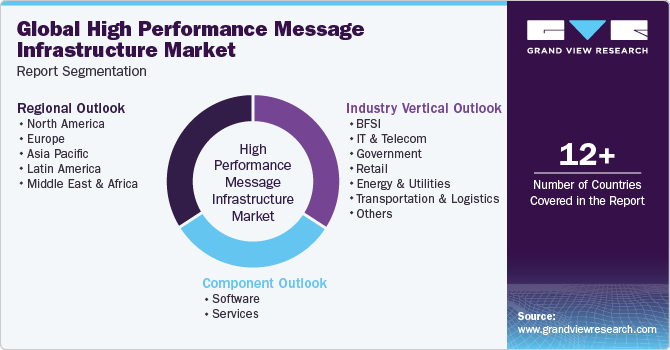

High Performance Message Infrastructure Market Size, Share & Trends Analysis Report By Component (Software, Services), By Industry Vertical (Government, Retail, Energy & Utilities), By Region, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-4-68039-563-5

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Technology

Market Size & Trends

The global high performance message infrastructure market size was valued at USD 1.08 billion in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 15.5% from 2023 to 2030. The market is expected to witness significant growth during the forecast period in line with the continued implementation of advanced IoT solutions. The growing demand for connected devices to manage, track, maintain, and monitor equipment effectively and retrieve real-time and meaningful insights to make informed decisions has remained a key factor driving the adoption of message infrastructure solutions worldwide. Moreover, the growing focus of companies on improving client-server interactions associated with IoT-based systems has encouraged companies to opt for advanced and custom high-performance message infrastructure solutions.

The growing need for organizations to deploy several innovative and advanced solutions to maintain a competitive edge in the global market encourages the adoption of high-performance message infrastructure solutions. Moreover, the growing awareness among enterprises regarding the enhancement of fault resilience and data protection across the network has created significant traction in the global market, thereby providing numerous opportunities to market players. There are increasing concerns about data security and the growing penetration of internet services and smartphones, which empower and make customers aware of using highly effective software solutions and influence the demand for cloud-based high-performance message infrastructure solutions. Moreover, the rich feature set of SaaS solutions that enable organizations to manage complex activities further triggers market growth.

During the pandemic, most businesses switched to the work-from-home model, and companies reduced their investment in new technologies and services to improve profitability. The pandemic also forced many small businesses to shut down due to a lack of funds to stay in business. Demand for high-performance message infrastructure decreased during COVID-19 lockdowns but eventually increased due to the commercial sector's reliance on cloud-based solutions and services. The COVID-19 pandemic propelled organizations to shift from an on-premise business model to a cloud one, thus resulting in the market's rapid growth. Moreover, the rapid adoption of the work-from-home approach in the wake of the pandemic created numerous opportunities for businesses to transform their operations and enhance their digital capabilities by integrating business-critical infrastructure.

The increasing cyber threats and rising data privacy concern likely hamper the market's growth. IT managers require reliable messaging infrastructure to automate business processes for various applications and improve fault resilience while protecting essential information across systems. Moreover, the rising interconnection between numerous devices through IoT increases the potential for malware attacks and exploits. The lack of reasonable security measures allows intruders to access and misuse critical business information collected and transmitted to or from a device.

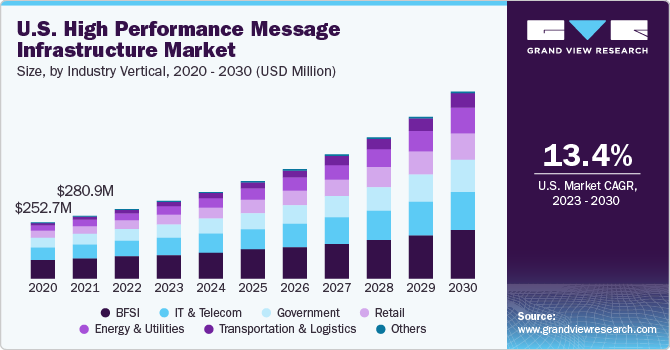

Industry Vertical Insights

The BFSI segment dominated the market and accounted for the largest revenue share of 31.8% in 2022. The dominance of this segment can be accredited to the rapid adoption of cloud services in the banking and finance sector. Continuous real-time data processing and integration are crucial to various use cases in the BFSI industry. The growing focus of enterprises on deploying event streaming applications for managing mission-critical transactional workloads, such as regulatory reporting and payment processing, is attributed as one of the key factors driving the demand for optimized message infrastructure solutions. Managing complex workloads with vast volumes of critical data requires a robust network infrastructure that securely and timely processes, intercepts, and transmits data.

The transportation & logistics segment is expected to grow at the fastest CAGR of 21.3% during the forecast period. The growing need for fleet managers to maximize on-road capacity and ensure that the fleet network is functioning at optimum capacity is a key driver contributing to adopting the latest technologies in the industry. Moreover, growing technological advancements and the rising urge to deploy innovative maintenance management solutions to save time and money and reduce asset breakdowns and failures are driving the adoption of high-performance message infrastructure solutions.

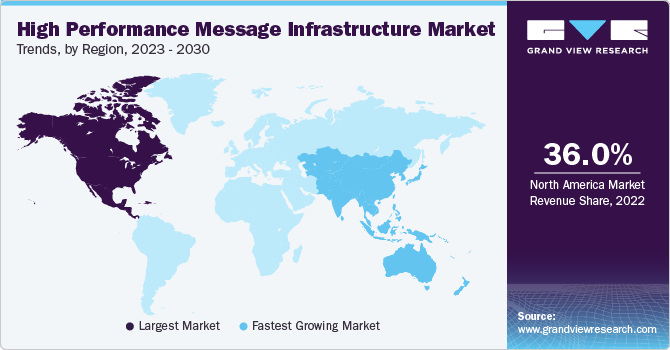

Regional Insights

North America dominated the market for high performance message infrastructure and accounted for the largest revenue share of 36.0% in 2022. The region is well-known for its advanced technology adoption and the highest automation equipment production. Additionally, the vast presence of market players such as Amazon Web Services, Inc.; International Business Machines Corporation; MuleSoft LLC, a Salesforce company; Oracle; and Red Hat, Inc. is also driving the growth of the North American market. Several organizations in the U.S. are increasingly adopting cloud and other IT services to drive innovation and digital transformation. Moreover, these companies also focus on deploying the Everything-as-a-Service (XaaS) model to improve their cloud infrastructure, data analytics capabilities, cybersecurity, and business model evaluation. Thus, the demand for robust and high-performance message infrastructure, which simplifies and streamlines communication among advanced devices for gaining optimized results, is expected to increase.

Asia Pacific is expected to grow at the fastest CAGR of 16.9% during the forecast period. The region is a hub of small and medium enterprises focusing on gaining a competitive advantage through better customer service, which can be attained by enhancing all industrial operations. As a result, the demand for appropriate tools, technologies, and IT infrastructure, which support local industries in achieving their goals, was observed. Due to the benefits of advanced message infrastructure solutions, the Asia Pacific market is anticipated to witness significant demand for these solutions during the forecast period.

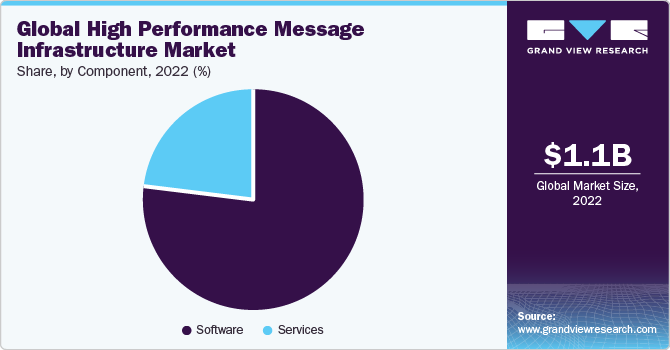

Component Insights

The software segment dominated the market and accounted for a revenue share of 77.2% in 2022. High-performance message infrastructure software solutions enable process-related communication across the network in an IT environment. Growing pressure on enterprises to deliver digital innovation faster in response to rising customer expectations is one of the critical factors driving the segment growth. Moreover, enterprises that have deployed high-performance message infrastructure software solutions have witnessed accelerated delivery speeds and automation of business processes, which has further triggered the development of this segment.

The services segment is expected to grow at the fastest CAGR of 17.0% during the forecast period. The services segment includes professional and managed services that provide consulting, integration, and post-deployment assistance. The services segment primarily includes professional and managed services. Rising investment in automation initiatives and deploying numerous smart connectivity solutions have allowed high-performance message infrastructure companies to provide their customers with integration, support, maintenance, and designing services.

Key Companies & Market Share Insights

Key participants in the industry adopt strategies such as collaborations, partnerships, and mergers and acquisitions to expand their reach. Moreover, service providers are making considerable investments in research and development activities to incorporate new technologies into their offerings and develop advanced products to gain a competitive advantage. For instance, in June 2021, Amazon Web Services (AWS), Inc. announced the acquisition of Wickr, a New York, U.S.-based software company. Amazon Web Services (AWS), Inc. has entered the encrypted messaging sector with this acquisition. Also, in December 2021, IBM Corporation collaborated with MuleSoft LLC. The collaboration aimed to develop further integrations and solutions centered on the IBM Z product portfolio to considerably increase the company's overall investment in integration software and industry experience, including adding to the organization's number of MuleSoft-certified professionals.

Key High Performance Message Infrastructure Companies:

- Amazon Web Services, Inc.

- Confinity Solutions GmbH

- International Business Machines Corporation

- Salesforce, Inc.

- Oracle

- Red Hat, Inc.

- SAP SE

- Solace

- TIBCO Software Inc.

- TWILIO INC.

Recent Developments

-

In December 2022, Red Hat Insights and Slack announced an integration that allows IT operations (ITOps) and development operations (DevOps) teams to collaborate more effectively. The service preview integration adds a ChatOps component to the Hybrid Cloud Console. The integration allows third-party applications to forward events to a specific user, channel, or Slack user.

-

In November 2022, TIBCO released the latest version of its Enterprise Message Service software. The new version of TIBCO Enterprise Message Service contains several new features and additions, including support for more messaging, such as Jakarta messaging 3.0 protocols, greater performance, scalability, and enhanced security.

-

In July 2022, Amazon Web Services (AWS) announced AWS Wickr, an end-to-end encrypted enterprise communication solution. AWS Wickr enables secure communication in messaging, audio and video chatting, file sharing, and screen sharing.

High Performance Message Infrastructure Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2023 |

USD 1.22 billion |

|

Revenue forecast in 2030 |

USD 3.34 billion |

|

Growth rate |

CAGR of 15.5% from 2023 to 2030 |

|

Base year for estimation |

2022 |

|

Historical data |

2018 - 2021 |

|

Forecast period |

2023 - 2030 |

|

Report updated |

November 2023 |

|

Quantitative units |

Revenue in USD million/billion, and CAGR from 2023 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Component, industry vertical, region |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; MEA |

|

Country scope |

U.S.; Canada; UK; Germany; France; China; Japan; India; Australia; South Korea; Brazil; Mexico; Saudi Arabia; South Africa; UAE |

|

Key companies profiled |

Amazon Web Services, Inc.; Confinity Solutions GmbH; Internatinal Business Machines Corporation; Salesforce, Inc.; Oracle; Red Hat, Inc.; SAP SE; Solace TIBCO Software Inc.; TWILIO INC. |

|

Customization scope |

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global High Performance Message Infrastructure Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global high performance message infrastructure market report based on component, industry vertical, and region:

-

Component Outlook (Revenue, USD Million, 2018 - 2030)

-

Software

-

Services

-

-

Industry Vertical Outlook (Revenue, USD Million, 2018 - 2030)

-

BFSI

-

IT & telecom

-

Government

-

Retail

-

Energy & utilities

-

Transportation & logistics

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

Mexico

-

-

Middle East and Africa

-

Saudi Arabia

-

South Africa

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global high performance message infrastructure market size was estimated at USD 1.08 billion in 2022 and is expected to reach USD 1.22 billion in 2023.

b. The global high performance message infrastructure market is expected to witness a compound annual growth rate of 15.5% from 2023 to 2030 to reach USD 3.34 billion by 2030.

b. North America held the largest share of over 36.0% in 2022. The region is well-known for its advanced technology adoption and the highest automation equipment production. Additionally, the vast presence of market players such as Amazon Web Services, Inc., IBM Corporation, MuleSoft LLC, and Red Hat, Inc. is also driving the growth of the North American market.

b. Key industry players operating in the high performance message infrastructure market include Amazon Web Services, Inc.; Confinity Solutions GmbH; International Business Machines Corporation; Salesforce, Inc.; Oracle; Red Hat, Inc.; SAP SE; Solace; TIBCO Software Inc.; and TWILIO INC. among others.

b. The growing demand for connected devices to manage, track, maintain, and monitor equipment effectively and retrieve real-time and meaningful insights to make informed decisions has remained a key factor driving the adoption of message infrastructure solutions worldwide.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."