- Home

- »

- Consumer F&B

- »

-

Himalayan Salt Market Size, Share And Growth Report, 2030GVR Report cover

![Himalayan Salt Market Size, Share & Trend Report]()

Himalayan Salt Market (2024 - 2030) Size, Share & Trend Analysis Report By Type (Pink Salt, Black Salt, White Salt), By Form (Granular, Powder, Liquid Brine, Blocks), By End-use (Food Processing, Food Service, Retail), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-402-7

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Himalayan Salt Market Size & Trends

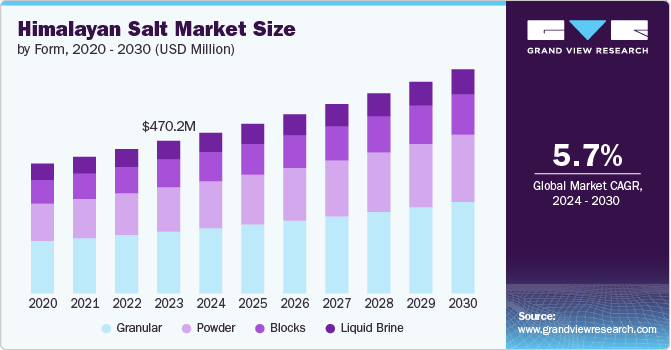

The global Himalayan salt market size was estimated at USD 470.2 million in 2023 and is expected to grow at a CAGR of 5.7% from 2024 to 2030. Consumer demand for Himalayan salt is on the rise, driven by a combination of perceived health benefits, unique aesthetic qualities, and evolving market trends. This pink-hued salt, extracted from the Khewra Salt Mine in Pakistan, is believed to contain over 80 trace minerals, including calcium, magnesium, potassium, copper, and iron. These minerals are thought to offer various health advantages, such as aiding in detoxification, improving digestion, and maintaining electrolyte balance.

Himalayan salt is renowned for its trace mineral content, including magnesium, essential for muscle and nerve function, and potassium, which helps regulate blood pressure. It is said to contain up to 84 trace minerals, making it a valuable source of essential nutrients. This salt is often used as a natural remedy for various health issues, such as alleviating respiratory problems by clearing airways and reducing inflammation. However, individuals with high blood pressure or sodium-related health concerns should consult their doctor before using Himalayan salt as a dietary supplement.

The rising demand for natural and organic products is boosting the Himalayan salt market. Consumers are increasingly seeking products without artificial additives and preservatives, making Himalayan salt a popular choice. Companies such as Evolution Salt Co. and The Spice Lab offer organic, non-GMO, and gluten-free Himalayan salt products to cater to this trend.

In addition, Himalayan salt's use in spa treatments is contributing to its market growth. It is believed to have detoxifying and healing properties, featured in various spa products such as salt scrubs, bath salts, and salt lamps. For example, Saltability reports growing demand for its Himalayan salt spa products due to the increasing popularity of salt therapy.

Also, effective marketing and branding efforts highlighting the unique benefits and origins of this salt have further boosted its appeal. In addition, its aesthetic and distinctive taste has made it a popular choice in gourmet cooking and fine dining. The wellness industry also embraces Himalayan salt for various spa treatments and wellness products, such as salt lamps, which are believed to improve air quality and enhance mood.

Innovations and trends in the consumption of Himalayan salt have also played a significant role in its increasing demand. Himalayan salt lamps, which claim to purify the air and release negative ions when heated, have become popular home décor items. Salt inhalers, marketed for their potential respiratory benefits, and cooking blocks, used for cooking and serving food, have widened the culinary applications of Himalayan salt. Furthermore, the inclusion of Himalayan salt in bath salts and body scrubs for its exfoliating and detoxifying properties, as well as in seasoning products combined with herbs and spices, has expanded its use in personal care and culinary products. Sustainable and aesthetically pleasing packaging also attracts environmentally conscious consumers, further driving the demand.

Type Insights

Pink Himalayan salt accounted for a market share of over 47% of the global revenues in 2023. Consumers are drawn to pink Himalayan salt for its potential health benefits, including its trace mineral content. It contains minerals such as magnesium and potassium that are important for overall well-being, which makes it a popular choice among those seeking natural health remedies.

In August 2022, Mishtann Foods launched Rock Salt (Himalayan Pink Salt) across various markets in India. The company boasts an extensive distribution network comprising over 70,000 distributors and retailers across the country. Himalayan pink salt, also known as rock salt or Sendha Namak, is renowned for its mineral content, including manganese, copper, iron, cobalt, and zinc, all of which offer various health benefits.

White Himalayan salt is expected to grow at a CAGR of 6.3% from 2024 to 2030. White Himalayan salt is prized for its pure, clean appearance and bright, white color. It is often perceived as a more refined and visually appealing alternative to pink salt, making it popular in upscale culinary and decorative applications. In addition, white Himalayan salt is increasingly favored in cooking for its subtle flavor and versatility. It is used as a seasoning and finishing salt in various dishes, providing a clean, delicate taste that enhances the flavor of food without overpowering it.

Form Insights

Granular Himalayan salt accounted for a market share of 40.5% of the global revenues in 2023. The granular form of Himalayan salt provides a pleasing texture and a slight crunch, which is desirable in various culinary applications. It is often used as a finishing salt to add a burst of flavor and a visually appealing crunch to dishes, making it popular in gourmet and artisanal food preparations. Granular Himalayan salt is often packaged in convenient, easy-to-use containers that facilitate quick dispensing and storage. Its form is practical for use in grinders, salt shakers, and cooking tools, which enhances its appeal to consumers looking for a hassle-free seasoning option.

Powder Himalayan salt is expected to grow at a CAGR of 6.2% from 2024 to 2030. Powdered Himalayan salt has a fine texture that dissolves quickly and evenly, making it ideal for applications where a smooth and uniform salt distribution is desired. This makes it particularly useful in baking, cooking, and creating sauces and dressings where a finer salt is needed to blend seamlessly. It simplifies the process of adding salt to various food products and is convenient for use in both home kitchens and commercial food production.

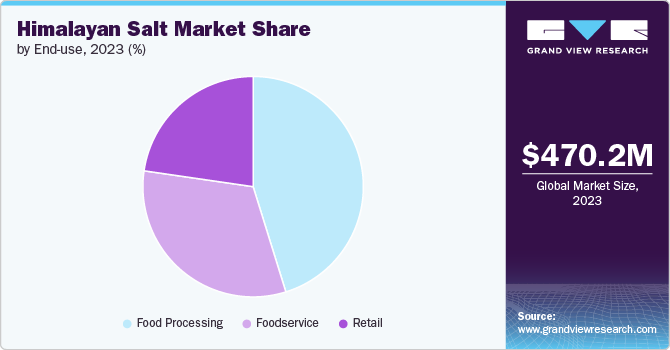

End-use Insights

The demand for Himalayan salt for food processing applications accounted for a share of 45.2% of the global revenues in 2023. Food-processing facilities provide Himalayan salt in a consistent and standardized form, ensuring uniform quality and taste. This reliability is crucial for manufacturers and food producers who require consistent results across large batches. Food-processing sources often offer Himalayan salt in various forms, such as finely ground, granulated, or in specific blends. This customization meets the needs of different food applications, from seasoning to curing, and ensures the salt is suited to particular processing requirements.

The demand for Himalayan salt in foodservice industry is expected to grow at a CAGR of 6.3% from 2024 to 2030. Foodservice suppliers offer Himalayan salt in large quantities, which is ideal for restaurants, catering businesses, and foodservice operations that require substantial amounts of seasoning. Buying in bulk from these suppliers is often more economical and ensures a steady supply. Purchasing from food service suppliers often includes convenient delivery options and service support. This can save time and effort for foodservice operations, ensuring that they receive their salt supplies promptly and can focus on their core activities.

Regional Insights

The Himalayan salt market in North America accounted for a market share of 19.4% in 2023. Many Americans are increasingly health-conscious and seek natural alternatives to processed foods. Himalayan salt is perceived as a healthier option compared to regular table salt due to its mineral content and lack of additives, aligning with the trend toward more natural and wholesome dietary choices.

U.S. Himalayan Salt Market Trends

The market for Himalayan salt is rising in the U.S. for several factors. Himalayan salt is believed to offer various health benefits, such as providing It is valued for its unique flavor and aesthetic qualities. Its distinctive pink color and mild taste make it a popular choice among home cooks and professional chefs for enhancing the flavor of dishes and as a visually appealing finishing salt in gourmet cooking.

Europe Himalayan Salt Market Trends

The Himalayan salt market in Europe is expected to grow at a CAGR of 5.5% from 2024 to 2030. Many Europeans are increasingly focused on health and wellness, and Himalayan salt is marketed as a healthier alternative to regular table salt, containing essential minerals such as potassium, magnesium, and calcium. With a growing trend towards natural and organic products, Himalayan salt's natural pink color and unrefined nature appeal to consumers looking for less processed options. It fits well with the clean eating and organic food movements.

Asia Pacific Himalayan Salt Market Trends

The market in Asia Pacific accounted for a market share of 32.4% in 2023. There is a strong trend towards health and wellness in the Asia Pacific region, with consumers increasingly seeking out natural and organic products. Himalayan salt is promoted for its mineral content and health benefits, making it a popular choice among health-conscious consumers. The expanding middle class in many Asia Pacific countries has increased disposable income, leading to greater spending on premium and specialty products, including gourmet salts such as Himalayan salt. This economic growth is fueling demand for higher-end food ingredients and health products.

Key Himalayan Salt Company Insights

The Himalayan salt market is characterized by dynamic competitive dynamics shaped by a combination of factors including product innovation, regional production capabilities, and evolving consumer preferences. Leading manufacturers invest in R&D and technological advancements to provide cost-effective and quality products.

Market players are entering into joint ventures, partnerships, mergers, agreements, and acquisitions to strengthen their market position and expand their geographical reach. Companies are also focusing on raising consumer awareness of the ambiguity of the ingredients used while strictly adhering to international regulatory standards.

Key Himalayan Salt Companies:

The following are the leading companies in the himalayan salt market. These companies collectively hold the largest market share and dictate industry trends.

- Evolution Salt Co

- Himalayan Salt Company

- Salts Worldwide

- Mineral Salt

- Naturo Healthplus

- NutroActive Industries

- San Francisco Salt Company

- Saltan Ltd.

- Rocky Mountain Salt Company

- The Meadow

Recent Developments

-

In May 2024, ITC Aashirvaad launched its new product, Himalayan Pink Salt, which promises "Purity You Can See & Taste." This salt is notable for its natural pink color, attributed to the high-quality sourcing from Himalayan salt mines. It contains no added colors, aligning with the brand's commitment to high-quality and safe products. Himalayan Pink Salt, also known as Sendha Namak in India, is recognized for its essential minerals, including calcium and magnesium.

-

In August 2023, Himalayan Source introduced the Himalayan salt capsule to assist spa, health, and fitness centers, as well as households, in expanding their halotherapy offerings. The capsule is designed to provide various health benefits, including detoxification, improved digestion, and reduced stress. Targeted at health-conscious consumers, the Himalayan Salt Capsule allows users to incorporate Himalayan salt into their wellness routines. This product launch aligns with the broader trend towards natural and holistic health products.

-

In June 2023, Kerala Naturals, a D2C brand specializing in natural and herbal products, launched pure Himalayan Pink Rock Salt, expanding its product range. Known for offering natural and pure quality products, Kerala Naturals' Himalayan Pink Rock Salt is enriched with 84 natural minerals, including magnesium, potassium, and calcium, which give it its distinctive pink hue. Although it tastes similar to common salt, it provides additional minerals beneficial for the body. These minerals help lower blood pressure and regulate blood sugar, earning the salt the nickname "Pink Gold."

Himalayan Salt Market Report Scope

Report Attribute

Details

Market form value in 2024

USD 495.8 million

Revenue forecast in 2030

USD 691.7 million

Growth rate (Revenue)

CAGR of 5.7% from 2024 to 2030

Actuals

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million, and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, form, end-use, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; UK; Spain; Italy; France; China; India; Japan; South Korea; Australia & New Zealand; Indonesia; Brazil; South Africa

Key companies profiled

Evolution Salt Co; Himalayan Salt Company; Salts Worldwide; Mineral Salt; Naturo Healthplus; NutroActive Industries; San Francisco Salt Company; Saltan Ltd.; Rocky Mountain Salt Company; The Meadow

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Himalayan Salt Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the global Himalayan salt market report on the basis of type, form, end-use, and region.

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Pink Salt

-

Black Salt

-

White Salt

-

-

Form Outlook (Revenue, USD Million, 2018 - 2030)

-

Granular

-

Powder

-

Liquid Brine

-

Blocks

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Food Processing

-

Foodservice

-

Retail

-

Hypermarkets & Supermarkets

-

Convenience Stores

-

Online

-

Others

-

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

Spain

-

Italy

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia & New Zealand

-

South Korea

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global Himalayan salt market size was estimated at USD 470.2 million in 2023 and is expected to reach USD 495.8 million in 2024.

b. The global Himalayan salt market is expected to grow at a compounded growth rate of 5.7% from 2024 to 2030 to reach USD 691.7 billion by 2030.

b. Pink salt accounted for a share of 47.6% in 2023. The use of pink Himalayan salt in spa treatments and wellness products is on the rise. Its purported detoxifying and healing properties are featured in salt scrubs, bath salts, and salt lamps, which enhances its popularity among consumers interested in wellness and self-care.

b. Some key players operating in Himalayan salt market include Evolution Salt Co, Himalayan Salt Company, Salts Worldwide, Mineral Salt, and others.

b. Key factors that are driving the market growth include rising consumption gourmet salts and increasing health consciousness among consumers

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.