enhancing its Oracle Health EHR system with advanced clinical services, optimized medication administration, and oncology support through its eNautilus project. The effort aimed to facilitate caregiver collaboration, reduce clinician administrative burdens, and improve patient safety across 15 hospitals.

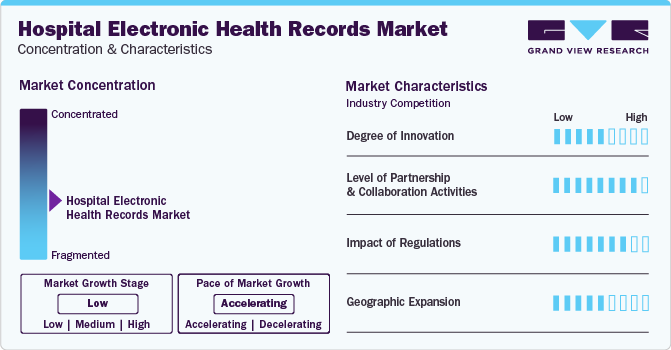

Market Concentration & Characteristics

The chart below illustrates the relationship between industry concentration, industry characteristics, and market participants. The x-axis represents the level of industry concentration, ranging from low to high. The y-axis represents various market characteristics, including industry competition, degree of innovation, impact of regulations, level of partnerships & collaborations activities, and geographic expansion. For instance, the hospital EHR industry is fragmented, with many service providers entering the industry. The degree of innovation is high, and the level of partnerships & collaboration activities is also high. The impact of regulations on the market is high, and the geographic expansion of the industry is moderate.

Degree of innovation is high in the industry as several industry players are launching new services such as integration of EHR with other software’s, to improve their industry penetration. For instance, in December 2023 , Fraser Health Authority (Surrey, B.C.) announced plans to implement generative AI for clinical documentation in MEDITECH’s Expanse EHR. The effort would utilize Google Cloud’s Vertex AI and large language models as part of a pilot program targeting the hospital course narrative during discharge.

The level of partnerships & collaborations in the industry is high due to several local and mature players engaging in partnerships and collaboration activities to expand their industry presence. For instance, in March 2024, Arkansas Heart Hospital partnered with Oracle to implement Oracle Patient Accounting and Health EHR solutions within two hospitals and its network of Outpatient clinics. This implementation aims to enhance patients' outcomes by providing data interoperability.

The impact of regulations on the industry is high. Governments of developed and developing countries are introducing stringent regulations to safeguard the privacy of the patients and reduce data thefts. For instance, in May 2023, the Ministry of Health (MOH) of Singapore issued guidelines on appropriate use and access to the National Electronic Health Record (NEHR) system, set technical standards for the industry, and monitored user functionality and risk to protect data security.

The level of geographic expansion in the industry is moderate due to the growing need for remote monitoring and improved patient care, which are experiencing significant growth in the industry. For instance, in September 2023, OCHIN, Inc. provided OCHIN Epic to rural hospitals across the U.S. This new EHR system aims to improve interdisciplinary care plans and enhance clinical teams providing patient care.

Deployment Insights

Based on deployment, the cloud-based segment dominated the market with a revenue share of 53.15% in 2023 and is anticipated to grow at the fastest rate during the forecast period. The growth of the segment can be attributed to growing inclination for cloud-based EHR solutions in hospitals due to their scalability, flexibility, and cost-effectiveness, along with rapid digitalization in the healthcare sector. This is due to the need to streamline operations and improve patient experiences in hospitals.

However, the on-premises segment is expected to grow significantly during the forecast period. This segment provides cost benefits to hospitals, such as decreased infrastructure costs and improved scalability. The rising need for robust data security measures in hospitals due to increasing cyberattacks on data leads to an increased preference for on-premise EHRs that provide more control over data.

Type Insights

The acute segment dominated the market in 2023 with a revenue share of 46.18%. The segment's growth is owing to government initiatives promoting the adoption of EHRs in hospitals, and the rise in the shift from fee-for-service to value-based reimbursement models. This is expected to drive the need for EHR systems that can support data analytics and population health management.

The post-acute segment is expected to grow at the fastest rate during the forecast period. The post-acute EHR helps streamline patient care by providing a comprehensive view of patient data, improving patient outcomes, and enhancing coordination between healthcare providers. Moreover, the post-acute EHR supports manage large amounts of patient data, ensuring that providers have access to the necessary information to deliver high-quality care.

Business Model Insights

Based on the business model, the professional services segment dominated the market with a revenue share of 32.02% in 2023 and is expected to grow at the fastest CAGR during the forecast period. The growth of this segment is attributed to the complexity and specialized nature of implementing and managing EHR systems. Hospitals need expert assistance in various areas, including initial system deployment, customization to fit specific workflows, integration with existing IT infrastructure, and compliance with stringent regulations. As hospitals prioritize digital transformation and data-driven healthcare delivery, the demand for professional services in the market is expected to grow further.

The subscriptions segment is anticipated to grow at a significant CAGR during the forecast period. The EHR subscription provides cost savings for hospitals by eliminating upfront license fees, regular upgrades, and device maintenance costs. It also reduces reliance on in-house IT staff, as providers handle installation, configuration, testing, operation, and updates. The affordability and user-friendly nature of this model contribute to its increasing popularity among providers.

Product Insights

Based on product, the integrated segment dominated the market with a revenue share of 78.25% in 2023 and is expected to grow at the fastest CAGR during the forecast period. The increasing demand for smooth interoperability and data exchange among different hospitals is boosting the growth of this sector. This integration improves clinical workflows, allowing hospitals to access comprehensive patient information in real time. This, in turn, enhances coordinated patient care, reduces errors, and improves operational efficiency. As healthcare increasingly relies on data, the need for integrated EHR solutions supporting connectivity between various departments and external providers is driving market growth.

The standalone segment is anticipated to grow at a significant CAGR during the forecast period. Healthcare systems increasingly require smooth interoperability and data exchange to improve clinical workflows. This allows providers to access complete patient information in real-time, enhancing coordinated patient care, reducing errors, and boosting operational efficiency. With healthcare depending more on data, the need for integrated EHR solutions that support connectivity among various departments and external providers is on the rise, thereby driving market growth.

Hospital Size Insights

Based on hospital size, the medium hospital segment dominated the market with revenue share of 41.52% in 2023. This is attributed to the increasing need for comprehensive data management, enhanced interoperability, and advanced analytics capabilities. These systems support complex clinical workflows, improve patient care coordination, and ensure compliance with regulatory standards. Moreover, medium hospitals seek EHR solutions to streamline operations, reduce medical errors, and facilitate better decision-making through real-time access to extensive patient data.

The small hospital segment is anticipated to grow at the fastest CAGR during the forecast period. The use of EHRs is becoming more widespread in small hospitals, due to government support and incentives. Programs such as the Medicare incentive payment system in the U.S. aim to encourage the use of EHRs in acute care hospitals, including smaller facilities. Additionally, small hospitals face lower implementation costs for EHR systems compared to ambulatory care facilities, which further promotes their adoption. The increasing volume of medical data and the shift towards integrated and coordinated care models are driving smaller hospitals to adopt EHR technologies.

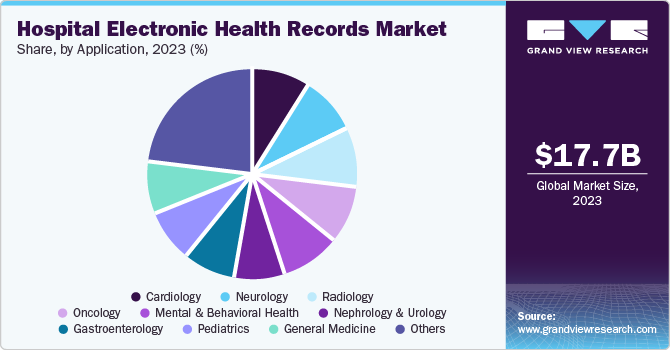

Application Insights

Based on application, the cardiology segment dominated the market with a revenue share of 32.02% in 2023 and is expected to grow at the fastest CAGR during the forecast period. This is attributed to the increasing incidence of hospitalization of patients diagnosed with cardiovascular diseases such as coronary heart disease and stroke. According to the American Heart Association's Heart Disease & Stroke 2024 Statistical Update, cardiovascular diseases, such as coronary heart disease, hypertension, and stroke, were the leading causes of death in the U.S. In 2021, the age-adjusted U.S. death rate attributable to cardiovascular disease is around 224.0 deaths per 100,000 population. This rise in the prevalence of cardiovascular diseases, coupled with the need for efficient evaluation & monitoring of cardiovascular functioning to prevent medication errors, is expected to boost the demand for EHR systems over the forecast period.

The neurology segment is anticipated to grow at a significant CAGR from 2024 to 2030. The growing adoption of EHR in the neurology segment is attributed to the increasing incidence of neurological diseases and the rising need for high-quality healthcare services.

Regional Insights

North America hospital electronic health records market held the largest revenue share of 44.65% in 2023. This can be attributed to the rise in government policies that support the adoption of EHR and the availability of infrastructure with high digital knowledge. Furthermore, favorable government regulations and acts for monitoring the safety of healthcare IT solutions are expected to fuel high demand in the region.

U.S. Hospital Electronic Health Records Market Trends

U.S. hospital electronic health records marketheld the largest share in 2023 due to the growing emphasis on interoperability and data exchange across healthcare systems. With increasing regulatory requirements and the shift towards value-based care models, hospitals are prioritizing EHR systems that can seamlessly integrate with other healthcare IT systems, facilitate secure data sharing among providers, and support coordinated patient care.

Europe Hospital Electronic Health Records Market Trends

The hospital electronic health records market in Europeis anticipated to grow significantly due to the improving healthcare efficiency and patient outcomes through digital transformation. European hospitals are increasingly adopting EHR systems to streamline workflows, enhance clinical decision-making, and promote integrated care delivery across healthcare settings.

UK hospital electronic health records market is expected to grow significantly over the forecast period. This can be attributed to increased initiatives by NHS promoting digital health transformation and implementation of national EHR system to enhance operational efficiency.

The hospital electronic health records market in Germany held the largest share in 2023, owing to the increasing adoption of interoperable EHR systems due to the efforts to reduce healthcare costs. This is facilitated by healthcare IT systems that enable seamless information sharing. There is also a growing emphasis on using patient health data to improve care quality and for advanced analytics.

Asia Pacific Hospital Electronic Health Records Market Trends

With the increasing digitalization of healthcare systems, government initiatives promoting healthcare IT adoption, improving patient care quality and safety, improving operational efficiency, and the need for better data management and interoperability across hospital is anticipated to drive the demand for the market over the coming years.

The hospital electronic health records market in Japan held the largest share in 2023, owing to the need for improved patient care, reduced medical errors, and enhanced data management, along with government initiatives such as the "Society 5.0" strategy, which promotes digital integration.

India hospital electronic health records market is driven by factors such as the rise in initiatives taken by major businesses, hospitals, and organizations to invest in digital healthcare solutions. The government has also been encouraging the adoption of EHR systems to ensure that everyone has access to affordable healthcare.

Latin America Hospital Electronic Health Records Market Trends

The hospital electronic health records market in Latin Americais anticipated to grow significantly due to the increased adoption of cloud-based services in healthcare organizations. There is also a rising demand for improved patient care and operational efficiency, driven by a growing population with diverse healthcare needs, leading to an increased demand for the market.

Brazil hospital electronic health records market is anticipated to grow significantly owing to the rising demand among healthcare providers to enhance decision-making through data analytics and improve patient engagement and satisfaction also contributes to the rising demand for the market in Brazil.

MEA Hospital Electronic Health Records Market Trends

The hospital electronic health records market in Middle East & Africais anticipated to grow significantly due to the increase in healthcare expenditures and rise in government investment in interoperability and AI efforts to better leverage EHRs in hospitals.

South Africa hospital electronic health records market is anticipated to grow significantly due to the increased workload on caregivers due to the large patient data generated in hospitals and rise in favorable measures are undertaken to develop the healthcare IT sector in the region which is expected to fuel the market.

Key Hospital Electronic Health Records Company Insights

The market is highly fragmented, with the presence of many country-level service providers. Key players in this industry include Epic Systems Corporation; Oracle; Evident a CPSI Company; Altera Digital Health Inc.; and MEDHOST among others. Furthermore, increasing industry consolidation activities such as partnership & collaboration, acquisitions, and mergers by the top service providers as well as growing initiatives in launching new services by key players are also anticipated to increase their share in the industry. Some of the emerging players include EverHealth Solutions Inc., Helium Health, and Remedly.

Key Hospital Electronic Health Records Companies:

The following are the leading companies in the Hospital Electronic Health Records market. These companies collectively hold the largest market share and dictate industry trends.

- Epic Systems Corporation

- Oracle

- Evident a CPSI Company

- Altera Digital Health Inc.

- MEDHOST

- WellSky

- Vista

- Netsmart Technologies

- MEDITECH

- Veradigm LLC

Recent Developments

-

In May 2024, Valley Health System announced the opening of a smart hospital in Paramus, NJ. The establishment will use the Meditech Expanse platform and other advanced technologies to improve workflows, including network infrastructure, clinical functions, & administrative operations.

-

In April 2024, Auxilio Mutuo Hospital, a private nonprofit hospital, partnered with Oracle to provide staff and clinicians with a comprehensive, simplified view of patient's data by selecting Oracle Health's EHR. In addition, the hospital chose Oracle Health's RevElate Patient Accounting to provide an automated billing process and bring together a convenient, clear view of clinical & financial data.

-

In May 2021, Veradigm LLC and Blessing Health System extended their partnership to 3 more facilities. With this, Allscripts Managed Services and Allscripts Sunrise would be deployed at Blessing Health Keokuk, Hannibal Clinic, and Scotland County Hospital.

Hospital Electronic Health Records Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 18.25 billion

Revenue forecast in 2030

USD 22.87 billion

Growth rate

CAGR of 3.84% from 2024 to 2030

Actual data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Deployment, type, business model, product, hospital size, application, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; Norway; Denmark; Sweden; The Netherlands; Russia; China; Japan; India; South Korea; Australia; Thailand; Singapore; Brazil; Argentina; Saudi Arabia; South Africa; UAE; Kuwait

Key companies profiled

Epic Systems Corporation; Oracle; Evident a CPSI Company; Altera Digital Health Inc.; MEDHOST; WellSky; Vista; Netsmart Technologies; MEDITECH; Veradigm LLC

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Hospital Electronic Health Records Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global hospital electronic health records market report based on deployment, hospital size, application, product, type, business model, and regions.

-

Deployment Outlook (Revenue, USD Million, 2018 - 2030)

-

On-premise

-

Web-Based

-

Cloud-Based

-

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Acute

-

Outpatient

-

Post Acute

-

-

Business Model Outlook (Revenue, USD Million, 2018 - 2030)

-

Licensed Software

-

Technology Resale

-

Subscriptions

-

Professional Services

-

Others

-

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Standalone

-

Integrated

-

-

Hospital Size Outlook (Revenue, USD Million, 2018 - 2030)

-

Large Hospital

-

Medium Hospital

-

Small Hospital

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Cardiology

-

Neurology

-

Radiology

-

Oncology

-

Mental and Behavioral Health

-

Nephrology and Urology

-

Gastroenterology

-

Pediatrics

-

General Medicine

-

Physical Therapy and Rehabilitation

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

Russia

-

The Netherlands

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

Thailand

-

Singapore

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa (MEA)

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The hospital electronic health records market size was estimated at USD 17.69 billion in 2023 and is expected to reach USD 18.25 billion in 2024.

b. The hospital electronic health records market is expected to grow at a compound annual growth rate of 3.84% from 2024 to 2030 to reach USD 22.87 billion by 2030.

b. The cloud-based segment dominated the market with a revenue share of 53.15% in 2023. The growth of the segment can be attributed to growing inclination for cloud-based EHR solutions in hospitals due to their scalability, flexibility, and cost-effectiveness, along with rapid digitalization in the healthcare sector.

b. Some key players operating in the hospital electronic health records market include Epic Systems Corporation, Oracle, Evident a CPSI Company, Altera Digital Health Inc., MEDHOST, WellSky, Vista, Netsmart Technologies, MEDITECH, Veradigm LLC, and others.

b. Key factors that are driving the hospital electronic health records market growth include the increasing government initiatives to encourage healthcare IT usage, introduction to technologically advanced healthcare services, and the rising demand for centralization and streamlining of healthcare administration.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."