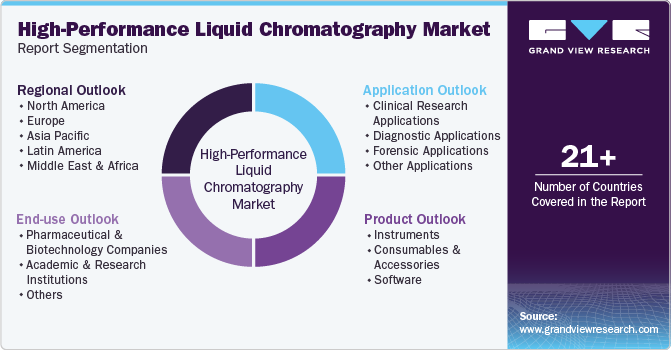

High-performance Liquid Chromatography Market Size, Share & Trends Analysis Report By Product (Instruments, Consumables & Accessories, Software), By Application, By End-use, By Region, And Segment Forecasts, 2025 - 2030

- Report ID: GVR-4-68039-962-3

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Healthcare

Market Size & Trends

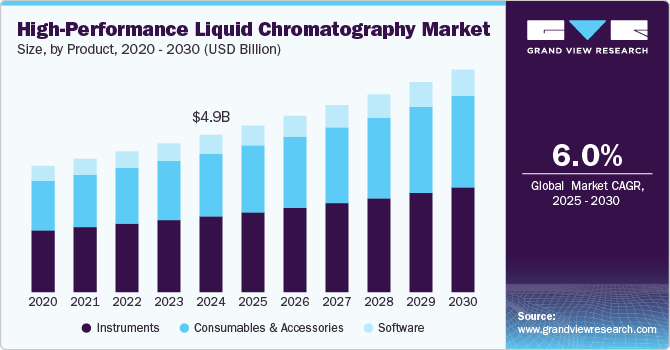

The global high-performance liquid chromatography market size was estimated at USD 4.96 billion in 2024 and is projected to grow at a CAGR of 6.0% from 2025 to 2030. The market's growth is anticipated as a result of advancements in high-performance liquid chromatography (HPLC) technology, which have enhanced the reliability and effectiveness of liquid chromatography processes. For instance, modern HPLC systems feature dual-injection setups, multidimensional functionalities, and intermediate pressure options, thereby expanding the technique's applicability across diverse research applications.

Moreover, the COVID-19 pandemic has expedited the integration of HPLC systems in developing new therapeutics, vaccines, and accurate diagnostic methods for the virus. For example, a study published in the Microchemical Journal in October 2021 introduced an innovative HPLC-based technique for quantifying favipiravir, a promising antiviral treatment for COVID-19. Additionally, as concerns regarding SARS-CoV-2 mutations grow, the application of HPLC for epidemiological studies specifically in characterizing viral proteins associated with emerging serotypes, is expected to increase. These developments are projected to have a favorable impact on market growth.

The market is further propelled by major HPLC manufacturers broadening their product offerings for specialized applications, including preparative purification, amino acid analysis, two-dimensional liquid chromatography, method development, and clinical diagnostics. For instance, in October 2021, Novasep introduced its Hipersep Process M HPLC system designed for the commercial-scale purification of oligonucleotides, peptides, insulin, and other pharmaceutically significant molecules. Furthermore, the growing adoption of protein-based therapeutics, such as bispecific antibodies and antibody-drug conjugates, is likely to enhance the role of HPLC within the biopharmaceutical sector.

The introduction of various liquid chromatography method development systems and supporting software in recent years is anticipated to enhance the usability and productivity of HPLC systems. For example, in August 2021, Thermo Fisher Scientific, Inc. partnered with ChromSword to unveil the Thermo Fisher Vanquish HPLC and UHPLC method development system. Similarly, in April 2022, Shimadzu Corporation introduced its LabSolutions MD software for HPLC platforms to aid in analytical method development. The release of such products is expected to boost the market penetration of HPLC systems and drive market growth.

Product Insights

The instruments segment held the largest revenue share of 48.2% in 2024 due to the increasing dominance of integrated HPLC systems and the availability of advanced detectors. Manufacturers in this sector concentrate on developing systems that provide enhanced productivity and application specificity. A notable example is Shimadzu Corporation's launch of the new i-Series LC-2050/LC-2060 integrated HPLC systems in February 2021. These systems feature high-speed sampling capabilities and minimal carryover, making them suitable for quality control applications. Additionally, detectors like Activated Research Company’s Solvere carbon selective detector, which accommodates both aqueous and organic solvents, are expanding the versatility of HPLC techniques for a diverse range of sample types.

Consumables and accessories segment is projected grow at a CAGR of 6.5% over the forecast period. Reasons being increased demand due to advancements in column chemistries and packing materials, as well as the growing importance of filtration techniques to safeguard HPLC columns from particulate contamination. The rising need for chromatography operations with enhanced sensitivity has heightened the focus on minimizing analyte-metal interactions that may compromise results. This can be achieved through advanced metal passivation techniques or by using PEEK (polyetheretherketone)-lined stainless steel columns. For example, Agilent Technologies, Inc. offers AdvanceBio SEC PEEK-lined stainless steel columns. These columns are expected to show significant growth potential and contribute positively to market growth.

Application Insights

Clinical research applications accounted for the largest revenue share of 40.7% in 2024 and likely to grow with the fastest CAGR over the forecast period. This growth can be linked to the increasing scope of clinical trial activities, a rise in biopharmaceutical research and development, and a growing demand for high-throughput analytical techniques. Additionally, the advantages provided by HPLC in clinical research-including high analytical specificity, short analysis times, the ability to conduct multi- and mega-parametric tests, and its suitability for thermolabile, polar, and high-molecular weight compounds-position it as a leading alternative to other analytical methods. These factors are expected to enhance the use of HPLC in clinical research applications.

Diagnostic applications of HPLC are primarily driven by its ability to identify and quantify biomarkers crucial for the early detection of chronic diseases. This technique enhances diagnostic accuracy by differentiating between similar diseases. Moreover, HPLC serves as an excellent method for metabolite analysis and is particularly utilized in the assessment of vitamin D and HbA1c hemoglobin due to its reproducibility and low coefficient of variation. With the rising incidence of chronic diseases and the growing demand for reliable diagnostic techniques, the use of HPLC in diagnostic applications is anticipated to expand significantly over the forecast period.

End-use Insights

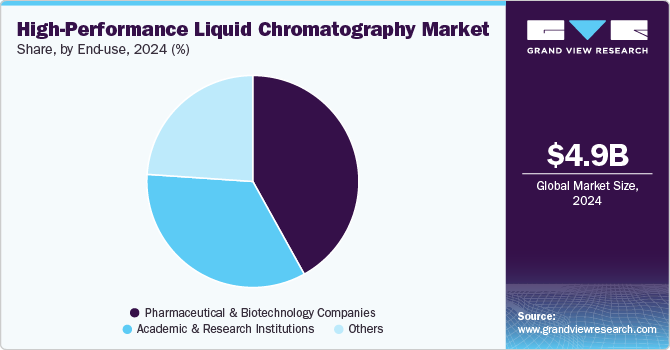

Pharmaceutical and biotechnology companies dominated the market and accounted for 41.9% share in 2024. Within these companies, HPLC methods are employed for various applications, including quality control, drug purity determination, characterization of drug candidates, and evaluation of the stability of active ingredients in pharmaceuticals. The segment is poised for growth, particularly due to the compatibility of HPLC with mass spectrometry, which significantly enhances the detection capabilities and selectivity of the technique. This synergy is expected to increase the adoption of HPLC for biopharmaceutical applications, further propelling market growth.

Academic and research institutions are projected to grow at a CAGR of 6.5% over the forecast period, driven by several factors. Increased government funding for academic research and the growing integration of analytical instrumentation in educational programs contribute significantly to this trend. Additionally, academic institutions play a vital role in research and development activities, with approximately 50% of basic research and 10% to 15% of overall R&D conducted in the U.S. within these settings. In 2020, research and development spending by academic institutions in the U.S. exceeded USD 86.4 billion. This strong investment underscores the high potential for adopting HPLC infrastructure in academic settings, which is likely to accelerate market growth in the coming years.

Regional Insights

North America high-performance liquid chromatography market dominated the overall global market and accounted for the 31.68% of revenue share in 2024.This growth can be attributed to the rapid expansion of the pharmaceutical industry, substantial investment in research and development, and the rising demand for clinical diagnostic applications. The presence of major players such as Thermo Fisher Scientific, Inc., Agilent Technologies, Inc., and Bio-Rad Laboratories, Inc. in the region also contributes significantly to market growth. Additionally, a high level of scientific awareness and the availability of skilled professionals in the area further enhance the adoption of HPLC applications.

U.S. High-performance Liquid Chromatography Market Trends

The U.S. high-performance liquid chromatography market held a significant share of North America market in 2024, fueled by the presence of key players. The HPLC market in the U.S. is experiencing significant growth due to several key factors. The robust pharmaceutical and biotechnology sectors are driving demand for high-quality analytical techniques for drug development and quality control. Increased government funding for research and development further supports innovation in the field. Additionally, the rising prevalence of chronic diseases fuels the need for efficient diagnostic tools. The presence of leading companies, advanced technological infrastructure, and a highly skilled workforce also contribute to the market's expansion, ensuring that HPLC remains a critical component in various scientific and clinical applications across the nation.

Europe High-performance Liquid Chromatography Market Trends

Europe high-performance liquid chromatography market is experiencing significant growth. The region boasts a strong pharmaceutical and biotechnology industry, with a significant focus on research and development, which increases the need for advanced analytical techniques like HPLC. Additionally, rising public health concerns and a growing prevalence of chronic diseases necessitate accurate diagnostic tools, further propelling the market.

The UK High-performance Liquid Chromatography market is experiencing significant growthdue to healthcare improvements and technological advancements. Rising healthcare expenditures and a growing emphasis on personalized medicine are fueling the demand for precise analytical methods. Regulatory requirements for quality control and safety in pharmaceuticals also enhance the adoption of HPLC systems, positioning the UK as a key market in the global HPLC landscape.

Germany high-performance liquid chromatography market is experiencing significant growth, driven by robust pharmaceutical and biotechnology industry, with numerous companies engaged in drug discovery and development. This creates a high demand for High-performance Liquid Chromatography market.

Asia Pacific High-performance Liquid Chromatography Market Trends

High-performance liquid chromatography market in the Asia Pacific is experiencing the fastest growth,driven by significant innovations in healthcare infrastructure and technology. The expansion of the pharmaceutical and biotechnology industries, particularly in countries like China and India, is a significant contributor, as these sectors increasingly rely on advanced analytical techniques for drug development and quality control.

China High-performance Liquid Chromatography market is growing, driven by the rapid expansion of its biotechnology and pharmaceutical industries. As one of the largest pharmaceutical markets globally, China increasingly relies on advanced analytical techniques like HPLC for drug development, quality control, and regulatory compliance. The government’s strong support for research and development, including substantial investments in healthcare and biopharmaceutical innovation, further fuels market growth.

Latin America High-performance Liquid Chromatography Market Trends

High-performance liquid chromatography market in Latin Americais experiencing significant growth,owing to increasing investments in pharmaceutical and biotechnology sectors, particularly in countries like Brazil, Mexico, and Argentina. Additionally, rising research and development activities, supported by government initiatives and funding, are fostering innovation in drug discovery and diagnostics. The growing prevalence of chronic diseases, coupled with the demand for accurate and efficient diagnostic tools, further enhances the market potential for HPLC applications

Middle East & Africa High-performance Liquid Chromatography Market Trends

The MEA high-performance liquid chromatography marketis growing driven by increasing investment in healthcare and life sciences in countries like Saudi Arabia, and the UAE.

The Saudi Arabia high-performance liquid chromatography market is expanding due to increased healthcare investment and improved infrastructure. Additionally, growing investments in research and development, supported by government initiatives, are fostering advancements in biotechnology and pharmaceuticals. Furthermore, international collaborations and partnerships are helping to introduce advanced HPLC technologies in the country.

Key High-performance Liquid Chromatography Company Insights

The competitive scenario in the high-performance liquid chromatography market is high, with key players such as Waters Corporation, Thermo Fisher Scientific, Inc., Agilent Technologies, Inc., Shimadzu Corporation holding significant positions. Leading companies in the market are actively seeking to expand their customer base through mergers, acquisitions, and strategic partnerships with other key players.

Key High-performance Liquid Chromatography Companies:

The following are the leading companies in the high-performance liquid chromatography market. These companies collectively hold the largest market share and dictate industry trends.

- Waters Corporation

- Thermo Fisher Scientific, Inc.

- Agilent Technologies, Inc.

- Shimadzu Corporation

- Sartorius AG

- PerkinElmer, Inc.

- Bio-Rad Laboratories, Inc.

- Merck KGaA

- Tosoh Bioscience GmbH

- Gilson, Inc.

- Danaher Corporation

Recent Developments

-

In April 2024, Waters Corporation has introduced the Alliance iS Bio HPLC System, designed to tackle the operational and analytical challenges faced by biopharma quality control (QC) laboratories. This innovative HPLC system integrates advanced bio-separation technology with built-in instrument intelligence features, aimed at enhancing efficiency for biopharma QC analysts. By utilizing this system, users can potentially reduce common errors by up to 40%, thereby minimizing the time spent on investigating issues related to failed runs and out-of-specification results.

High-performance Liquid Chromatography Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2025 |

USD 5.25 billion |

|

Revenue forecast in 2030 |

USD 7.03 billion |

|

Growth rate |

CAGR of 6.0% from 2025 to 2030 |

|

Historical data |

2018 - 2024 |

|

Forecast period |

2025 - 2030 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2025 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Product, application, end-use, region |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; MEA |

|

Country scope |

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; Norway; Denmark; Sweden; China; Japan; India; Australia; Thailand; South Korea; Brazil; Argentina; South Africa; Saudi Arabia; UAE; Kuwait |

|

Key companies profiled |

Waters Corporation; Thermo Fisher Scientific, Inc.; Agilent Technologies, Inc.; Shimadzu Corporation; Sartorius AG; PerkinElmer, Inc.; Bio-Rad Laboratories, Inc.; Merck KGaA; Tosoh Bioscience GmbH; Gilson, Inc.; Danaher Corporation |

|

Customization scope |

Free report customization (equivalent up to 8 analyst working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global High-performance Liquid Chromatography Market Report Segmentation

This report forecasts revenue growth at country levels and provides an analysis on the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the high-performance liquid chromatography market report based on product, application, end-use and region.

-

Product Outlook (Revenue, USD Billion, 2018 - 2030)

-

Instruments

-

HPLC Systems

-

Pumps

-

Detectors

-

Others

-

-

Consumables & Accessories

-

Columns

-

Reverse-phase HPLC Columns

-

Normal-phase HPLC Columns

-

Ion Exchange HPLC Columns

-

Size Exclusion HPLC Columns

-

Other HPLC Columns

-

-

Filters

-

Vials

-

Tubes

-

Others

-

-

Software

-

-

Application Outlook (Revenue, USD Billion, 2018 - 2030)

-

Clinical Research Applications

-

Diagnostic Applications

-

Forensic Applications

-

Other Applications

-

-

End-use Outlook (Revenue, USD Billion, 2018 - 2030)

-

Pharmaceutical & Biotechnology Companies

-

Academic & Research Institutions

-

Others

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Norway

-

Denmark

-

Sweden

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global high-performance liquid chromatography market size was estimated at USD 4.96 billion in 2024 and is expected to reach USD 5.25 billion in 2025.

b. The global high-performance liquid chromatography market is expected to grow at a compound annual growth rate of 6.0% from 2025 to 2030 to reach USD 7.03 billion by 2030.

b. North America dominated the HPLC market with a share of 31.68% in 2024. This is attributable to the rapid growth in the pharmaceutical industry, high research and development spending, increasing demand for clinical diagnostic applications, and the presence of key players such as Thermo Fisher Scientific, Inc., Agilent Technologies, Inc., Bio-Rad Laboratories, Inc., and others in the region.

b. Some key players operating in the HPLC market include Waters Corporation; Thermo Fisher Scientific, Inc.; Agilent Technologies, Inc.; Shimadzu Corporation; Sartorius AG; PerkinElmer, Inc.; Bio-Rad Laboratories, Inc.; Merck KGaA; Tosoh Bioscience GmbH; Gilson, Inc. and Danaher Corporation.

b. Key factors that are driving the high-performance liquid chromatography market growth include rapid growth in pharmaceuticals production, stringent regulatory norms for drug purity, increasing adoption of HPLC techniques for diagnostics and research purposes, and technological advancements in HPLC systems that are expanding its scope of applications.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."