- Home

- »

- Homecare & Decor

- »

-

Home Decontamination Services Market Size Report, 2030GVR Report cover

![Home Decontamination Services Market Size, Share & Trends Report]()

Home Decontamination Services Market (2025 - 2030) Size, Share & Trends Analysis Report By Type (Infection Prevention And Control, Biohazard Cleaning), By Application (Individual Houses, Apartments), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-407-7

- Number of Report Pages: 108

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Market Size & Trends

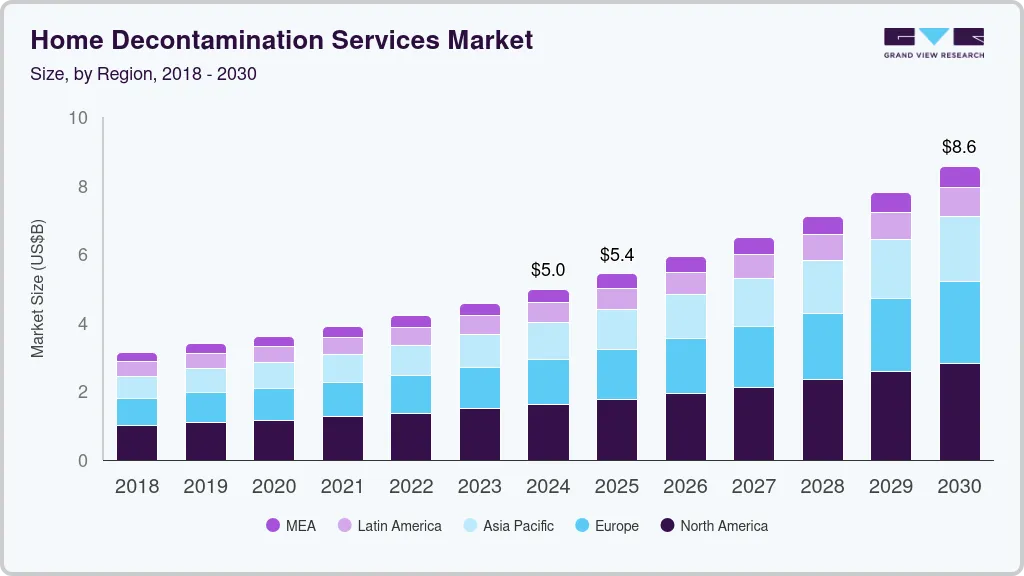

The global home decontamination services market size was estimated at USD 4,979.4 million in 2024 and is projected to grow at a CAGR of 9.5% from 2025 to 2030. The market has experienced significant growth, primarily driven by heightened awareness of health and hygiene due to the COVID-19 pandemic. The COVID-19 pandemic has significantly raised awareness about the importance of cleanliness and hygiene. Homeowners are more vigilant about maintaining sanitary living conditions, leading to a higher demand for professional home decontamination related services.

In May 2021, Harrison Wipes in collaboration with Toluna, surveyed 359 individuals in the UK online.Harrison Wipes aimed to assess how attitudes toward cleaning have shifted among the UK public and to predict the post-COVID landscape. Harrison Wipes reported that the general public is significantly more attentive to cleanliness, whether it involves wearing face masks or washing hands more frequently. The firm noted that one lasting aspect of COVID protocols is the heightened awareness of cleaning practices and the importance of how home decontamination is conducted.

The World Health Organization recommends implementing disinfection procedures in residences to minimize the risk of coronavirus exposure. Priority should be given to cleaning high-contact areas such as kitchen counters, bathroom faucets, door and window knobs, and electronic devices. Due to health concerns and increased awareness of well-being, household decontamination services have become essential. Furthermore, to mitigate the risk of future pandemic waves, various standard operating procedures (SOPs) and guidelines have been issued by the governments of several countries.

Growing awareness of indoor allergens and their impact on health has led many to seek professional decontamination services to control dust mites, pollen, pet dander, and other allergens. Homeowners are increasingly focused on improving indoor air quality, which drives the demand for services like HVAC cleaning and air duct decontamination. In response to the evolving understanding of hygiene and health in our daily lives, the American Cleaning Institute (ACI) officially launched the Cleaning is Caring campaign in April 2021. This initiative aims to underscore the vital role of cleaning in our society, particularly in protecting individuals from the spread of illness and fostering the healthy habits that emerged during the COVID-19 pandemic.

Advances in cleaning technologies, such as electrostatic sprayers, UV-C light disinfection, and antimicrobial coatings, have enhanced the effectiveness and appeal of professional decontamination services. In January 2024, Eureka, a longstanding pillar in the home cleaning industry, proudly commemorated its 115th anniversary this year with a vibrant presence at the renowned Consumer Electronics Show (CES). At the landmark launch event, Eureka showcased two standout products: the groundbreaking Eureka J20 robotic vacuum and the powerful Eureka OmniVerse multi-function vacuum. These innovative cleaning companions are designed to redefine the cleaning experience, merging cutting-edge technology with user-friendly functionality.

Type Insights

Based on type, the biohazard cleaning segment led the market with the largest revenue share of 42.50% in 2023. The pandemic has heightened awareness of the importance of sanitizing and disinfecting homes to prevent the spread of infectious diseases. This has led to a surge in demand for biohazard cleaning services, which are specifically equipped to handle pathogens and contaminants. Government regulations and safety standards for handling biohazard materials are stringent, necessitating professional services that are trained and certified to meet these requirements.

The infection prevention and control segment is expected to grow at the fastest CAGR of 10.2% from 2024 to 2030. Recommendations from health organizations such as the World Health Organization (WHO) and the Centers for Disease Control and Prevention (CDC) emphasize the importance of regular disinfection and sanitization to prevent infections. Compliance with these guidelines fuels the demand for IPC services. Many countries have implemented stricter health and safety regulations for residential areas, promoting the growth of IPC services to meet these standards. Moreover, homes with elderly or immunocompromised residents require stringent infection control measures, boosting the demand for IPC services tailored to protect these vulnerable groups.

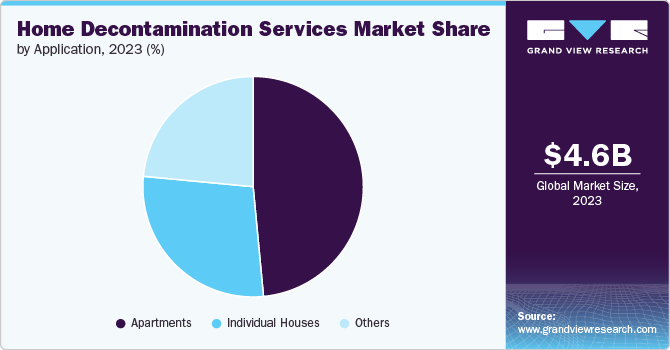

Application Insights

Based on application, the apartment segment led the market with the largest revenue share of 48.50% in 2023. Apartments typically have shared common areas such as lobbies, elevators, and hallways, which see frequent use by multiple residents. This increases the need for regular decontamination to prevent the spread of infections.Apartments often experience high turnover rates with new tenants moving in regularly. Each new occupancy demands thorough cleaning and disinfection to ensure a safe living environment for new residents. Many property management companies have adopted rigorous cleaning protocols to attract and retain tenants, particularly during health crises. This has increased the reliance on specialized decontamination services.

The individual houses segment is expected to grow at the fastest CAGR of 10.8% from 2024 to 2030. The COVID-19 pandemic has heightened awareness about the importance of maintaining a clean and sanitized living environment, leading to increased demand for decontamination services in individual homes. Homeowners place a high value on the peace of mind that comes from knowing their living space is free from harmful pathogens, making them more likely to regularly hire decontamination services. With the rise of remote work and home-based learning, people are spending more time at home. This increases the need for regular decontamination to ensure a healthy living and working environment.

Regional Insights

North America dominated the home decontamination services market with the revenue share of 32.54% in 2023. The pandemic has significantly increased awareness and demand for home decontamination services. North Americans have become more conscious of maintaining clean and sanitized living spaces to prevent the spread of infectious diseases. The adoption of advanced disinfection technologies such as electrostatic sprayers, UV-C light, and antimicrobial coatings has enhanced the effectiveness and appeal of decontamination services. Higher disposable incomes in North America have led to increased spending on home maintenance and decontamination services. Consumers are willing to invest in services that provide peace of mind and ensure a healthy living environment.

U.S. Home Decontamination Services Market:

The home decontamination services market in the U.S. is expected to grow at the fastest CAGR of 9.8% from 2024 to 2030.The increasing preference for environmentally friendly and non-toxic disinfectants aligns with consumer concerns about health and environmental impact, driving market growth. Recommendations from health organizations, such as the Centers for Disease Control and Prevention (CDC), emphasize the importance of maintaining clean living environments, driving consumer demand for decontamination services.

Moreover, leading companies and retailers are forming partnerships with infection prevention solution providers to enhance home decontamination services across the U.S. In a strategic move to enhance its cleaning product offerings, Home Depot announced a partnership in February 2023 with Ecolab Inc., a prominent global leader in water, hygiene, and infection prevention solutions. This collaboration will bring forth a new line of cleaning products, dubbed Ecolab Scientific Clean, designed to meet the diverse needs of commercial, industrial, and residential customers.

Europe Home Decontamination Services Market

The home decontamination services market in Europe is expected to grow at the fastest CAGR of 10.4% from 2024 to 2030. The COVID-19 pandemic has raised awareness about the importance of maintaining high hygiene standards in homes. Europeans are now more vigilant about preventing the spread of infections through regular decontamination. European countries have implemented stringent health and safety regulations that emphasize the need for regular disinfection in residential settings. Compliance with these regulations drives demand for professional cleaning services.

Asia Pacific Home Decontamination Services Market

The home decontamination services market in Asia Pacific is expected to witness at a significant CAGR of 10.2% from 2024 to 2030. Rapid urbanization in countries like China, India, and Indonesia has led to an increase in apartment living and high-density residential areas. This creates a higher demand for regular decontamination services in these settings.Public health campaigns and guidelines from health authorities support the importance of maintaining clean and sanitized environments, boosting market growth.Consumers are increasingly adopting preventive measures to avoid health issues, leading to a higher demand for regular decontamination services.

Key Home Decontamination Services Company Insights

The market is indeed characterized by a diverse range of companies, from small local providers to large multinational firms. EnviroServe (Savage Companies), NYC Steam Cleaning, Inc., Bio Decontamination Group Ltd., Shiny Carpet Cleaning, The Ecosense Company, Stratus Building Solutions, Terminix Global Holdings, Inc., Aseptic Health, LLC, Rentokil Initial plc, Duraclean International are some of the dominant players operating in the global market. These companies are employing various strategies to gain a competitive edge and capture market share. Companies are diversifying their service offerings to cater to a broad spectrum of customer needs. This includes expanding from basic cleaning to specialized decontamination services, such as biohazard cleaning, mold remediation, and air purification.

Key Home Decontamination Services Companies:

The following are the leading companies in the home decontamination services market. These companies collectively hold the largest market share and dictate industry trends.

- EnviroServe (Savage Companies)

- NYC Steam Cleaning, Inc.

- Bio Decontamination Group Ltd.

- Shiny Carpet Cleaning

- The Ecosense Company

- Stratus Building Solutions

- Terminix Global Holdings, Inc.

- Aseptic Health, LLC

- Rentokil Initial plc

- Duraclean International

Recent Developments

-

In March 2024, three New Mexico-based companies-Build With Robots (BWR), Sandia Green Clean (SGC), and Profit Cleaners joined forces to develop an innovative product offering 'Breezy Blue' tailored specifically for residential cleaners. This unique solution was designed to be straightforward, secure, and environmentally friendly—qualities that resonate well with both cleaning professionals and their clients

-

In October 2023, Cleanster.com officially announced its state-of-the-art cleaning service platform in Florida, marking a significant advancement in home and property maintenance. With its design inspired by the successful model of Uber, Cleanster.com aims to revolutionize the way property owners, homeowners, and short-term rental hosts approach cleaning services

Home Decontamination Services Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 5,428.5 million

Revenue forecast in 2030

USD 8,561.3 million

Growth rate

CAGR of 9.5% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion, and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, application, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; China; Japan; India; South Korea; Australia & New Zealand; Brazil; and South Africa

Key companies profiled

EnviroServe (Savage Companies); NYC Steam Cleaning, Inc.; Bio Decontamination Group Ltd.; Shiny Carpet Cleaning; The Ecosense Company; Stratus Building Solutions; Terminix Global Holdings, Inc.; Aseptic Health, LLC; Rentokil Initial plc; and Duraclean International

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Home Decontamination Services Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global home decontamination services market report based on type, application, and region:

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Infection Prevention and Control

-

Biohazard Cleaning

-

Others

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Individual Houses

-

Apartments

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

France

-

Germany

-

Spain

-

Italy

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia & New Zealand

-

South Korea

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global home decontamination services market size was estimated at USD 4,574.4 million in 2023 and is expected to reach USD 4,979.3 million in 2024.

b. The global home decontamination services market is expected to grow at a compounded growth rate of 9.5% from 2024 to 2030 to reach USD 8,561.3 million by 2030

b. The biohazard cleaning segment dominated the home decontamination services market with a share of 42.50% in 2023. The pandemic has heightened awareness of the importance of sanitizing and disinfecting homes to prevent the spread of infectious diseases. This has led to a surge in demand for biohazard cleaning services, which are specifically equipped to handle pathogens and contaminants.

b. Some key players operating in the home decontamination services market include EnviroServe (Savage Companies); NYC Steam Cleaning, Inc.; Bio Decontamination Group Ltd.; Shiny Carpet Cleaning; The Ecosense Company; and Stratus Building Solutions.

b. Key factors that are driving the market growth include increased awareness about the importance of cleanliness and hygiene. Homeowners are increasingly focused on improving indoor air quality, which drives the demand for services like HVAC cleaning and air duct decontamination.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.