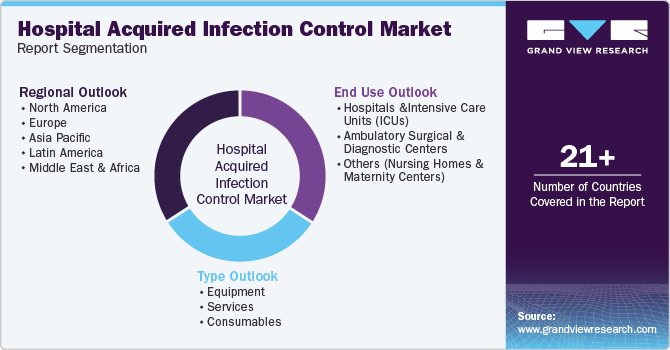

Hospital Acquired Infection Control Market Size, Share & Trends Analysis Report By Type (Equipment, Services, Consumables), By End Use (Hospitals & ICUs, Ambulatory Surgical and Diagnostic Centers), By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68039-383-5

- Number of Report Pages: 120

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Healthcare

Market Size & Trends

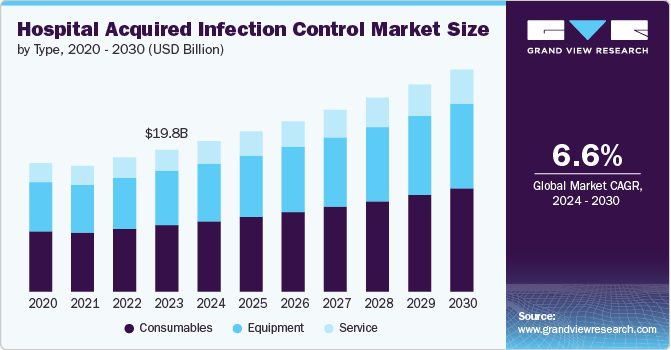

The global hospital acquired infection control market size was estimated at USD 19.76 billion in 2023 and is expected to grow at a CAGR of 6.65% from 2024 to 2030. The market is experiencing significant growth, driven by an increase in Healthcare-Associated Infections (HAIs) and the urgent need for stringent infection prevention measures across healthcare facilities.

The rise in HAIs, such as surgical site infections (SSIs), Catheter-associated Urinary Tract Infections (CAUTIs), Central Line-associated Bloodstream Infections (CLABSIs), and Ventilator-associated Pneumonia (VAP), have boosted the demand for advanced infection controlling measures in hospitals and healthcare settings globally. For instance, in 2023, Pennsylvania's long-term care facilities reported 23,970 infections, an 18.6% increase from 2022, with an overall infection rate of 0.98%. The increase was driven by a 20.1% rise in Urinary Tract Infections (UTIs) and a 17.4% rise in Skin and Soft Tissue Infections (SSTIs), with the Northeast region having the highest infection rate at 1.28 per 1,000 resident days. This increase can be largely attributed to factors such as prolonged hospital stays, the use of invasive procedures, and the high transmissibility of pathogens in hospital settings. Thus, with the rising incidences of HAIs, the market is witnessing an increase in advancements and adoption of stringent infection control standards.

Furthermore, technological advancements play a crucial role in driving the market and introducing innovative solutions that are transforming how infections are prevented, managed, & treated in healthcare settings. The application of advanced technologies, ranging from advanced sterilization methods to smart surveillance systems, has significantly boosted the efforts to combat HAIs, aligning with the increasing demand for efficient and effective infection controlling practices. For instance, in October 2023, ASP, a global provider of infection prevention, expanded its sterilization monitoring portfolio with new steam monitoring products, enhancing efficiency and sterility assurance in healthcare facilities. The portfolio includes BIOTRACE readers & biological indicators, VERISURE chemical indicators, and SEALSURE steam indicator tape, all designed to streamline workflow and ensure compliance across sterile processing departments. ASP’s enhanced portfolio reflects its ongoing commitment to advancing sterility assurance, supporting healthcare providers with faster, more reliable sterilization processes.

Market Concentration & Characteristics

The chart below illustrates the relationship between industry concentration, market characteristics, and market participants. The x-axis represents the level of industry concentration, ranging from low to high. The y-axis represents various market characteristics, including market competition, level of partnerships & collaboration activities, degree of innovation, the impact of regulations, and regional expansion. The market is fragmented, with the presence of several emerging and dominating market players. The degree of innovation is high, and the level of partnerships & collaboration activities is moderate. The impact of regulations on the industry is high, and the regional expansion of the industry is moderate.

The degree of innovation in the market is high. Innovators and companies in this market are focused on developing innovative solutions to address the increasing need for effective and advanced HAI controlling devices. For instance, in June 2024, Getinge launched the Poladus 150, a cutting-edge low-temperature sterilizer designed for heat-sensitive surgical instruments. The sterilizer features advanced cross-contamination barrier technology; it operates at up to 55°C with Vaporized Hydrogen Peroxide (VH2O2) to ensure instruments are sterile & ready for use.

The level of partnerships & collaborations in the market is moderate due to the need for effective solutions to combat rising infection rates. Moreover, partnerships allow companies to leverage each other's expertise in technology development and implementation, which is crucial for improving infection management strategies in hospitals. For instance, in June 2024, Metall Zug and Miele launched a joint venture combining Steelco and Belimed Inc., now branded as SteelcoBelimed, to advance Infection Control and Life Science solutions. This partnership aims to enhance market positioning and innovation, addressing the growing needs of the global healthcare and life sciences sectors with complementary cleaning, disinfection, and sterilization technologies.

The impact of regulations on the market is high due to the increasing recognition of HAIs as a critical public health issue. Regulatory frameworks established by entities such as the World Health Organization (WHO) and the Centers for Disease Control and Prevention (CDC) mandate stringent infection prevention and control (IPC) protocols in healthcare settings. These regulations encourage hospitals to adopt comprehensive preventive measures, which include hand hygiene, the use of personal protective equipment (PPE), and environmental cleaning. Compliance with these regulations is essential to counter the rising incidence of HAIs, which can lead to significant morbidity, mortality, and financial burdens on healthcare systems.

The level of regional expansion in the market is moderate owing to the growing awareness regarding the importance of preventing HAIs. Several market players are focused on increasing their regional presence, by taking strategic initiatives such as mergers & acquisitions, partnerships & collaboration, and other strategies. For instance, in September 2021, Sterigenics Germany GmbH and Nelson Labs expanded its center of excellence in Wiesbaden, Germany, to enhance microbiological laboratory testing and sterilization capacity. This expansion would help meet the rising demands of the medical device and pharmaceutical industries. Some of the market players with their presence globally include Belimed, Inc.; ASP (Advanced Sterilization Product Services, Inc.; STERIS, and others.

Type Insights

The consumables segment dominated the market with a revenue share of 46.88% in 2023. Consumables include essential items such as disinfectants, gloves, masks, and sterilization wipes products that are used daily in large volumes to ensure hygiene in hospitals and healthcare environments. To meet the growing demand for the consumables market, players across the globe are acquiring small players to expand their presence and product portfolio. For instance, in October 2023, Getinge acquired US-based Healthmark Industries Co. Inc., a provider of infection controlling consumables and instrument care, for approximately USD 320 million. This strategic acquisition strengthened Getinge's position in sterile reprocessing in the US and supports Healthmark's global expansion.

The services segment is expected to witness fastest growth over the forecast period as healthcare facilities strive to minimize HAIs, there is a growing demand for comprehensive infection control services, including training, consulting, and maintenance of disinfection and sterilization equipment. For instance, in February 2023, Midmark Corporation launched a new continuing medical education course titled "Enhancing Patient Safety: The Vital Role of Manufacturer's Instructions for Use (IFUs) in Instrument Processing," in partnership with Pfiedler Education. This course provides continuing education units (CEUs) and is designed to explain the importance of IFUs and underscore their significance in instrument processing.

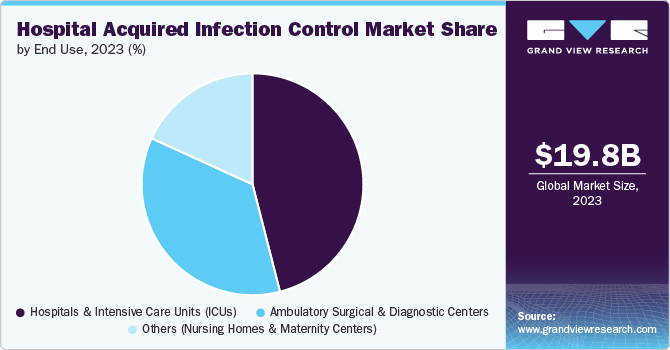

End-use Insights

The hospitals and Intensive Care Units (ICUs) segment dominated the market in 2023. The primary factor driving the market is the critical need to prevent and manage infections in environments where patients are most vulnerable. ICUs, in particular, house patients with compromised immune systems or those undergoing complex medical procedures, making them highly susceptible to HAIs. This necessitates the adoption of stringent preventive measures, including advanced sterilization and disinfection technologies, to safeguard patients and healthcare workers. For instance, in September 2021, Getinge partnered with Östra Hospital to provide a comprehensive solution at the new Central Sterile Supply Department (CSSD) opened at Östra Hospital in Gothenburg, Sweden. This collaborative effort involved four partners and aimed to improve surgical instrument workflow & minimize HAIs.

The ambulatory surgical and diagnostic centers segment is expected to witness fastest growth over the forecast period. The growing popularity of outpatient care is due to the increasing number of surgical and diagnostic procedures performed outside of traditional hospital settings. Ambulatory Surgical Centers (ASCs) are often considered a more convenient and cost-effective alternative to hospitals, offering shorter patient stays and faster recovery times.

However, this shift also brings the challenge of ensuring that stringent infection controlling measures are in place to prevent HAIs in these settings. The need to maintain high standards of cleanliness and sterilization, despite the rapid turnover of patients and procedures, is driving the demand for specialized solutions in ASCs.

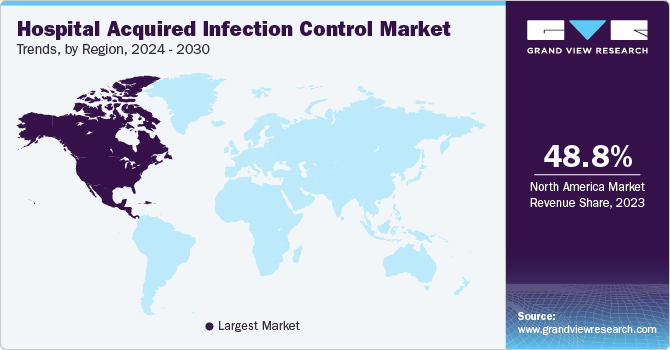

Regional Insights

North America hospital acquired infection control market dominated the global market with a revenue share of 48.77% in 2023. The high prevalence of HAIs across U.S. healthcare facilities is a key driver of market growth in the region. For instance, the U.S. Centers for Disease Control and Prevention (CDC) reported that cases of Candida auris (C. auris), a drug-resistant fungus, have escalated in healthcare settings across the country, with clinical infections rising from 476 in 2019 to 1,471 in 2021. As HAIs like C. auris pose a growing threat, particularly in hospitals and ICUs, healthcare providers are adopting advanced infection control technologies to mitigate these risks.

U.S. Hospital Acquired Infection Control Market Trends

The hospital acquired infection control market in the U.S. held the largest share in 2023. The U.S. is witnessing a significant rise in the number of HAI cases. According to CDC, HAIs affect approximately 1 in 31 hospital patients in the U.S. each year. The increasing prevalence of HAIs leads to longer hospital stays, higher healthcare costs, and greater patient morbidity & mortality, necessitating effective preventive & controlling measures, which is driving the market growth.

Europe Hospital Acquired Infection Control Market Trends

Europe hospital acquired infection control market is expected to witness significant growth over the forecast period. The financial burden associated with treating HAIs drives healthcare facilities to prioritize preventive measures to reduce costs related to prolonged hospital stays and additional treatments. As a result, there is an increased demand for innovative products and solutions aimed at controlling HAI rates in hospital settings. This trend is expected to drive the market across Europe as healthcare facilities increase their efforts to enhance patient safety and improve overall healthcare outcomes.

The hospital acquired infection control market in the UK held significant revenue share in 2023. The UK healthcare sector has observed a surge in innovative products designed to combat HAIs effectively. For instance, in March 2021, Innova Care Concepts partnered with Weber Hospital Systems to introduce an advanced Bed Washing System to the UK hospital market, aimed at automating the cleaning and disinfection of beds and mattresses. Similarly, the introduction of automated disinfection systems, antimicrobial surfaces, and real-time monitoring devices has revolutionized how hospitals manage HAI risks. This technological evolution is expected to drive market growth as healthcare providers adopt these cutting-edge tools to enhance their HAI prevention protocols.

Germany hospital acquired infection control market held a significant revenue share in 2023, owing to the increasing presence of international market players and enhanced access to advanced sterilization solutions & services. For instance, in September 2022, STERIS announced the establishment of a new medical device testing facility in Leipzig, Germany, aimed at enhancing support for medical device manufacturing. This facility provides packaging testing services, including accelerated aging, transportation, and microbiological testing, complementing existing services in Radeberg.

Asia Pacific Hospital Acquired Infection Control Market Trends

Asia Pacific hospital acquired infection control marketis expected to witness the fastest growth over the forecast period driven by increasing healthcare infrastructure investments, rising incidence of HAIs, and increasing awareness of HAI control practices. The 11th International Congress of the Asia Pacific Society of Infection Control in Jakarta was held in July 2024 with the theme "Infection Prevention and Control for All." It offered valuable insights and networking opportunities. The region's growing population, coupled with urbanization and the expansion of healthcare facilities, is fueling demand for advanced infection controlling solutions. Regulatory bodies across the Asia Pacific are also enhancing standards and guidelines for HAI control, further fueling the market growth.

The hospital acquired infection control market in China held a significant revenue share in 2023 owing to the increasing hospital admissions and surgeries, coupled with the rising prevalence of chronic diseases in the country. The demographic changes, including an aging population, are also contributing to the increased demand for healthcare services, which in turn amplifies the need for effective HAI controlling solutions to ensure patient safety & care quality. This growing awareness among patients and healthcare providers about the risks associated with HAIs is fostering a supportive environment for the adoption of advanced HAI control practices & technologies.

India hospital acquired infection control market held the largest revenue share in 2023. The increasing prevalence of HAIs across the country has increased the demand for effective infection control measures. According to a survey published by the Public Library of Science (PLOS) in June 2023, estimated 9 million to 15 million people show an incidence of hospital-associated drug-resistant infections (HARIs) per year from 2010 to 2020. Hospitals and healthcare facilities are actively seeking solutions to prevent the spread of infections, thus boosting the adoption of advanced products and technologies. This trend is further supported by the growing awareness among healthcare professionals and patients about the importance of HAI prevention and control, leading to the implementation of stringent hygiene & sanitation practices.

Latin America Hospital Acquired Infection Control Market Trends

The hospital acquired infection control market in Latin America is experiencing growth due to the growing prevalence of HAIs across the region. The rise in the incidence of infections such as urinary tract infections, pneumonia, and bloodstream infections, often acquired in hospital settings, has necessitated the adoption of stringent regulatory measures. According to a study in December 2022, using WHO’s Infection Prevention and Control Assessment Framework (IPCAF), 40 hospitals were surveyed across Panama, Guatemala, Ecuador, and Argentina. The survey revealed that 57% of hospitals achieved an "Advanced" IPC level. However, gaps persist, especially in IPC education, training, staffing, and bed occupancy, with public hospitals generally scoring lower than private ones.

Brazil hospital acquired infection control market is anticipated to grow significantly over the forecast period. Growing hospital admissions owing to an increasing population and rising prevalence of diseases that require hospital care are contributing to market growth. In addition, strict government regulations and the implementation of comprehensive guidelines aimed at reducing the spread of these infections require hospitals to enhance their HAI controls protocols. This regulatory landscape is complemented by advancements in medical technology, introducing innovative solutions that hospitals are increasingly adopting.

Middle East & Africa Hospital Acquired Infection Control Market Trends

The hospital acquired infection control market in the Middle East & Africa is expected to grow significantly over the forecast period. The increasing prevalence of HAIs in the region is leading to an urgent need for stringent HAI control practices. These infections, often caused by bacteria, viruses, or fungi, acquired by patients during their stay in healthcare facilities, lead to prolonged hospital stays, increased medical costs, and higher morbidity & mortality. The increasing awareness and growing concern regarding these conditions among healthcare professionals and the public are compelling healthcare facilities to adopt comprehensive HAI control measures.

Saudi Arabia hospital acquired infection control market is anticipated to grow significantly over the period owing to the growing awareness of the importance of HAI control in healthcare settings, increasing prevalence of HAIs, advancements in sterilization & disinfection technologies, and stringent regulations by healthcare authorities to curb the spread of HAIs.

Key Hospital Acquired Infection Control Company Insights

The market is fragmented, with several large players and emerging players operating in this space adopting various strategies such as collaborations, acquisitions, partnerships, and launching new products. Some emerging players in the market include MATACHANA; Metrex Research, LLC; and C.B.M. S.r.l. Medical Equipment.

Key Hospital Acquired Infection Control Companies:

The following are the leading companies in the hospital acquired infection control market. These companies collectively hold the largest market share and dictate industry trends.

- 3M

- Belimed Inc.

- O&M Halyards

- Getinge

- ASP (Advanced Sterilization Products Services, Inc.)

- Sterigenics U.S., LLC - A Sotera Health Company

- MMM Group

- Midmark Corporation

- STERIS

- W&H

Recent Developments

-

In July 2024, Midmark Corporation launched its next-generation M11 and M9 steam sterilizers, designed for enhanced durability & ease of use. These sterilizers feature integrated capabilities to improve instrument processing and compliance documentation efficiencies.

-

In June 2023, MMM Group and Southwest Clinic partnership established a new CSSD/RUMED facility at the Calw clinic site on Robert-Bosch-Straße 13. This state-of-the-art facility handles the reprocessing of medical products, including Critical C-level items, for four clinics.

-

In May 2022, Sterigenics U.S., LLC, a provider of sterilization services, expanded its electron beam (E-beam) facility in Indiana. This extension enhances the capacity for sterilizing medical and pharmaceutical products, bolstering safety across the global healthcare sector.

-

In February 2021, 3M launched the 3M Clean & Protect Certified Badge Program, a robust system designed to enhance facility management. This program offers advanced disinfecting and cleaning solutions, along with comprehensive training, to support the safer resumption of normal operations and activities.

Hospital Acquired Infection Control Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2024 |

USD 20.98 billion |

|

Revenue forecast in 2030 |

USD 30.86 billion |

|

Growth rate |

CAGR of 6.65% from 2024 to 2030 |

|

Actual data |

2018 - 2023 |

|

Forecast period |

2024 - 2030 |

|

Quantitative units |

Revenue in USD million/billion and CAGR from 2024 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Type, end use, region |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; MEA |

|

Country scope |

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; Norway; Denmark; Sweden; China; Japan; India; South Korea; Australia; Thailand; Brazil; Argentina; Saudi Arabia; South Africa; UAE; Kuwait |

|

Key companies profiled |

3M; Belimed Inc.; O&M Halyards; Getinge; ASP (Advanced Sterilization Products Services, Inc.); Sterigenics U.S., LLC - A Sotera Health Company; MMM Group; Midmark Corporation; STERIS; W&H |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Hospital Acquired Infection Control Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global hospital acquired infection control market report based on type, end use, and regions.

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Equipment

-

Sterilization Equipment

-

Heat Sterilization Equipment

-

Low Temperature Sterilization

-

Radiation Sterilization

-

-

Disinfection Equipment

-

Washer Disinfector

-

Flusher Disinfector

-

Endoscopic Reprocessor Systems

-

-

-

Services

-

Consumables

-

Disinfectants

-

Sterilization Consumables

-

-

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospitals and Intensive Care Units (ICUs)

-

Ambulatory Surgical and Diagnostic Centres

-

Others (Nursing Homes and Maternity Centers)

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa (MEA)

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global hospital acquired infection control market was valued at 19.76 billion in 2023 and is expected to reach USD 20.98 billion in 2024.

b. The global hospital acquired infection control market is expected to grow at a compound annual growth rate of 6.65% from 2024 to 2030 to reach USD 30.86 billion by 2030.

b. As of 2023, the consumables segment dominated the hospital acquired infection control market and accounted for the largest revenue share of 46.88%.

b. Some key players operating in the hospital acquired infection control market include 3M; Belimed Inc.; O&M Halyards; Getinge; ASP (Advanced Sterilization Products Services, Inc.); Sterigenics U.S., LLC - A Sotera Health Company; MMM Group; Midmark Corporation; STERIS; W&H

b. Key factors driving the hospital acquired infection control market growth include the establishment of infection prevention standards & protocols at the hospital, regional, and national levels, supportive government initiatives, and increasing prevalence of HAIs.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."