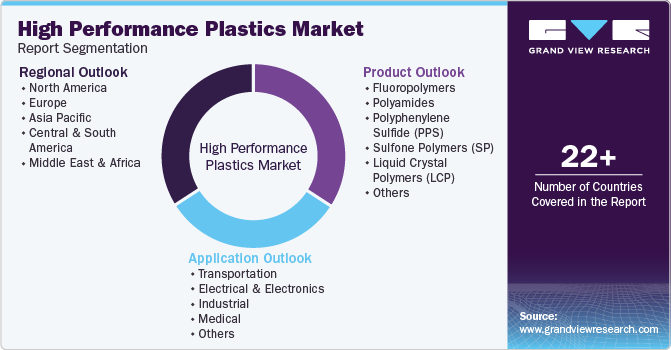

High Performance Plastics Market Size, Share & Trends Analysis Report By Product (Fluoropolymers, Polyamides), By Application (Transportation, Electrical & Electronics), By Region, And Segment Forecasts, 2025 - 2030

- Report ID: GVR-4-68040-517-0

- Number of Report Pages: 110

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Bulk Chemicals

High Performance Plastics Market Trends

The global high performance plastics market size was estimated at USD 26,750.06 million in 2024 and expected to grow at a CAGR of 9.32% from 2025 to 2030. The shift toward EVs is driving the need for high-performance plastics in battery casings, lightweight components, and thermal management systems, helping improve efficiency and range.

The high-performance plastics market is witnessing a strong shift toward lightweight and high-strength materials, particularly in aerospace and automotive applications. Manufacturers are prioritizing materials that reduce weight without compromising durability, thermal stability, and mechanical strength. The increasing use of carbon-fiber-reinforced and glass-fiber-reinforced high-performance plastics in structural and under-the-hood automotive components is replacing traditional metals. In aerospace, regulatory mandates for fuel efficiency and emission reductions are driving demand for advanced polymers that can withstand extreme temperatures while reducing overall aircraft weight. This trend aligns with the broader shift toward energy efficiency and sustainability across industries.

Drivers, Opportunities & Restraints

Rapid advancements in polymer science and engineering are significantly driving the high-performance plastics market. Continuous R&D efforts are leading to the development of next-generation polymers with enhanced chemical resistance, superior mechanical properties, and greater processability. Innovations such as nanocomposites, self-healing polymers, and high-temperature-resistant fluoropolymers are expanding application possibilities across sectors such as electronics, medical devices, and industrial manufacturing. Furthermore, advancements in additive manufacturing and precision molding techniques are improving cost-efficiency and customization, making high-performance plastics more attractive for specialized and high-value applications.

The medical industry presents a major growth opportunity for high-performance plastics, driven by increasing demand for biocompatible, sterilization-resistant, and durable materials. The shift toward minimally invasive procedures and implantable medical devices is creating a need for polymers with exceptional mechanical strength, chemical inertness, and high precision. High-performance plastics such as polyether ether ketone (PEEK) and PPSU (polyphenylsulfone) are gaining traction in applications such as orthopedic implants, surgical instruments, and drug delivery systems. In addition, the rise of personalized medicine and 3D printing in healthcare is further boosting demand for advanced polymer-based solutions, making this segment a key area for market expansion.

Despite their superior properties, high-performance plastics face significant cost challenges due to complex production processes and expensive raw materials. Unlike conventional plastics, these advanced polymers require precise manufacturing conditions, high-temperature processing, and specialized equipment, leading to increased capital expenditure for producers. In addition, the cost of raw materials such as fluoropolymers, aromatic polyamides, and high-grade polyimides remains high, limiting their widespread adoption in price-sensitive industries. Small and mid-sized manufacturers often struggle with economies of scale, further constraining market penetration. Unless cost-reduction strategies, such as recycling advancements or alternative material innovations, gain traction, the cost factor will remain a key restraint in this market.

Product Insights

Fluoropolymers dominated the high performance plastics market across the product segmentation in terms of revenue, accounting for a market share of 46.82% in 2024 due to their exceptional chemical resistance, low friction, and high thermal stability. With the rapid expansion of the semiconductor industry, particularly in Asia Pacific and North America, these advanced polymers are being widely used in wafer processing equipment, chemical storage systems, and high-purity fluid handling components. The rise of extreme ultraviolet (EUV) lithography and advanced chip fabrication techniques has increased the need for materials that can withstand aggressive cleaning agents and high temperatures without degradation. As semiconductor manufacturers push for higher production efficiency and miniaturization, fluoropolymers are becoming indispensable in ensuring operational reliability and contamination control.

The increasing deployment of 5G networks and the rapid expansion of IoT ecosystems are fueling demand for liquid crystal polymers (LCP) due to their excellent electrical properties and high-frequency signal transmission capabilities. LCPs offer low dielectric loss, high heat resistance, and dimensional stability, making them ideal for miniaturized electronic components such as flexible circuits, connectors, and antennas in 5G infrastructure and smart devices.

As global telecom operators accelerate 5G rollout and IoT applications expand into smart homes, automotive connectivity, and industrial automation, LCPs are emerging as a critical material for ensuring reliable, high-speed data transmission with minimal energy loss. This shift is significantly driving innovation and investment in LCP-based materials.

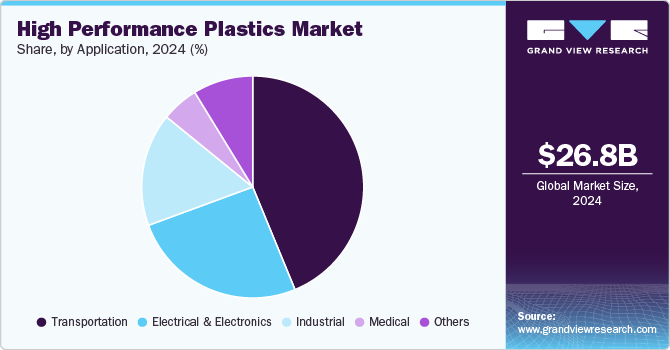

Application Insights

Transportation dominated the high performance plastics market across the technology segmentation in terms of revenue, accounting to a market share of 43.78% in 2024. The transportation industry is undergoing a major transformation, with automakers and aerospace manufacturers prioritizing lightweight materials to enhance fuel efficiency and reduce carbon emissions. High-performance plastics, including polyetheretherketone (PEEK), polyphenylene sulfide (PPS), and polyimides, are increasingly replacing metals in structural, under-the-hood, and interior components due to their high strength-to-weight ratio, thermal resistance, and durability. With stricter regulatory mandates such as Euro 7 emission standards and the U.S. government’s push for vehicle electrification, demand for high-performance plastics in transportation is growing rapidly. This trend is not only improving vehicle performance and battery range but also reducing overall production costs through material consolidation and design flexibility.

The demand for high-performance plastics in the electrical and electronics industry is rising as manufacturers seek advanced materials capable of withstanding high temperatures and providing superior insulation in compact, high-power devices. With the proliferation of miniaturized electronics, power-hungry processors, and next-generation wearable technology, there is an urgent need for polymers such as polyetherimide (PEI) and polyaryletherketone (PAEK) that offer excellent thermal stability, dielectric strength, and flame resistance.

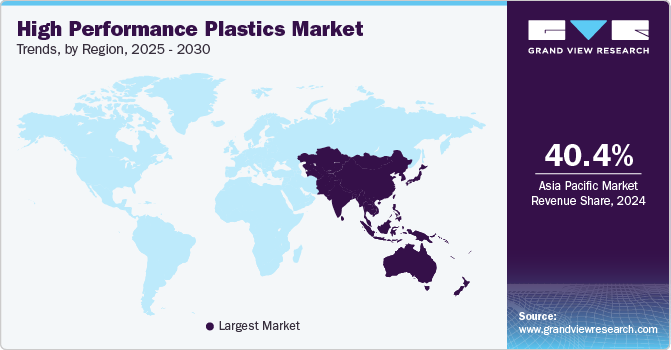

Regional Insights

Asia Pacific dominated the global high performance plastics market and accounted for largest revenue share of 40.40% in 2024, which is attributable to the region’s dominance in semiconductor and consumer electronics manufacturing. Countries such as South Korea, Japan, and Taiwan are leading producers of advanced microchips, where high-performance polymers such as LCP and PEEK play a crucial role in high-speed connectors, insulation coatings, and miniaturized circuit components. In addition, the region's expanding 5G infrastructure and growing demand for high-end smartphones, wearable technology, and smart appliances are further boosting the need for advanced polymer solutions. With government incentives supporting semiconductor production and electronic exports, particularly in Taiwan and South Korea, Asia Pacific remains a key market for high-performance plastics used in next-generation electronics and connectivity solutions.

North America High Performance Plastics Market Trends

The high-performance plastics market in North America is being driven by significant investments in the aerospace and defense sectors, where advanced materials are essential for lightweight, durable, and high-temperature-resistant components. With increasing defense budgets in the U.S. and Canada, there is growing demand for high-performance polymers in aircraft interiors, structural components, and missile systems.

U.S. High Performance Plastics Market Trends

In the U.S., the rapid expansion of the electric vehicle (EV) industry is a major driver for the high-performance plastics market, particularly as automakers seek lightweight, heat-resistant materials for battery casings, power electronics, and structural components. With the Biden administration’s strong push for EV adoption through tax incentives, infrastructure investment, and stringent emissions regulations, major automotive manufacturers and battery suppliers are increasing their reliance on advanced polymers such as PPS, LCP, and fluoropolymers. These materials not only enhance thermal management and electrical insulation but also contribute to longer battery life and vehicle range. As the U.S. continues to invest heavily in domestic battery production and sustainable transportation, demand for high-performance plastics in this sector is expected to grow substantially.

Europe High Performance Plastics Market Trends

Europe’s high-performance plastics market is being propelled by strict environmental policies and the push for sustainable materials across industries. The European Green Deal and various national sustainability mandates are compelling manufacturers to adopt advanced polymers that are not only high-performing but also recyclable or bio-based. The automotive sector, driven by the EU’s strict CO₂ emission targets and the upcoming Euro 7 standards, is increasingly shifting toward lightweight polymers to improve fuel efficiency and lower emissions.

China’s high-performance plastics market is being driven by its rapid industrial expansion and the growing need for advanced materials in high-tech manufacturing. The country’s strong presence in automotive, aerospace, and medical device production is fueling demand for high-strength, chemically resistant, and heat-resistant polymers. As China intensifies efforts to become self-sufficient in semiconductor manufacturing, investments in high-performance plastics for chip packaging, printed circuit boards, and high-frequency connectors are increasing.

Key High Performance Plastics Company Insights

The high performance plastics market is highly competitive, with several key players dominating the landscape. Major companies include BASF SE, SABIC, Evonik Industries, Victrex Plc, Kuraray Co., Ltd., Dupont, Arkema S.A., SEKISUI CHEMICAL CO., LTD., HPP GmbH, Solvay, Celanese Corporation, and Daikin Industries, Ltd. The high performance plastics market is characterized by a competitive landscape with several key players driving innovation and market growth. Major companies in this sector are investing heavily in research and development to enhance the performance, cost-effectiveness, and sustainability of their types.

Key High Performance Plastics Companies:

The following are the leading companies in the high performance plastics market. These companies collectively hold the largest market share and dictate industry trends.

- BASF SE

- SABIC

- Evonik Industries

- Victrex Plc

- Kuraray Co., Ltd.

- Dupont

- Arkema S.A.

- SEKISUI CHEMICAL CO., LTD.

- HPP GmbH

- Solvay

- Celanese Corporation

- Daikin Industries, Ltd.

Recent Developments

-

In January 2025, Toray Industries announced the expansion of its production capacity for PICASSO spunbond, a nonwoven fabric crucial for hygiene products like diapers and sanitary items, by adding a new production line at its Indonesian subsidiary, P.T. Toray Polytech Jakarta. This investment addresses the growing demand in Asian markets, particularly Indonesia, and enhances Toray's supply capabilities in the hygiene material sector. The new line, slated to begin production in September 2026, will increase annual production capacity by approximately 18,000 tons.

-

In October 2024, 3P - Performance Plastics Products, a French industrial group specializing in high-performance plastic solutions, acquired ICM Industrie, another French industrial group specializing in precision machining and plastic and composite supply.

High Performance Plastics Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2025 |

USD 28,846.60 million |

|

Revenue forecast in 2030 |

USD 45.03 billion |

|

Growth rate |

CAGR of 9.32% from 2025 to 2030 |

|

Historical data |

2018 - 2023 |

|

Base year |

2024 |

|

Forecast period |

2025 - 2030 |

|

Quantitative units |

Revenue in USD million, volume kilotons, and CAGR from 2025 to 2030 |

|

Report coverage |

Revenue forecast, competitive landscape, growth factors and trends |

|

Segments covered |

Product, application, region |

|

Regional scope |

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa |

|

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; China; India; Japan; South Korea; Australia Brazil; Argentina; Saudi Arabia; UAE; South Africa |

|

|

Key companies profiled |

All4Labels; CCL Industries; Amcor Plc; Avery Dennison; Multi-Color Corporation; Mondi plc; Huhtamaki Group; Neenah, Inc; Berry Global; 3M |

|

Customization scope |

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global High Performance Plastics Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented global high performance plastics market report on the basis of product, application, and region:

-

Product Outlook (Revenue, USD Million, Volume Kilotons, 2018 - 2030)

-

Fluoropolymers

-

Polyamides

-

Polyphenylene Sulfide (PPS)

-

Sulfone Polymers (SP)

-

Liquid Crystal Polymers (LCP)

-

Others

-

-

Application Outlook (Revenue, USD Million, Volume Kilotons, 2018 - 2030)

-

Transportation

-

Electrical & Electronics

-

Industrial

-

Medical

-

Others

-

-

Regional Outlook (Revenue, USD Million, Volume Kilotons, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

Saudi Arabia

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global high performance plastics market size was estimated at USD 26,750.06 million in 2024 and is expected to reach USD 28,846.60 million in 2025.

b. The global high performance plastics market is expected to grow at a compound annual growth rate of 9.32% from 2025 to 2030 to reach USD 45.03 billion by 2030.

b. Fluoropolymers dominated the high performance plastics market across the product segmentation in terms of revenue, accounting for a market share of 46.82% in 2024 due to their exceptional chemical resistance, low friction, and high thermal stability.

b. Some key players operating in the high performance plastics market include BASF SE, SABIC, Evonik Industries, Victrex Plc, Kuraray Co., Ltd., Dupont, Arkema S.A., SEKISUI CHEMICAL CO., LTD., HPP GmbH, Solvay, Celanese Corporation, and Daikin Industries, Ltd.

b. The shift toward EVs is driving the need for high-performance plastics in battery casings, lightweight components, and thermal management systems, helping improve efficiency and range.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."