Honey Wine Market Size, Share & Trends Analysis Report By Product (Fruits, Spices, Herbs, Others), By Distribution Channel (On Trade, Off Trade), By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68039-914-2

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Consumer Goods

Honey Wine Market Size & Trends

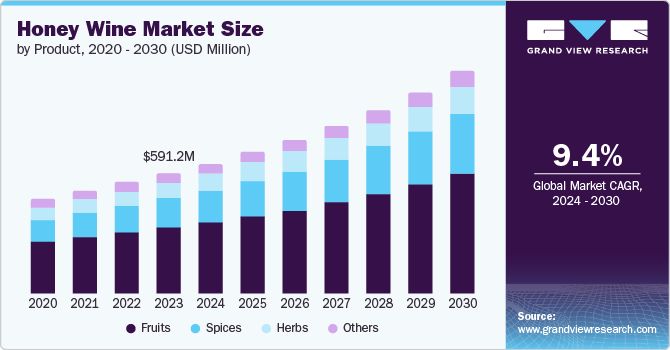

The global honey wine market size was valued at USD 591.2 million in 2023 and is projected to grow at a CAGR of 9.4% from 2024 to 2030. Honey wine has a high nutritional content and provides anti-oxidants and anti-inflammatory benefits. It also helps with gastrointestinal issues. These dietary contents allow the honey wine market to grow over the forecast period. Furthermore, rapid innovations in flavors and growing popularity among food enthusiasts are expected to boost product demand.

Consumers strongly prefer beverages made with raw, natural, and wholesome ingredients, and honey wine is emerging as a natural and authentic option. This shift in consumer preference is driven by a growing demand for healthier and more natural alcoholic beverages. With an alcohol content ranging from 7% to 20%, honey wine is the preferred choice for many consumers. The increasing popularity of fruit-based cocktails is also significant in driving market growth.

The innovation of different flavors of honey wines, such as Melomel, a honey wine flavored with fruits; Cyser, a type of honey wine flavored with apple cider; metheglin, a honey wine infused with herbs and spices; and many other types of honey wine, is attracting new customers. Innovative packaging, development, and marketing strategies create hype among customers. The strong distribution channel, digital marketing, and e-commerce platforms are also helping the honey wine industry reach a broader consumer base and ensure further growth.

Product Insights

The fruits segment dominated the market and accounted for a share of 54.6% in 2023. Fruit flavors, such as apples, berries, grapes, pineapples, and more exotic options, offer a wide variety of honey wines, making them more flavorful and enjoyable. This segment also caters to a large consumer base enjoying unique fruit honey wine combinations. Fruit honey wines have potential health benefits compared to other alcoholic beverages, which have antioxidant properties and improve blood flow.

The spices segment is expected to register the fastest CAGR during the forecast period. Spiced honey wines are rich in tradition and taste. It offers uniqueness and distinct flavor compared to other honey wines. Spiced honey wine has a broader scope for creativity and experimentation. It allows honey winemakers to innovate unique combinations and stand out in the market. Spice wine can be served in many cuisines, making it a more versatile drink option, hence driving market growth.

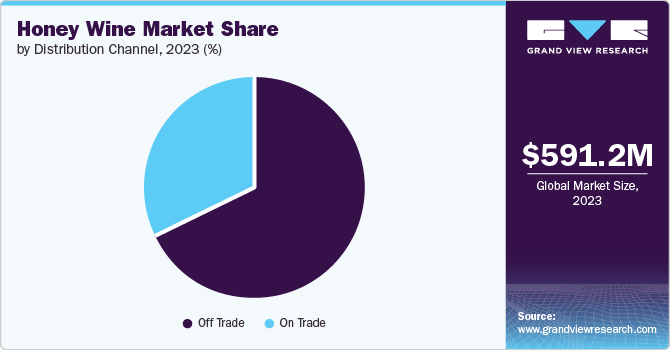

Distribution Channel Insights

The off trade segment dominated the market in 2023. Off trade distribution channels, including liquor stores, hypermarkets, supermarkets, convenience stores, wine and spirits shops, and others, have a broad market reach and cater to a large consumer base. These channels offer a diverse range of products and provide convenience for customers to purchase drinks for take-away and future consumption.

The on trade sector is projected to grow at the fastest CAGR over the forecast period. The on trade distribution channel encompasses establishments where food and beverages are consumed on the premises, such as clubs, pubs, bars, restaurants, hotels, and coffee shops. This channel offers a unique customer experience and serves as a direct sales platform for craft beer and alcoholic beverages within these establishments. Products sold through the on-trade channel are typically priced higher than those sold through the off-trade distribution. Honey wines are gaining popularity in hotels and bars due to the growing trend of socializing in these venues. These establishments are ideal for social gatherings, celebrations, and relaxation, attracting a large adult clientele and contributing to the anticipated growth of the on-trade channel.

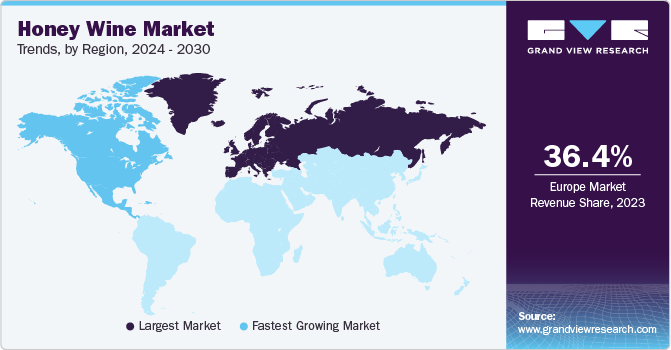

Regional Insights

North America honey wine market is expected to grow fastest at a CAGR of 11.4% over the forecast period. The North American region, especially the U.S., is home to the highest number of honey wine producers. The region is a hub for huge bars, clubs, and restaurants serving honey wines with different cuisines, providing a unique experience to consumers.

U.S. Honey Wine Market Trends

The U.S. honey wine market is growing significantly in North America due to the rising craft and artisan beverage trend. Several small-scale wine producers across the country are contributing to the growing popularity of honey wine, fueling the region's market growth.

Europe Honey Wine Market Trends

Europe honey wine market dominated in 2023. The European region has a strong tradition of honey wine. It offers diverse honey wine flavors and caters to a vast consumer base. Europe strongly prefers authentic and artisanal alcoholic beverages, and traditional honey wine serves this purpose. The region has numerous honey wine producers, ranging from large-scale operations to small producers, which cater to the worldwide demand for honey wine.

Germany has a large number of on-trade distribution channels that contribute to the growth of the market. Moreover, the millennials comprise approximately 33% of the country's population, contributing more to the honey wine market.

Asia Pacific Honey Wine Market Trends

The Asia Pacific honey wine market is expected to witness significant growth over the forecast period. Honey wine is readily available in the region because of the presence of both domestic producers and international brands. The region has a large evolving consumer base due to major countries' young demographics.

China and Australia have major craft breweries, and consumer interest is shifting more towards artisanal products. Additionally, the standard of living is increased in the region, which allows consumers to spend more on experiences rather than necessities

Key Honey Wine Company Insights

Some of the key companies in the honey wine market are Redstone; Brothers Drake Meadery; Medovina Meadery; Kuhnhenn Brewing Co. LLC; Schramm’s Mead; and Winery Kuhnhenn. The major players in the market are launching new products. Various organizations are taking several strategic initiatives to open more mead stores across countries.

-

Brothers Drake Meadery is one of the oldest establishments in the U.S. The company uses local honey and ingredients in its mead to keep the taste authentic and raw. It now offers a full bar, live music, and mead in the U.S.

-

Moonshine Meadery is Asia’s and India’s first mead producer. Their offerings include apple mead, traditional mead, coffee mead, grilled pineapple mead, guava chili mead, and many more.

Key Honey Wine Companies:

The following are the leading companies in the honey wine market. These companies collectively hold the largest market share and dictate industry trends.

- Medovina Meadery

- Kuhnhenn Brewing Co. LLC

- Redstone

- Brothers Drake Meadery

- Schramm’s Mead

- Winery Kuhnhenn Brewing Co LLC

- The Honey Wine Company

- Martin Brothers Winery

- Moonshine Meadery

- Talon Wines.

Recent Developments

-

In August 2023, Moonshine Meadery, one of the major mead producers, expanded its flagship mead series by launching a new Lemon Tea Mead. The new mead offering combines the traditional honey-based mead with the refreshing flavors of lemon and tea, providing consumers with a unique and innovative mead experience.

-

In July 2023, Ronin Wines, the maker of Moonshine Meads, in a pre-Series A funding round raised USD 675,000. The funds are expected to expand the brand's meadery business in existing markets and support the Moonshine Honey Project, which focuses on bee conservation and honey sales.

Honey Wine Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2024 |

USD 640.2 million |

|

Revenue forecast in 2030 |

USD 1.1 billion |

|

Growth Rate |

CAGR of 9.4% from 2024 to 2030 |

|

Base year for estimation |

2023 |

|

Historical data |

2018 - 2022 |

|

Forecast period |

2024 - 2030 |

|

Report updated |

August 2024 |

|

Quantitative units |

Revenue in USD million and CAGR from 2024 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Product, distribution channel, region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, MEA |

|

Country scope |

U.S., UK, France, Italy, China, Australia, Brazil |

|

Key companies profiled |

Redstone; Brothers DrakeMaedery; Medovina Meadery; Kuhnhenn Brewing Co. LLC; Schramm’s Mead; Winery Kuhnhenn Brewing Co LLC; The Honey Wine Company; Martin Brothers Winery; Moonshine Meadery; Talon Wines. |

|

Customization scope |

Free report customization (equivalent up to 8 analysts' working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Honey Wine Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. Grand View Research has segmented the global honey wine market report based on product, distribution channel, and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Fruits

-

Spices

-

Herbs

-

Others

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

On Trade

-

Off Trade

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

-

Europe

-

UK

-

France

-

Italy

-

-

Asia Pacific

-

China

-

Australia

-

-

Latin America

-

Brazil

-

-

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."