- Home

- »

- Electronic & Electrical

- »

-

Home Appliances Market Size & Share, Industry Report, 2030GVR Report cover

![Home Appliances Market Size, Share & Trends Report]()

Home Appliances Market Size, Share & Trends Analysis Report By Product (Major Appliances, Small Appliances), By Distribution Channel (Hypermarkets & Supermarkets, Electronic Stores, Online), By Region, And Segment Forecasts, 2025 - 2030

- Report ID: GVR-4-68040-491-4

- Number of Report Pages: 100

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Consumer Goods

Home Appliances Market Size & Trends

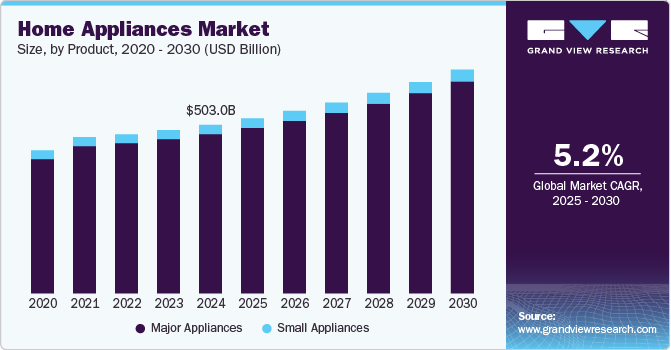

The global home appliances market size was estimated at USD 503.03 billion in 2024 and is expected to grow at a CAGR of 5.2% from 2025 to 2030. The industry is experiencing significant growth, driven by factors such as increased disposable incomes, urbanization, a focus on convenience, and advancements in technology. These trends, coupled with evolving consumer lifestyles and heightened awareness of energy efficiency, are accelerating the demand and market expansion for home appliances worldwide.

A key factor driving this growth in the industry is the rise in disposable incomes and living standards, especially in emerging economies across Asia Pacific, Latin America, and parts of Africa. As more households gain financial stability, they’re investing in modern appliances that enhance convenience and improve quality of life. This shift is particularly strong in urban areas, where busy lifestyles encourage the adoption of appliances that save time, such as washing machines, dishwashers, and microwaves. Urbanization also brings smaller living spaces, which has led to demand for compact, multifunctional, and energy-efficient appliances.

The surge in smart technology is another major contributor. Modern home appliances increasingly feature smart capabilities, allowing users to control and monitor devices remotely via smartphones or integrate them with other devices for enhanced functionality. Smart refrigerators, for instance, can track groceries and suggest recipes, while smart washing machines can be programmed from afar. This growing interest in smart homes aligns with the demand for appliances that can simplify tasks, offering added convenience and customization options that appeal to tech-savvy consumers.

Sustainability and energy efficiency are also critical factors influencing the home appliance industry. With increased awareness of environmental issues and rising energy costs, many consumers are choosing appliances that consume less energy and are environmentally friendly. Governments and organizations worldwide support this shift by implementing energy efficiency standards and providing incentives, such as tax credits or rebates, for purchasing eco-friendly appliances. As a result, manufacturers are prioritizing energy-efficient models and using sustainable materials to attract environmentally conscious buyers.

Product Insights

Major appliances accounted for a revenue share of 89.6% in 2024. The growing urban population and expanding middle-class demographic are major factors driving the demand for major appliances like refrigerators, washing machines, and air conditioners. As urbanization increases, more households are investing in essential home appliances to improve their living standards and convenience. This trend is particularly notable in emerging markets such as India, China, and Brazil, where rising disposable incomes and changing lifestyles are encouraging consumers to purchase modern appliances.

The small appliances market is expected to grow at a CAGR of 6.4% from 2025 to 2030. The growing demand for convenience in households is a major factor driving the small appliances market. Consumers are seeking products that can reduce time and effort in everyday tasks, leading to the rising popularity of small appliances like blenders, coffee makers, toasters, and hair dryers. The shift toward busy lifestyles, especially in urban areas, has accelerated the adoption of these devices, as they provide quick solutions to cooking, cleaning, and personal care needs.

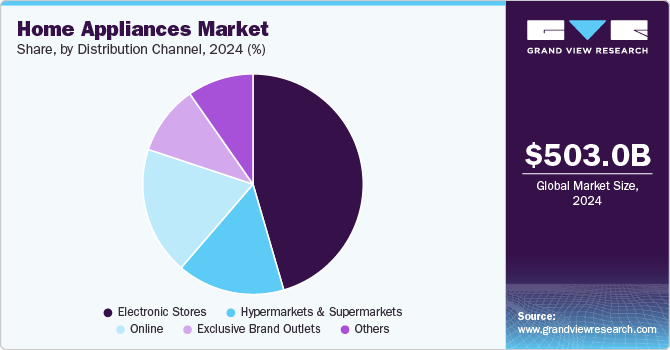

Distribution Channel Insights

Sales through electronic stores accounted for a revenue share of 45.5% in 2024 in the home appliances market. Electronic stores have emerged as a prominent distribution channel in the major appliances industry due to their unique ability to blend traditional retail strengths with modern technological advancements. Established Indian retailers like Vijay Sales, Croma, and Reliance Digital have demonstrated resilience and adaptability in the face of rising e-commerce competition. These stores offer a comprehensive shopping experience that combines the tactile benefits of in-store shopping with the convenience of online access. With an extensive range of high-quality appliances, expert staff, and personalized customer service, they provide a more immersive and informative shopping experience than many online platforms.

Sales of home appliances through online channels are expected to grow with a CAGR of 6.1% from 2025 to 2030. This segment is witnessing significant growth, driven by a shift in consumer behavior toward digital shopping. According to Adtaxi's 2024 Ecommerce Survey, 78% of Americans are now comfortable purchasing major appliances online, an increase from 73% reported the previous year. This growing acceptance reflects broader trends in online shopping, where convenience and the ability to compare products and prices easily have become paramount. With 93% of American adults engaging in online shopping and a notable increase in daily online shoppers, the online channel has become a critical platform for major appliances, offering an efficient way to reach a vast audience.

Regional Insights

North America home appliances market is expected to grow at a CAGR of 3.8% from 2025 to 2030. The North America market is characterized by its maturity and homogeneity, primarily driven by demand from a growing housing industry and increasing disposable incomes. In the U.S., the high costs associated with manufacturing have prompted many companies to offshore their production to other countries.

This shift has been further influenced by the strengthening of the U.S. dollar, resulting in a market that relies more on imports than exports. Despite these challenges, the rise in disposable income and the robust housing market have helped offset some of the adverse effects of the stronger dollar. In Canada, the major home appliance market is experiencing moderate growth, but the rising manufacturing costs are leading many companies to move their production facilities to the U.S., where labor costs are lower.

U.S. Home Appliances Market Trends

The home appliances market in the U.S. is expected to grow at a CAGR of 3.8% from 2025 to 2030. Recent innovations in the refrigerator and dishwasher markets are aimed at enhancing functionality and sustainability. Refrigerators now feature advanced technologies to improve food preservation and reduce waste, while dishwashers are being designed with variable pressure settings to enhance cleaning performance. These innovations reflect manufacturers' efforts to stay competitive by introducing new, advanced products that attract consumers.

Europe Home Appliances Market Trends

Europe home appliances market is expected to grow at a CAGR of 4.0% from 2025 to 2030. European consumers are becoming increasingly conscious of energy efficiency and environmental impact. This awareness has fueled demand for energy-efficient appliances that reduce electricity consumption and lower carbon footprint. The European Union's stringent regulations on energy efficiency, such as the Energy Labeling Regulation and the Ecodesign Directive, have further encouraged the adoption of energy-efficient appliances.

Asia Pacific Home Appliances Market Trends

The home appliances market in Asia Pacific accounted for a revenue share of 44.6% in 2024. The region is home to some of the fastest-growing cities globally, with countries like China, India, Indonesia, and Vietnam experiencing substantial urban expansion. This urban growth is often accompanied by a surge in housing and infrastructure development, which in turn drives demand for household appliances.

As more people move to urban areas, the need for modern homes equipped with essential appliances increases. Newly built apartments and houses are often designed to accommodate contemporary lifestyles, requiring appliances that offer convenience, efficiency, and space-saving solutions. This trend is particularly evident in densely populated cities where living spaces are often smaller, necessitating the use of compact and multifunctional appliances.

Key Home Appliances Company Insights

The industry is characterized by numerous well-established and emerging players. Manufacturers are engaging in a variety of strategic initiatives to keep pace with evolving consumer demands and market trends. For instance, in January 2024, Groupe SEB announced the launch of a state-of-the-art professional equipment hub in Shaoxing, China. This facility aims to enhance the group's production capabilities and strengthen its global supply chain by focusing on innovative manufacturing processes. The hub will support the growing demand for high-quality kitchen and home appliances while fostering local employment and contributing to the region's economy.

Key Home Appliances Companies:

The following are the leading companies in the home appliances market. These companies collectively hold the largest market share and dictate industry trends.

- Whirlpool Corporation

- Samsung Electronics Co. Ltd.

- Robert Bosch GmbH

- LG Electronics Inc.

- Electrolux AB

- Haier Smart Home Co., Ltd.

- Panasonic Corporation

- Sharp Corporation

- Miele

- Midea Group

View a comprehensive list of companies in the Home Appliances Market

Recent Developments

-

In August 2024, Samsung Electronics Co. Ltd. introduced 10 large-capacity Bespoke AI washing machines for Indian consumers, reinforcing its commitment to smart, energy-efficient appliances. These new models feature AI-driven technologies like AI Wash, which enhances water and detergent usage based on load weight and fabric type, and AI EcoBubble for improved cleaning performance with energy savings. The machines are also equipped with Wi-Fi connectivity, enabling users to control and monitor wash cycles remotely through the SmartThings app. This launch is part of Samsung's strategy to enhance convenience, sustainability, and personalization in the home appliance sector in India.

-

In January 2024, Bosch introduced innovations in its line of dishwashers in 2023 to enhance the user experience. These improvements include sleek touch controls, anti-fingerprint design, and advanced features like the PowerControl spray arm technology for better cleaning performance. The Home Connect app offers remote monitoring, customization options for different cycles, safety alerts, and other convenient features for a seamless dishwashing experience. Bosch aims to provide users with a range of dishwasher models across different series to meet various needs and budgets.

Home Appliances Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 523.60 billion

Revenue forecast in 2030

USD 675.73 billion

Growth rate

CAGR of 5.2% from 2025 to 2030

Actual data

2018 - 2024

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion, and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, distribution channel, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; China; Japan; India; Australia & New Zealand; South Korea; Brazil; Argentina; Middle East & South Africa

Key companies profiled

Whirlpool Corporation; Samsung Electronics Co. Ltd.; Robert Bosch GmbH; LG Electronics Inc.; Electrolux AB; Haier Smart Home Co., Ltd.; Panasonic Corporation; Sharp Corporation; Miele; Midea Group

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Home Appliances Market Report Segmentation

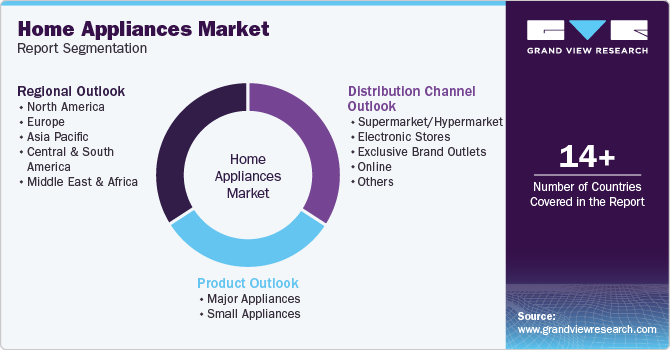

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global home appliances market report based on the product, distribution channel, and region.

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Major Appliances

-

Water Heater

-

Dishwasher

-

Refrigerator

-

Cooktop, Cooking Range, Microwave, and Oven

-

Vacuum Cleaner

-

Washing Machine and Dryers

-

Air Conditioner

-

-

Small Appliances

-

Coffee Makers

-

Toasters

-

Juicers, Blenders and Food Processors

-

Hair Dryers

-

Irons

-

Deep Fryers

-

Space Heaters

-

Electric Trimmers and Shavers

-

Air Purifiers

-

Humidifiers & Dehumidifiers

-

Rice Cookers & Steamers

-

Air Fryers

-

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Supermarket/Hypermarket

-

Electronic Stores

-

Exclusive Brand Outlets

-

Online

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia & New Zealand

-

South Korea

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global home appliances market size was estimated at USD 503.03 billion in 2024 and is expected to reach USD 523.60 billion in 2025.

b. The global home appliances market is expected to grow at a compounded growth rate of 5.2% from 2025 to 2030 to reach USD 675.73 billion by 2030.

b. Small appliances are expected to growth with a CAGR of 6.4% from 2025 to 2030. The integration of smart technologies in small appliances is reshaping the market. Devices that can connect to Wi-Fi, be controlled through mobile apps, or work with voice assistants like Alexa and Google Assistant are increasingly popular. For instance, smart coffee makers can be programmed to brew coffee at specific times. These innovations align with the broader trend of smart home ecosystems, where consumers are adopting appliances that provide enhanced functionality, efficiency, and convenience.

b. Some key players operating in home appliances market include Whirlpool Corporation, Samsung Electronics Co. Ltd., Robert Bosch GmbH, LG Electronics Inc., Electrolux AB, and others.

b. Key factors that are driving the market growth include rising consumer demand for energy-efficient appliances and rising technological advancements

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."