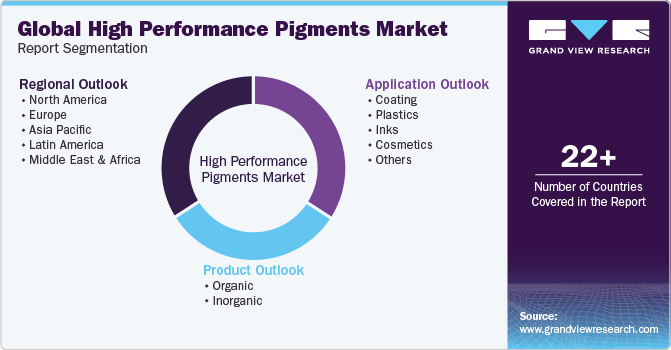

High Performance Pigments Market Size, Share & Trends Analysis Report By Product (Organic, Inorganic), By Application (Coatings, Plastics, Inks, Cosmetics, Others), By Region, And Segment Forecasts, 2023 - 2030

- Report ID: 978-1-68038-804-6

- Number of Report Pages: 130

- Format: PDF

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Bulk Chemicals

Market Size & Trends

The global high performance pigments market size was valued at USD 5.69 billion in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 4.8% from 2023 to 2030. Growing demand for Inks coatings is presumed to play a key role in positively shaping the growth. The high-performance pigments are characterized by superior properties when compared to their conventional counterparts. These superior characteristics include high resistance to heat and light, enhanced fastness, and longer operational life, making them useful for various applications across multiple industries.

Inks coatings are the key application area and hence it critically influences the demand for high-performance pigment. Rising demand for Inks coatings owing to increased Inks sales in the recent past has had a positive impact on the growth. Industry participants have been taking several key strategic initiatives such as capacity expansion and introducing superior high-performance products with an aim to serve the customer’s increasing needs.

However, such high-performance products are priced much higher when compared to their conventional counterparts. Such price disparity is anticipated to remain a key challenge for the market participants over the forecast period. Volatile raw material prices are also expected to pose threats to industry profitability.

Developed countries including India, China, Japan is expected to witness rapid growth in demand over the forecast period across numerous industries. Such robust growth prospects promise ample growth opportunities to the companies in the near future. Technological innovation related to superior products with enhanced properties is also estimated to offer abundant opportunities for growth and development.

Growing environmental awareness and stringent regulatory frameworks are expected to result in high demand for high-performance pigments in the near future. Customer preference for bio-based products has resulted in industry participants taking several key initiatives to develop high-performance pigments from completely bio-based products. Such initiatives and technological advancements are expected to offer ample growth opportunities for the market participant over the forecast period.

Economic slowdown across the globe had hampered the market growth in the recent past. However, with a positive economic outlook over the forecast period, the market is presumed to witness rapid growth. These high-performance pigments are exposed to several regulations that govern their usage and raw materials. These regulations are established to safeguard customer interest and environmental issues.

High Performance Pigments Market Trends

Automobile industry is a major end-use market for the high performance pigments industry. Inks demand has witnessed brisk growth in the recent past and is expected to continue this trend over the forecast period. Growing population and increasing disposable income, especially in the developing regions such as Asia Pacific, the Middle East & Africa, and Central & South America are presumed to fuel inks demand over the forecast period.

High performance pigments are characterized by several superior properties that distinguish them from their conventional counterparts. These properties include enhanced light fastness, weather fastness, longer operational life, better resistance to natural elements as well as chemicals, high heat stability, low solubility, and reduced migration. These properties make them imperative for a host of applications across a diverse range of industries, particularly the outdoor applications. Major outdoor applications include inks coatings and exterior coatings for buildings. Other superior characteristics include fluorescence, luminescence, and photo chromatic.

Such superior properties can be segregated into different categories which include effectiveness, economy, and ecology. Effectiveness includes the technical performance of these pigments when used across various applications. Economy incorporates multiple financial benefits for the customer. Though these high performance pigments are costlier than the conventional pigments, they require higher initial investment, and they pay off in the long run due to multiple factors. These factors include lower maintenance, longer operational life, and reduced repeat coatings. Ecology includes lower toxicity and reduced impact on the environment.

Stringent environmental regulations and growing concerns have resulted in pigments being exposed to a host of regulations. These regulations are put in place to safeguard the environment as well as customers’ interest. High performance pigments are expected to be low on toxicity and have a comparatively low impact on the environment. These pigments are essential for applications that require high performance.

High performance pigments are priced higher than their conventional counterparts. Such a price disparity is due to the superior properties offered by these pigments as well as higher production cost. This difference in price is presumed to negatively impact the high performance pigments market over the forecast period especially in developing regions such as Asia Pacific, Central & South America, and the Middle East & Africa. Though these markets offer ample growth opportunities for the industry participants, they are extremely price-sensitive. Such developing regions are also characterized by lenient regulatory framework, which results in end-use industries opting for conventional pigments instead of high performance pigments to cut costs.

These pigments are developed after extensive R&D and require superior quality raw materials, and hence, they have a high price. The recent shift in consumer preferences towards bio-based products along with growing awareness regarding the hazardous effects of pigments has resulted in bio-based pigments witnessing a robust demand. Such a trend is expected to continue in the near future. Companies have taken several initiatives to develop environment-friendly and superior products, which in turn drive up their cost. The massive R&D initiative expenditure is passed on to the customers.

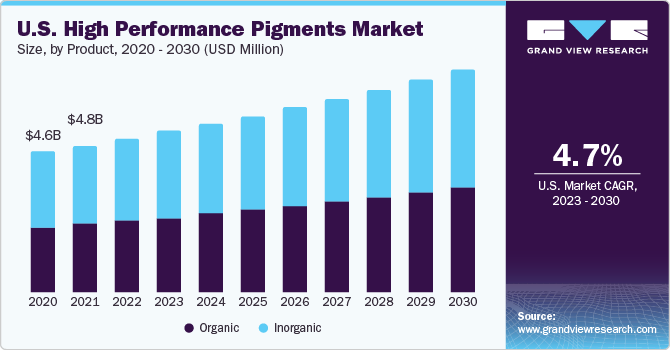

Product Insights

The inorganic segment accounted for the largest revenue share of 57.1% in 2022. Inorganic high-performance pigments are synthetic pigments known for their excellent color strength, durability, heat stability, lightfastness, and chemical resistance. The demand for inorganic high performance pigments is influenced by end-use industries such as inks, plastics, and packaging, which require high-performance pigments for enhanced product properties and aesthetics.

Continuous research and development efforts have resulted in the development of new and improved inorganic HPPs with enhanced properties, such as improved color intensity, heat stability, and weather resistance. These advancements attract manufacturers and end-users alike.

The organic segment is expected to grow at the fastest CAGR of 4.9% over the forecast period. With growing concerns about the environmental impact of chemical-based pigments, there is a rising demand for organic pigments derived from natural sources. Organic high-performance pigments are often favored due to their reduced ecological footprint and lower toxicity compared to inorganic pigments.

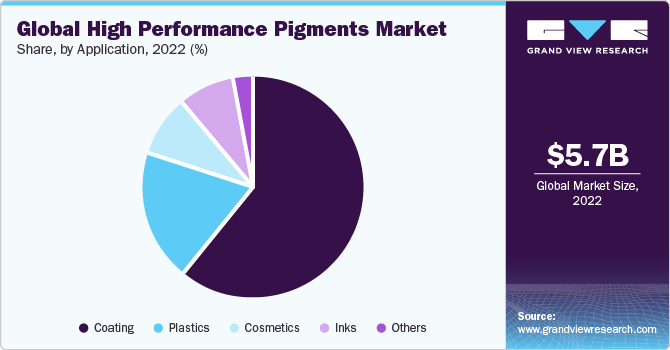

Application Insights

The coating segment dominated the market and held the largest revenue share of 60.9% in 2022. The escalating demand for high-performance pigments in the inks industry propels the growth of this segment. Inks coatings necessitate pigments capable of enduring harsh environmental conditions, encompassing exposure to UV radiation, chemicals, and extreme temperatures. High-performance pigments provide enhanced color retention and durability, rendering them highly suitable for inks coatings, which encompass exterior finishes, trim paints, and protective coatings. Inks coating is a key application under coatings segments, followed by other applications such as industrial and decorative coatings.

The plastics segment held the second largest revenue share in 2020. However, applications such as inks are anticipated to witness sluggish growth owing to factors such as rapid digitization in both developed as well as developing regions. Stringent regulations related to food contact applications are expected to further hamper the growth, particularly for inorganic pigments.

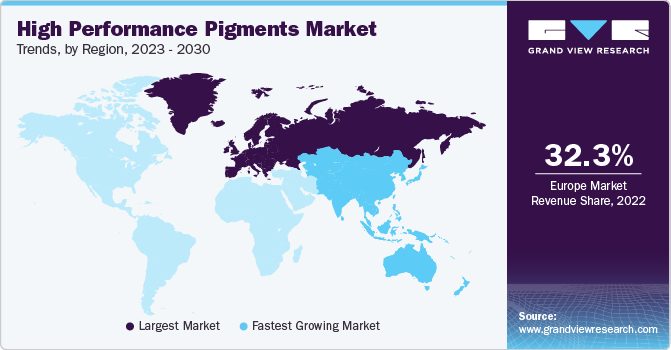

Regional Insights

Europe dominated the market and held a market share of 32.3% in 2022. This is attributed to high demand from multiple industries. Developed regions are less price-sensitive when compared to developing regions. Such a trend has resulted in developed regions dominating the global market.

The markets in developed regions such as North America and Europe are saturated in terms of applications. However, strong environmental concerns and stringent regulations are projected to fuel the market in these regions and offer ample growth opportunities to the industry participants.

Europe's inks industry has also shown signs of recovery which are expected to further strengthen the regional demand. North America market is primarily driven by the growth of inks coatings in U.S. Hence, it is expected to remain a major market for the key industry participants.

Emerging markets of Asia Pacific and Central & South America are estimated to witness rapid demand growth over the forecast period. Rapid expansion of the inks industry in China, India, Thailand, and Indonesia is expected to lead growth for the regional market. Concerns remain for the Brazilian economy which still remains soft.

Developing regions such as Asia Pacific are presumed to witness strong demand growth in the near future and provide ample opportunities for market development. Economies such as China and India are anticipated to lead the regional market over the next seven years. Change in consumption patterns coupled with stringent regulations governing the high performance pigments are presumed to critically impact the market in the near future. Developed regions are expected to witness a slightly moderate growth rate due to market saturation.

Changing customer preferences towards superior products in the recent past has resulted in companies investing heavily in R&D initiatives to develop superior pigments. Rapid urbanization and industrialization, particularly in the developing regions such as the Middle East & Africa, Asia Pacific, and Central & South America, is presumed to be a driver for this market. These developments have increased the demand in recent years and are presumed to continue this trend over the forecast period.

Key Companies & Market Share Insights

Companies operating in the global market lay high emphasis on expanding their global footprint to increase their revenue and market share. Companies are taking certain strategic initiatives to increase their production capacity and enhance their product portfolio to cater to the growing demand, particularly in developing regions.

Key High Performance Pigments Companies:

- Sun Chemical

- Clariant

- BASF SE

- Ferro Corporation

- Vijay Chemical Industries

- Meghmani Organics Ltd.

- VOXCO India

- Heubach GmbH

- ALTANA AG

- Trust Chem Co., Ltd.

- Merck KGaA

Recent Developments

-

In May 2023, U.S. Silica launched a product called EverWhite, designed specifically for coatings, building products, and various other applications. This innovative pigment offers a unique solution as it can either partially substitute or complement other inorganic white pigments, such as aluminum trihydrate (ATH) and titanium dioxide (TiO2). This introduction of the EverWhite Pigment aligns with U.S. Silica's strategy, which focuses on delivering innovative and superior solutions to meet the specific needs of customers across different industries.

-

In March 2023, BTC Europe and Sudarshan Chemical Industries Limited entered into an agreement for the distribution of pigments in Europe. This strategic partnership will enable Sudarshan Chemical Industries Limited to function as a dependable supplier of high-performance pigments, encompassing a wide spectrum of colors. As a result of this collaboration, they will gain access to a diverse range of top-quality pigments suitable for various applications and industries. By expanding their third-party product portfolio through this partnership, BTC Europe aims to augment its competitive edge in the pigments market and reinforce its overall corporate strategy.

-

In January 2023, Heubach GmbH unveiled the new product line, Ultrazur, at PlastIndia 2023. This innovative line comprises ultramarine blue pigments, offered in four distinct tones that span from greenish to reddish hues. These pigments are meticulously designed to cater to a wide range of applications, encompassing both common and intricate uses.

-

In September 2019, BASF SE introduced an innovative range of responsive and high-performance dispersing agents tailored for organic pigments and carbon blacks. These agents, recognized as Efka PX 4787, Efka PX 4785 and Efka PX 4780, leverage advanced polymer technology and are directed towards the automotive and industrial coatings sectors. The central objective of these high-performance dispersing agents is to elevate coating properties by delivering exceptional dispersing efficiency, heightened solvent resistance, and increased hardness. BASF SE's strategic approach involves harnessing inventive solutions to meet the precise demands of the coatings industry, thereby solidifying their stance as a pioneering company within the market.

High Performance Pigments Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2023 |

USD 5.95 billion |

|

Revenue forecast in 2030 |

USD 8.26 billion |

|

Growth Rate |

CAGR of 4.8% from 2023 to 2030 |

|

Base year for estimation |

2022 |

|

Historical data |

2018 - 2021 |

|

Forecast period |

2023 - 2030 |

|

Quantitative units |

Volume In Kilo Tons, revenue in USD million/billion and CAGR from 2023 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Product, application, region |

|

Regional scope |

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa |

|

Country scope |

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; China; Japan; India; Brazil; Argentina; Saudi Arabia; South Africa |

|

Key companies profiled |

Sun Chemical; Clariant; BASF SE; Ferro Corporation; Vijay Chemical Industries; Meghmani Organics Ltd.; VOXCO India; Heubach GmbH; ALTANA AG; Trust; Chem Co., Ltd.; Merck KGaA |

|

Customization scope |

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global High Performance Pigments Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global high performance pigments market based on product, application, and region:

-

Product Outlook (Volume, Kilo Tons, Revenue, USD Million, 2018 - 2030)

-

Organic

-

Inorganic

-

-

Application Outlook (Volume, Kilo Tons, Revenue, USD Million, 2018 - 2030)

-

Coating

-

Plastics

-

Inks

-

Cosmetics

-

Other

-

-

Regional Outlook (Volume, Kilo Tons, Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

Japan

-

China

-

India

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa (MEA)

-

South Africa

-

Saudi Arabia

-

-

Frequently Asked Questions About This Report

b. The global high performance pigments market size was estimated at USD 5.69 billion in 2022 and is expected to reach USD 5.95 billion in 2023.

b. The global high performance pigments market is expected to grow at a compound annual growth rate of 4.8% from 2023 to 2030 to reach USD 8.26 billion by 2030.

b. Europe dominated the high performance pigments market with a share of 32.30% in 2022. This is attributable to rising demand from various end use industries such as plastic, and coatings.

b. Some key players operating in the high performance pigments market include BASF SE; Ferro, Vijay Chemical Industries, Sudarshan Chemical Industries Ltd., Voxco Pigments and Chemicals Pvt. Ltd., DIC Corporation, Trust Chem and Eckart GmbH, and Lansco Colors.

b. Key factors that are driving the market growth include high performance pigment application for or automotive coatings, and its application for plastics, ink and cosmetic products.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."