- Home

- »

- Advanced Interior Materials

- »

-

High Strength Steel Market Size, Share, Industry Report 2030GVR Report cover

![High Strength Steel Market Size, Share & Trends Report]()

High Strength Steel Market (2025 - 2030) Size, Share & Trends Analysis Report By Product (High Strength Low Alloy, Dual Phase), By Application (Automotive, Construction, Aviation), By Region, And Segment Forecasts

- Report ID: GVR-2-68038-340-9

- Number of Report Pages: 90

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

High Strength Steel Market Size & Trends

The global high strength steel market size was valued at USD 8,701.7 million in 2024 and is projected to grow at a CAGR of 7.6% from 2025 to 2030. This growth is attributed to technological advancements, increased computing power, and innovative algorithms. In addition, the rise of cloud computing provides essential infrastructure for data processing and storage, while the availability of big data enhances AI-driven analysis capabilities. Industries are adopting AI to improve customer experiences and gain competitive advantages. Furthermore, government investments in AI research and rising demand for automation across sectors such as manufacturing and finance further drive market expansion.

High-strength steel is a new generation of steel possessing uniquely high flexibility and strength. High-strength steels are alloyed into the steel with chromium, titanium, vanadium, Martensitic, and copper to enhance stability. High-strength steel is used actively in automobiles due to many factors, such as being lightweight, among other mechanical characteristics such as ease of welding, high toughness, and good form ability. The primary driver for the growth of the market for high-strength steel is the increase in demand from the construction and automobile industries.

The demand for high-strength steel in the construction and automobile industries drives the market. High-strength steels are used in structural applications and are termed structural steels; hence, the high adoption rate of the efficient characteristics of high-strength steels for structural uses fuels the market growth. The market is further impacted by the wide range of specialty steel grades with diverse uses in industries such as construction, aviation, marine, automotive, wind energy, electrical equipment, mining equipment, and pipes.

The construction industry is anticipated to experience growth worldwide due to factors such as better job prospects, higher income levels for the general population, and the middle class adopting more luxurious lifestyles. This results in a higher need for high-strength steels in construction as they allow for thinner products, enhance product toughness at low temperatures, and guarantee high yield strength.

Product Insights

The high strength low alloy segment dominated the market and accounted for the largest revenue share of 36.3% in 2023 owing to its higher toughness than ordinary carbon steels, ductility, high formability, weldability, and high corrosion resistance. It can be found in the presence of minor alloying elements such as vanadium, niobium, or titanium, as well as carbon and manganese. In addition, the growing need for high strength low alloy in sectors such as automotive and building & construction is expected to propel the worldwide market.

The dual-phase segment is expected to register the fastest CAGR of 8.0% during the forecast period. Dual Phase is baked-hard enabling steel primarily utilized in producing vehicle body components such as hoods, doors, front and rear rails, fasteners, and wheels. The yield strength and flexibility can be regulated by monitoring hot coiling and baking hardening temperatures. The utilization of this product category is on the rise for producing car components, leading to a projected increase in its popularity.

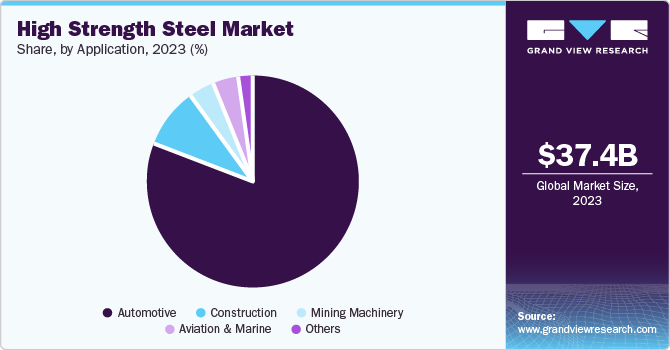

Application Insights

The automotive segment accounted for the largest revenue share of 81.3% in 2023, owing to its wide range of uses in the automotive industry. Its capability to offer light weighting, increased fuel efficiency, improved safety, and structural integrity makes it utilized in different automotive parts and elements, such as body and closures, chassis, suspension systems, safety reinforcements, and crash management systems.

The construction segment is projected to grow at the fastest CAGR of 10.1% over the forecast period. Population growth in the global community and urbanization processes have led to the rise of construction initiatives. High-strength steel is vital in developing high-rise buildings, bridges, and other big structures. The construction industry tends to embrace environmentally friendly procedures. High-strength steel is, in fact, reclaimable and reduces the mean energy of buildings; hence, it is widely recognized by green building protocols.

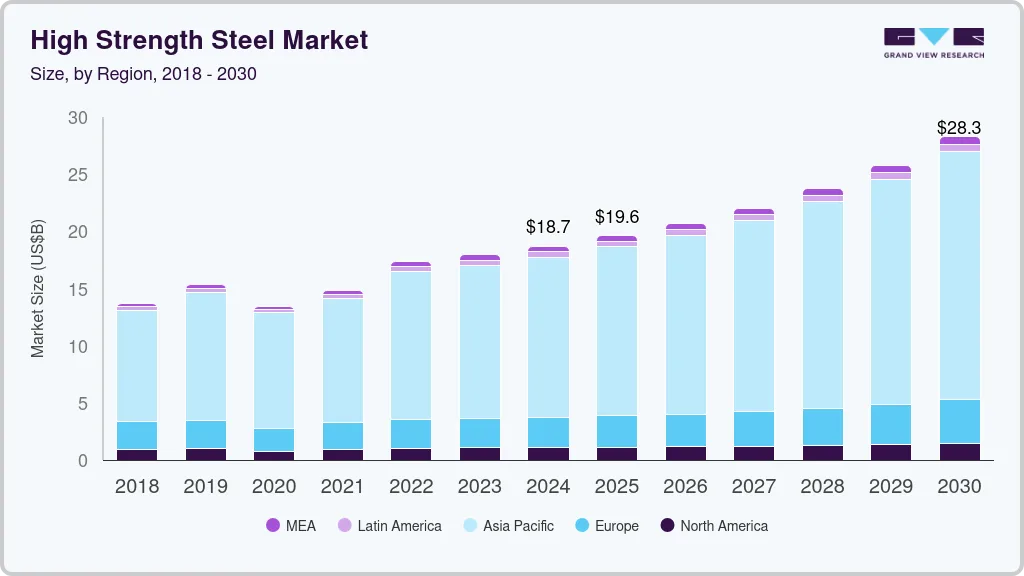

Regional Insights

Asia Pacific high-strength steeldominated the global market and accounted for the largest revenue share of 47.9% in 2023 attributed to industrialization, urbanization, and infrastructure growth in China, Japan, South Korea, and India. These nations possess a robust manufacturing foundation and are significant purchasers of high-strength steel for sectors such as automotive, construction, and machinery. The rising automotive industry in the APAC region and the growth of construction projects play a key role in its leadership in the high-strength steel market.

China High Strength Steel Market Insights

The high strength steel market in Chinadominated Asia Pacific with a share in 2023 due to increased investments and building constructions across the nation. Another characteristic of the Asia-Pacific region's economic situation is China's general leadership, which is the largest country in terms of GDP. The growth rate is still high but declining as the population is living longer; the economy also shifts from investment, industry, and export orientation towards consumption, service, and domestic consumption. China is a big counterpart as it has ranked among the top investors in infrastructure projects worldwide each year.

North America High Strength Steel Market Insights

The North America high-strength steel marketis expected to grow significantly over the forecast period, owing to increasing residential and commercial activity in the US and the need for high-strength steel fabrics in construction projects. Continuous technological advancements also contribute to the regional demand for superior-quality, high-strength steel products used in automotive applications.

U.S. High Strength Steel Market Insights

The high-strength steel market in the U.S.is expected to grow rapidly in the coming years. Strict government rules to enhance car fuel efficiency have increased the need for lightweight materials, making high-strength steel a top option. Increased safety requirements in the automotive industry require more robust materials offered by high-strength steel. Population growth and economic expansion in the growing construction sector drive the increasing demand for construction materials such as high-strength steel.

Europe High Strength Steel Market Insights

The Europe high-strength steel marketis anticipated to witness significant growth. Lightweight car body components are often manufactured from high-strength steel. Thanks to many automakers and suppliers in the area, Germany is the primary player in the regional market. In addition, the regional market is boosting the demand for high-strength steel products in manufacturing aircraft and their parts. Moreover, the German market for high-strength steel dominated the market, while the UK market experienced the highest growth rate in Europe.

The high strength steel market in Germany held a substantial market share in 2023. Germany is at the forefront of the European car industry, hosting 41 factories that make engines and cars, responsible for a third of Europe's total car production. Germany, a major manufacturing hub in the automotive industry, houses a variety of manufacturers across different sectors, including equipment suppliers, material producers, engine manufacturers, and full system integrators.

Key High Strength Steel Company Insights

Some key companies in the high-strength steel market include ArcelorMittal, Tata Steel, Voestalpine AG, and others. Various manufacturers are developing high-strength steel to meet customers' specific requirements in the automotive, construction, and mining sectors. Manufacturers are focusing on increasing their production capacity to match rising consumer demand.

-

ArcelorMittal, the world's largest steel producer, offers a diverse range of advanced steel products. The company specializes in high-yield, high-strength steels that cater to various industries, including automotive, construction, and industrial applications.

-

Nippon Steel manufactures various high-strength steel products, including advanced high-strength, low-alloy steels, and ultra-high-strength steels. Due to their superior mechanical properties and durability, these materials are primarily used in automotive manufacturing, construction, and infrastructure projects.

Key High Strength Steel Companies:

The following are the leading companies in the high strength steel market. These companies collectively hold the largest market share and dictate industry trends.

- ArcelorMittal

- Tata Steel

- voestalpine AG

- POSCO

- SSAB

- ThyssenKrupp AG

- Nucor Corporation

- Liaocheng Development Zone Ruixing Steel Pipe Manufacturing Co., Ltd (Baosteel Group)

- SAIL

- NIPPON STEEL CORPORATION

- JSW

- China Ansteel Group Corporation Limited

Recent Developments

-

In July 2024, ArcelorMittal Gent initiated the world's first industrial trial of D-CRBN's innovative technology to recycle CO2 emissions from steel production. This groundbreaking project involves converting captured carbon dioxide into carbon monoxide, a valuable steel and chemical manufacturing resource. Partnering with Mitsubishi Heavy Industries, the trial expands existing carbon capture efforts at the Gent facility, supporting ArcelorMittal's commitment to reduce CO2 emissions by 35% in Europe by 2030 through advanced carbon management strategies.

-

In September 2023, Tata Steel and the UK government announced a joint proposal for investment in the UK steel industry, marking the largest investment in decades. This initiative focuses on transitioning to sustainable steel production at the Port Talbot site, aiming to reduce carbon emissions by approximately 5 million tonnes annually.

High Strength Steel Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 19,619.4 million

Revenue forecast in 2030

USD 28,328.0 million

Growth rate

CAGR of 7.6% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Volume in Kilotons, Revenue in USD Million, and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, application, region

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country scope

U.S., Canada, Mexico, Germany, UK, France, Italy, Spain, Russia, China, Japan, India, South Korea, Brazil, and Saudi Arabia

Key companies profiled

ArcelorMittal; Tata Steel; voestalpine AG; POSCO; SSAB; thyssenkrupp AG; Nucor Corporation; Liaocheng Development Zone Ruixing Steel Pipe Manufacturing Co., Ltd (Baosteel Group); SAIL; NIPPON STEEL CORPORATION; JSW; China Ansteel Group Corporation Limited

Customization scope

Free report customization (equivalent to up to 8 analyst working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global High Strength Steel Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and analyzes the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global high-strength steel market report based on product, application, and region.

-

Product Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

High Strength Low Alloy

-

Dual Phase

-

Transformation Induced Plasticity

-

Bake Hardenable

-

Martensitic

-

Others Product

-

-

Application Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Automotive

-

Construction

-

Mining Machinery

-

Aviation & Marine

-

Others Application

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

Russia

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

-

Latin America

-

Brazil

-

-

Middle East and Africa (MEA)

-

Saudi Arabia

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.