- Home

- »

- Consumer F&B

- »

-

High Protein Flour Market Size, Share, Growth Report, 2030GVR Report cover

![High Protein Flour Market Size, Share & Trends Report]()

High Protein Flour Market (2025 - 2030) Size, Share & Trends Analysis Report By Type (Bleached, Unbleached), By Source, By End-user, By Distribution Channel (Food & Beverages), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-406-5

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

High Protein Flour Market Summary

The global high protein flour market size was estimated at USD 15.70 billion in 2024 and is projected to reach USD 28.93 billion by 2030, growing at a CAGR of 10.8% from 2025 to 2030. The growth can be attributed to the increasing health consciousness among consumers, rise of plant-based diets, globalization of diets and technological advancements in milling processes.

Key Market Trends & Insights

- The high protein flour market in North America captured a revenue share of 32.6% in 2023.

- Asia Pacific high protein flour market is expected to grow with a CAGR of 12.3% during 2024 to 2030.

- In 2023, high protein flour market in Europe is anticipated to grow with a CAGR of 10.7% during 2024 to 2030.

- Based on type, bleached high protein flour accounted for a revenue share of 70.54% in 2023.

- In terms of source, the wheat based high protein flour held a market share of 85.49% in 2023.

Market Size & Forecast

- 2024 Market Size: USD 15.70 Billion

- 2030 Projected Market Size: USD 28.93 Billion

- CAGR (2025-2030): 10.8%

- North America: Largest market in 2023

The high protein flour market robust growth is fueled by the escalating health consciousness among consumers. As individuals become more aware of the benefits of a balanced diet and the importance of protein in muscle growth, repair, and overall wellness, they are actively seeking out food products that are rich in protein. High protein flours, sourced from various high-protein grains and legumes such as wheat, chickpeas, and lentils, are increasingly becoming the preferred choice for health-conscious consumers. These flours offer a valuable source of protein without the additional fats and sugars often associated with processed foods, perfectly aligning with the growing trend towards clean eating and natural ingredients. This shift in consumer preferences is significantly expanding the market for high protein flours in a wide range of food applications, from baking to pasta making, reflecting the market's responsiveness to evolving dietary demands. According to a 2021 survey by Kerry, 50% of consumers link protein to a healthy diet, while 46% associate it with a “healthy lifestyle.”

The market is also witnessing a notable surge due to the growing popularity of plant-based diets. As more individuals opt for plant-centric lifestyles due to health, environmental, and ethical considerations, the demand for plant-based protein sources is on the rise. High protein flours are gaining traction as they offer a viable and sustainable protein alternative to animal-based products. These flours are not only rich in protein but are also gluten-free, making them suitable for a wide range of dietary needs and preferences. According to UMN survey published in 2022, the interest in plant-based protein is on the rise, with 31% of consumers indicating that they plan to increase their consumption of plant protein over the next five years. This trend underscores the market's adaptability to changing consumer dietary patterns and the increasing demand for healthier and more environmentally friendly food options.

Furthermore, the globalization of diets and food trends is significantly contributing to the expansion of the high protein flour market, as people around the world increasingly adopt diverse eating habits, influenced by international food trends. This phenomenon has popularized the incorporation of plant-based proteins into daily diets, with health-conscious consumers seeking out alternatives that offer nutritional benefits beyond traditional wheat flour. The rise of veganism, vegetarianism, and flexitarian lifestyles, coupled with a growing awareness of the environmental impact of food choices, has fueled the demand for high protein flours.

These flours not only cater to specific dietary preferences and restrictions but also align with global trends towards healthier and more sustainable eating practices. As a result, food manufacturers are innovating and diversifying their product lines to include high protein flours, which are now commonly found in a wide range of food products, from bakery items to pasta and snacks, catering to the evolving tastes and nutritional needs of a global audience. For instance, in January 2024, Plento announced that it is set to launch nutrient-dense snacks made from pea protein and cricket flour, a high protein flour in South Korea.

Moreover, advancements in milling technology have significantly bolstered the market by enabling the production of flours with enhanced protein content and superior nutritional profiles. These innovations ensure higher extraction rates, minimal nutrient loss, and improved flour quality, meeting the growing consumer demand for healthier, plant-based alternatives. As a result, food manufacturers are increasingly adopting these state-of-the-art milling processes to expand their offerings and tap into the expanding market for high protein flours. For instance, in July 2024, Akij Resource, a leading industrial conglomerate in Bangladesh, inaugurated a cutting-edge flour mill through its subsidiary, Akij Essentials Ltd. The facility is equipped with advanced technology and machinery sourced from the Swiss firm Buhler and boasts a production capacity of 600 tons per day.

Type Insights

Bleached high protein flour accounted for a revenue share of 70.54% in 2023.The demand for bleached high protein flour is predominantly driven by its widespread use in commercial baking and food manufacturing sectors. Bleached flour, with its finer texture and whiter appearance, is preferred for products where visual appeal is crucial, such as in pastries, cakes, and bread where a lighter color and softer texture are desired. Its extended shelf life, due to processing, also makes it a favored choice for large-scale operations. In March 2023, Ardent Mills introduced a new flour collection called BakeHaven, specifically designed for private label manufacturers. The BakeHaven collection includes a variety of wheat flours such as all-purpose bleached and unbleached flours, self-rising flour, whole wheat flour, bread flour, and a keto-friendly blend. In addition, it offers gluten-free specialty flours such as high protein almond flour and coconut flour.

Unbleached high protein is expected to witness a CAGR of 11.9 % during 2024 to 2030. The demand for unbleached high protein flour is primarily driven by increasing consumer awareness about the health benefits of whole grains and minimally processed foods. Consumers are increasingly seeking out products that are free from chemicals and additives, which has led to a preference for unbleached flour. In addition, the rise in the popularity of artisanal and homemade baking further fuels this demand, as unbleached high protein flour is favored for its ability to enhance the flavor and texture of baked goods. For instance, in April 2021, the Australian family-owned Manildra Group expanded its The Healthy Baker range by introducing high protein muffin and pancake premixes. The Protein Pancake Mix offers 15 grams of protein per serving, while The Protein Muffin Base Mix provides 10 grams of protein per serving.

Source Insights

The wheat based high protein flour held a market share of 85.49% in 2023. The trend towards gluten-free alternatives has created a market for high protein wheat flour blends that mimic the texture and taste of traditional wheat products. Moreover, the stable supply chain and cost-effectiveness of wheat as a staple crop ensure that high protein flour remains accessible and affordable to a broad consumer base.

The non- wheat based high protein flour is anticipated to grow with a CAGR of 10.9% during 2024 to 2030. The growth of the non-wheat based high protein flour market is driven by the increasing demand for gluten-free and alternative grain products due to rising health consciousness among consumers. In addition, innovations in food technology that enhance the nutritional profile of non-wheat flours, along with a surge in fitness trends promoting protein-rich diets, further propel this market segment. For instance, in March 2020, Doves Farm introduced its Organic Coconut Flour, a high in protein product crafted from the finest organic and sustainably sourced coconuts from Sri Lanka. The flour is designed to cater to a variety of baking needs, making it an excellent choice for health-conscious consumers and those seeking gluten-free alternatives.

End-user Insights

Food and beverages held a revenue share of 54.04% in 2023 and is anticipated to witness a CAGR of 11.1% during 2024 to 2030. The surge in demand for high protein flour within the food and beverage industry, particularly in bakery, dairy, and confectionary sectors, is primarily fueled by evolving consumer preferences towards healthier eating and lifestyle trends. Health-conscious consumers are increasingly seeking out food products that are nutrient-dense, particularly high in protein, for benefits such as muscle health and weight management. This has prompted food manufacturers to innovate, integrating high protein flours into a variety of products to improve texture, structure, and nutritional value, thereby catering to the growing market for health-focused foods.

Household is expected to grow with a CAGR of 10.0 % during 2024 to 2030. The growth of high protein flour in the retail industry is driven by health-conscious consumers seeking nutrient-dense foods, the rise of specialized diets such as gluten-free and vegan, and the food industry's innovation in creating new products that cater to these trends. Retailers, responding to market demands, are expanding their offerings to include a variety of high protein flour options, thus meeting the needs of a diverse customer base. For instance in April 2021, Cascade Organic Flour launched a retail line featuring its organic flour products. The first product in this line is 5 lb. bags of high protein, Natural Organic Whole Wheat Flour.

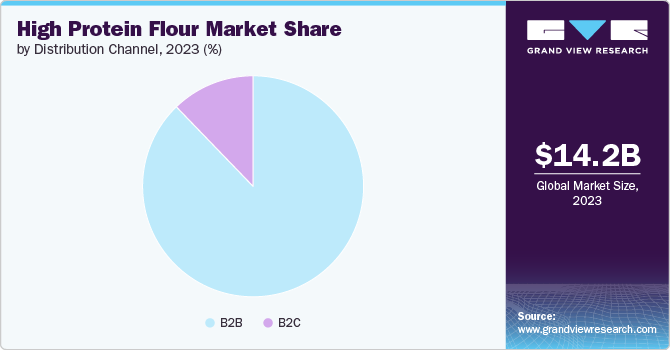

Distribution Channel Insights

The B2B distribution channel for high protein flour accounted for revenue share of 87.78% in 2023 and is expected to witness a CAGR of 10.8% during 2024 to 2030. The growing health consciousness among consumers has led to an increased demand for protein-rich products, driving bakeries and food manufacturers to seek high protein flour to meet these preferences. In addition, the expanding global food processing industry demands high-quality ingredients, with high protein flour being essential for creating value-added products.

B2C distribution of high protein flour is expected to grow with a CAGR of 10.0 % during 2024 to 2030. The distribution is driven by increasing consumer awareness about health and nutrition, leading to higher demand for protein-rich diets. In addition, the availability of e-commerce platforms and direct-to-consumer sales channels has significantly enhanced accessibility and convenience, further boosting the market penetration of such products.

Regional Insights

The high protein flour market in North America captured a revenue share of 32.6% in 2023. The presence of major food processing companies and the increasing demand for gluten-free and organic products contribute to the market's growth. Consumer awareness about the benefits of high protein diets, coupled with the region's high purchasing power, also supports the expansion of this market segment.

U.S. High Protein Flour Market Trends

The high protein flour market in the U.S. accounted for a notable revenue share in 2023. The flour market growth is fueled by rising health consciousness, fitness trends emphasizing protein intake, and effective marketing strategies that promote protein-rich diets. Robust distribution networks also significantly contribute to market expansion.

Asia Pacific High Protein Flour Market Trends

Asia Pacific high protein flour market is expected to grow with a CAGR of 12.3% during 2024 to 2030. The high protein flour market is propelled by growing health consciousness and the increasing popularity of protein-centric diets among the burgeoning middle class. Urbanization and changing lifestyles have also contributed to a higher demand for ready-to-eat and convenience foods that incorporate high protein flours. Moreover, the presence of large-scale agricultural production in countries such as China and India facilitates the availability of protein-rich grain sources.

Europe High Protein Flour Market Trends

In 2023, high protein flour market in Europe is anticipated to grow with a CAGR of 10.7% during 2024 to 2030. The high protein flour market in Europe is fueled by increasing consumer demand for health and wellness products and the rise of plant-based diets. In addition, innovations in food technology that enhance the nutritional profile of baked goods and a shift towards clean label products are further propelling market growth.

Key High Protein Flour Company Insights

Key market players such as General Mills, King Arthur Baking Company, Inc., Miller Milling Company, Archer Daniels Midland, Central Milling, and Ardent Mills among others contribute significantly to the innovation and growth of the market through their extensive product offerings, innovative approaches, and strong market presence.

Key High Protein Flour Companies:

The following are the leading companies in the high protein flour market. These companies collectively hold the largest market share and dictate industry trends.

- Archer Daniels Midland (ADM)

- General Mills

- Ardent Mills

- King Arthur Flour Company

- Doves Farm Foods

- Bob’s Red Mill Natural Foods

- Bay State Milling Company

- Great River Organic Milling

- Central Milling

- Miller Milling Company

Recent Developments

-

In May 2024, Hamburg-based GoodMills Innovation launched a new product known as SMART Wheat high-protein flour. The cutting-edge flour aims to tackle the issues related to quality inconsistencies commonly found in traditional wheat flour.

-

In February 2024, Amfora, a company focused on innovative food ingredients, launched its first commercial products. The highlight of this launch is its soy flour, which boasts an impressive protein content of over 60 percent. This high-protein soy flour is designed to cater to the growing demand for plant-based protein sources in various food applications.

High Protein Flour Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 17.36 billion

Revenue forecast in 2030

USD 28.93 billion

Growth rate

CAGR of 10.8% from 2025 to 2030

Actual data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion, and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, source, end-user, distribution channel, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada, Mexico; UK; Germany; France; Italy; Spain; China; Japan; India; Australia & New Zealand; South Korea; Brazil; South Africa

Key companies profiled

Archer Daniels Midland (ADM); General Mills; Ardent Mills; King Arthur Flour Company; Doves Farm Foods; Bob’s Red Mill Natural Foods; Bay State Milling Company; Great River Organic Milling; Central Milling; Miller Milling Company

Customization scope

Free r Report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options. Global High Protein Flour Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the global high protein flour market report based on type, source, end-user, distribution channel, and region:

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Bleached

-

Unbleached

-

-

Source Outlook (Revenue, USD Million, 2018 - 2030)

-

Wheat Based

-

Non-wheat Based

-

-

End-user Outlook (Revenue, USD Million, 2018 - 2030)

-

Food & Beverages

-

Animal Feed

-

Household

-

Foodservice

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

B2B

-

B2C

-

Hypermarkets & Supermarkets

-

Specialty Stores

-

Online

-

Others

-

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia & New Zealand

-

South Korea

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global high protein flour market size was estimated at USD 14.22 billion in 2023 and is expected to reach USD 15.70 billion in 2024.

b. The global high protein flour market is expected to grow at a compounded growth rate of 10.7% from 2024 to 2030 to reach USD 28.93 billion by 2030.

b. North America held a market share of 32.6% in 2023. The presence of major food processing companies and a well-established distribution network facilitate easy access to high protein flour products boosting the market growth.

b. Some key players operating in the market include Archer Daniels Midland (ADM); General Mills; Ardent Mills; King Arthur Flour Company; Doves Farm Foods; Bob’s Red Mill Natural Foods; Bay State Milling Company; Great River Organic Milling; Central Milling; Miller Milling Company

b. The growth can be attributed to the increasing health consciousness among consumers, rise of plant-based diets, globalization of diets and technological advancements in milling processes.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.