- Home

- »

- Next Generation Technologies

- »

-

Home Insurance Market Size, Share & Growth Report, 2030GVR Report cover

![Home Insurance Market Size, Share & Trends Report]()

Home Insurance Market (2024 - 2030) Size, Share & Trends Analysis Report By Coverage (Dwelling Coverage, Content Coverage), By Distribution Channel (Tied Agents & Branches, Brokers), By End-use (Landlords, Tenants), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-345-8

- Number of Report Pages: 130

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Home Insurance Market Summary

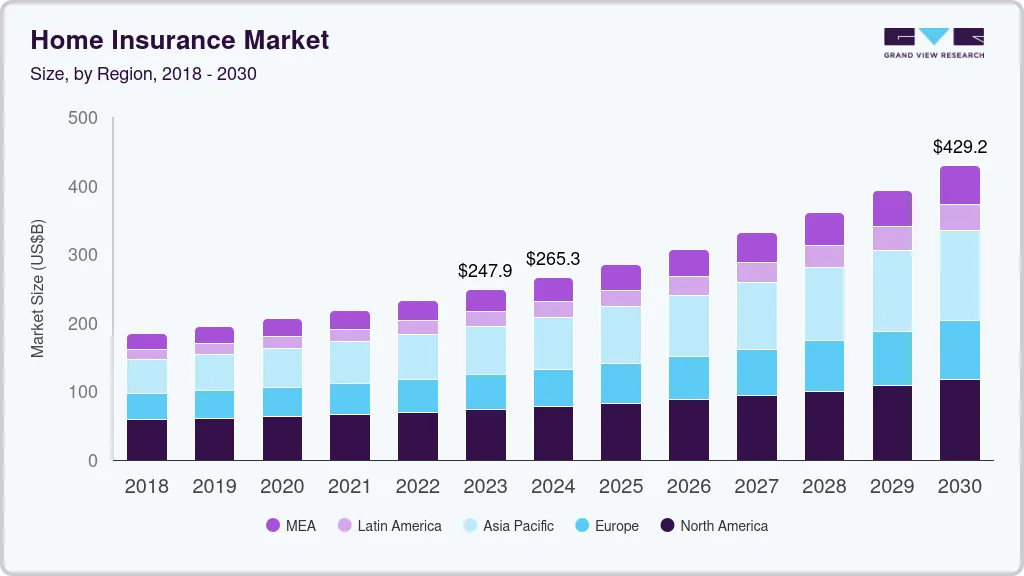

The global home insurance market size was estimated at USD 247.92 billion in 2023 and is projected to reach USD 429.24 billion by 2030, growing at a CAGR of 8.3% from 2024 to 2030. Home insurance provides financial protection to an individual against all the damages and losses that happen to their residence.

Key Market Trends & Insights

- North America home insurance market is poised for significant growth from 2024 to 2030.

- The U.S. home insurance market is anticipated to register a significant growth from 2024 to 2030.

- Based on coverage, the comprehensive coverage segment led the market and accounted for 38.2% of the global revenue in 2023.

- Based on distribution channel, the brokers segment accounted for the largest market revenue share in 2023.

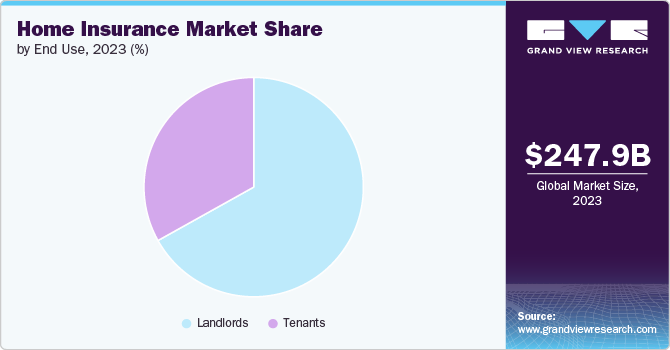

- Based on end-use, the landlords segment accounted for a significant market revenue share in 2023.

Market Size & Forecast

- 2023 Market Size: USD 247.92 Billion

- 2030 Projected Market Size: USD 429.24 Billion

- CAGR (2024-2030): 8.3%

- North America: Largest market in 2023

Home insurance is also known as household insurance, private property insurance, or homeowner’s insurance. Home insurance covers not only damages to the property of individuals but also the legal responsibility or liability for any property damage and injuries by policyholders. The increasing demand for customized home insurance products is anticipated to propel the home insurance market growth. Nowadays, customers are focusing on adopting insurance products that are tailored or customized to their specific preferences and needs. As a result, insurance providers are also responding by providing more flexibility and expanding coverage options. Various factors, such as the rising need for comprehensive insurance coverage coupled with the increasing awareness of risks and challenges involved with home ownership, are expected to fuel the adoption of home insurance products over the forecast period.

The home insurance market is witnessing an increase in the adoption of technologies, such as big data, blockchain, data analytics, Artificial Intelligence (AI), Application Program Interface (API), and geolocation, among others. These technologies are providing innovative opportunities for home insurance providers in the market. Furthermore, by making use of these technological developments, home insurance companies will be able to enhance the distribution platform’s productivity. The technology-integrated insurance products will enable businesses to manage renter’s insurance and additional living expenses. In addition, digital transformation allows home insurance businesses to create personalized user experiences with their customers.

Another key factor driving home insurance market’s growth is the increasing urbanization and the expansion of residential real estate. As more people move to urban areas and invest in new homes, the demand for home insurance rises accordingly. This trend is particularly notable in developing regions where urban development is rapidly progressing. The surge in home ownership, coupled with the growing need for financial protection, is significantly boosting the home insurance market.

On the other hand, a significant factor restraining the home insurance market's growth is the rising incidence of fraudulent claims. This issue increases the overall cost for insurance companies, which, in turn, leads to higher premiums for policyholders. The fear of fraud can also lead insurers to implement stricter underwriting processes, making it more difficult for consumers to obtain coverage. These challenges not only increase costs but also reduce accessibility, thereby limiting the market’s growth potential.

Coverage Insights

Based on coverage, the comprehensive coverage segment led the market and accounted for 38.2% of the global revenue in 2023 and is expected to retain its dominance over the forecast period. Comprehensive insurance products enable policyholders to restore or replace their home belongings if they are damaged in an accident or stolen. Moreover, comprehensive insurance coverage includes protection against natural disasters, vandalism, and fire, among others.

The dwelling coverage segment is expected to register significant growth from 2024 to 2030. Dwelling coverage is experiencing robust growth driven by increased investments in residential real estate and the rising awareness of the importance of safeguarding home structures. This segment benefits from higher construction costs and a growing number of homeowners seeking comprehensive protection against various perils, ensuring the sustained expansion of dwelling coverage in the home insurance market.

Distribution Channel Insights

The brokers segment accounted for the largest market revenue share in 2023. The broker segment in the home insurance market is expanding due to their pivotal role in providing personalized advice and tailored insurance solutions. Brokers' expertise in navigating complex insurance products and their ability to offer customized plans are increasingly valued by consumers, leading to a significant rise in demand for broker-mediated insurance services.

The tied agents & branches segment is expected to grow significantly from 2024 to 2030. Tied agents and branches have established customer relationships and are often seen as a trusted source of information and advice. This allows them to effectively market and sell home insurance policies to customers, increasing their market share. In addition, tied agents and branches have the backing of a large insurance company, which can provide them with resources and support to effectively market and sell home insurance policies. This helps them to remain competitive in the market, thus driving the segment’s growth.

End Use Insights

The landlords segment accounted for a significant market revenue share in 2023. The increasing population, along with the rise in migration in cities, has led to a surge in rental property activities. This surge in rental property activities has pushed landlords to opt for a home insurance policy in order to secure their asset. Moreover, home insurance protects landowners against the financial losses resulting from injuries, accidents, natural disasters, and other liability issues. These aforementioned factors are contributing to the landlords’ segment growth

The tenants segment is expected to register significant growth from 2024 to 2030. The tenant segment is witnessing considerable growth as more individuals opt for rental properties, particularly in urban areas. The increasing awareness of the need for renters' insurance to protect personal belongings, and liability coverage is driving demand in this segment, contributing to the overall expansion of the home insurance market.

Regional Insights

North America home insurance market is poised for significant growth from 2024 to 2030. The North American home insurance market is growing steadily due to rising home ownership rates and increased natural disaster occurrences. The adoption of advanced technologies by insurers to streamline operations and enhance customer experience further propels market growth, positioning North America as a significant contributor to the global home insurance industry.

The U.S. home insurance market is anticipated to register a significant growth from 2024 to 2030. The U.S. home insurance market is expanding robustly, driven by high home ownership rates and frequent natural disasters necessitating comprehensive coverage. Technological advancements in insurance products and distribution channels are enhancing market efficiency and customer satisfaction, driving the U.S. home insurance market’s growth.

Europe Home Insurance Market Trends

The Europe home insurance market is poised for significant growth from 2024 to 2030. The regional market is growing at a steady pace, driven by stringent regulatory frameworks and a high awareness of insurance benefits among homeowners. The increasing adoption of smart home technologies and a focus on sustainability are further supporting market growth, making Europe a key region in the global home insurance market.

Asia Pacific Home Insurance Market Trends

The Asia Pacific home insurance market is poised for significant growth from 2024 to 2030. The regional market’s growth can be attributed to the increasing urbanization, rising home ownership, and greater awareness of risk management. The expansion of residential construction activities and the adoption of digital insurance platforms are also contributing to the accelerated growth of the home insurance sector in this region.

Key Home Insurance Company Insights

Key players operating in the home insurance market include Zurich, Chubb, American International Group, Inc., Liberty Mutual Insurance, Admiral, State Farm Mutual Automobile Insurance Company, Allstate Insurance Company, Allianz, PICC, and Nationwide. Overall, the home insurance market is highly competitive, with both traditional insurers and newer entrants competing for customers by offering a combination of competitive pricing, innovative technology, and customer-centric service. Consumers benefit from this competition as it can lead to more choices and better coverage options.

Key players in the market are taking strategic initiatives to expand their geographical presence. For instance, in April 2023, Tailrow Insurance Company entered Florida, U.S., following the Florida Office of Insurance Regulation (OIR) approval. Tailrow Insurance Company is now an authorized domestic insurer and can write homeowners multi-peril lines of insurance in Florida.

Home Insurance Market Report Scope

Attribute

Details

Market size value in 2024

USD 265.31 billion

Revenue forecast in 2030

USD 429.24 billion

Growth rate

CAGR of 8.3% from 2024 to 2030

Actual data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company market share, competitive landscape, growth factors, and trends

Segments covered

Coverage, distribution channel, end use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; and MEA

Country scope

U.S.; Canada; Mexico; Germany; UK; France; China; India, Japan; South Korea; Australia; Brazil; Kingdom of Saudi Arabia (KSA); UAE; South Africa

Key companies profiled

Zurich; Chubb; American International Group, Inc.; Liberty Mutual Insurance; Admiral; State Farm Mutual Automobile Insurance Company; Allstate Insurance Company; Allianz; PICC; Nationwide

Customization scope

Free report customization (equivalent to up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Home Insurance Market Segmentation

The report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the home insurance market based on coverage, distribution channel, end use, and region.

-

Coverage Outlook (Revenue, USD Billion, 2018 - 2030)

-

Comprehensive Coverage

-

Dwelling Coverage

-

Content Coverage

-

Other Optional Coverage

-

-

Distribution Channel Outlook (Revenue, USD Billion, 2018 - 2030)

-

Tied Agents & Branches

-

Brokers

-

Others

-

-

End Use Outlook (Revenue, USD Billion, 2018 - 2030)

-

Landlords

-

Tenants

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East & Africa (MEA)

-

UAE

-

Kingdom of Saudi Arabia (KSA)

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global home insurance market size was estimated at USD 247.92 billion in 2023 and is expected to reach USD 265.31 billion in 2024.

b. The global home insurance market is expected to grow at a compound annual growth rate of 8.3% from 2024 to 2030 to reach USD 429.24 billion by 2030.

b. North America dominated the home insurance market with a share of 29.70% in 2023. The North American home insurance market is growing steadily due to rising home ownership rates and increased natural disaster occurrences.

b. Some key players operating in the home insurance market include Zurich, Chubb, American International Group, Inc., Liberty Mutual Insurance, Admiral, State Farm Mutual Automobile Insurance Company, Allstate Insurance Company, Allianz, PICC, and Nationwide.

b. Key factors that are driving the market growth include global growth in households and an increase in the number of accidents and natural disasters.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.