- Home

- »

- Automotive & Transportation

- »

-

High-tech Logistics Market Size, Share, Growth Report, 2030GVR Report cover

![High-tech Logistics Market Size, Share & Trends Report]()

High-tech Logistics Market Size, Share & Trends Analysis Report By Service (Transportation, Warehousing & Storage, Inventory Management), By Industry (Semiconductor Industry, Consumer Electronics, Medical Devices), By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-460-2

- Number of Report Pages: 120

- Format: PDF, Horizon Databook

- Historical Range: 2017 - 2023

- Forecast Period: 2024 - 2030

- Industry: Technology

High-tech Logistics Market Size & Trends

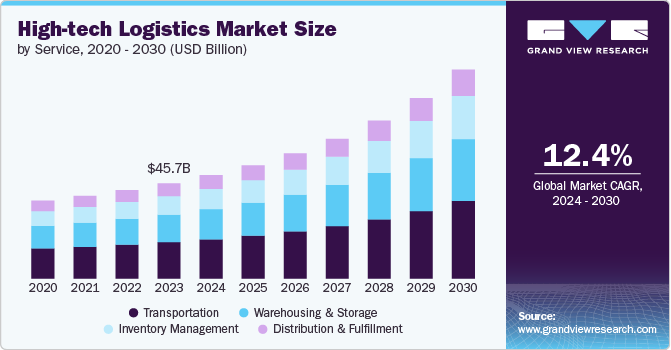

The global high-tech logistics market size was valued at USD 45.70 billion in 2023 and is expected to register a CAGR of 12.4% from 2024 to 2030. The growth of the market is driven by the increasing demand for efficient, specialized logistics solutions to support the evolving needs of high-tech industries. Sectors like semiconductors, consumer electronics, telecommunications, and medical devices rely on the safe and timely transport of sensitive, high-value products. As these industries expand globally, logistics providers must adapt to the complexities of global supply chains, integrating advanced technologies such as real-time tracking, temperature-controlled transportation, and specialized handling systems. These advancements ensure the safe transit of fragile items, meeting the stringent requirements of high-tech products and fostering market growth.

Technological innovation is another key driver in the expansion of the market. The rise of artificial intelligence (AI), automation, and data analytics is transforming logistics operations, enabling more efficient inventory management, predictive maintenance, and optimized routing. AI-driven tools enhance decision-making by offering real-time insights into supply chain performance while automation speeds up processes such as warehousing, picking, and packing. These innovations help logistics companies handle the increased volume and complexity of shipments, particularly as e-commerce and global trade continue to grow.

Additionally, the increasing integration of IoT (Internet of Things) devices and blockchain technology is reshaping the logistics landscape. IoT-enabled devices provide real-time data on the temperature, location, and condition of high-tech products during transit, improving transparency and reducing the risk of damage or delays. Blockchain offers a secure, decentralized platform for tracking goods, enhancing trust and security in the supply chain. These technologies not only improve efficiency but also help logistics providers offer more tailored, responsive services to their high-tech clients, further driving market growth.

However, the market faces challenges that could restrain growth. Rising transportation costs, fluctuating fuel prices, and labor shortages in key logistics hubs can hinder the smooth operation of supply chains.

Service Insights

The transportation segment held the largest revenue share of 38.2% in 2023 in the high-tech Logistics market and is expected to maintain its dominance from 2024-2030.The market growth is driven be the need for efficient and secure movement of high-value, sensitive technology products such as semiconductors and medical devices. This segment is expected to maintain its dominance from 2024 to 2030 due to continued advancements in transportation solutions, including real-time tracking, temperature control, and specialized handling for fragile or high-tech goods, ensuring timely and safe deliveries.

The inventory management segment is expected to register the fastest CAGR of 13.5% from 2024-2030 in the global High-tech logistics market. This growth is primarily attributed to the increasing complexity of supply chains for high-tech products, driving the demand for advanced inventory solutions that ensure real-time visibility, accurate stock levels, and efficient order fulfillment. Additionally, the rise of automation, AI-driven analytics, and smart warehousing technologies are further enhancing inventory management capabilities, supporting its rapid expansion in the high-tech logistics sector.

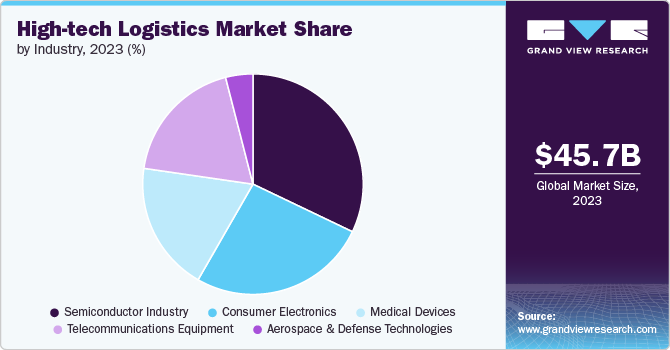

Industry Insights

The semiconductor Industry segment held the largest revenue share of 32.1% in 2023 in the global High-tech logistics market, which is mainly attributed to the sector's complexity and global nature. Semiconductor manufacturing involves intricate supply chains spanning multiple countries, requiring specialized handling and transportation of sensitive components. The industry's high-value products demand secure, temperature-controlled, and time-sensitive logistics solutions. Additionally, the recent global chip shortage has heightened the focus on efficient semiconductor logistics to meet surging demand across various technology sectors.

The consumer electronics segment is expected to register the fastest CAGR of 12.9% from 2024-2030 in the global high-tech logistics market. The market growth is primarily attributed to the increasing global demand for smartphones, smart home devices, and wearables is expanding the need for efficient distribution networks. Frequent product launches and shorter product lifecycles necessitate agile supply chains capable of rapid market deployment. The rise of e-commerce and direct-to-consumer sales models is pushing for more streamlined last-mile delivery solutions.

Regional Insights

North America dominated the global high-tech logistics market with a revenue share of 38.1% in 2023. North America's dominance in the market is attributed to several key factors. The region's strong technology sector drives demand for specialized logistics services to handle sensitive electronics and high-value components. Robust e-commerce growth and consumer expectations for rapid delivery of tech products necessitate advanced supply chain solutions. Additionally, the presence of major tech companies and their complex global supply networks contributes to the region's significant market share in high-tech logistics.

U.S. High-tech Logistics Market Trends

The U.S. dominates the North American high-tech logistics market due to its extensive technology industry and innovation hubs. The country's large consumer base for electronics and tech products drives demand for efficient logistics solutions. U.S. companies are at the forefront of implementing advanced supply chain technologies, including AI and IoT, to optimize high-tech logistics operations. Additionally, the nation's well-developed transportation infrastructure and strategic geographical position facilitate the seamless distribution of high-value tech products both domestically and internationally.

Asia Pacific High-tech Logistics Market Trends

The Asia Pacific region is projected to experience rapid growth in the market for high-tech logistics, with a CAGR of 13.0% from 2024 to 2030. The Asia Pacific region's rapid growth in the high-tech logistics market is driven by several factors. The area's expanding technology manufacturing sector, particularly in countries like China, Taiwan, and South Korea, is increasing demand for specialized logistics services. Rising consumer electronics adoption across emerging economies is fueling the need for efficient distribution networks. Investments in digital infrastructure and e-commerce platforms are accelerating the requirement for advanced supply chain solutions. Additionally, government initiatives to promote technology industries and improve logistics capabilities are contributing to the market's expansion in the region.

Europe High-tech Logistics Market Trends

The European high-tech logistics market growth is primarily driven by the region's strong focus on Industry 4.0 and digital transformation is increasing demand for advanced logistics solutions. The expansion of e-commerce platforms for consumer electronics necessitates more efficient supply chain management. European countries' emphasis on sustainability is pushing for greener logistics practices in the high-tech sector. The rise of smart cities and IoT applications is creating new opportunities for specialized logistics services. Additionally, the region's stringent regulations on data protection and product safety are prompting logistics providers to develop more secure and traceable supply chain solutions for high-value tech goods.

Key High-tech Logistics Company Insights

Some of the key companies operating in the market include C.H. Robinson Worldwide, Inc., and United Parcel Service of America, Inc., among others.

-

C.H. Robinson Worldwide Inc. is a U.S.-based company that specializes in 3PL services, providing a diverse range of solutions such as freight transportation, supply chain optimization, and technology-driven logistics for nearly 10,000 customers and 96,000 contract carriers across 150 countries. The company utilizes advanced platforms for real-time tracking, data analytics, and supply chain visibility, which enables operational efficiency and empowers clients with actionable insights to make informed decisions.

-

United Parcel Service of America, Inc provides supply chain management solutions globally. Services provided by the company include transportation, contract logistics, distribution, third-party logistics, ocean freight, air freight, ground freight, and customs brokerage & insurance. The company operates through three reportable segments, namely International Package, U.S. Domestic Package, and Supply Chain & Freight. The company also has two clinical supply chain subsidiaries, namely UPS Express Critical and Marken, to handle critical biopharma and clinical trial shipments.

A.P. Moller - Maersk.and CEVA Logistics are some of the emerging market companies in the target market.

-

A.P. Moller - Maersk is an integrated logistics company and a member of the A.P. Moller Group. The company operates in around 130 countries across the globe. It operates through three business segments, namely Ocean, Logistics and Services, and Terminals & Towage. It has a wide geographic presence with operations and service facilities established across Europe, Latin America, North America, Africa, and West Central Asia. It has approximately 250 warehousing facilities across 50 countries across the globe. It caters to the following industries: FMCG, retail, fashion & lifestyle, chemicals, automotive, technology, and electronics. It also provides pharma and healthcare logistics.

Key High-tech Logistics Companies:

The following are the leading companies in the high-tech logistics market. These companies collectively hold the largest market share and dictate industry trends.

- C.H. Robinson Worldwide, Inc.

- FedEx

- Agility

- DHL Group

- DB Schenker

- A.P. Moller - Maersk

- Ceva Logistics

- Kerry Logistics Network Limited

- Rhenus Group

- Aramex

- BLG LOGISTICS GROUP AG & Co. KG

Recent Developments

-

In September 2024, UPS acquired Frigo-Trans, a leading healthcare logistics provider based in Germany, to expand its cold chain logistics capabilities across Europe. This acquisition enhances UPS's ability to offer end-to-end solutions for temperature-sensitive and time-critical healthcare products. By integrating Frigo-Trans' advanced temperature-controlled warehousing and transportation systems, UPS strengthens its position in the high-tech logistics market, particularly in healthcare. This move supports the growing need for sophisticated logistics technology in the medical devices and pharmaceuticals sectors, which rely on precise temperature control and real-time monitoring in their supply chains.

-

In September 2024 A.P. Moller-Maersk and Hapag-Lloyd AG have launched the Gemini Cooperation, a joint ocean freight network for East-West trades aimed at delivering over 90% schedule reliability and enhanced connectivity. The redesigned network, expected to launch in February 2025, promises to set new standards for reliability and sustainability in the shipping industry.

High-tech Logistics Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 49.63 billion

Revenue forecast in 2030

USD 100.24 billion

Growth Rate

CAGR of 12.4% from 2024 to 2030

Actual Data

2017 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD Million/Billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Service, Industry, Region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; China; Japan; India; South Korea; Australia; Brazil; KSA; UAE; South Africa

Key companies profiled

C.H. Robinson Worldwide, Inc.; FedEx; Agility; DHL Group; DB Schenker; A.P. Moller - Maersk; Ceva Logistics; AP Moller- Maersk; Kerry Logistics Network Limited; Rhenus Group; Aramex; BLG LOGISTICS GROUP AG & Co. KG

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global High-tech Logistics Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the global high-tech logistics market report based on service, industry and region.

-

Service Outlook (Revenue, USD Million, 2017 - 2030)

-

Transportation

-

Warehousing and Storage

-

Inventory Management

-

Distribution and Fulfillment

-

-

Industry Outlook (Revenue, USD Million, 2017 - 2030)

-

Semiconductor Industry

-

Consumer Electronics

-

Medical Devices

-

Telecommunications Equipment

-

Aerospace and Defense Technologies

-

-

Regional Outlook (Revenue, USD Million, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

U.K.

-

Germany

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East and Africa (MEA)

-

KSA

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global high-tech logistics market size was estimated at USD 45.70 billion in 2023 and is expected to reach USD 49.63 billion in 2024.

b. The global high-tech logistics market is expected to grow at a compound annual growth rate of 12.4% from 2024 to 2030 to reach USD 100.24 billion by 2030.

b. North America dominated the high-tech logistics market with a share of over 38.1% in 2023. This is attributable to the increased corporate spending on events, conferences, and trade shows.

b. Some key players operating in the high-tech logistics market include C.H. Robinson Worldwide, Inc., FedEx, Agility, DHL Group, DB Schenker, A.P. Moller - Maersk, Ceva Logistics, AP Moller- Maersk, Kerry Logistics Network Limited, Rhenus Group, Aramex, and BLG LOGISTICS GROUP AG & Co. KG

b. Key factors driving market growth include the rising demand for supply chain visibility and efficiency, IoT and blockchain integration, globalization and e-commerce expansion, increasing adoption of just-in-time (jit) supply chains, and regulatory compliance and security.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."