- Home

- »

- Homecare & Decor

- »

-

Home And Laundry Care Market Size & Share Report, 2030GVR Report cover

![Home And Laundry Care Market Size, Share & Trends Report]()

Home And Laundry Care Market (2022 - 2030) Size, Share & Trends Analysis Report By Type (Laundry Care, Household Cleaners), By Distribution Channel (Online, Offline), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-003-6

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2017 - 2020

- Forecast Period: 2022 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Home And Laundry Care Market Summary

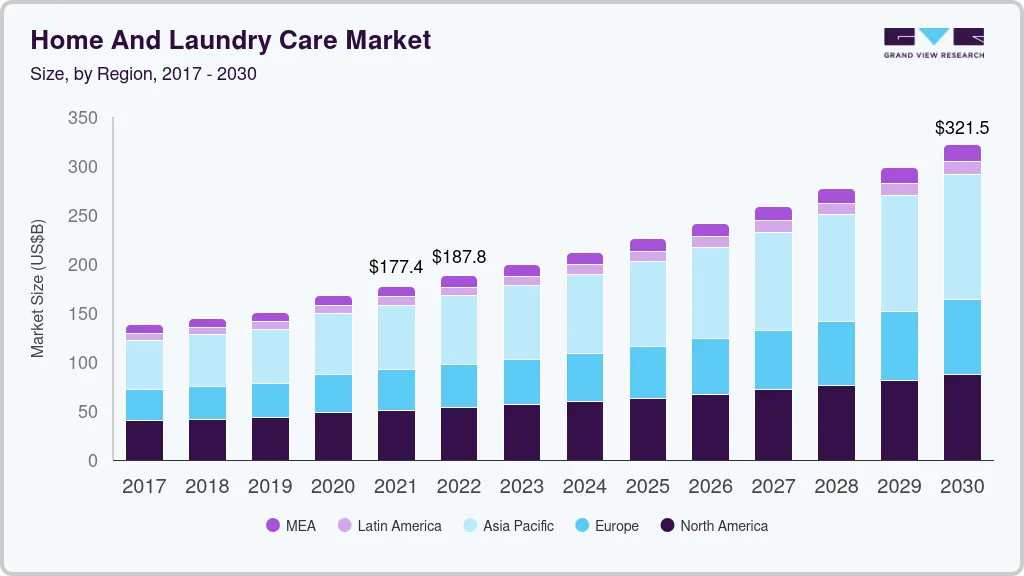

The global home and laundry care market size was estimated at USD 177,429.6 million in 2021 and is projected to reach USD 321,509.5 million by 2030, growing at a CAGR of 6.8% from 2022 to 2030. This can be attributed to the rising demand for home and laundry care products from developed regions. Intensifying awareness among people regarding household and laundry hygiene has become a major factor fueling the market growth.

Key Market Trends & Insights

- In terms of region, Asia Pacific was the largest revenue generating market in 2021.

- Country-wise, South Africa is expected to register the highest CAGR from 2022 to 2030.

- In terms of segment, laundry care accounted for a revenue of USD 92,147.1 million in 2021.

- Household Cleaners is the most lucrative type segment registering the fastest growth during the forecast period.

Market Size & Forecast

- 2021 Market Size: USD 177,429.6 Million

- 2030 Projected Market Size: USD 321,509.5 Million

- CAGR (2022-2030): 6.8%

- Asia Pacific: Largest market in 2021

Intensifying awareness among people regarding household and laundry hygiene has become a major factor fueling the market growth. Moreover, the easy availability of laundry and household cleaners along with the availability of variations such as different fragrances in the market is projected to propel the market growth.

The advent of COVID-19 impacted the global economy significantly and key players operating in the global market had to witness severe problems such as reduced product demand, transportation halts, and supply chain disruption. As a result of the pandemic, the World Health Organization (WHO) made home disinfection techniques mandatory to limit the risk of contamination from the virus. This resulted in increased demand for home care products including household cleaners, detergents, and room disinfectants. For instance, according to the statistics published in Stepan Company’s annual report, North American sales of floor surfactants were up 8% in 2020 as compared to the previous years. The company also mentioned that sales volume growth was primarily driven by high demand for cleaning, disinfection, and personal wash products among end-users.

In the coming years, the global industry is expected to witness strong growth owing to rising disposable income and initiatives taken up by manufacturers to launch organic cleaning products. The online sales distribution channel is expected to play an important role in making constructive addition to the market growth.

Rising awareness about personal hygiene and home cleanliness owing to the spread of COVID-19 is also estimated to fuel the growth of this market in the coming years. Moreover, augmenting disposable income and rapid urbanization led to substantial infrastructural developments resulting in an upsurge in demand for household and laundry care products. Also, an increase in demand for eco-friendly and sustainable laundry and household cleaning products is expected to generate more opportunities for key industry players, thus significantly propelling the growth of this market during the forecast period.

Growing environmental concerns related to the toxic chemicals included in cleaning products, together with growing awareness regarding health and hygiene, are predicted to be a major driver of the market throughout the forecast period. To cater to the rising demand from consumers, major industry participants are taking major initiatives to launch eco-friendly cleaning products. For instance, in July 2022, Unilever launched a sustainable laundry capsule, a form of detergent that helps decarbonize the laundry process whilst delivering top cleaning performance.

Rising investments by key players in the latest technologies and focus on innovative product launches are further anticipated to boost industry sales. Moreover, advertisement and promotional strategies by the key player's aid in the growth of the market. However, the availability of counterfeit or cheap substitutes and strict environmental regulations in some regions may hinder the growth of this market during the forecast period.

Type Insights

The laundry care segment accounted for the largest revenue share of over 50.0% in 2021. The segment is mainly driven by the rising demand for laundry care products among residential and commercial consumers. Laundry care products are mostly used to remove stains and dirt from clothes. The quick and effective results of cleaning by laundry care detergent have made it popular among consumers. Since the outbreak of COVID-19 outbreak across the globe, consumer acceptance of online distribution channels has increased and key companies are taking major initiatives to launch different laundry care products on online sales channels. For instance, in August 2021, Godrej Consumer Products Limited (GCPL) launched an e-commerce platform to offer laundry and dishwashing detergents and home care products to its customers across the globe. This is expected to drive the demand for laundry care products across the globe.

The household cleaners segment is expected to expand at the fastest CAGR of 7.5% from 2022 to 2030 owing to the increasing demand in emerging economies for cleaning purposes. Customers are expressing interest in natural products that are safe for their skin, hence the demand for household cleansers formulated with natural components is anticipated to increase throughout the projected period. With consumers developing a major interest in liquid and gel type of products, companies are introducing refill packs, which further leads to an increased product demand among consumers.

Distribution Channel Insights

The offline distribution channel accounted for the largest share of over 70.0% in 2021. The segment covers specialty stores, hypermarkets, supermarkets, independent retail stores, etc. Due to the availability of multiple products in offline channels, the demand for household and laundry care products increased. The framework of the organized retail sector is expected to enhance the demand for laundry and home care products in the coming years. In addition, the rapidly growing organized retail sector in developing economies, such as China, India, and India, is anticipated to boost product demand during the forecast period.

The online segment will register the fastest CAGR of 7.5% from 2022 to 2030. This can be attributed to the growing popularity and usage of e-commerce platforms. Major manufacturers are partnering with online retailers intending to reach out to new buyers. Also, an upsurge in sales of home and laundry care products mainly through company-owned websites and other e-commerce platforms such as Amazon and Walmart is further anticipated to drive the online distribution channel segment in the coming years. The pandemic has increased consumer adoption of digital technology, leading them to choose direct-to-consumer (D2C) channels that provide more convenience. A high affinity for internet shopping is also shown by recent changes in customer behaviors. As a result of this, companies are launching their products on online distribution channels.

Regional Insights

Asia Pacific led the global market in 2021 with a share of over 35.0%. The region is expected to expand at the highest CAGR during the forecast period. This growth is due to the rising demand for laundry and home care products from emerging countries, such as China, India, and Japan. The increasing population and rising disposable income are major factors driving the demand for home and laundry care products. Furthermore, there has been significant demand for eco-friendly laundry and home cleaning products in this region, which, in turn, will drive the regional market over the forecast period. Customers in the region are making purchase decisions based on sustainability concerns, including packaging, as they become more conscious of how products affect the environment. To capitalize on this opportunity, key players are focusing on innovation with environment-friendly and economic alternative materials and sustainable packaging strategy as a plan of their business strategy.

North America captured a significant market share in 2021 due to the increasing demand for laundry care products. Upward sales of sustainable and eco-friendly household and laundry cleaning products are majorly driving the market in this region. In the wake of the COVID-19 pandemic across the region, consumers from the U.S. and Canada shifted to online channels to purchase home and laundry care products. To take advantage of this chance, significant players teamed up with retail stores and e-commerce giants to expand their consumer base and solidify their worldwide position.

Numerous homegrown and local firms developed organic laundry detergents and worked with online grocery and retail outlets to boost sales while some of the main manufacturing facilities were interrupted and big brands were battling to survive amid the worldwide lockdown. According to the statistics published by The International Council of Societies of Industrial Design (Icsid.org), an average American family spends USD 600 on cleaning supplies each year, and this is expected to rise in the coming years as a result of increased hygiene awareness, making a significant addition to the market growth.

Key Companies & Market Share Insights

Key players are focusing on R&D and introducing innovative products such as sustainable and eco-friendly home and laundry care products to meet the increasing demand and regulations. Additionally, companies are investing in new manufacturing plants to increase production capacity and are collaborating with regional, small-scale manufacturers to increase the geographical reach and client base.

-

For instance, in October 2021, Unilever launched the first-ever paper-based laundry detergent bottle for OMO, Unilever's largest detergent brand. With the use of this technology, Unilever created the world's first paper-based bottles for liquid products. These bottles are composed of pulp that is produced responsibly and can also be recycled in the paper waste stream to get rid of hazardous contents.

-

For instance, in September 2022, Downy, a Procter & Gamble brand launched Downy Rinse & Refresh, a ground-breaking deep-cleaning fabric rinse. It is intended to assist eliminate odor-causing residues 3X better than detergent alone. Downy developed the ideal addition to customers' laundry routines to help cure malodor problems in the first wash, every time, with 1 in 3 homes citing malodor as their top laundry concern.

Some prominent players in the global home and laundry care market include:

-

The Procter & Gamble Company

-

BASF SE

-

Unilever plc

-

Bayer AG

-

Henkel AG & Co. KGaA

-

3M Company

-

DuPont de Nemours, Inc.

-

Reckitt Benckiser Group plc

-

Colgate-Palmolive Company

-

Kao Corporation

Recent Developments

-

In March 2023, Bounty, an American paper towel brand made by Procter & Gamble, introduced an improved Quicker Picker Upper. With improved structure, flexible strength, and optimum fluid efficiency, Bounty's newest innovative paper towel lets you use less product to wipe up even the toughest messes.

-

In November 2022, BASF SE and Inditex’s brand Zara Home released The Laundry by Zara Home – a primary laundry detergent designed to lessen microfiber shedding all through washing, Developed jointly by Inditex and BASF Home Care and I&I Solutions Europe, the innovative solution is capable to reduce microfiber release by up to 80%

Home And Laundry Care Market Report Scope

Report Attribute

Details

Market size value in 2022

USD 187.77 billion

Revenue forecast in 2030

USD 321.51 billion

Growth rate

CAGR of 6.8% from 2022 to 2030

Base year for estimation

2021

Historical data

2017 - 2020

Forecast period

2022 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2022 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, distribution channel, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Germany; U.K.; France; China; India; Japan; Brazil; South Africa

Key companies profiled

The Procter & Gamble Company; BASF SE; Unilever plc; Bayer AG; Henkel AG & Co. KGaA; 3M Company; DuPont de Nemours, Inc.; Reckitt Benckiser Group plc; Colgate-Palmolive Company; Kao Corporation

Customization scope

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Home And Laundry Care Market Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2017 to 2030. For the purpose of this study, Grand View Research has segmented the global home and laundry care market report based on type, distribution channel, and region:

-

Type Outlook (Revenue, USD Million, 2017 - 2030)

-

Laundry Care

-

Household Cleaners

-

Dishwashing Detergents

-

Polishes, Room Scents & Insecticides

-

-

Distribution Channel Outlook (Revenue, USD Million, 2017 - 2030)

-

Offline

-

Online

-

-

Regional Outlook (Revenue, USD Million, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

Germany

-

U.K.

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global home and laundry care market was estimated at USD 177.43 billion in 2021 and is expected to reach USD 187.77 billion in 2022.

b. The global home and laundry care market is expected to grow at a compound annual growth rate of 6.8% from 2022 to 2030 to reach USD 321.51 billion by 2030.

b. Asia Pacific dominated the home & laundry care market with a share of around 35% in 2021. The growth is mainly driven by rising demand for home and laundry care products among residential and commercial consumers from China, India, and Japan.

b. Some of the key players operating in the home and laundry care market include The Procter & Gamble Company, BASF SE, Unilever plc, Bayer AG, Henkel AG & Co. KGaA, 3M company, DuPont de Nemours, Inc., Reckitt Benckiser Group plc, Colgate-Palmolive Company, and Kao Corporation.

b. Key factors that are driving the home and laundry care market growth include rising demand for home & laundry care products from developed regions and intensifying awareness among people regarding household and laundry hygiene.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.