High-speed Camera Market Size, Share & Trends Analysis Report By Component (Image Sensors, Processors, Lens, Memory), By Application, By Spectrum (Infrared, X-ray, Visible RGB), By Frame Rate, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-384-9

- Number of Report Pages: 160

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Technology

High-speed Camera Market Size & Trends

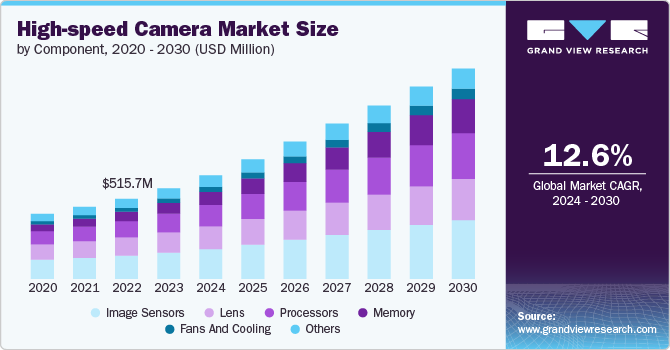

The global high-speed camera market size was estimated at USD 583.7 million in 2023 and is projected to grow at a CAGR of 12.6% from 2024 to 2030. The growing applications of cameras in industrial applications such as automotive, transportation, consumer electronics, aerospace and defense, healthcare, and media and entertainment, among others, are anticipated to drive the market growth. Industries such as automotive, aerospace, and manufacturing increasingly use cameras for quality control, testing, and process optimization. The need for precise analysis of high-speed processes, such as engine performance and assembly line operations, fuels demand. Additionally, advancements in automation and manufacturing technologies expand the use of cameras, supporting their adoption for detailed inspections, defect detection, and real-time monitoring, thereby propelling market expansion.

Increasing demand for research and development (R&D) is a crucial driver of the market growth. Scientists and researchers rely on cameras to study fast phenomena and conduct experiments that require high-resolution, high-frame-rate imaging. Applications in fields such as biomechanics, fluid dynamics, and material science benefit from the precise data captured by these cameras. The continuous pursuit of scientific breakthroughs and technological innovations drives investment in high-speed imaging solutions, supporting the growth and development of the market.

Technological advancements are a major market growth driver. Innovations in image sensors, processing speed, and frame rates enable cameras to capture detailed images of fast-moving events with greater precision. Improvements in resolution, dynamic range, and low-light performance enhance the versatility of cameras, making them more attractive to a wide range of industries. These technological breakthroughs facilitate new applications and drive demand for cutting-edge imaging solutions across various sectors, including automotive, aerospace, and scientific research.

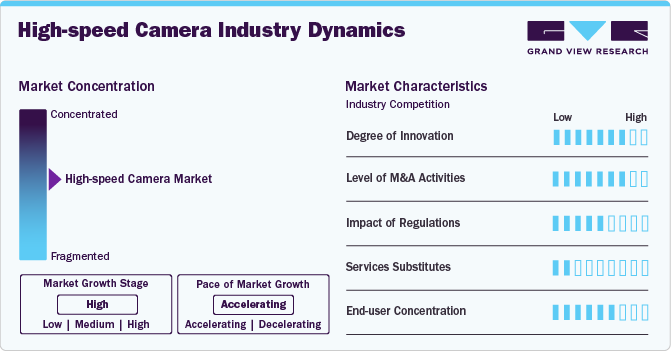

Market Concentration & Characteristics

The market growth stage is exponential, and the pace of the market growth is accelerating. Driven by advancements in technology, increasing applications across industries like automotive, aerospace, and research, and rising demand for high-resolution imaging, the market is experiencing significant momentum. Innovations in camera capabilities and expanding use cases contribute to this rapid growth, reflecting a dynamic and evolving sector that is swiftly adapting to emerging needs and opportunities.

The market is witnessing an increasing number of merger and acquisition (M&A) activities, underscoring its exponential growth stage and ever-expanding potential. Companies are engaging in M&A to enhance technological capabilities, access new markets, and strengthen their competitive position. These strategic moves reflect the market's dynamic evolution and the increasing demand for advanced imaging solutions across various industries. The trend underscores the sector's vitality and the pursuit of innovation and market leadership by key players.

The high-speed camera market is also subject to moderate regulatory scrutiny and is impacted by its operations and strategic decisions. Compliance with these regulations affects manufacturing processes, product design, and market entry. Additionally, strategic decisions, such as adopting new technologies or expanding into new markets, are influenced by regulatory requirements. Companies must navigate these regulations to ensure product safety, maintain industry standards, and avoid legal challenges, all while driving innovation and meeting customer needs.

High-speed camera face minimal competition from product substitutes in the market. This is due to their specialized capabilities in capturing extremely fast events with high precision. While other imaging technologies like standard cameras and video systems offer varying performance, they lack the frame rates and resolution needed for high-speed applications. The unique requirements of industries such as automotive testing, aerospace, and scientific research create a niche market, reducing the impact of alternative technologies and ensuring a strong position in their sector.

End user concentration is a significant factor in the high-speed camera market. This demand from specific industries such as automotive, aerospace, defense, and research. High concentration in sectors like automotive testing and scientific research leads to targeted innovations and tailored solutions, while diverse applications within these industries influence market growth. Companies often focus on serving large, established end users with specific needs, which shapes product development and market dynamics, fostering competition and driving technological advancements in high-speed imaging solutions.

Component Insights

The image sensors segment accounted for the largest revenue share in 2023. The market benefits from advancements in sensor technology, which enhance cameras' performance and capabilities. Innovations in image sensor design led to higher resolution, better low-light performance, and faster frame rates. Increased demand for high-quality imaging in various applications, including industrial, automotive, and consumer electronics, drives the growth of the image sensors segment.

The memory segment is expected to register the fastest CAGR from 2024 to 2030. The growth is driven by the need for high-speed data storage solutions capable of handling large volumes of high-resolution imaging data. As cameras capture more frames per second and higher resolutions, there is a growing demand for advanced memory solutions that ensure efficient data storage and retrieval. Innovations in-memory technology and the need for reliable data management in high-speed imaging applications contribute to the segment's expansion.

Application Insights

The aerospace and defense segment accounted for the largest revenue share of 23.0% in 2023. The segment growth is fueled by the need for cameras to test and monitor advanced aerospace systems, missile development, and defense applications. These cameras are essential for capturing high-speed events, analyzing flight dynamics, and ensuring the reliability of defense technologies. Increased defense spending and advancements in aerospace technology drive the demand for specialized high-speed imaging solutions in this sector.

The healthcare segment is expected to register the fastest CAGR of 18.0% from 2024 to 2030. The market growth is due to the increasing use of cameras in medical research, diagnostics, and surgical procedures. These cameras enable detailed analysis of biological processes, assist in surgical precision, and enhance imaging techniques for diagnostics. The rising focus on improving patient outcomes and technological advancements in medical imaging drive the adoption of cameras in healthcare settings.

Spectrum Insights

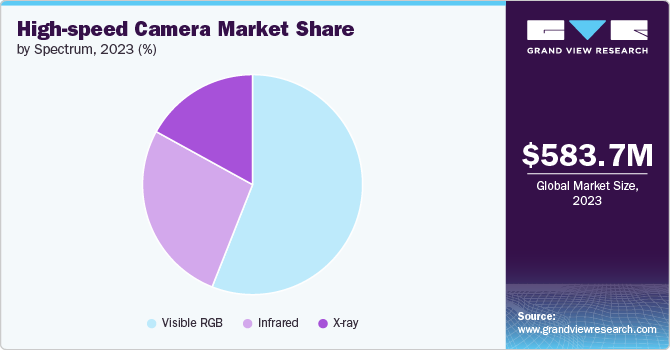

The 3D spectrum segment accounted for the largest market revenue share in 2023. The growth can be attributed to broad application of 3D in consumer electronics, automotive testing, and industrial monitoring. These cameras provide high-resolution imaging in the visible spectrum, essential for quality control, machine vision, and entertainment. Advances in sensor technology and the growing demand for detailed and accurate color reproduction in various applications drive the adoption of visible RGB cameras

The X-ray segment is expected to register the fastest CAGR from 2024 to 2030. This rapid growth can be attributed to the increasing applications in healthcare, security, and industrial inspection. X-ray cameras provide critical insights into the internal structure of objects and materials, supporting non-destructive testing, medical imaging, and security screening. Advancements in imaging technology and growing demand for detailed, high-resolution imaging in diagnostics and inspection contribute to the segment's growth.

Frame Rate Insights

The 1000 - 10000 FPS segment accounted for the largest revenue share in 2023. The increasing demand in industrial automation, automotive testing, and research applications. These cameras offer a balance between high frame rates and resolution, making them suitable for capturing fast processes in manufacturing, quality control, and scientific experiments. The growing need for precise motion analysis and fault detection in industrial settings drives the adoption of cameras within this frame rate range.

The 30000 - 50000 FPS segment is expected to grow at a steady CAGR from 2024 to 2030. The segment growth is driven by the need for ultra-high-speed imaging in advanced research, high-speed manufacturing processes, and entertainment. This range is crucial for capturing extremely fast events such as ballistic impacts, high-speed mechanical operations, and detailed motion studies. Increased investment in scientific research and demand for slow-motion effects in media and sports contribute to the growth of this high frame rate segment.

Regional Insights

North America accounted for the highest revenue share of over 34% in 2023, driven by strong demand from the automotive, aerospace, and defense sectors. Advanced research and development activities, coupled with significant investments in technology innovation and manufacturing, support market growth. Additionally, the region's emphasis on cutting-edge technology and the presence of major industry players further fuel the demand for high-speed cameras in scientific research and industrial applications.

U.S. High-speed Camera Market Trends

The high-speed camera market in the U.S. is expected to grow at a notable CAGR from 2024 to 2030. The market benefits from rapid advancements in technology and high adoption rates in sectors like automotive testing, industrial automation, and entertainment. The presence of leading technology companies, substantial R&D investments, and a strong focus on innovation drive the demand for cameras. Additionally, government and defense contracts contribute to the market's growth by requiring high-resolution imaging for various applications

Asia Pacific High-speed Camera Market Trends

The high-speed camera market in Asia Pacific accounted for a significant revenue share in 2023. The market growth is driven by rapid industrialization, growing demand for advanced manufacturing processes, and increased investments in research and development. The region's expanding automotive, aerospace, and electronics industries, coupled with rising consumer electronics and media production needs, support market growth. Additionally, government initiatives to boost technology adoption and infrastructure development contribute to the demand for cameras.

The Japan high-speed camera market is estimated to grow significantly from 2024 to 2030. The growth is fueled by its strong emphasis on technological innovation and advancements in electronics and automotive sectors. The country's focus on precision manufacturing, high-tech research, and development initiatives supports the adoption of cameras. Additionally, Japan's significant investments in scientific research and industrial automation drive demand for high-resolution and high-speed imaging solutions.

The high-speed camera market in India is estimated to record a notable CAGR from 2024 to 2030. The market growth is driven by increasing industrial automation, advancements in automotive testing, and the growth of the media and entertainment industry. Rising investments in research and development, coupled with government initiatives to enhance technological capabilities and infrastructure, support market expansion. Additionally, growing consumer demand for high-quality imaging solutions in various sectors contributes to the market's growth.

The China high-speed camera market had the largest revenue share in 2023. The market growth is propelled by rapid industrialization, significant investments in technological advancements, and growth in the automotive and electronics sectors. The country's emphasis on manufacturing excellence, scientific research, and innovation supports the demand for cameras. Additionally, government policies encouraging technological development and infrastructure improvements drive market expansion.

Europe High-speed Camera Market Trends

The high-speed camera market in Europe is anticipated to grow at a moderate CAGR from 2024 to 2030. The market benefits from strong demand in automotive testing, industrial automation, and scientific research. The region's focus on technological innovation, high-quality manufacturing standards, and significant R&D investments drive growth. Additionally, Europe's stringent quality and safety regulations, coupled with increasing adoption of advanced imaging technologies, support market expansion across various industries.

The France high-speed camera market accounted for a significant revenue share in 2023. The market is supported by the country's emphasis on technological innovation and advancements in automotive and aerospace industries. Significant investments in research and development, coupled with a strong focus on high-quality imaging solutions for scientific and industrial applications, drive demand. Additionally, France's growing media and entertainment sector contributes to the market's expansion.

The high-speed camera market in the UK is estimated to grow at the fastest CAGR from 2024 to 2030. The market is driven by advancements in research and development, particularly in the automotive and aerospace sectors. The country's focus on cutting-edge technology, significant investments in scientific research, and a strong presence of industry players support market growth. Additionally, the growing demand for high-resolution imaging in industrial and media applications contributes to market expansion.

The Germany high-speed camera market is estimated to grow at a moderate CAGR from 2024 to 2030. The market benefits from its strong industrial base, particularly in automotive testing and manufacturing. The country's emphasis on technological innovation, high-quality engineering, and significant investments in research and development drive demand for cameras. Additionally, Germany's leadership in advanced manufacturing and scientific research supports market growth across various sectors.

Middle East & Africa (MEA) High-speed Camera Market Trends

The high-speed camera market in the Middle East and Africa (MEA) region is estimated to grow significantly from 2024 to 2030. The market is driven by increasing investments in infrastructure development, growing industrialization, and advancements in the entertainment and media sectors. Rising demand for high-resolution imaging solutions in automotive testing, oil and gas exploration, and scientific research supports market growth. Additionally, government initiatives to boost technology adoption and infrastructure development contribute to market expansion.

The high-speed camera market in Saudi Arabia accounted for a considerable revenue share in 2023. The market is supported by increasing investments in infrastructure projects, oil and gas exploration, and industrial automation. The country's focus on technological advancements, coupled with rising demand for high-resolution imaging in various sectors, drives market expansion. Additionally, government initiatives to enhance technological capabilities and support economic diversification contribute to the growth of the market.

Key High-speed Camera Company Insights

Some of the key players operating in the market include Vision Research Inc.; Photron Ltd.; and Olympus Corporation.

-

Vision Research Inc.'s growth strategy in high-speed cameras focuses on innovation and expanding market reach. They invest in advanced technologies like CXP-over-Fiber (CXPoF) for high data transfer rates and enhanced features like Auto-exposure and Extreme Dynamic Range (EDR). The company aims to cater to diverse industries, including industrial, scientific, and media, by offering versatile solutions like the Phantom series. They also emphasize user-friendly features and high performance to maintain leadership and attract new customers.

-

Olympus Corporation's growth strategy in high-speed cameras focuses on leveraging its expertise in optics and imaging technology to innovate and expand its product offerings. The company aims to enhance image quality, resolution, and frame rates, catering to advanced scientific and industrial applications. Strategic partnerships and investments in research and development are key components, enabling Olympus to integrate cutting-edge features like enhanced sensitivity and faster data processing. This approach positions Olympus to meet the increasing demand for high-speed imaging solutions.

Fastec Imaging, Optronis GmbH, and Motion Capture Technologies are some of the emerging market participants.

-

Fastec Imaging's growth strategy in high-speed cameras focuses on delivering compact, portable, and user-friendly solutions tailored for industrial, scientific, and sports applications. The company emphasizes innovative features like easy integration, high frame rates, and advanced software for precise motion analysis. By targeting niche markets and offering cost-effective, customizable products, Fastec aims to differentiate itself from competitors. Additionally, they focus on expanding their global distribution network and providing robust customer support to enhance market presence and customer loyalty.

- Optronis GmbH's growth strategy in high-speed cameras focuses on enhancing technological innovation and expanding market reach. They invest in developing advanced imaging technologies, such as higher frame rates and improved resolution. Optronis also aims to strengthen partnerships with industry leaders and expand their product offerings to meet diverse application needs. By emphasizing high-quality performance and customer-centric solutions, they target growth in sectors like automotive testing, industrial applications, and scientific research.

Key High-speed Camera Companies:

The following are the leading companies in the high-speed camera market. These companies collectively hold the largest market share and dictate industry trends.

- Photron Ltd.

- Olympus Corporation

- NAC Image Technology

- Mikrotron GmbH

- Excelitas Technologies Corp

- Fastec Imaging

- Vision Research Inc.

- Optronis GmbH

- Motion Capture Technologies

- Del Imaging Systems LLC

- Ix-Cameras Inc.

Recent Developments

-

In May 2024, Excelitas Technologies Corp. introduced the pco.flim X Camera System, a successor to the pco.flim. The system, designed for life science and metrology applications, offered simplified setup with 1008 x 1008 pixel resolution and could read 45 double images per second. It supported a modulation frequency range of 5 kHz to 40 MHz and featured an enhanced cooling image sensor, achieving temperatures of -5°C with forced air and -20°C with water cooling. This improvement reduced readout noise below 15 [e-] and extended exposure times to 4 seconds, compared to the previous 2 seconds.

-

In January 2024, Vision Research introduced the Phantom S711, a high-speed streaming Machine Vision camera capable of 7 Gpx/sec, utilizing CXP-over-Fiber (CXPoF) for immediate data analysis. The S711 offered over 7,000 fps at full 1 Mpx resolution (1280 x 800) and over 240,000 fps at the lowest resolution. It featured up to two Regions of Interest (ROI), reducing unwanted data flow and potentially increasing frame rates. The camera also included Auto-exposure, Extreme Dynamic Range (EDR), and a mechanical shutter for remote black references, ensuring optimal image quality.

High-speed Camera Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2024 |

USD 666.3 million |

|

Revenue forecast in 2030 |

USD 1,354.5 million |

|

Growth rate |

CAGR of 12.6% from 2024 to 2030 |

|

Actual data |

2018 - 2023 |

|

Forecast period |

2024 - 2030 |

|

Quantitative units |

Revenue in USD million and CAGR from 2024 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Component, application, spectrum, frame rate, region |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

|

Country scope |

U.S.; Canada; Mexico; Germany; UK; France; China; Japan; India; South Korea; Australia; Brazil; UAE; Saudi Arabia; South Africa |

|

Key companies profiled |

Photron LTD.; Olympus Corporation; NAC Image Technology; Mikrotron GmbH; PCO AG; Weisscam, Vision Research Inc.; Optronis GmbH; Motion Capture Technologies; Del Imaging Systems, LLC; Ix-Cameras Inc. |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global High-speed Camera Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global high-speed camera market report based on component, application, spectrum, frame rate, and region:

-

Component Outlook (Revenue, USD Million, 2018 - 2030)

-

Image Sensors

-

Processors

-

Lens

-

Memory

-

Fans And Cooling

-

Others

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Automotive & Transportation

-

Consumer Electronics

-

Aerospace & Defense

-

Healthcare

-

Media & Entertainment

-

Others

-

-

Spectrum Outlook (Revenue, USD Million, 2018 - 2030)

-

Infrared

-

X-ray

-

Visible RGB

-

-

Frame Rate Outlook (Revenue, USD Million, 2018 - 2030)

-

250 - 1000 FPS

-

1000 - 10000 FPS

-

10000 - 30000 FPS

-

30000 - 50000 FPS

-

Above 50000 FPS

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East and Africa (MEA)

-

UAE

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global high-speed camera market size was estimated at USD 583.7 million in 2023 and is expected to reach USD 666.3 million in 2024.

b. The global high-speed camera market is expected to grow at a compound annual growth rate of 12.6% from 2024 to 2030 to reach USD 1,354.5 million by 2030.

b. North America accounted for the highest market revenue share in 2023, driven by strong demand from the automotive, aerospace, and defense sectors. Advanced research and development activities, coupled with significant investments in technology innovation and manufacturing, support market growth.

b. Some key players operating in the high-speed camera market include Vision Research Inc., Photron Ltd., Olympus Corporation, Fastec Imaging, Optronis GmbH, Motion Capture Technologies, and among others

b. The growing industrial applications of cameras significantly drive market growth. Industries such as automotive, aerospace, and manufacturing increasingly use cameras for quality control, testing, and process optimization. The need for precise analysis of high-speed processes, such as engine performance and assembly line operations, fuels demand.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."