High Potency API Contract Manufacturing Market Size, Share & Trends Analysis Report By Product (Innovative, Generic), By Dosage Form (Injectable, Creams), By Application, By Synthesis, By Region, And Segment Forecasts, 2025 - 2030

- Report ID: GVR-4-68039-970-5

- Number of Report Pages: 130

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Healthcare

Market Size & Trends

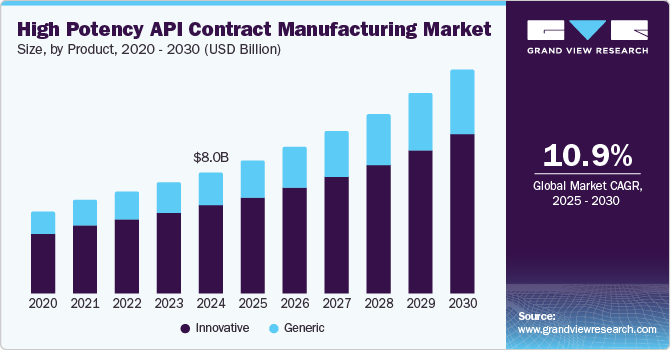

The global high potency API contract manufacturing market size was estimated at USD 8.05 billion in 2024 and is projected to grow at a CAGR of 10.98% from 2025 to 2030. The market growth is mainly due to the increasing prevalence of chronic diseases such as cancer, which is increasing demand for targeted drugs and therapies. Moreover, advancements in high potency API manufacturing technologies, coupled with growing demand for effective treatments to improve patient outcomes, have led to a surge in the development of HPAPIs, thereby driving market growth.

Furthermore, growing research and development activities, coupled with increasing investments by pharmaceutical companies, are also accelerating the development of high-potency APIs (HPAPIs). These compounds are crucial for creating therapies that target specific cancer pathways, making them more effective and less toxic. These factors have heightened the focus on specialized treatment options, resulting in more HPAPIs entering the development pipeline, further contributing to market growth. According to an article published by Wiley in September 2024, high-potency compounds are crucial in the pharmaceutical landscape, primarily due to the oncology sector. Around 40%-50% of drugs currently in development are targeting cancer, with 75% of these being high potency. This highlights the need for contract manufacturing organizations to have the expertise and infrastructure to manage highly potent compounds.

Regulators worldwide are placing greater emphasis on the design of facilities for multi-product processes involving high-potency APIs (HPAPIs) to minimize the risk of cross-contamination. This trend has led to stricter validation and cleaning requirements for contract developers, which many companies are addressing by adopting single-use systems and technologies. In addition, contract manufacturers are increasingly expected to implement engineering controls rather than solely relying on Personal Protective Equipment (PPE) and standard work practices to reduce exposure to HPAPIs. These regulatory changes have significantly boosted the production of HPAPIs among contract manufacturers, thereby driving growth in the industry

In addition, the growing focus of market players to invest and expand their service offerings in various locations is further driving the market growth. For instance, in October 2024, Piramal Pharma Limited announced to invest USD 80 million to expand its Kentucky facility. This site focuses on sterile compounding, liquid filling, and lyophilization for sterile injectable drug products. Thus, increasing investments by the market players to develop effective treatment options would also boost the demand for high-potency APIs in the coming years.

Product Insights

The innovative segment dominated the market with a share of 72.4% in 2024. The segment's growth is mainly due to increasing R&D initiatives for developing novel therapeutic treatment options coupled with increasing government support. Innovative drugs are transforming the pharmaceutical landscape, particularly in the treatment of complex diseases like cancer and rare disorders. Furthermore, the strong drug pipeline of leading pharmaceutical companies and increasing investments in pharmaceutical R&D are expected to drive segment growth during the forecast period. According to an article from Contract Pharma, the demand for HPAPI molecules is projected to rise significantly, fueled by the expanding pipeline of cancer drugs and therapies for autoimmune diseases.

The generic segment is projected to witness considerable growth during the forecasted period owing to the increasing demand for biopharmaceutical therapies and the rising number of patent expirations for blockbuster drugs. In addition, the growing trend of pharmaceutical companies opting for single-partner collaborations for HPAPI manufacturing and development services is driving growth in the generic segment. By partnering with contract manufacturing organizations that offer comprehensive services, companies can streamline their drug development processes, reduce costs, and shorten time to market. This collaborative approach not only improves operational efficiency but also allows pharmaceutical companies to focus on their core competencies while leveraging the expertise of CMOs in handling high potency APIs.

Application Insights

The oncology segment dominated the market in 2024 and is projected to witness significant growth during the forecast period. The segment growth is mainly due to the increasing cases of cancer globally coupled with increasing product pipelines by the market players. According to the data published in 2023 by Lonza, 30% of new molecular entity (NME) approvals for small molecules by the FDA are focused on oncology. In addition, within the oncology market, small molecules account for over 60% of FDA NME approvals, with about 90% of these being administered orally. Thus, the aforementioned factors are contributing to the segment’s market growth.

The glaucoma segment is projected to witness lucrative growth in the coming years owing.to high prevalence of glaucoma in both developed and emerging economies. According to the data published by Botshilu Hospital in March 2024, approximately 80% of the people have glaucoma globally out of which 50% of the individuals with glaucoma are unaware that they have the disease. Thus, the rapidly growing condition has attracted several researchers to conduct clinical studies in this therapeutic area, further boosting the demand for HPAPIs.

Synthesis Insights

The synthetic segment dominated the market in 2024 owing to the advancements in synthetic chemistry and manufacturing technologies that have enhanced the efficiency and scalability of production processes. Innovations such as automated synthesis, continuous manufacturing, and improved analytical techniques have streamlined the development of synthetic high potency APIs, making it easier for manufacturers to meet regulatory requirements and market demands. This has further solidified the synthetic segment's position in the market.

Biotech segment is projected to witness fastest growth in the coming years owing.to advancements in technology and the high potency of these compounds. The majority of biotech high-potency active pharmaceutical ingredients (HPAPIs) are produced using molecular methods, such as recombinant DNA technology. This segment is extremely lucrative, attracting numerous large players due to the significant revenue potential associated with biotech-related APIs.

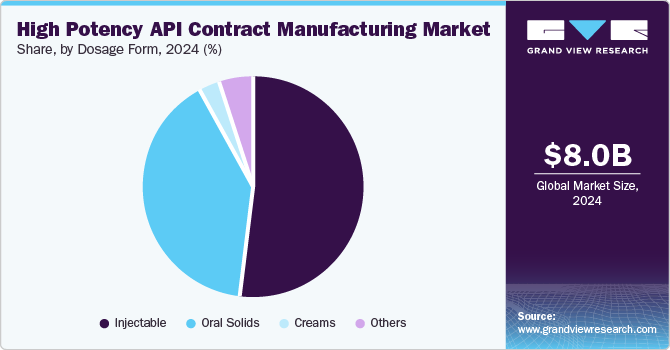

Dosage Form Insights

The injectables segment dominated the market in 2024 owing to rapid delivery of HPAPI to the target location. They can be delivered as either subcutaneous (in the fat layer), intradermal (between the layer of the skin), or intramuscular (in the muscle). In addition, several developments by the market players is further contributing to the segment’s market growth. For instance, in March 2024, CordenPharma announced to expand its early clinical peptide manufacturing capabilities to launch an integrated offering that includes IND-targeted peptide APIs and injectable drug products. This integration allows for more efficient transitions from early-stage development to clinical trials, reducing timelines and accelerating the time to market for new therapies. Thus, constant developments by the market players in this segment would contribute to the high potency API contract manufacturing market growth.

The oral segment is projected to witness fastest growth in the coming years owing to reduced time and costs as well as decreasing cross-contamination. In addition, manufacturing oral solids helps in improving the safety of the operator by reducing the potential exposure and increasing fill speeds. Moreover, oral solids are much more patient-centric as these are a very convenient method of drug delivery, thus leading to greater demand for this dosage type. Hence, the aforementioned factors are anticipated to support the segment's growth.

Regional Insights

North America high potency API contract manufacturing market dominated globally with a market share of 38.0% in 2024. The growth in the region is attributed to the fact that approximately 40% of new chemical entity manufacturing is outsourced to large contract manufacturers in developed regions, particularly North America. This region is a leader in contract development, especially for high potency drug engineering, resulting in a substantial volume of projects being directed to the U.S. Furthermore, the stringent regulatory requirements surrounding manufacturing and product quality are expected to create additional growth opportunities for contract manufacturing services, especially in the U.S., where compliance with these standards is critical for success.

U.S. High Potency API Contract Manufacturing Market Trends

The high potency API contract manufacturing market in the U.S. is projected to be driven by significant investments by pharmaceutical companies and growing research and development activities in the country. Moreover, increasing demand for oncology therapies is also contributing to the country’s market growth. As the prevalence of cancer continues to rise, pharmaceutical companies are focusing on developing targeted therapies that require high potency APIs. This trend is driving contract manufacturers to enhance their capabilities and invest in specialized processes to produce these potent compounds safely and efficiently.

Europe High Potency API Contract Manufacturing Market Trends

The high potency API contract manufacturing market in Europe is anticipated to witness lucrative growth over the projected period. The growth is due to the expansion of outsourcing activities among pharmaceutical companies. Several companies are entering into a partnership and collaboration agreement with contract manufacturers that offer expertise in high potency API production. By outsourcing, companies can reduce operational costs, enhance production flexibility, and access advanced manufacturing technologies. This trend is contributing to the growth of the contract manufacturing market across the region.

The high potency API contract manufacturing market in the UK is anticipated to experience considerable growth over the forecast period. The UK operates under a rigorous regulatory framework that oversees the manufacturing and quality of high potency APIs. Thus, with the more stringent regulation, contract manufacturers are required to invest in robust quality assurance and compliance systems. This trend not only increases the operational costs for manufacturers but also emphasizes the importance of partnering with outsourcing organizations that follows proper regulatory compliance and ensures that products meet the highest standards of safety and efficacy.

The high-potency API contract manufacturing market in Germany is expected to grow at a considerable rate over the forecast period. Technological advancements are significantly shaping the landscape of the market in the country. Innovations such as continuous manufacturing, single-use systems, and enhanced containment technologies are improving the efficiency and safety of high potency API production. These advancements have facilitated compliance with stringent regulatory standards and has enhanced the overall quality of the products.

Asia Pacific High Potency API Contract Manufacturing Market Trends

Asia Pacific high potency API contract manufacturing market is expected to grow at the fastest CAGR over the forecast period. The growth can be attributed to the increasing scope of opportunities, especially in Japan, China, and India. Factors, such as an improved regulatory framework, high scope for cost savings, increased risk management capabilities, and a robust drug pipeline, is expected to augment the region’s growth in the years to come. Furthermore, the availability of a skilled workforce at lower costs than in developed economies, such as the U.S., is anticipated to propel the regional market’s growth further.

The high potency API contract manufacturing market in China is projected to witness significant growth in the coming years owing to the increasing demand for biopharmaceuticals. Pharmaceutical companies in the country are increasing their focus on developing innovative therapies, particularly in oncology and chronic diseases. Thus, these factors are boosting the demand for high potency APIs. This trend is prompting contract manufacturers to enhance their production capabilities and invest in specialized technologies to meet the rising demand for complex biologics.

Japan high potency API contract manufacturing market is expected to witness lucrative growth over the forecast period. Regulatory compliance, technological advancements, strong R&D capabilities, skilled workforce, strategic location, and favorable government initiatives are expected to create lucrative growth opportunities. The Global Health Innovative Technology (GHIT) Fund represents Japan’s inaugural Public-Private Partnership (PPP) dedicated to advancing the R&D and commercialization of novel medical solutions, such as drugs & vaccines, to combat the prevalent diseases in developing nations. Thus, increasing investments and initiatives by government and market players are contributing to the country’s market growth.

The high potency API contract manufacturing market in India is poised to grow in the coming years. Low labor costs, improvements in healthcare infrastructure, and easy availability of technical expertise are expected to be some of the major factors propelling market growth over the forecast period. Moreover, the increase in government funding for research & development (R&D) to accelerate new product development is expected to make India one of the highly favored locations for establishing manufacturing services.

MEA High Potency API Contract Manufacturing Market Trends

The MEA high potency API contract manufacturing market is projected to grow at a lucrative rate over the forecast period. Growth in the region can be attributed to rising incidence of chronic diseases. Furthermore, improvements in government initiatives, regulations for the production of APIs, and changes in geopolitical developments are expected to propel the MEA market.

The high potency API contract manufacturing market in Saudi Arabia is projected to witness the fastest CAGR owing to the growing awareness about the benefits of effective pharmaceutical solutions and rising investments in R&D. The pharmaceutical industry in Saudi Arabia is expected to gain substantial benefits over the forecast period due to rising prevalence of diseases, presence of CMOs, and the growing number of clinical trials.

Key High Potency API Contract Manufacturing Company Insights

Key players operating in the high potency API contract manufacturing industry are undertaking various initiatives to strengthen their market presence and increase the reach of their services. Companies such as Piramal Pharma Solutions; Lonza, Catalent, Inc. are continuously involved in expanding their facilities, collaborating, and engaging in partnerships, mergers, and acquisitions of companies. These are key strategic initiatives that are influencing the industry dynamics. For instance, in September 2024, Lonza announced the launch of the Innovaform Accelerator, an innovation and formulation center located in France. The new facility will function as a center of excellence dedicated to the development and innovation of capsule-based manufacturing and delivery solutions for both oral and pulmonary administration.

Key High Potency API Contract Manufacturing Companies:

The following are the leading companies in the high potency API contract manufacturing market. These companies collectively hold the largest market share and dictate industry trends.

- Piramal Pharma Solutions

- Lonza

- Catalent, Inc.

- VxP Pharma, Inc.

- Pfizer CentreOne

- Gentec Pharmaceutical Group

- AbbVie

- Aurigene Pharmaceutical Services Ltd.

- CordenPharma International

- Curia Global, Inc.

Recent Developments

-

n July 2024, Pfizer opened its expanded, highly automated active pharmaceutical ingredient (API) manufacturing facility in Singapore. The facility aims to develop antibiotics and small molecules for Pfizer’s oncology, pain, and antibiotic medications.

-

In June 2024, Aurigene Pharmaceutical Services Limited opened a biologics facility in Hyderabad, India. This facility is designed to support customers with process and analytical development and small-scale manufacturing of antibodies and other recombinant proteins for preclinical and early-phase clinical needs.

-

In February 2024, AbbVie strengthened its manufacturing capabilities by investing USD 223 million in an expansion of its Singapore manufacturing facility. This will further strengthen the company’s position in the Asia Pacific region.

High Potency API Contract Manufacturing Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2025 |

USD 8.83 billion |

|

Revenue forecast in 2030 |

USD 14.87 billion |

|

Growth rate |

CAGR 10.98% from 2025 to 2030 |

|

Actual data |

2018 - 2024 |

|

Forecast period |

2025 - 2030 |

|

Quantitative units |

Revenue in USD million/billion, and CAGR from 2025 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Product, application, synthesis, dosage form, region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, MEA |

|

Country scope |

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; Japan; China, India, South Korea, Thailand, Australia; Brazil; Argentina; South Africa; Saudi Arabia; UAE; Kuwait. |

|

Key companies profiled |

Piramal Pharma Solutions; Lonza, Catalent, Inc.; VxP Pharma, Inc.; Pfizer CentreOne, Gentec Pharmaceutical Group; AbbVie; Aurigene Pharmaceutical Services Ltd.; CordenPharma International; Curia Global, Inc. |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global High Potency API Contract Manufacturing Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global high potency API contract manufacturing market report based on product, application, synthesis, dosage form, and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Innovative

-

Generic

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Oncology

-

Hormonal Disorders

-

Glaucoma

-

Others

-

-

Synthesis Outlook (Revenue, USD Million, 2018 - 2030)

-

Synthetic

-

Biotech

-

-

Dosage Form Outlook (Revenue, USD Million, 2018 - 2030)

-

Injectable

-

Oral Solids

-

Creams

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Norway

-

Sweden

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

MEA

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global high potency API contract manufacturing market size was estimated at USD 8.05 billion in 2024 and is expected to reach USD 8.83 billion in 2025.

b. The global high potency API contract manufacturing market witnessed a considerable growth rate of 10.98% from 2025 to 2030 to reach USD 14.87 billion by 2030.

b. By application, oncology segment dominated the market with a share of 67.0% in 2024. This is attributable to the increasing pipeline of HPAPI-based oncology target therapies.

b. Some key players operating in the market include Piramal Pharma Solutions, Lonza, Catalent Inc, VxP Pharma, Inc., Pfizer CentreOne, Gentec Pharmaceutical Group, AbbVie, Aurigene Pharmaceutical Services Ltd., CordenPharma International, Curia Global, Inc., and a few others.

b. The increasing pipeline of pharmaceutical drugs, growing expansion of HPAPI production facilities, increasing trend of outsourcing, and rising application of HPAPIs are a few of the factors supporting the HPAPI contract manufacturing market growth.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."