High-Purity Plastics For Medical Devices And Implants Market Size, Share & Trends Analysis Report By Product (PEEK, UHMWPE, PC), By Application (Implantable Devices, Diagnostic Devices, Surgical Instruments), By Region, And Segment Forecasts, 2025 - 2030

- Report ID: GVR-4-68040-544-7

- Number of Report Pages: 110

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Bulk Chemicals

Market Size & Trends

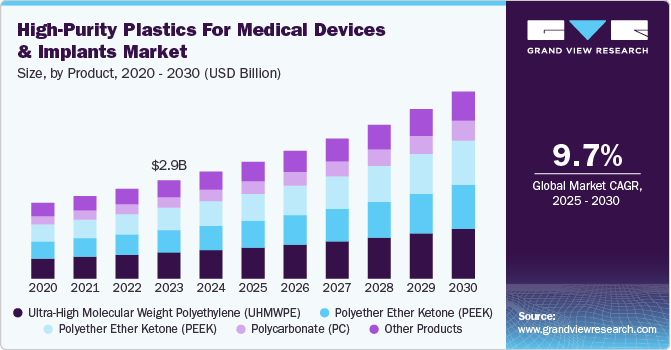

The global high-purity plastics for medical devices and implants market size was valued at USD 3.11 billion in 2024 and expected to grow at a CAGR of 9.68% from 2025 to 2030. The increasing use of 3D printing in medical device manufacturing is driving demand for high-purity plastics, as these materials enable precise, customized implants with superior biocompatibility. Additionally, advancements in antimicrobial polymers are boosting adoption in surgical tools and implant coatings to reduce infection risks.

The high-purity plastics for medical devices & implants industry is experiencing a strong shift toward biocompatible and bioabsorbable polymers, driven by advancements in material science and the rising demand for long-term implantable medical solutions. Manufacturers are increasingly developing high-performance polymers such as polyether ether ketone (PEEK), polylactic acid (PLA), and polycaprolactone (PCL), which offer enhanced biocompatibility, mechanical strength, and controlled degradation properties. These materials are particularly gaining traction in orthopedic, cardiovascular, and soft tissue applications, where reducing inflammatory response and promoting tissue integration are critical. This trend is also being accelerated by regulatory bodies emphasizing stringent safety and performance standards for implantable materials, compelling companies to invest in innovative polymer formulations with superior physiological compatibility.

Drivers, Opportunities & Restraints

The market is significantly driven by the growing adoption of minimally invasive surgeries (MIS) and implantable medical devices, particularly in orthopedic, cardiovascular, and dental applications. High-purity medical-grade plastics are integral to these procedures, as they provide exceptional chemical resistance, sterilizability, and mechanical durability while reducing device weight and manufacturing complexity.

The increasing geriatric population, coupled with the rising prevalence of chronic diseases such as osteoarthritis, cardiovascular disorders, and neurological conditions, is further fueling the demand for advanced implantable solutions. Additionally, the shift toward personalized medicine and 3D-printed medical implants is reinforcing the use of high-purity plastics, as these materials enable precise customization while meeting stringent biocompatibility standards.

The expanding regulatory acceptance of high-purity medical-grade polymers in emerging markets presents a lucrative opportunity for manufacturers. Countries such as China, India, and Brazil are witnessing increased healthcare investments and a surge in medical infrastructure development, creating a favorable environment for the adoption of advanced polymer-based medical devices and implants.

Regulatory bodies in these regions are progressively aligning with global standards such as ISO 10993 and USP Class VI, allowing international players to introduce high-purity plastics with established clinical safety records. Furthermore, domestic manufacturers are ramping up production capacities and investing in R&D to develop cost-effective, locally compliant polymer solutions, enabling greater market penetration and accelerating the adoption of polymer-based implantable technologies.

Despite the growing demand for high-purity plastics in medical applications, stringent regulatory compliance requirements and prolonged approval processes present a substantial restraint to market growth. Regulatory agencies such as the FDA, EMA, and CFDA impose rigorous testing protocols for biocompatibility, mechanical performance, and long-term safety before approving new polymer-based medical devices and implants. This not only increases the time-to-market but also escalates the costs associated with R&D, clinical trials, and regulatory documentation.

Additionally, frequent updates to compliance guidelines and country-specific approval frameworks create challenges for manufacturers attempting to standardize products across multiple regions. As a result, companies must allocate significant resources to navigate the complex regulatory landscape, potentially limiting the entry of new market players and delaying the commercialization of innovative polymer solutions.

Product Insights

Ultra-high molecular weight polyethylene (UHMWPE) dominated the high-purity plastics for medical devices & implants industry across the product segmentation in terms of revenue, accounting for a market share of 34.64% in 2024. The growing prevalence of osteoarthritis and other degenerative joint disorders is driving the demand for ultra-high molecular weight polyethylene (UHMWPE) in orthopedic implants, particularly in hip and knee replacements.

As patients increasingly opt for early surgical intervention and longer-lasting implants, manufacturers are focusing on next-generation UHMWPE formulations with enhanced wear resistance and oxidative stability. Advances such as vitamin E-stabilized and cross-linked UHMWPE are significantly improving implant longevity by reducing wear debris formation and minimizing inflammatory responses.

The increasing preference for metal-free implantable solutions is driving strong demand for polyether ether ketone (PEEK) in spinal and trauma implants, as this high-performance polymer offers exceptional biocompatibility, radiolucency, and mechanical properties closely mimicking human bone. Surgeons and medical institutions are increasingly favoring PEEK over titanium and stainless steel, particularly in spinal fusion and interbody cages, as its modulus of elasticity reduces stress shielding and improves bone integration.

Additionally, recent advancements in surface modification technologies, such as plasma treatment and bioactive coatings, are further enhancing PEEK’s osseointegration properties, making it a viable alternative for long-term orthopedic and neurological applications. The rising adoption of additive manufacturing in healthcare is also supporting the customization of PEEK-based implants, enabling patient-specific solutions that enhance surgical outcomes.

Application Insights

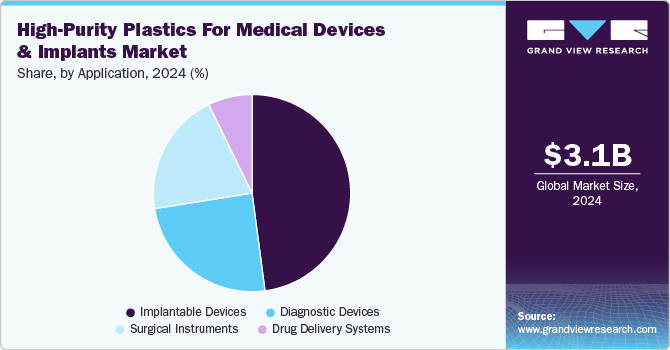

Implantable Devices dominated the high-purity plastics for medical devices & implants industry across the application segmentation in terms of revenue, accounting for a market share of 47.91% in 2024. The rising integration of smart and bioactive polymer technologies in implantable medical devices is fueling significant growth in this segment.

High-purity medical plastics such as bioresorbable polymers and drug-eluting materials are gaining traction in cardiovascular stents, pacemaker leads, and orthopedic implants, as they enable controlled drug delivery and improved tissue regeneration. Innovations in polymer chemistry are also enabling the development of antimicrobial-coated implants, significantly reducing the risk of post-surgical infections-a key concern in long-term implant procedures.

The rapid expansion of point-of-care (POC) diagnostics and wearable medical technologies is driving strong demand for high-purity plastics in diagnostic devices. As healthcare systems worldwide shift toward decentralized testing and real-time health monitoring, polymer-based microfluidic devices, biosensors, and lab-on-a-chip platforms are becoming increasingly essential for delivering fast and accurate diagnostics.

High-performance plastics such as cyclic olefin polymers (COP) and polycarbonate are gaining widespread adoption due to their superior optical clarity, chemical resistance, and biocompatibility, which are critical for ensuring precise detection in blood analyzers and molecular diagnostic systems. Furthermore, the rise of AI-powered and connected diagnostic devices is creating new opportunities for advanced polymeric materials that offer lightweight, durable, and flexible properties, enhancing patient comfort and device longevity in wearable health monitoring solutions.

Regional Insights

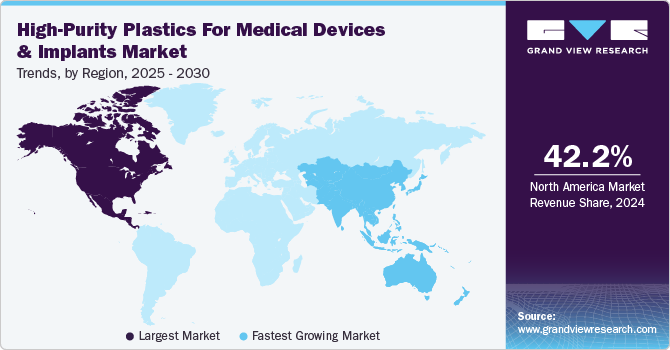

North America dominated the global high-purity plastics for medical devices & implants industry and accounted for the largest revenue share of 42.24% in 2024. The North American market is witnessing a surge in investments in high-performance polymer-based medical technologies, driven by strong funding for research in biocompatible materials and next-generation implantable devices.

Leading medical polymer manufacturers and healthcare companies are actively collaborating with research institutions to develop cutting-edge biomaterials that enhance patient outcomes while meeting stringent regulatory requirements. The rise of smart implants and bioresorbable medical polymers is further fueling market expansion, as these materials offer improved functionality in areas such as cardiovascular stents, orthopedic implants, and neurostimulators.

With increasing regulatory scrutiny on environmental sustainability, the North American medical device sector is actively shifting toward eco-friendly, high-purity plastics that offer superior sterilizability while reducing environmental impact.

The demand for recyclable and bio-based polymers is growing, particularly in single-use diagnostic devices and surgical tools, as hospitals and healthcare facilities prioritize sustainability initiatives. Companies are investing in the development of non-toxic, solvent-free, and energy-efficient polymer processing technologies to comply with environmental regulations while maintaining the high safety and performance standards required in medical applications.

U.S. High-Purity Plastics for Medical Devices & Implants Market Trends

The U.S. is at the forefront of innovation in high-purity polymer applications for medical devices and implants, largely due to rapid advancements in 3D printing and additive manufacturing technologies. The growing adoption of patient-specific, 3D-printed medical implants-particularly in orthopedic, dental, and cranial applications-is driving demand for ultra-pure polymers such as polyether ether ketone (PEEK) and ultra-high molecular weight polyethylene (UHMWPE). Medical institutions and device manufacturers are increasingly utilizing high-precision polymer printing technologies to create implants with improved mechanical properties, better osseointegration, and enhanced biocompatibility.

Europe High-Purity Plastics for Medical Devices & Implants Market Trends

Europe’s high-purity plastics market for medical devices and implants is being propelled by the region's stringent medical regulations, particularly the European Medical Device Regulation (EU MDR) and REACH compliance.

These frameworks are pushing medical device manufacturers to invest in advanced, highly purified polymers that meet rigorous safety, biocompatibility, and traceability standards. The emphasis on patient safety and long-term implant performance has increased demand for innovative polymer materials with superior mechanical integrity, reduced toxicity, and improved resistance to sterilization processes.

Asia Pacific High-Purity Plastics for Medical Devices & Implants Market Trends

The Asia Pacific region is witnessing rapid growth in the high-purity medical plastics market due to increasing healthcare investments, expanding medical infrastructure, and localized polymer production capabilities. Countries such as China, India, and South Korea are heavily investing in advanced medical device manufacturing, creating significant demand for medical-grade polymers that are cost-effective yet meet international quality standards.

Local companies are collaborating with global polymer suppliers to develop innovative materials tailored to regional medical needs, including antimicrobial polymers for infection control and bioabsorbable plastics for minimally invasive procedures. Additionally, government initiatives supporting domestic medical device production, coupled with rising healthcare accessibility in rural areas, are further driving market expansion in this region.

Key High-Purity Plastics For Medical Devices And Implants Company Insights

The high-purity plastics for medical devices & implants industry is highly competitive, with several key players dominating the landscape. Major companies include Honeywell International Inc., Teijin Limited, Toyobo Co., Ltd., Celanese Corporation, LyondellBasell Industries, Braskem S.A., Fiber-Line (Avient Corporation), Hangzhou Impact New Materials Co., Ltd., Jiaxing Doshine New Material Co., Ltd., and ChangQingTeng High Performance Fiber Material Co.,Ltd.

The market is characterized by a competitive landscape with several key players driving innovation and market growth. Major companies in this sector are investing heavily in research and development to enhance the performance, cost-effectiveness, and sustainability of their products.

Key High-Purity Plastics For Medical Devices And Implants Companies:

The following are the leading companies in the high-purity plastics for medical devices and implants market. These companies collectively hold the largest market share and dictate industry trends.

- Honeywell International Inc.

- Teijin Limited

- Toyobo Co., Ltd.

- Celanese Corporation

- LyondellBasell Industries

- Braskem S.A.

- Fiber-Line (Avient Corporation)

- Hangzhou Impact New Materials Co., Ltd.

- Jiaxing Doshine New Material Co., Ltd.

- ChangQingTeng High Performance Fiber Material Co.,Ltd.

Recent Developments

-

In October 2024, Honeywell International Inc. announced plans to spin off its Advanced Materials business into an independent, publicly traded company by late 2025 or early 2026. This strategic move aims to enhance focus on sustainability-driven specialty chemicals and materials, featuring brands like Solstice and Spectra (UHMWPE).

-

In March 2023, DSM Biomedical announced a sustainability initiative to introduce bio-based Dyneema Purity UHMWPE fibers for medical devices. Certified by the International Sustainability and Carbon Certification (ISCC), these fibers are derived from renewable resources, supporting the industry's environmental, social, and governance (ESG) objectives. The bio-based fibers were scheduled to be available in 2024, offering the same quality and performance as traditional UHMWPE fibers without supply chain disruptions. This initiative aimed to enable medical device manufacturers to reduce reliance on fossil fuels and promote a circular economy.

High-Purity Plastics For Medical Devices And Implants Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2025 |

USD 3.38 billion |

|

Revenue forecast in 2030 |

USD 5.37 billion |

|

Growth rate |

CAGR of 9.68% from 2025 to 2030 |

|

Historical data |

2018 - 2023 |

|

Base Year |

2024 |

|

Forecast period |

2025 - 2030 |

|

Quantitative units |

Revenue in USD Million, Volume in Kilotons, and CAGR from 2025 to 2030 |

|

Report coverage |

Revenue forecast, competitive landscape, growth factors and trends |

|

Segments covered |

Product, application, region |

|

Regional scope |

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa |

|

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; China; India; Japan; South Korea; Australia Brazil; Argentina; Saudi Arabia; South Africa; UAE |

|

|

Key companies profiled |

Honeywell International Inc.; Teijin Limited; Toyobo Co., Ltd.; Celanese Corporation; LyondellBasell Industries; Braskem S.A.; Fiber-Line (Avient Corporation); Hangzhou Impact New Materials Co., Ltd.; Jiaxing Doshine New Material Co., Ltd.; ChangQingTeng High Performance Fiber Material Co.,Ltd. |

|

Customization scope |

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global High-Purity Plastics For Medical Devices And Implants Market Report Segmentation

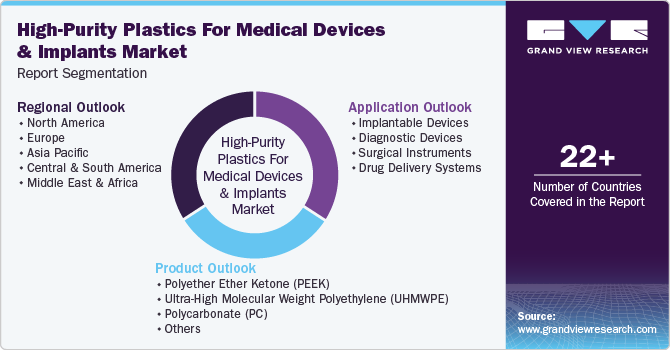

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented high-purity plastics for medical devices and implants market report on the basis of product, application, and region:

-

Product Outlook (Revenue, USD Million; Volume, Kilotons; 2018 - 2030)

-

Polyether Ether Ketone (PEEK)

-

Ultra-High Molecular Weight Polyethylene (UHMWPE)

-

Polycarbonate (PC)

-

Others

-

-

Application Outlook (Revenue, USD Million; Volume, Kilotons; 2018 - 2030)

-

Implantable Devices

-

Diagnostic Devices

-

Surgical Instruments

-

Drug Delivery Systems

-

-

Regional Outlook (Revenue, USD Million; Volume, Kilotons; 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

Saudi Arabia

-

South Africa

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global high-purity plastics for medical devices and implants market size was estimated at USD 3.11 billion in 2024 and is expected to reach USD 3.38 billion in 2025.

b. The global high-purity plastics for medical devices and implants market is expected to grow at a compound annual growth rate of 9.68% from 2025 to 2030 to reach USD 5.37 billion by 2030.

b. Implantable Devices dominated the high-purity plastics for medical devices & implants market across the application segmentation in terms of revenue, accounting for a market share of 47.91% in 2024. The rising integration of smart and bioactive polymer technologies in implantable medical devices is fueling significant growth in this segment.

b. Some key players operating in the high-purity plastics for medical devices and implants market include Honeywell International Inc., Teijin Limited, Toyobo Co., Ltd., Celanese Corporation, LyondellBasell Industries, Braskem S.A., Fiber-Line (Avient Corporation), Hangzhou Impact New Materials Co., Ltd., Jiaxing Doshine New Material Co., Ltd., and ChangQingTeng High Performance Fiber Material Co.,Ltd.

b. The increasing use of 3D printing in medical device manufacturing is driving demand for high-purity plastics, as these materials enable precise, customized implants with superior biocompatibility. Additionally, advancements in antimicrobial polymers are boosting adoption in surgical tools and implant coatings to reduce infection risks.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."