High Purity Methane Gas Market Size, Share & Trends Analysis Report By Transportation (Cylinders, Bottles), By End Use (Automotive & Transportation, Oil & Gas, Chemicals), By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-446-9

- Number of Report Pages: 98

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Bulk Chemicals

High Purity Methane Gas Market Trends

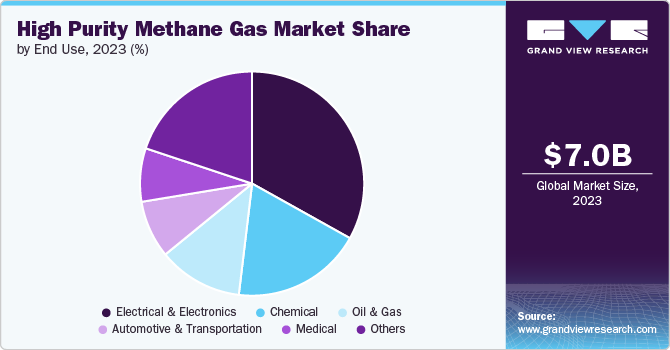

The global high purity methane gas market size was valued at USD 7.04 billion in 2023 and is projected to grow at a CAGR of 5.2% from 2024 to 2030. The demand for high purity methane gas is primarily driven by its critical applications across various industries, particularly in the electronics, semiconductors, and pharmaceuticals sectors. As these industries continue to expand, the need for ultra-pure gases that can ensure contamination-free processes becomes increasingly vital.

High purity methane, often exceeding 99.999% purity, is essential for applications such as chemical synthesis, radiation detection, and the production of advanced materials like solar cells and photoconductors. This growing reliance on high purity methane for precision manufacturing and research is propelling market growth, with projections indicating a significant increase in market value over the coming years.

The trend towards industrialization and technological advancement is further fueling the high purity methane market. As countries modernize their manufacturing capabilities and invest in cutting-edge technologies, the demand for high purity gases is expected to rise. The automotive sector, particularly with the push for electric vehicles, also contributes to this demand as manufacturers seek cleaner and more efficient production processes. Overall, the combination of expanding industrial applications and the need for stringent quality standards in production processes positions high purity methane gas as a key component in the ongoing evolution of various high-tech industries.

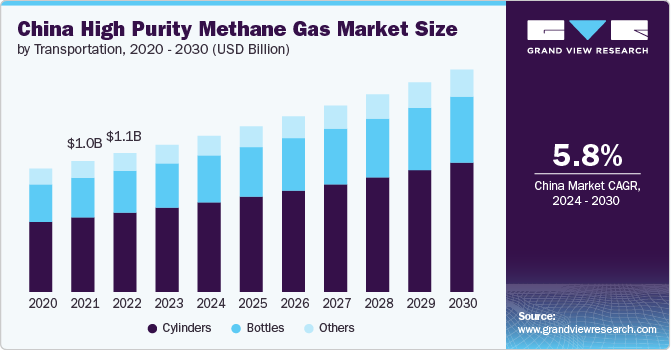

Moreover, the increasing focus on technological advancements and the transition towards renewable energy sources are key factors propelling the high purity methane market in China. The automotive sector, particularly with the rise of natural gas vehicles (NGVs), is contributing to this trend as manufacturers seek cleaner fuels to meet stringent emission standards.

Transportation Insights

Cylinder dominated the market with a revenue share of 53.3% in 2023. The transportation of high purity methane gas in cylinders and bottles is a critical aspect of ensuring safety and maintaining the integrity of the gas during transit. Given the highly flammable nature of methane, it is essential to adhere to strict safety protocols and regulations.

Cylinders must be designed to withstand high pressures and are typically equipped with protective caps to prevent accidental release of gas. Proper ventilation in transport vehicles is also crucial, as increased temperatures can elevate pressure within the cylinders, posing safety risks. Additionally, personnel involved in the transportation process must be trained in handling hazardous materials and equipped with appropriate personal protective equipment (PPE) to mitigate risks during loading, unloading, and transit.

Moreover, logistical considerations play a significant role in the effective transportation of high purity methane. This includes planning delivery routes that avoid obstacles and comply with local regulations regarding the movement of hazardous materials. Companies must also ensure that all necessary permits are obtained and that drivers are aware of the specific requirements for transporting gas cylinders.

Implementing a robust transportation plan not only enhances safety but also ensures timely delivery to customers, which is vital for industries relying on high purity methane for their operations. By prioritizing safety and efficiency in the transportation of methane gas, companies can effectively support the growing demand for this essential industrial resource.

End Use Insights

Electrical & electronics end use dominated the market with a revenue share of 33.1% in 2023. The electrical and electronics industry is a significant consumer of high purity methane gas, primarily due to the increasing complexity of electronic devices and the demand for advanced manufacturing processes. High purity methane is essential in the production of semiconductors, where it is used as a precursor in chemical vapor deposition (CVD) processes.

In the automotive and transportation sectors, high purity methane is increasingly recognized as a viable alternative fuel, particularly in the form of compressed natural gas (CNG). The push for cleaner fuels to reduce greenhouse gas emissions has led to a growing adoption of methane as a fuel source for vehicles.

Additionally, high purity methane is utilized in the production of hydrogen through steam methane reforming, which is gaining traction as a clean energy solution for fuel cell vehicles. As governments implement stricter emissions regulations and promote sustainable transportation options, the demand for high purity methane in this sector is expected to rise significantly.

The oil and gas industry also plays a crucial role in the high purity methane market. Methane is a primary component of natural gas, and its high purity is essential for various applications, including enhanced oil recovery and as a feedstock for chemical synthesis.

Region Insights

Asia Pacific dominated the market segment with a revenue share of 37.40% in 2023. The Asia Pacific market is experiencing robust growth, driven by several key trends that reflect the region's industrial evolution and technological advancements. One of the primary factors contributing to this growth is the increasing demand from the electronics and semiconductor industries.

The high purity methane gas market in China is witnessing significant growth, driven by the rapid expansion of the electronics and semiconductor industries. As China continues to solidify its position as a global manufacturing hub, the demand for high purity gases, including methane, is surging.

North America High Purity Methane Gas Market Trends

The region accounted for the largest share of the global market in 2023, with significant consumption in the production of semiconductors and electronic components. High purity methane is essential for processes such as chemical vapor deposition (CVD), which is critical for manufacturing integrated circuits and other electronic devices.

Europe High Purity Methane Gas Market Trends

The European market puts a strong emphasis on sustainability and environmental regulations. The European Union has implemented stringent policies aimed at reducing greenhouse gas emissions, which is driving the automotive sector to adopt cleaner fuel alternatives.

Key High Purity Methane Gas Company Insights

Some of the key players operating in the market include

-

AGT International, headquartered in Zurich, Switzerland, is a prominent technology company focused on revolutionizing public safety and security through innovative solutions. Founded in 2007 by CEO Mati Kochavi, AGT International employs over 2,400 people globally and is recognized for delivering some of the world's largest and most sophisticated public safety projects.

-

Air Liquide S.A. is a global leader in gases, technologies, and services for the industrial and healthcare sectors. Founded in 1902 by Georges Claude and Paul Delorme, the company is headquartered in Paris, France. Air Liquide operates in over 70 countries and employs approximately 67,800 people, serving more than 4 million customers worldwide.

Key High Purity Methane Gas Companies:

The following are the leading companies in the high purity methane gas market. These companies collectively hold the largest market share and dictate industry trends.

- Advanced Specialty Gases

- AGT International

- Air Liquide S.A.

- American Welding & Gas

- Axcel Gases

- Bhuruka Gases Limited.

- Chemix Gases

- Chengdu Taiyu Industrial Gases Co., Ltd.

- Cryocarb

- Electronic Fluorocarbons LLC

- Gas Innovation

- Linde plc

- Matheson Tri-Gas, Inc.

- Messer Group GmbH

- Middlesex Gases & Technologies

- Taiyo Nippon Sanso India

Recent Developments

-

In March 2024, The International Energy Agency (IEA) has released a new analysis indicating that fully implementing existing methane reduction pledges could significantly contribute to the emissions cuts necessary to align with the 1.5 °C climate target. The analysis highlights that if all current commitments from countries and companies are realized, methane emissions from fossil fuels could be reduced by 50% by 2030.

High Purity Methane Gas Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2024 |

USD 7.40 billion |

|

Revenue forecast in 2030 |

USD 10.04 billion |

|

Growth rate |

CAGR of 5.2% from 2024 to 2030 |

|

Historical data |

2018 - 2023 |

|

Forecast period |

2024 - 2030 |

|

Quantitative units |

Revenue in USD million/billion and CAGR from 2024 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Transportation, end use, region |

|

Regional scope |

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa |

|

Country scope |

U.S.; Canada; Mexico; Germany; UK; Italy; France; Spain; China; India; Japan; South Korea; Brazil; Argentina; South Africa; Saudi Arabia |

|

Key companies profiled |

Advanced Specialty Gases; AGT Internationa; Air Liquide S.A.; American Welding & Gas; Axcel Gases; Bhuruka Gases Limited; Chemix Gases; Chengdu Taiyu Industrial; Gases Co., Ltd.; Cryocarb; Electronic; Fluorocarbons LLC; Gas Innovation; Linde plc; Matheson Tri-Gas, Inc.; Messer Group GmbH; Middlesex Gases & Technologies; Taiyo Nippon Sanso India |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global High Purity Methane Gas Market Report Segmentation

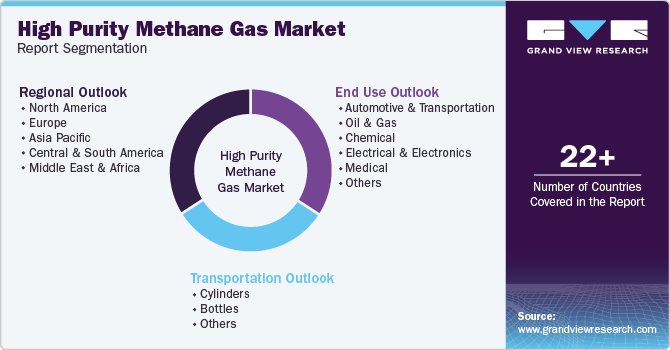

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global high purity methane gas market report based on transportation, end use, and region:

-

Transportation Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Cylinders

-

Bottles

-

Others

-

-

End Use Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Automotive & Transportation

-

Oil & Gas

-

Chemical

-

Electrical & Electronics

-

Medical

-

Others

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East and Africa

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global high purity methane gas market was valued at USD 7.04 billion in 2023 and is projected to reach USD 10.04 billion by 2030.

b. The global high purity methane gas market is expected to grow at a compound annual growth rate of 5.2% from 2024 to 2030.

b. Asia Pacific dominated the market segment with a revenue share of 37.40% in 2023. The Asia Pacific high purity methane gas market is experiencing robust growth, driven by several key trends that reflect the region's industrial evolution and technological advancements. One of the primary factors contributing to this growth is the increasing demand from the electronics and semiconductor industries.

b. Some key players operating in the high purity methane gas market include Advanced Specialty Gases, AGT Internationa, Air Liquide S.A., American Welding & Gas, Axcel Gases, Bhuruka Gases Limited., Chemix Gases, Chengdu Taiyu Industrial, Gases Co., Ltd., Cryocarb, Electronic, Fluorocarbons LLC, Gas Innovation, Linde plc, Matheson Tri-Gas, Inc., Messer Group GmbH, Middlesex Gases & Technologies, Taiyo Nippon Sanso India

b. Key factors that are driving the market growth include to the demand for high purity methane gas is primarily driven by its critical applications across various industries, particularly in the electronics, semiconductors, and pharmaceuticals sectors.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."