- Home

- »

- Electronic & Electrical

- »

-

Home Beer Brewing Machine Market Size Report, 2030GVR Report cover

![Home Beer Brewing Machine Market Size, Share & Trends Report]()

Home Beer Brewing Machine Market (2024 - 2030) Size, Share & Trends Analysis Report By Product (Mini Brewer, Full-Size Brewer), By Mechanism (Automatic, Manual), By Region, And Segment Forecasts

- Report ID: GVR-3-68038-817-6

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Home Beer Brewing Machine Market Summary

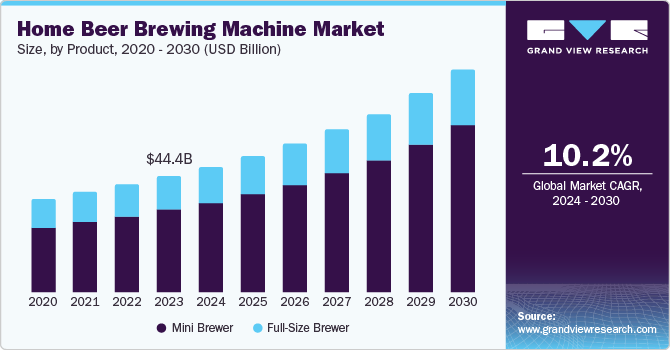

The global home beer brewing machine market size was estimated at USD 44.40 billion in 2023 and is projected to reach USD 85.84 billion by 2030, growing at a CAGR of 10.2% from 2024 to 2030. The growing popularity of craft beer among young consumers, owing to the availability of various flavors, including malted barley, chestnut, and honey, is a crucial factor driving the growth of the global market.

Key Market Trends & Insights

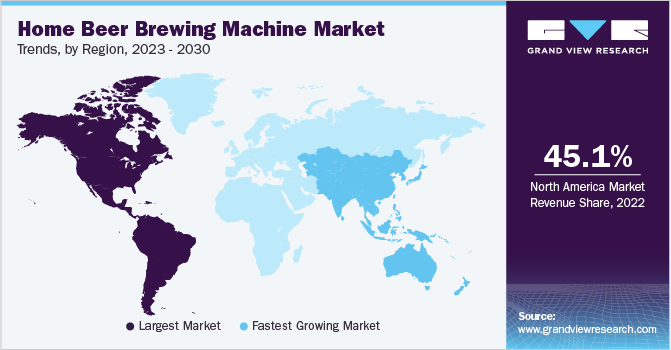

- The North America home beer brewing machine market dominated the market revenue share with 30.6% in 2023.

- The U.S. home beer brewing machine market dominated the regional industry in 2023.

- Based on product, the mini brewer dominated the market and accounted for a revenue share of 69.8% in 2023.

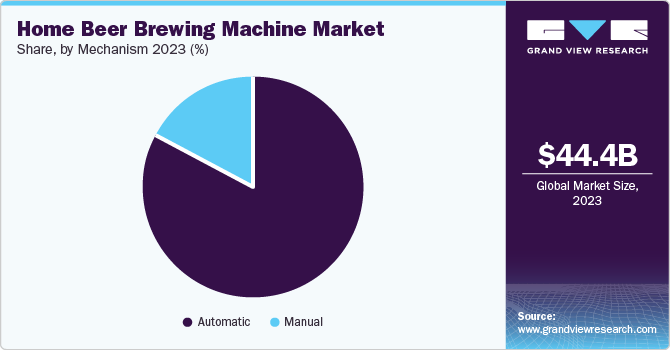

- In terms of mechanism, the automatic mechanism has the largest revenue share in 2023.

- On the basis of mechanism, the manual mechanism is expected to register a significant CAGR during the forecast period.

Market Size & Forecast

- 2023 Market Size: USD 44.40 billion

- 2030 Projected Market Size: USD 85.84 billion

- CAGR (2024-2030): 10.2%

- North America: Largest market in 2023

Moreover, rising consumer preference for fresh beer and the rising trend of on premise sales are expected to fuel the growth further.

The increasing consumption of beer is primarily responsible for the market's growth. Moreover, rising consumer preference for fresh beer and the growing trend of on-premises sales are expected to boost the market. The outlook of the home beer brewing machines industry is promising, with significant potential for global expansion. As the craft beer movement continues gaining momentum worldwide, more consumers seek unique and personalized experiences with their beverages. This growing interest in craft beer culture presents a vast opportunity for the market to expand its reach across different regions.

The rise of the craft beer movement in the U.S. has led to a renewed interest in beer culture and appreciation for diverse beer styles. In addition, prominent organizations such as the American Homebrewers Association (AHA), dedicated to promoting and advancing the process of home brewing in the U.S., drive market growth. The AHA organizes events such as the National Homebrew Competition, one of the largest homebrew competitions in the world. This competition allows home brewers to highlight their skills and receive feedback from experienced judges.

Manufacturers of home brewing machines are expanding their sales channels to reach more customers worldwide. They are establishing partnerships with international retailers and e-commerce platforms, making their products accessible to customers worldwide. In addition, product packaging and marketing are often designed with a universal appeal, transcending language barriers and cultural differences.

Product Insights

The mini brewer dominated the market and accounted for a revenue share of 69.8% in 2023. Technological advancements have played a crucial role in the growth of the mini brewer market. Manufacturers have been able to design compact, efficient, and user-friendly brewing systems, making home brewing more approachable to a broader audience. It has led to an increase in the number of hobbyist brewers who might have been intimidated by traditional, larger-scale brewing equipment. Families with limited members tend to prefer mini brewers due to the compact size of machines and integrated smart features, driving the market growth.

The full-size brewer is expected to experience a significant CAGR during the forecast period. The increasing number of small-scale and independent brewers in the U.S., Europe, and New Zealand, owing to the growing popularity of craft beer among consumers, is anticipated to contribute to the rise of the full-sized brewer segment. People are increasingly looking for personalized products, evident in the beer brewing market. Full-sized brewers allow people to create unique beers, contributing to the market's growth. Moreover, with automated features and intuitive interfaces, beginners can easily navigate the brewing process. It has expanded the potential customer base and attracted newcomers to the hobby.

Mechanism Insights

The automatic mechanism has the largest revenue share in 2023. The growing do-it-yourself (DIY) trend and the desire for unique, personalized beverages are fueling the demand for automatic home beer brewing machines. These appliances allow users to experiment with different ingredients, flavors, and brewing techniques, enabling them to create custom-tailored beers that align with their tastes and preferences. Many manufacturers offer mobile-based apps with access to various built-in recipes and an option to create new recipes. Manufacturers also invest in R&D to introduce innovative products with features such as a digital thermostat, multiple taps, and removable keg. These improved designs and smart features are expected to boost market growth.

The manual mechanism is expected to register a significant CAGR during the forecast period. The increasing inclination towards manual home beer brewing machines can be attributed to the consumers’ desire for a hands-on, personalized brewing experience, the appeal of traditional brewing methods, the influence of the craft beer culture, and a growing emphasis on sustainable practices. As these factors continue shaping consumer preferences, the manual brewing machine segment is expected to grow steadily.

Regional Insights

North America home beer brewing machine market dominated the market revenue share with 30.6% in 2023. The growing popularity of home brewing among millennials in countries such as the U.S., Canada, and others in North America has contributed to the widespread demand for home beer brewing machines in the region. The DIY (do-it-yourself) movement has gained momentum across various hobbies, including home brewing. Such factors have surged the demand for residential households to buy brewing machines. Moreover, a growing regional market for brewing supplies, available in both brick-and-mortar stores and online, provides enthusiasts with easy access to the essential ingredients and tools for home brewing.

U.S. Home Beer Brewing Machine Market Trends

The U.S. home beer brewing machine market dominated the regional industry in 2023. Several factors that have positively influenced the demand for home beer brewing machines in the U.S. include the increasing inclination towards consumption of craft beer, growing interest in experimenting with various beers, availability of compact size machines, and advancements in technology related to brewing are expected to generate greater growth for this industry in approaching years.

Europe Home Beer Brewing Machine Market Trends

Europe home beer brewing machine market was identified as a lucrative region in 2023. The European alcohol sector is diverse, consisting primarily of small and medium-sized businesses such as microbreweries and breweries functioning at the municipal, regional, or national levels. It also includes large European brewers such as Anheuser-Busch Companies LLC, Carlsberg Breweries A/S (Denmark), and Heineken N.V. (Netherlands), which are prominent companies in their respective industries.

The UK home beer brewing machine market is expected to grow rapidly in the coming years. The UK has a strong brewing heritage, with a rich beer production and consumption history, and this tradition has contributed to the popularity of home brewing. The global craft beer movement has made a significant impact in the UK. According to the Society of Independent Brewers and Associates (SIBA) Craft Beer Report 2023, 80% of individuals in the UK believe that a well-managed independent brewery can benefit the local community. Over 25% of independent brewers sell their products directly to consumers, and over 40% manage their bar or taproom while experiencing a rise in online sales.

Asia Pacific Home Beer Brewing Machine Market Trends

The Asia Pacific home beer brewing machine market is anticipated to witness significant growth during the forecast period. The consumption of home-brewed beers in Asia Pacific has grown due to the increasing appreciation for craft beers with distinctive flavors, rapid urbanization, and rising disposable incomes in countries such as Australia and New Zealand. The market is being driven by the increasing popularity of craft beer among young consumers, who are drawn to the wide range of flavors such as malted barley, honey, and chestnut. Moreover, increasing consumer demand for fresh beer and the growing popularity of on-site sales are predicted to drive further expansion.

New Zealand home beer brewing machine market held a substantial market share in 2023. New Zealand has an expanding home brewing community; various options are available for home beer brewing machines and equipment to enthusiasts. The increase in home beer brewing and beer sales in New Zealand reflects a growing interest in beer culture and consumption, which bodes well for the market.

Key Home Beer Brewing Machine Company Insights

Some of the key companies in the home beer brewing machine market include BREWIE, MINIBREW, Spike Brewing, SPEIDEL TANK AND CONTAINER CONSTRUCTION, BEERMKR, BREWART, and others. The prominent companies are actively involved in strategic initiatives such as facility expansion, mergers & acquisitions, and partnerships to expand their product portfolios, reach a more extensive customer base, and enhance their market presence in the highly fragmented market. These companies consistently invest in research & development to improve their products and integrate new technologies, enabling them to maintain a competitive edge.

-

MiniBrew is a beer e-commerce platform that aims to enhance the brewing experience by making it more delicious and convenient. The company's flagship product is the MiniBrew Craft Beer Maker, an all-in-one brewing machine that allows users to create microbrew-level beer.

-

Brewie, a prominent company, focuses on combining technology and beer brewing to innovate new technologies in the beer industry. The company's flagship product, Brewie, an automated brewing machine (brewery), caters to a broad customer base.

Key Home Beer Brewing Machine Companies:

The following are the leading companies in the home beer brewing machine market. These companies collectively hold the largest market share and dictate industry trends.

- BREWIE

- MINIBREW

- Shandong zunhuang brewing equipment Co., Ltd.

- SPEIDEL TANK AND CONTAINER CONSTRUCTION

- Spike Brewing

- BEERMKR

- BREWART

- LG Electronics

- Bevie

- CLAWHAMMER SUPPLY

Recent Developments

-

In March 2024, the Texas Craft Brewers Guild, composed of over 300 small and independent breweries in the state, introduced the Brew City, Texas program. This initiative aimed to unite municipalities and cities, promoting craft beer tourism and encouraging economic growth, thereby establishing Texas as a prominent craft beer tourism spot in the coming years.

Home Beer Brewing Machine Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 47.98 billion

Revenue forecast in 2030

USD 85.84 billion

Growth rate

CAGR of 10.2% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Report updated

October 2024

Quantitative units

Revenue in USD million/billion, and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, mechanism, region

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country scope

U.S., Canada, Mexico, Germany, UK, Italy, New Zealand, Australia, Brazil, South Africa

Key companies profiled

BREWIE; MINIBREW; Shandong zunhuang brewing equipment Co., Ltd.; SPEIDEL TANK AND CONTAINER CONSTRUCTION; Spike Brewing; BEERMKR; BREWART; LG Electronics; Bevie; CLAWHAMMER SUPPLY

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Home Beer Brewing Machine Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global home beer brewing machine market report based on product, mechanism, and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Mini Brewer

-

Full-Size Brewer

-

-

Mechanism Outlook (Revenue, USD Million, 2018 - 2030)

-

Automatic

-

Manual

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

Italy

-

-

Asia Pacific

-

New Zealand

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East and Africa (MEA)

-

South Africa

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.