Horse Riding Equipment Market Size, Share & Trends Analysis Report By Product (Helmets, Vests), By Price Range (Mass, Premium), By Distribution Channel (Sporting Goods, Online), By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-435-9

- Number of Report Pages: 108

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Consumer Goods

Horse Riding Equipment Market Trends

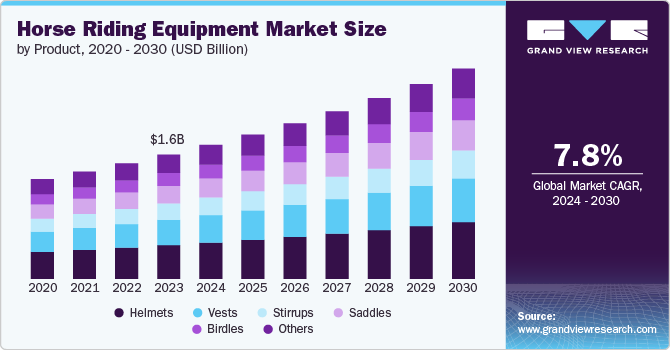

The global horse riding equipment market size was estimated at USD 1.60 billion in 2023 and is expected to grow at a CAGR of 7.8% from 2024 to 2030. The market is undergoing significant transformation, driven by a growing interest in equestrian activities, rising disposable incomes, and a heightened focus on safety and comfort for both riders and horses. Industry executives and product managers are concentrating on harnessing technological innovations, understanding consumer preferences, and navigating regulatory challenges to maintain growth and meet the evolving needs of the equestrian community.

Consumer preferences are increasingly shifting towards more advanced and technologically sophisticated horse riding equipment, reflecting the market's ongoing evolution. The popularity of equestrian sports, including dressage, show jumping, and recreational riding, has surged globally. This interest is fueled by cultural factors, competitive sports, and the therapeutic benefits of horse riding, particularly in regions like North America and Europe.

Higher disposable incomes, particularly in developed regions, have led to greater spending on leisure activities, including horse riding. This has driven demand for premium and customized horse riding equipment. With increasing awareness of the risks associated with horse riding, there is a growing demand for safety gear such as helmets, body protectors, and high-quality saddles. Comfort is also a key consideration, leading to innovations in ergonomic designs and materials that enhance the riding experience for both riders and horses.

The integration of technology into horse riding equipment has opened new avenues for market growth. Innovations such as GPS-enabled riding trackers, smart saddles, and breathable, moisture-wicking fabrics are gaining traction among consumers.

The horse riding equipment market is set for sustained growth, driven by innovations in product designs, campaigns and collaboration activities, strategic marketing efforts, and expanding distribution networks. Manufacturers and stakeholders in this sector have significant opportunities to capitalize on changing consumer trends and strengthen their positions in the global market.

Leading companies are investing in research and development to create advanced products that offer superior safety, comfort, and performance. This includes the use of lightweight, durable materials, and the integration of smart technologies. There is a growing trend towards sustainability, with manufacturers focusing on eco-friendly materials and production processes. Brands are increasingly offering products made from biodegradable materials and adopting sustainable practices to reduce their environmental footprint. Moreover, companies are forming alliances with equestrian associations, event organizers, and technology firms to enhance their product offerings and expand their market presence. Collaborations with fashion brands have also led to the introduction of stylish and functional riding apparel.

Product Insights

The helmet segment accounted for a share of 27.05% of the global revenue in 2023. Helmets are critical for rider safety, providing essential protection against head injuries in case of falls or accidents. The importance of headgear is widely recognized in the equestrian community, and the mandatory use of helmets in many riding schools and competitions has further driven demand. In many regions, safety regulations require riders to wear certified helmets during competitions and training sessions. These regulations have made helmets a non-negotiable item for both amateur and professional riders, contributing to their dominance in the market.

The vests segment is expected to grow at a CAGR of 8.1% from 2024 to 2030. Vests, particularly body protectors and air vests, provide crucial protection for the rider's torso, shielding vital organs in the event of a fall or collision. As awareness of the potential risks associated with horse riding grows, more riders are investing in vests as an added layer of safety. The development of air vests, which deploy air cushions to protect the rider upon impact, has revolutionized the market. These vests offer enhanced protection without compromising mobility or comfort, making them increasingly popular among riders.

Price Range Insights

The mass segment accounted for a share of 80.52% of the global revenue in 2023. A significant portion of the equestrian market consists of recreational riders, beginners, and hobbyists who may not be willing or able to invest in high-end, premium equipment. Mass-priced products offer a more affordable option, making horse riding more accessible to a broader audience. For new riders, the initial investment in horse riding equipment can be substantial. Mass-priced products provide an entry point that allows beginners to get started with the basics without a hefty financial commitment.

Premium segment is expected to grow at a CAGR of 8.0% from 2024 to 2030. Premium horse riding equipment is often made from high-quality materials like full-grain leather, advanced synthetic fabrics, and state-of-the-art technology. Riders seeking durability, comfort, and performance are increasingly willing to invest in these top-tier products, driving growth in this segment. Consumers in the premium segment often perceive higher-priced products as offering better value in terms of quality, longevity, and brand prestige. This perception drives them to invest in premium equipment, even if it comes at a higher cost.

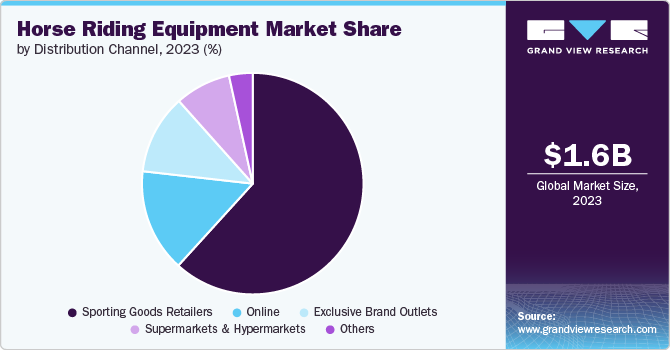

Distribution Channel Insights

The sales of horse riding equipment through sporting goods retailers accounted for a revenue share of 61.75% in 2023. Sporting goods retailers often have extensive networks of physical stores, making horse riding equipment easily accessible to a broad range of consumers. These retailers are typically located in high-traffic areas such as shopping malls and city centers, increasing the visibility and availability of horse riding products. These retailers often carry multiple brands, ranging from mass-priced to premium options. This variety allows customers to find products that match their preferences and budgets, further enhancing the appeal of shopping at sporting goods stores.

The sales of horse riding equipment through online channel is expected to grow at a CAGR of 8.2% from 2024 to 2030. Online retailers often provide a broader range of products compared to physical stores, including niche and specialized items that may not be available locally. This extensive selection attracts riders looking for specific brands, styles, or customized gear. Many equestrian brands are adopting the direct-to-consumer model, bypassing traditional retail channels to sell their products directly through their websites. This approach allows them to offer competitive pricing, personalized shopping experiences, and a closer connection with customers, fueling the growth of online sales.

Regional Insights

The horse riding equipment market in North America captured a revenue share of over 35.24% in 2023. The market has shown steady growth over recent years, driven by the continued popularity of equestrian sports and recreational horse riding. The market is expected to maintain a positive growth trajectory, supported by increasing consumer spending on high-quality and specialized equipment. North America holds a significant share of the global horse riding equipment market, with the United States and Canada being the primary contributors. The region's well-established equestrian culture, coupled with high disposable incomes, supports the demand for a wide range of horse riding gear.

U.S. Horse Riding Equipment Market Trends

The U.S. horse riding equipment market is projected to grow at a significant CAGR from 2024 to 2030.The U.S. market has shown steady growth, supported by the consistent participation in equestrian activities across various demographics. This growth is expected to continue, with increasing consumer spending on high-quality and innovative riding equipment. Equestrian sports and horse riding are integral parts of American culture, particularly in rural and suburban areas. The popularity of events like rodeos, horse shows, and racing continues to drive demand for a wide range of horse riding equipment.

Europe Horse Riding Equipment Market Trends

The horse riding equipment market in Europe is expected to grow at a CAGR of 8.1% from 2024 to 2030. European consumers are increasingly concerned about environmental impact, driving demand for horse riding equipment made from sustainable and ethically sourced materials. Brands are responding by incorporating eco-friendly practices into their manufacturing processes. Premium brands are offering customized and personalized products, catering to the specific needs and preferences of riders. This includes bespoke saddles, tailored riding apparel, and custom-fit helmets.

Asia Pacific Horse Riding Equipment Market Trends:

The Asia Pacific horse riding equipment market is expected to witness a CAGR of 7.9% from 2024 to 2030. There is a growing interest in equestrian sports in several Asia Pacific countries, including China, India, Japan, and South Korea. This trend is driven by increasing awareness, the expansion of equestrian clubs, and rising participation in events and competitions. The rise in recreational horse riding among urban and suburban populations is contributing to market growth. More individuals are engaging in horse riding as a leisure activity, leading to increased sales of entry-level and mid-range equipment.

Key Horse Riding Equipment Company Insights

The market is characterized by dynamic competitive dynamics shaped by a combination of factors including product innovation, regional production capabilities, and evolving consumer preferences. Leading manufacturers invest in R&D and technological advancements to provide cost-effective and quality products.

Market players are entering into joint ventures, partnerships, mergers, agreements, and acquisitions to strengthen their market position and expand their geographical reach. Key manufacturers in the horse riding equipment market utilize their expansive distribution networks and robust brand recognition to sustain a substantial market presence. They prioritize quality, innovation, and regional preferences, thereby reinforcing their leadership in international markets that embrace equestrian gear and equipment.

Key Horse Riding Equipment Companies:

The following are the leading companies in the horse riding equipment market. These companies collectively hold the largest market share and dictate industry trends.

- Colonial Saddlery

- Dainese

- Georg Kieffer Sattlerwarenfabrik GmbH

- Decathlon

- Cavallo GmbH

- Antares Sellier

- Fabtron Inc.

- Mountain Horse

- HKM Sports Equipment.

- Charlie1Horse

Recent Developments

-

In July 2024, Samshield, renowned for its innovative approach to horse riding helmets, launched a new line of helmets 2.0. These cutting-edge helmets represent the culmination of four years of research, offering exceptional comfort and top-tier safety.

-

In March 2024, Evoke, an equestrian brand, introduced a line of cutting-edge helmets and a replacement scheme following a £3 million investment. This initiative aims to improve rider safety and style through advanced, technology-driven designs.

Horse Riding Equipment Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2024 |

USD 1.73 billion |

|

Revenue forecast in 2030 |

USD 2.72 billion |

|

Growth rate |

CAGR of 7.8% from 2024 to 2030 |

|

Actual data |

2018 - 2023 |

|

Forecast period |

2024 - 2030 |

|

Quantitative units |

Revenue in USD million/billion, and CAGR from 2024 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Product, price range, distribution channel, region |

|

Regional scope |

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa |

|

Country scope |

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; China; Japan; India; Australia & New Zealand; South Korea; Brazil; and South Africa |

|

Key companies profiled |

Colonial Saddlery; Dainese; Georg Kieffer Sattlerwarenfabrik GmbH; Decathlon; Cavallo GmbH; Antares Sellier; Fabtron Inc.; Mountain Horse; HKM Sports Equipment.; Charlie1Horse |

|

Customization scope |

Free Report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Horse Riding Equipment Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global horse riding equipment market report based on product type, price range, distribution channel, and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Helmets

-

Vests

-

Stirrups

-

Saddles

-

Birdles

-

Others

-

-

Price Range Outlook (Revenue, USD Million, 2018 - 2030)

-

Mass

-

Premium

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Online

-

Sporting Goods Retailers

-

Supermarkets & Hypermarkets

-

Exclusive Brand Outlets

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

France

-

Germany

-

Spain

-

Italy

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia & New Zealand

-

South Korea

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global horse riding equipment market size was estimated at USD 1.60 billion in 2023 and is expected to reach USD 1.73 billion in 2024.

b. The global horse riding equipment market is expected to grow at a compounded growth rate of 7.8% from 2024 to 2030 to reach USD 2.72 billion by 2030.

b. The helmets segment dominated the horse riding equipment market with a share of 27.05% in 2023. Helmets are critical for rider safety, providing essential protection against head injuries in case of falls or accidents. The importance of headgear is widely recognized in the equestrian community, and the mandatory use of helmets in many riding schools and competitions has further driven demand.

b. Some key players operating in the frozen bakery market include Colonial Saddlery; Dainese; Georg Kieffer Sattlerwarenfabrik GmbH; Decathlon; Cavallo GmbH; Antares Sellier; and Fabtron Inc.

b. Key factors driving the market growth include the popularity of equestrian sports, including dressage, show jumping, and recreational riding. Moreover, this interest is fueled by cultural factors, competitive sports, and the therapeutic benefits of horse riding, particularly in regions like North America and Europe.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."