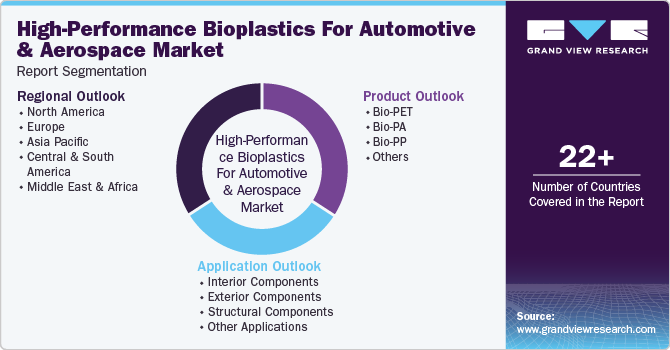

High-performance Bioplastics For Automotive And Aerospace Market Size, Share & Trends Analysis Report By Product (Bio-PET, Bio-PA, Bio-PP), By Application (Interior, Exterior, Structural), By Region, And Segment Forecasts, 2025 - 2030

- Report ID: GVR-4-68040-545-0

- Number of Report Pages: 130

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Bulk Chemicals

Market Size & Trends

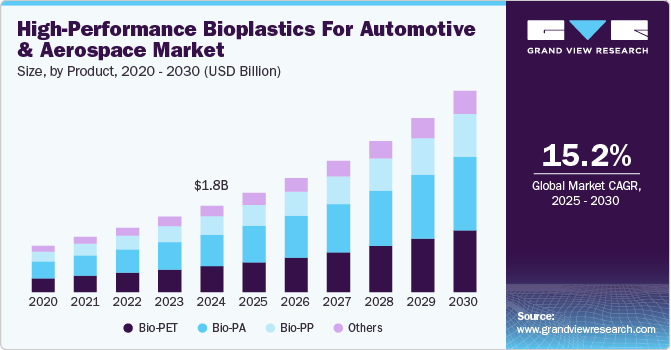

The global high-performance bioplastics for automotive and aerospace market size was estimated at USD 1.82 billion in 2024 and is expected to expand at a CAGR of 15.2% from 2025 to 2030. Stringent environmental regulations such as the EU’s Single-Use Plastics Directive and CAFE standards and growing Environmental, Social, & Governance pressures are compelling automotive and aerospace manufacturers to adopt high-performance bioplastics. These materials reduce reliance on fossil fuels, lower carbon footprints, and align with circular economy goals-critical for compliance and brand reputation.

The push for fuel efficiency (in aerospace) and extended battery range (in EVs) is accelerating the shift to bioplastics like PHA (polyhydroxyalkanoates) and bio-based PA (polyamides). These materials offer strength-to-weight ratios comparable to traditional plastics while being 20-30% lighter-directly improving energy savings.

Breakthroughs in bio-based polymers (e.g., lignin-reinforced plastics, algae-derived resins) and advanced processing techniques (e.g., 3D printing with bioplastics) are expanding applications in high-stress automotive/aerospace parts. Companies like Boeing and Tesla are investing in R&D for flame-retardant, UV-resistant bioplastics that meet stringent safety standards. In addition, partnerships between biopolymer producers (e.g., Corbion, Arkema) and OEMs are scaling production, reducing costs, and overcoming historical performance limitations-making bioplastics viable for structural components.

Despite their advantages, the widespread adoption of high-performance bioplastics in automotive and aerospace faces challenges due to their higher production costs than conventional plastics-often 2-3 times more expensive-limiting their use to premium applications.

Moreover, while bioplastics have made significant strides in durability and thermal stability, some variants still struggle to match traditional petroleum-based polymers' mechanical strength, flame resistance, or longevity, particularly in critical structural or high-temperature components. This performance gap and limited large-scale production infrastructure slow adoption among cost-sensitive manufacturers, requiring further R&D and economies of scale to become viable for mainstream use.

Product Insights

Bio-PA recorded the largest market revenue share of over 36.65% in 2024 and is projected to grow at the fastest CAGR of 15.3% during the forecast period. Bio-PA, including grades like PA 6.10 and PA 4.10, is a high-performance bioplastic prized in automotive and aerospace for its excellent thermal stability, chemical resistance, and strength-to-weight ratio. Sourced from castor oil or other renewables, it is used in engine covers, fuel lines, and electrical connectors, where traditional plastics fail under high temperatures. In aerospace, bio-PA’s low moisture absorption and fatigue resistance make it ideal for hydraulic systems, cable insulation, and even unmanned aerial vehicle (UAV) components.

Bio-PP, produced from sugarcane or waste oils, is emerging as a versatile bioplastic for automotive dashboards, door panels, and battery casings due to its balance of flexibility, impact resistance, and recyclability. Bio-PP is preferably used in non-critical cabin parts (e.g., storage bins, lavatory components), as aerospace applications prioritize weight savings and hygiene (inherent antimicrobial properties). However, its lower heat deflection temperature versus Bio-PA or PEEK limits its use in structural applications.

Bio-PET is gaining traction in the automotive and aerospace industries as a sustainable alternative to conventional PET, offering comparable mechanical strength and clarity while reducing carbon footprints. Derived partially from bio-based monoethylene glycol (MEG), it is increasingly used in vehicle interiors (seat fabrics, trim panels) and aircraft cabin components due to its lightweight, recyclability, and resistance to wear. Major automakers like Toyota and Ford are incorporating Bio-PET in non-structural parts to meet sustainability targets without compromising performance. However, reliance on fossil-based terephthalic acid (TPA) limits its fully bio-based potential, prompting R&D into 100% plant-derived alternatives.

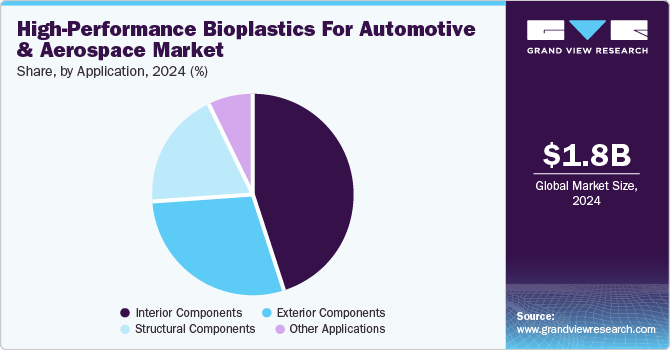

Application Insights

Interior components recorded the largest market share of 44.92% in 2024 and are projected to grow at the fastest CAGR of 14.9% during the forecast period. High-performance bioplastics are increasingly adopted for automotive and aerospace interiors, where sustainability, weight reduction, and passenger comfort are paramount. In vehicles, bio-based materials like Bio-PA (polyamides) and Bio-PET are used for seat fabrics, dashboard panels, door trims, and upholstery, offering comparable durability to conventional plastics while reducing carbon footprints.

In aerospace, bioplastics are gaining traction for non-structural cabin components such as lavatory fixtures, galleys, and insulation panels, where weight savings directly impact fuel efficiency. Airlines like Airbus and Boeing are testing bio-based composites to reduce overall aircraft weight and comply with sustainability mandates. Furthermore, bioplastics with antimicrobial properties are being explored for high-touch surfaces to improve hygiene-a critical factor in post-pandemic travel.

Bioplastics are making inroads into automotive and aerospace exterior applications, where durability, weather resistance, and aerodynamic efficiency are critical. In the automotive sector, bio-based polypropylene (Bio-PP) and reinforced bioplastics are used for bumper fascia, wheel arch liners, and side trims, offering weight savings without compromising impact resistance. Similarly, in aerospace, bioplastics are tested for non-load-bearing parts like fairings, wingtips, and antenna covers. The focus is on UV-stabilized, weather-resistant biopolymers that withstand extreme temperatures and aerodynamic stresses.

High-performance bioplastics in structural automotive and aerospace components remain limited but hold significant potential for future lightweight and sustainability gains. In automotive, bio-based epoxy resins and natural fiber composites are being explored for door frames, seat structures, and battery housings in electric vehicles (EVs). Structural aerospace applications are even more demanding, requiring materials that meet strict strength-to-weight and fire-safety standards. While fully bio-based solutions are rare, hybrid composites (e.g., bio-resins with carbon fiber) are being researched for secondary structures like floor beams, cargo liners, and UAV frames.

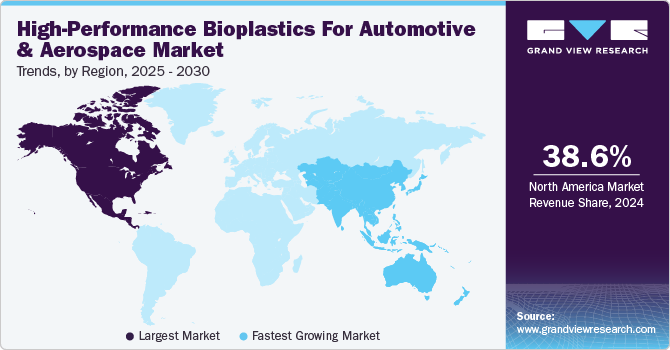

Region Insights

North America dominated the market and accounted for the largest revenue share of over 38.63% in 2024 and is anticipated to grow at the fastest CAGR of 15.1% over the forecast period. North America is a key market for high-performance bioplastics in automotive and aerospace, driven by stringent sustainability regulations, corporate ESG commitments, and strong R&D investments. The U.S. leads adoption, with automakers like Ford and Tesla incorporating bio-based materials in interiors and lightweight components, while aerospace giants like Boeing explore bio-composites for cabin and structural applications to meet emissions targets.

U.S. High-Performance Bioplastics For Automotive And Aerospace Market Trends

The U.S. high-performance bioplastics for automotive and aerospace market is accounted for a substantial share of regional demand in 2024. The robust demand from electric vehicle (EV) manufacturers and aerospace OEMs seeking lightweight, sustainable alternatives is driving the product demand. However, reliance on imports for feedstocks (e.g., sugarcane-based Bio-PET) and competition from low-cost Asian producers hinder scalability.

Europe High-Performance Bioplastics For Automotive And Aerospace Market Trends

The high-performance bioplastics for automotive and aerospace market in Europe is expected to grow significantly during the forecast period. Europe’s Circular Economy Action Plan and bans on single-use plastics. Automotive OEMs like BMW and Volvo use bio-based materials for interiors and structural parts, while Airbus integrates flax-fiber composites in aircraft panels to comply with carbon-neutrality goals. Strict regulations and consumer eco-consciousness drive innovation, but high production costs and limited local feedstock availability pose hurdles.

Germany high-performance bioplastics for automotive and aerospace market is largely driven bychemical giants like BASF and Covestro developing advanced bio-PA and bio-epoxy resins for automotive structures. The country’s Automotive Industry 4.0 strategy prioritizes sustainable materials, with Mercedes-Benz using cactus-based leather alternatives in interiors. Aerospace applications focus on flame-retardant bioplastics for cabin components, though dependence on Asian bio-feedstocks and high R&D costs slow mass adoption.

Asia Pacific High-performance Bioplastics For Automotive And Aerospace Market Trends

The high-performance bioplastics for automative and aerospace market in Asia Pacific is the fastest-growing, with a 15.3% CAGR from 2025 to 2030, driven by China’s and Japan’s push for green manufacturing and EV expansion. Automakers like Toyota and BYD use bio-PP and bio-PET in dashboards and trims, while aerospace demand rises with India’s UDAN regional connectivity scheme. Low production costs and abundant sugarcane/cassava feedstocks favor scalability, but inconsistent regulations and lower consumer awareness limit premium applications.

China high-performance bioplastics for automotive and aerospace market dominates Asia’s bioplastics production, with Bio-PET and Bio-PA widely used in EVs and consumer electronics. Government policies like the 14th Five-Year Plan promote bio-based materials, with automakers like NIO and Geely testing bamboo-fiber composites. However, competition from conventional plastics and limited high-performance biopolymer innovation restrain aerospace adoption.

Middle East & Africa High-Performance Bioplastics For Automotive And Aerospace Market Trends

The high-performance bioplastics for automotive and aerospace market in the Middle East and Africa show nascent growth, with Saudi Arabia’s Vision 2030 driving investments in sustainable materials for construction and packaging. Automotive and aerospace use remains limited, but bio-composites for aircraft interiors have potential as airlines like Emirates explore eco-friendly cabin solutions. Challenges include harsh climates, testing material durability, and low local production capacity.

Saudi Arabia high-performance bioplastics for automotive and aerospace market is emerging as a bioplastic player, with NEOM and SABIC investing in bio-based polymers to diversify from oil. Pilot projects include bio-PP for automotive parts in partnership with Japanese OEMs, while aerospace applications focus on lightweight cabin materials for Hajj-related air travel. High temperatures and arid conditions demand specialized UV-resistant formulations, raising R&D costs.

Key High-performance Bioplastics For Automotive And Aerospace Company Insights

To gain an edge, major players are investing in vertical integration-securing bio-feedstock supplies and acquisitions. Differentiation revolves around performance enhancements, such as UV-stabilized bioplastics for exteriors or lignin-reinforced composites for structural parts. However, high production costs and limited scalability of advanced biopolymers, including bio-based PEEK, hinder its mass adoption, pushing companies to seek government subsidies and circular economy models.

Key High-Performance Bioplastics For Automotive And Aerospace Companies:

The following are the leading companies in the high-performance bioplastics for automotive and aerospace market. These companies collectively hold the largest market share and dictate industry trends.

- BASF

- RYAM.

- Knauf Industries.

- Asahi Kasei Corporation.

- AirX

- DuPont.

- Arkema

- Solvay

- TORAY INDUSTRIES, INC.

- Braskem

- NatureWorks LLC.

Recent Developments

-

In November 2024, BASF announced that it has secured ISCC PLUS certification for its Polyamide 6 (PA6) production facility in Shanghai, enabling the supply of bio-based and chemically recycled PA6 & PA6/6.6 copolymers. This milestone strengthens BASF’s commitment to circular economy solutions, offering automotive and aerospace industries low-carbon alternatives without compromising performance. The certified materials, produced via a mass balance approach, support manufacturers in meeting sustainability targets while maintaining the high-performance standards required for engineering applications.

High-Performance Bioplastics For Automotive And Aerospace Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2025 |

USD 2.08 billion |

|

Revenue forecast in 2030 |

USD 4.23 billion |

|

Growth rate |

CAGR of 15.2% from 2025 to 2030 |

|

Actual data |

2018 - 2024 |

|

Forecast period |

2025 - 2030 |

|

Quantitative units |

Volume in kilotons, revenue in USD million/billion, and CAGR from 2025 to 2030 |

|

Report coverage |

Revenue forecast, volume forecast, competitive landscape, growth factors, and trends |

|

Segments covered |

Product, application, region |

|

Regional scope |

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa |

|

Country scope |

U.S.; Canada; Mexico; Germany; France; UK; Italy; Spain; China; India; Japan; South Korea; Australia; Brazil; Argentina; South Africa; Saudi Arabia; UAE |

|

Key companies profiled |

BASF; RYAM; Knauf Industries; Asahi Kasei Corporation; AirX, DuPont; Arkema; Solvay; TORAY INDUSTRIES, INC.; Braskem; NatureWorks LLC. |

|

Customization scope |

Free report customization (equivalent to 8 analyst’s working days) with purchase. Addition or alteration to country, regional, and segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global High-Performance Bioplastics For Automotive And Aerospace Market Report Segmentation

This report forecasts volume revenue growth at a global level and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global high-performance bioplastics for automotive and aerospace market report based on product, application, and region:

-

Product Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Bio-PET

-

Bio-PA

-

Bio-PP

-

Others

-

-

Application Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Interior Components

-

Exterior Components

-

Structural Components

-

Other Applications

-

-

Region Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

France

-

UK

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global high-performance bioplastics for automotive and aerospace market was estimated at around USD 1.82 billion in 2024 and is expected to reach around USD 2.08 billion in 2025.

b. The global high-performance bioplastics for automotive and aerospace market is expected to grow at a compound annual growth rate of 15.2% from 2025 to 2030, reaching around USD 4.23 billion by 2030.

b. The Bio-PA segment recorded the largest market revenue share of over 36.65% in 2024 owing to its excellent thermal stability, chemical resistance, and strength-to-weight ratio in automotive and aerospace industries.

b. The key players in the high-performance bioplastics for automotive and aerospace market include BASF, RYAM., Knauf Industries., Asahi Kasei Corporation., AirX, DuPont., Arkema, Solvay, TORAY INDUSTRIES, INC., Braskem, NatureWorks LLC.

b. The high-performance bioplastics for automotive and aerospace market is driven by stringent environmental regulations such as the EU’s Single-Use Plastics Directive and CAFE standards, along with growing Environmental, Social, & Governance (ESG) pressures are compelling automotive and aerospace manufacturers to adopt high-performance bioplastics

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."