- Home

- »

- Consumer F&B

- »

-

Hoisin Sauce Market Size, Share And Growth Report, 2030GVR Report cover

![Hoisin Sauce Market Size, Share & Trends Report]()

Hoisin Sauce Market (2025 - 2030) Size, Share & Trends Analysis Report By Nature (Conventional, Organic), By Packaging (Glass Bottle, Pouches And Sachets), By Distribution Channel, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-422-4

- Number of Report Pages: 108

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Hoisin Sauce Market Size & Trends

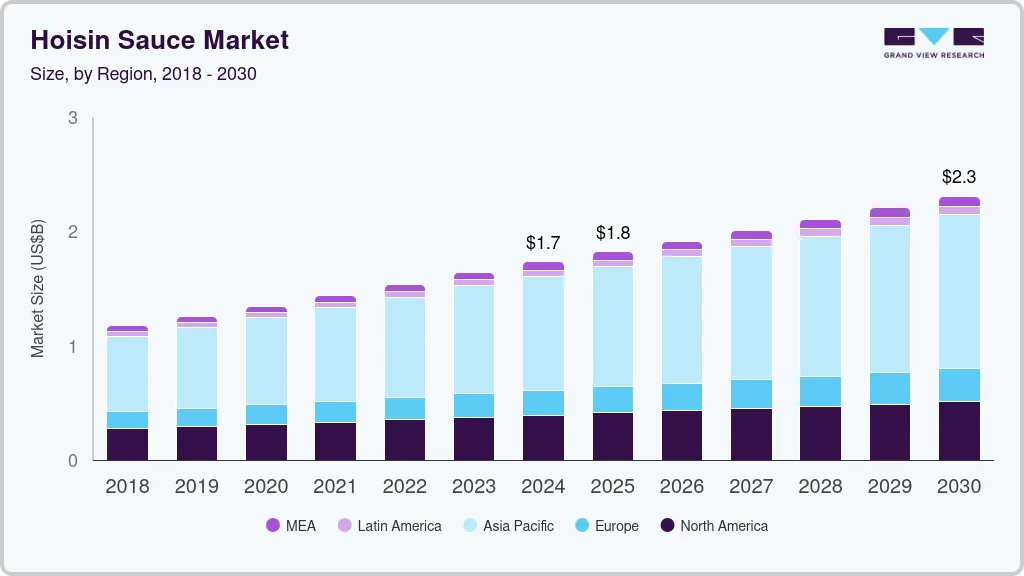

The global hoisin sauce market size was estimated at USD 1.73 billion in 2024 and is expected to grow at a CAGR of 4.8% from 2025 to 2030. The global rise in popularity of Asian cuisine, particularly Chinese and Vietnamese dishes, has significantly boosted the demand for hoisin sauce. Consumers are increasingly seeking authentic flavors for home cooking, leading to higher sales of traditional condiments like hoisin sauce. The expansion of the food service industry, including restaurants, fast food chains, and takeaways, has contributed to the increased use of hoisin sauce. It's a staple ingredient in many Asian-inspired dishes, making it essential in commercial kitchens.

As consumers become more health-conscious, there is a growing demand for natural, preservative-free, and low-sodium sauces. Manufacturers are responding by offering healthier versions of hoisin sauce, which is attracting a broader consumer base. The rise of e-commerce has made it easier for consumers worldwide to access a variety of ethnic foods and condiments. This has facilitated the global distribution of hoisin sauce, boosting its market growth.

Manufacturers are diversifying their product lines to include variations such as low-sodium hoisin sauce, organic versions, and sauces blended with other flavors like garlic or sriracha. This diversification is helping brands cater to different consumer preferences. Innovations in packaging, such as convenient squeeze bottles, single-serve packets, and eco-friendly materials, are becoming increasingly popular. These innovations cater to consumer demands for convenience and sustainability.

Hoisin sauce is being increasingly used in fusion cuisine, where chefs combine elements of different culinary traditions. This trend is expanding the use of hoisin sauce beyond traditional Asian dishes, into sandwiches, pizzas, and marinades for non-Asian recipes. The growing demand for vegan and gluten-free foods has led to the development of hoisin sauces that cater to these dietary needs. Brands are launching products that are free from animal products and gluten, appealing to a wider audience.

Collaborations between brands and celebrity chefs or influencers are becoming common, helping to increase the visibility and appeal of hoisin sauce. These collaborations often include recipes, cooking shows, or social media promotions highlighting the sauce's versatility.

Leading manufacturers like Lee Kum Kee and Kikkoman are introducing healthier versions of hoisin sauce with reduced sugar, lower sodium, and no artificial preservatives. This aligns with the growing consumer preference for clean-label products. Manufacturers increasingly focus on sustainable production practices, such as ethically sourced ingredients and recyclable packaging. This appeals to environmentally conscious consumers and helps brands differentiate themselves in a competitive market.

Market Drivers And Opportunities

The market is set for sustained growth, driven by innovations in product formulations, strategic marketing efforts, and expanding distribution networks. Manufacturers and stakeholders in this sector have significant opportunities to capitalize on changing consumer trends and strengthen their positions in the global condiment market.

As consumer preferences shift towards more diverse and health-conscious options, hoisin sauce is well-positioned to gain popularity. Its versatility in catering to a wide range of culinary tastes, from traditional to fusion dishes, makes it an appealing choice for both households and food service establishments.

The future of the market appears promising, with considerable potential for growth and innovation. Manufacturers who can effectively meet emerging consumer demands, innovate product offerings, and develop strategic distribution will be well-positioned to succeed in this dynamic and evolving condiment landscape.

Nature Insights

Conventional hoisin sauce accounted for a share of 71.86% of the global revenue in 2023. The segment’s growth is due to its widespread popularity and established presence among consumers. This traditional version of the sauce is widely recognized for its authentic taste, making it a staple in both household kitchens and professional culinary settings. Its broad availability, consistent flavor profile, and compatibility with a wide range of dishes have contributed to its dominant position in the market. In addition, conventional hoisin sauce benefits from strong brand recognition and loyalty, further solidifying its leading market share.

Organic hoisin sauce market is expected to grow at a CAGR of 5.1% from 2024 to 2030. The growing awareness of environmental issues is driving consumers toward products that are produced sustainably. Organic farming practices are perceived as more environmentally friendly, and consumers are willing to support brands that align with these values. The rise of private-label organic products has made organic hoisin sauce more affordable, encouraging more consumers to switch from conventional to organic options. Brands are positioning organic hoisin sauce as a premium product, often highlighting the quality, taste, and health benefits associated with organic ingredients. This premium positioning allows brands to attract discerning consumers who are willing to pay more for organic products.

Packaging Insights

The glass bottle segment accounted for a revenue share of 56.80% in 2023. Glass is non-reactive, meaning it does not interact with the contents, which helps preserve the authentic taste and aroma of hoisin sauce. This is particularly important for maintaining the sauce’s rich, umami flavor over time. With increasing consumer awareness about environmental issues, there is a growing preference for sustainable packaging options. Glass is 100% recyclable and can be reused indefinitely without loss of quality. This makes it an attractive option for environmentally conscious consumers who want to reduce their carbon footprint.

The pouches and sachets segment is expected to grow at a CAGR of 5.4% from 2024 to 2030. Pouches and sachets are lightweight and portable, making them perfect for on-the-go use, whether for picnics, travel, or packed lunches. They are generally more cost-effective to produce than glass bottles or larger plastic containers, allowing for lower pricing and greater affordability for hoisin sauces. As modern lifestyles increasingly favor quick and convenient food options, pouches, and sachets align with the growing trend of snacking and on-the-go consumption, fitting effortlessly into the busy routines of consumers.

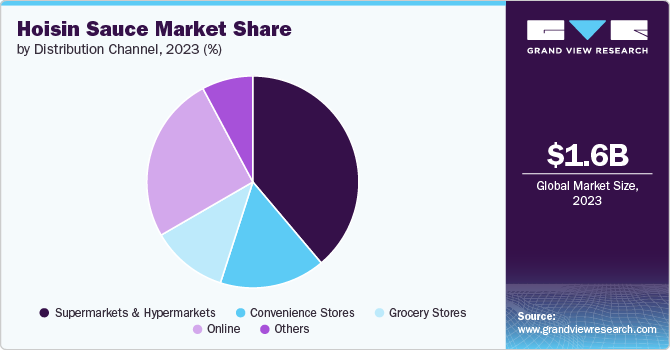

Distribution Channel Insights

The sales of hoisin sauce through supermarkets & hypermarkets accounted for a revenue share of 38.84% in 2023. Supermarkets and hypermarkets have a vast network of stores that cater to a large and diverse customer base, ensuring widespread availability of hoisin sauce to a broad audience. Their strategic locations make it convenient for consumers to purchase hoisin sauce alongside their regular groceries. In addition, these major retailers frequently collaborate with hoisin sauce brands to develop private label products, which can be offered at competitive prices. This approach appeals to cost-conscious shoppers without sacrificing quality.

The sales of hoisin sauce through online channel is expected to grow at a CAGR of 6.0% from 2024 to 2030. Online platforms provide 24/7 accessibility, enabling consumers to buy hoisin sauce at any time from the convenience of their homes or while on the move. The growing trend of online shopping spans all consumer demographics, driven by the convenience, time savings, and broader product selection it offers. E-commerce platforms often feature discounts, coupons, and promotional deals on hoisin sauce, appealing to price-sensitive shoppers and encouraging repeat purchases. Additionally, online channels facilitate market expansion into emerging markets with limited traditional retail infrastructure, creating new growth opportunities for hoisin sauce brands.

Regional Insights

The hoisin sauce market in North America captured a revenue share of over 27.71% in 2023. The growing fascination with Asian cuisine, including Chinese, Vietnamese, and Thai foods, has led to increased demand for hoisin sauce. Consumers are increasingly incorporating this sauce into their home cooking and dining experiences. Hoisin sauce is now more widely available in supermarkets, hypermarkets, and specialty stores across North America. This increased accessibility is driving consumer adoption and market growth. Key players in the North American hoisin sauce market include established brands like Lee Kum Kee, Kikkoman, and Panda Express. These brands offer a range of hoisin sauce products and benefit from strong market presence and brand recognition.

U.S. Hoisin Sauce Market Trends

The U.S. hoisin sauce market is projected to grow at a significant CAGR from 2024 to 2030.As more Americans explore international flavors and engage in home cooking, the use of hoisin sauce in various recipes has become more prevalent. The versatility of hoisin sauce, used in marinades, stir-fries, and as a dipping sauce, appeals to home cooks. There is a growing demand for healthier hoisin sauce options, such as organic, low-sodium, and gluten-free varieties. Consumers are becoming more health-conscious and are seeking products with natural ingredients and fewer additives.

Europe Hoisin Sauce Market Trends

The hoisin sauce market in Europe is expected to grow at a CAGR of 4.8% from 2024 to 2030. European consumers are becoming more health-conscious, leading to an increased demand for healthier food options. Organic hoisin sauce, as well as variants with reduced sodium and no artificial additives, are gaining popularity in response to these health trends. The expansion of Asian restaurants, food trucks, and casual dining establishments across Europe is driving the demand for hoisin sauce. These establishments often use hoisin sauce in their menu offerings, further popularizing it among European consumers.

Asia Pacific Hoisin Sauce Market Trends

The Asia Pacific hoisin sauce market is expected to witness a CAGR of 5.3% from 2024 to 2030. The expansion of restaurants, food stalls, and street food vendors in the Asia Pacific region is contributing to higher consumption of hoisin sauce. These food service establishments use hoisin sauce in a variety of dishes, enhancing its visibility and popularity. The rise of fusion cuisine, blending traditional Asian flavors with global culinary trends, is creating new opportunities for hoisin sauce use in innovative and diverse dishes. Manufacturers are innovating with new flavor profiles and formulations, such as spicier or sweeter versions of hoisin sauce. These innovations cater to diverse taste preferences and enhance product appeal.

Key Hoisin Sauce Company Insights

The market is characterized by dynamic competitive dynamics shaped by a combination of factors including product innovation, regional production capabilities, and evolving consumer preferences. Leading manufacturers invest in R&D and technological advancements to provide cost-effective and quality products. Market players are entering into joint ventures, partnerships, mergers, agreements, and acquisitions to strengthen their market position and expand their geographical reach. Key manufacturers in the hoisin sauce market utilize their expansive distribution networks and robust brand recognition to sustain a substantial market presence. They prioritize quality, innovation, and regional preferences, thereby reinforcing their leadership in local Filipino markets and in international markets that embrace Filipino cuisine.

Key Hoisin Sauce Companies:

The following are the leading companies in the hoisin sauce market. These companies collectively hold the largest market share and dictate industry trends.

- Lee Kum Kee

- HADAY

- Koon Chun Sauce Factory Hong Kong

- Ka-me

- San-J

- Allied Old English Inc.

- Iron Chef

- Ty Ling

- Hormel Foods LLC

- House of Tsang

Recent Developments

-

In February 2022, Lucky Foods introduced its new range of Asian organic sauces, featuring Organic Vegan Oyster and Hoisin sauces. These sauces are ideal for any pantry, crafted with clean ingredients and free from MSG, GMOs, artificial colors, and preservatives.

-

In February 2022, in celebration of the Lantern Festival, Mala Market unveiled an exciting assortment of Sichuan spices and chilies sourced from the 2021 harvest. Alongside this refreshed collection, the market is also introducing a new addition to its growing line of Cantonese specialty ingredients. Coming soon is a unique take on hoisin sauce, a staple in American Cantonese cuisine: Guangwei Yuan Hoisin Sauce.

Hoisin Sauce Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 1.82 billion

Revenue forecast in 2030

USD 2.31 billion

Growth rate

CAGR of 4.8% from 2025 to 2030

Actual data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion, and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Nature, packaging, distribution channel, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; China; Japan; India; South Korea; Philippines, Singapore; Thailand; Malaysia; Brazil; and South Africa

Key companies profiled

Lee Kum Kee; HADAY; Koon Chun Sauce Factory Hong Kong; Ka-me; San-J; Allied Old English Inc.; Iron Chef; Ty Ling; Hormel Foods LLC; House of Tsang

Customization scope

Free Report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options.

Global Hoisin Sauce Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global hoisin sauce market report based on nature, packaging, distribution channel, and region:

-

Nature Outlook (Revenue, USD Million, 2018 - 2030)

-

Conventional

-

Organic

-

-

Packaging Outlook (Revenue, USD Million, 2018 - 2030)

-

Glass Bottle

-

Plastic Bottle

-

Pouches and Sachets

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Supermarkets & Hypermarkets

-

Convenience Stores

-

Grocery Stores

-

Online

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

France

-

Germany

-

Spain

-

Italy

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia & New Zealand

-

South Korea

-

Philippines

-

Singapore

-

Thailand

-

Malaysia

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global hoisin sauce market size was estimated at USD 1.64 billion in 2023 and is expected to reach USD 1.73 billion in 2024.

b. The global hoisin sauce market is expected to grow at a compounded growth rate of 4.9% from 2024 to 2030 to reach USD 2.31 billion by 2030.

b. The conventional segment dominated the hoisin sauce market with a share of 71.86% in 2023. Conventional hoisin sauce dominates the market due to its widespread popularity and strong consumer presence. Known for its authentic flavor, this traditional version is a staple in both home kitchens and professional culinary environments.

b. Some key players operating in the hoisin sauce market include Lee Kum Kee; HADAY; Koon Chun Sauce Factory Hong Kong; Ka-me; San-J; and Allied Old English Inc.

b. Key factors driving the market growth include the expansion of the food service industry, including restaurants, fast food chains, and takeaways. Moreover, manufacturers are responding by offering healthier versions of hoisin sauce, attracting a broader consumer base.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.