- Home

- »

- Medical Imaging

- »

-

High Intensity Focused Ultrasound Market Size Report, 2030GVR Report cover

![High Intensity Focused Ultrasound Market Size, Share & Trends Report]()

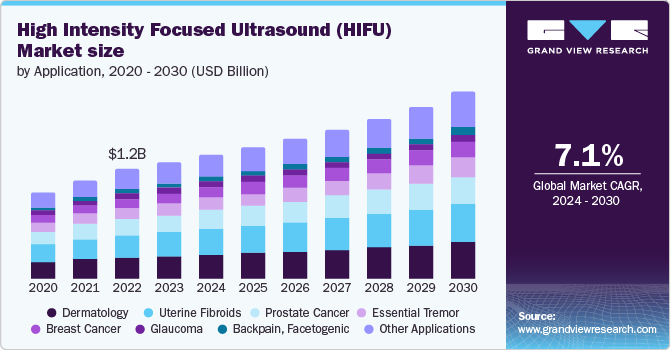

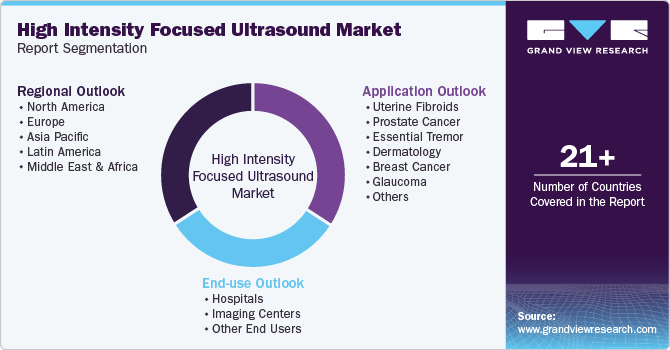

High Intensity Focused Ultrasound Market Size, Share & Trends Analysis Report By Application (Dermatology, Uterine Fibroids), By End-use (Hospitals, Imaging Centers), By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-334-9

- Number of Report Pages: 220

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Healthcare

HIFU Market Size & Trends

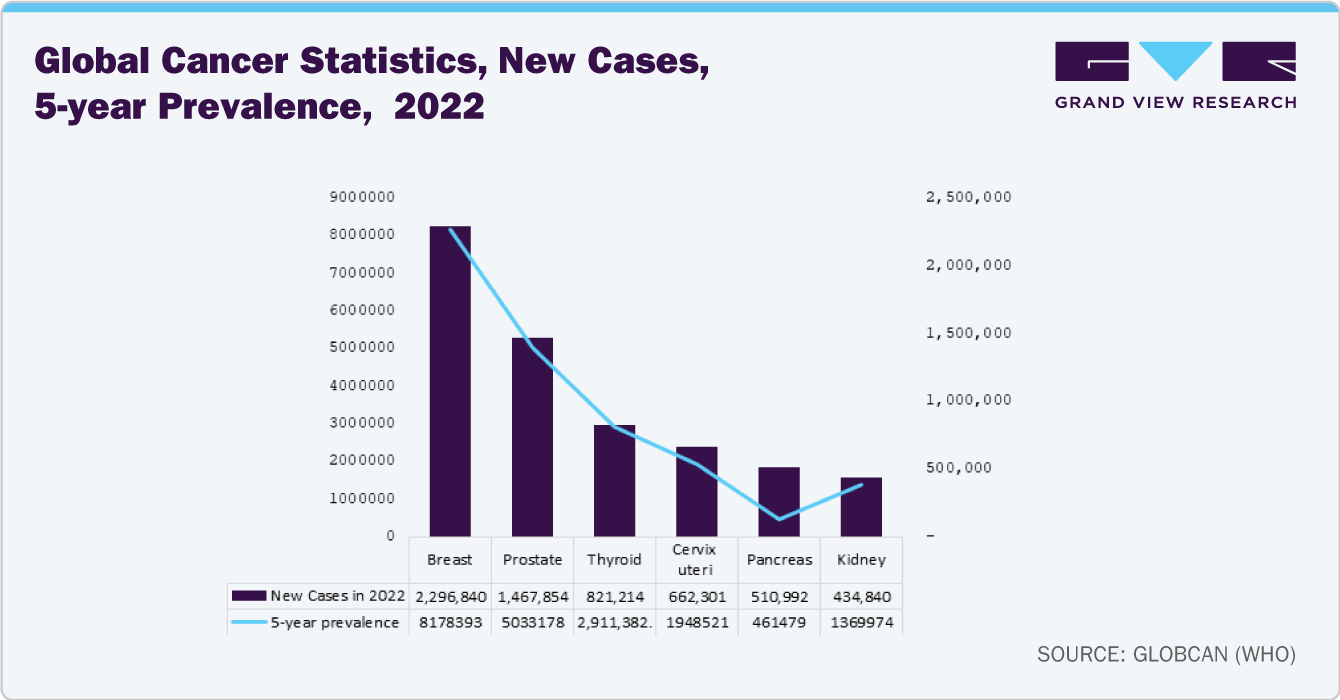

The global high intensity focused ultrasound market size was estimated at USD 1.23 billion in 2023 and is expected to grow at a CAGR of 7.06% from 2024 to 2030. Major factors contributing to the High Intensity Focused Ultrasound (HIFU) market growth include increasing prevalence of cancer and other chronic disorders, growing prevalence of minimally invasive procedures, technological advancements and increasing adoption in non-oncological applications. For instance, according to the International Agency for Research on Cancer in 2022, about 19,976,499 new cancer cases were reported globally.

HIFU is an efficient technique that uses focused ultrasound waves to generate precise and localized heat. This technique effectively targets and destroys diseased tissue without the need for invasive surgical procedures. This less-invasive approach minimizes damage to surrounding healthy tissues and reduces patients' recovery time. HIFU is particularly useful in treating various types of tumors, including prostate, liver, and kidney cancers. The growing prevalence of cancers worldwide is expected to have a positive impact on market growth.

Besides cancer treatment, HIFU is also being increasingly used for non-oncological applications due to its precision and minimally invasive nature. For instance, HIFU is highly effective in treating uterine fibroids, providing a non-surgical alternative that reduces recovery time and associated risks. In neurological disorders, HIFU is employed for conditions like essential tremor and Parkinson's disease, offering targeted brain lesioning without the need for open surgery. In addition, HIFU is gaining popularity in the cosmetic industry for procedures such as skin tightening and body contouring. These cosmetic applications benefit from HIFU's ability to precisely target and heat deep layers of the skin, stimulating collagen production and reducing fat cells, leading to improved skin texture and body shape without the need for invasive methods. For instance, in March 2024, Pure Tone Aesthetics announced the launch of its Pure Tone Aesthetics Inofus HIFU machines. This state-of-the-art device transforms non-invasive facial and body contouring, providing affordable treatments with reliable, proven results.

Continuous technological advancements in HIFU devices and procedures have significantly improved their efficiency, safety, and effectiveness, making them increasingly attractive to both healthcare providers and patients. Innovations such as the Mini HIFU machine, also known as a home-use HIFU device, example of such technology include ULTRAISER P1, ULTRAISER P1 Pro, Portable HIFU Device by ULTRAISER. These compact and portable devices are designed for personal use in the comfort of one's home, offering a smaller and less powerful version of the professional HIFU machines used in clinics or medical spas. This makes advanced skincare and body contouring treatments more accessible and convenient. Furthermore, the integration of HIFU with artificial intelligence (AI) enhances the precision and customization of treatments. AI algorithms can analyze patient data to optimize HIFU settings, ensuring that treatments are tailored to individual needs, thereby improving outcomes and reducing the risk of complications.

The incorporation of AI in HIFU systems is improving diagnostic accuracy and treatment planning, leading to better patient outcomes. AI-powered systems can analyze vast amounts of data to optimize treatment protocols. HIFU is gaining traction in the treatment of neurological disorders such as essential tremor and Parkinson's disease. Clinical trials and research studies are demonstrating the efficacy of HIFU in these applications, driving market interest. HIFU is increasingly being used in aesthetic medicine for non-surgical facelifts and body contouring. The growing demand for minimally invasive cosmetic procedures is fueling this trend.

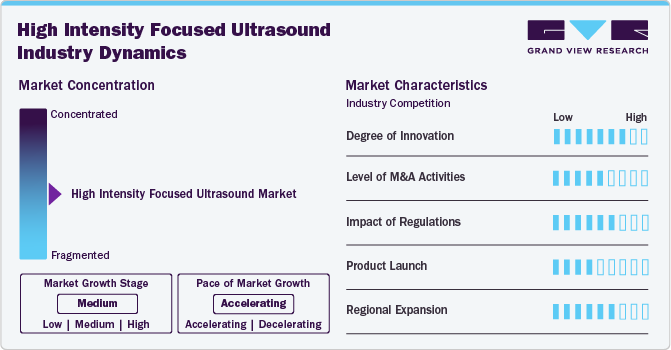

Industry Dynamics

The HIFU industry is accelerating at a high pace and has seen significant innovation driven by advancements in medical technology, increasing demand for less-invasive treatment options, and the integration of AI technologies. Medical technology advancements have led to the development of more precise and efficient HIFU devices capable of targeting tissues with greater accuracy while minimizing damage to surrounding areas. This has broadened the application range of HIFU, making it suitable for treating various medical conditions, from cancers to cosmetic concerns.

Major players in the industry are continuously working to improve their product offerings to expand their customer base and gain a larger industry share. This involves upgrading their products, exploring acquisitions, obtaining government approvals, and engaging in important cooperation activities. For instance, in November 2023, Shvabe Holding, a part of Rostec State Corporation, is conducting clinical trials of the DIATER-M HIFU system for tumor diagnostics and treatment. This represents the first Russian medical solution for tumor resection using the safer method of ultrasound. Commercial production of the equipment is scheduled to begin in 2024.

The degree of innovation in HIFU devices is remarkable, driven by continuous advancements in technology and growing demand for less-invasive treatment options. For instance, in May 2023, Researchers from Spain and the UK developed a new focused ultrasound system designed to use hyperthermia to treat multiple tumor spheroids simultaneously. This innovation will enable potential tumor treatments to be tested more rapidly.

In addition to manufacturers, service providers in the healthcare sector are actively pursuing various initiatives to offer patients advanced treatments. This includes mergers and acquisitions aimed at expanding service capabilities, improving patient access to high-end technologies, and enhancing overall healthcare delivery. For instance, in April 2024, HIFU Prostate Services, LLC (HPS), a provider of non-invasive treatments for prostate cancer using HIFU, announced the acquisition of specific HIFU assets from Vituro Health, LLC (Vituro). Vituro brings with it a network of physicians and existing hospital contracts that will enhance and expand the HPS platform.

"We have a long-standing relationship with many of the Vituro physicians and are looking forward to working with each of them to grow their HIFU practice."

- Jenny Robeson, Chief Sales Officer of HPS.

The impact of regulations on HIFU varies across different regulatory agencies and regions. Regulatory bodies such as the FDA in the U.S., the EMA in Europe, and equivalent agencies in other countries play a crucial role in overseeing the safety, efficacy, and market approval of HIFU devices and treatments. These agencies set standards and guidelines that manufacturers must adhere to, ensuring that HIFU technologies meet stringent safety requirements and demonstrate clinical effectiveness through testing and clinical trials.

Manufacturers are actively involved in launching new products to meet evolving market demands and technological advancements. For instance, in March 2022, Ilooda, a South Korean medical device manufacturer, announced the launch of Hyzer Me, a new HIFU device that sets a new standard in aesthetic lifting technology. This advanced device delivers powerful performance with 30W, aiming to redefine the market landscape.

The geographical reach of the HIFU industry has been expanding significantly, driven by factors such as population growth, increasing healthcare expenditures, and evolving regulatory frameworks.

Application Insights

The dermatology segment dominated the market by capturing a share of 20.7% in 2023. This is primarily attributed to the increasing adoption of HIFU technology for various aesthetic and therapeutic applications. In dermatology, HIFU is widely utilized for non-invasive skin tightening, wrinkle reduction, and facial rejuvenation treatments, resulting in the growing adoption of minimally invasive cosmetic solutions. The technology's ability to stimulate collagen production and tighten skin without the need for surgery has made it particularly popular among both patients and dermatologists. According to the American Board of Cosmetic Surgery, HIFU treatments for skin tightening show favorable outcomes within 2–3 months, with proper skin care practices helping to sustain these results for up to 1 year.

The uterine fibroid segment is expected to grow at the fastest CAGR of 7.74% over the forecast period. Uterine fibroids are a common condition among women, leading to symptoms such as heavy menstrual bleeding, pelvic pain, and reproductive issues. HIFU technology offers a less-invasive alternative to traditional surgical treatments like hysterectomy or myomectomy, beneficial to patients seeking less invasive options with shorter recovery times and fewer complications. In addition, advancements in HIFU devices have improved their precision and effectiveness in targeting fibroids while minimizing damage to surrounding tissues, enhancing the safety and efficacy of the procedure. As awareness about non-surgical treatment options grows and healthcare providers increasingly adopt HIFU for uterine fibroid. For instance, in June 2024, Nordica Fibroid Care Centre is preparing to introduce the nation's first HIFU machine for treating uterine fibroids. Nordica, known for its expertise in fertility and fibroid care, initially introduced the HIFU treatment method in Lagos back in 2021.

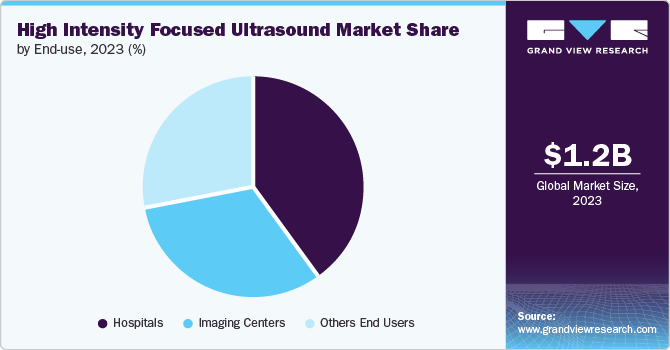

End-use Insights

The hospital segment dominated the market with a share of over 39.9% in 2023 and is further expected to grow at the fastest CAGR over the forecast period. This is owing to the adoption of technologically advanced medical devices by hospitals. For instance, in February 2022, Children’s National Hospital, based in Washington, D.C., achieved a milestone by performing the first HIFU surgery on a pediatric patient diagnosed with neurofibromatosis (NF). Furthermore, these facilities often have specialized departments and trained medical personnel capable of administering HIFU treatments effectively. Moreover, hospitals treat a wide range of medical conditions, including cancer and other diseases, where HIFU proves beneficial.

The imaging centers segment also held a significant market share in 2023. Imaging centers are equipped with advanced diagnostic technologies essential for guiding and monitoring HIFU procedures with precision and accuracy. These centers play a crucial role in providing comprehensive diagnostic services and are increasingly integrating therapeutic applications like HIFU to offer minimally invasive treatment options to patients. Moreover, imaging centers often collaborate closely with hospitals and healthcare providers, enhancing their capacity to deliver specialized care and expand their service offerings in non-surgical treatments.

Regional Insights

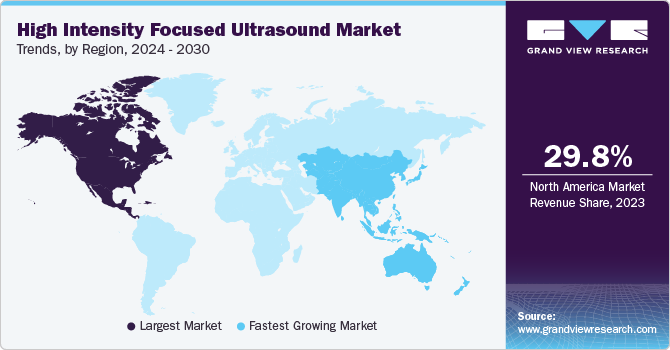

The North America High Intensity Focused Ultrasound (HIFU) market held the largest global revenue share of 29.75% in 2023. This can be attributed to the presence of key market players and ongoing research and development activities in the region.Furthermore, a high prevalence of chronic diseases, including cancer, drives demand for effective and less invasive treatment methods like HIFU.

U.S. High Intensity Focused Ultrasound (HIFU) Market Trends

The High Intensity Focused Ultrasound (HIFU) market in the U.S. held the largest market share in 2023 in the North America region. This is owing to the growing prevalence of various cancers such as prostate, breast, and others in the country, which is expected to increase the adoption of this less-invasive technique compared to surgery. For instance, according to the International Agency for Research on Cancer, in 2022, there were about 230,125 prostate cancer cases in the country, and 33,746 deaths were reported.

Europe High Intensity Focused Ultrasound (HIFU) Market Trends

The High Intensity Focused Ultrasound (HIFU) market in Europe held a significant market share in 2023. Europe benefits from a well-established healthcare infrastructure and advanced medical technology adoption, which facilitates the integration of HIFU across various medical specialties.

The High Intensity Focused Ultrasound (HIFU) market in the UK is anticipated to expand due to several factors. These include increasing awareness and adoption of non-invasive treatment options, advancements in medical technology, supportive regulatory frameworks, and rising healthcare expenditure aimed at improving patient care and outcomes.

The France High Intensity Focused Ultrasound (HIFU) market is expected to grow over the forecast period due to the growing adoption of non-oncological applications such as the treatment of neurological disorders, uterine fibroids, and cosmetic procedures like skin tightening and body contouring.

The High Intensity Focused Ultrasound (HIFU) market in Germany is expected to grow over the forecast period. This growth can be attributed to technological advancements, which include improvements in HIFU devices, such as enhanced precision, imaging integration, and treatment outcomes.

Asia Pacific High Intensity Focused Ultrasound (HIFU) Market Trends

The Asia Pacific High Intensity Focused Ultrasound (HIFU) market is estimated to witness the fastest CAGR of 7.74% during the forecast period. Advancements in healthcare infrastructure and increasing healthcare expenditures in countries such as China, Japan, and South Korea are facilitating the adoption of innovative medical technologies, including HIFU. Moreover, a growing aging population in the region, coupled with changing healthcare policies and favorable regulatory frameworks, supports the expansion of HIFU applications in both therapeutic and cosmetic fields.

The High Intensity Focused Ultrasound (HIFU) market in China is expected to grow at a notable growth rate over the forecast period. This growth can be attributed to the growing prevalence of cancer in the country. For instance, according to the International Agency for Research on Cancer, in 2022, there were about 4,824,703 new cancer cases in the country which are expected to reach 10,968,974 by 2027.

The Japan High Intensity Focused Ultrasound (HIFU) market is expected to grow over the forecast period. This growth is mainly attributed to the country's focus on technological advancement and the widespread uptake of advanced solutions.

Latin America High Intensity Focused Ultrasound (HIFU) Market Trends

The High Intensity Focused Ultrasound (HIFU) market in Latin America is anticipated to undergo moderate growth throughout the forecast period. This is owing to the increasing adoption of advanced medical technologies across the region, supported by improvements in healthcare infrastructure and expanding healthcare investments. Furthermore, the increasing prevalence of chronic disorders such as cancer is further expected to fuel regional market growth.

MEA High Intensity Focused Ultrasound (HIFU) Market Trends

The High Intensity Focused Ultrasound (HIFU) in MEA is anticipated to witness growth owing to several key factors. There is a rising prevalence of cancer of various types, such as prostate, breast, and liver cancers. Moreover, advancements in healthcare infrastructure and technology adoption are increasing the accessibility of HIFU treatments across MEA countries.

Key High Intensity Focused Ultrasound Company Insights

The major players in the market are actively enhancing their product portfolios through various strategies aimed at staying competitive and expanding their market share. This includes continuous product upgrades to incorporate the latest technological advancements, strategic collaborations, and exploring opportunities for acquisitions. In addition, obtaining government approvals for their products is crucial to ensure compliance with regulatory standards.

Key High Intensity Focused Ultrasound Companies:

The following are the leading companies in the high intensity focused ultrasound (HIFU) market. These companies collectively hold the largest market share and dictate industry trends.

- Focal One

- Sonablate Corp.

- Verasonics, Inc.

- ALPINION MEDICAL SYSTEMS Co., Ltd.

- Theraclion

- Chongqing Haifu Medical Technology Co., Ltd.

- Lynton Lasers Ltd

- ULTRAISER

- Profound Medical Inc.

Recent Developments

-

In January 2024, Kokilaben Dhirubhai Ambani Hospital, India, introduced the advanced High-Intensity Focused Ultrasound (HIFU) technology for prostate cancer treatment. HIFU uses high-frequency sound waves to precisely target and destroy prostate cancer cells, offering a minimally invasive and highly targeted approach to treating localized prostate cancer.

-

In October 2023, the FDA approved HistoSonics' innovative therapy platform, Edison, for treating liver tumors. This marks the ninth clinical use of focused ultrasound treatment approved by the FDA. Edison employs histotripsy to destroy liver tissue noninvasively and is the first and only platform of its kind available in the US. This also represents the first global regulatory approval for histotripsy.

-

In July 2023, EDAP TMS SA, a leading company in robotic energy-based therapies, announced that Switzerland approved reimbursement for High-Intensity Focused Ultrasound (HIFU) to treat prostate cancer, effective July 1, 2023.

-

In November 2020, the FDA approved Profound Medical Inc.'s Sonalleve MR-guided high-intensity focused ultrasound (MR-HIFU) system for treating osteoid osteoma in the extremities. This technique combines high-intensity focused ultrasound ablation with real-time temperature monitoring during treatment.

High Intensity Focused Ultrasound Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 1.31 billion

Revenue forecast in 2030

USD 1.97 billion

Growth rate

CAGR of 7.06% from 2024 to 2030

Actual period

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion, and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Application, end-use, region

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; Japan; China; India; Australia; Thailand; South Korea; Brazil; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

Focal One, Sonablate Corp., Verasonics, Inc., Alpinion Medical Systems Co., Ltd., Theraclion, Chongqing Haifu Medical Technology Co., Ltd.,

Lynton Lasers Ltd, ULTRAISER, Profound Medical Inc.

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global High Intensity Focused Ultrasound Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global high intensity focused ultrasound (HIFU) market report based on application, end-use, and region:

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Uterine Fibroids

-

Prostate Cancer

-

Essential Tremor

-

Dermatology

-

Breast Cancer

-

Glaucoma

-

Backpain, Facetogenic

-

Other Applications

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospitals

-

Imaging Centers

-

Other End Users

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

Thailand

-

South Korea

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global High Intensity Focused Ultrasound (HIFU) market size was estimated at USD 1.23 billion in 2023 and is expected to reach USD 1.31 billion in 2024.

b. The global High Intensity Focused Ultrasound (HIFU) market is expected to grow at a compound annual growth rate of 7.06% from 2024 to 2030 to reach USD 1.97 billion by 2030.

b. North America High Intensity Focused Ultrasound (HIFU) market held the largest share of 29.75% in 2023. This can be attributed to the presence of key market players and ongoing research and development activities in the region. Furthermore, a high prevalence of chronic diseases, including cancer, drives demand for effective and less invasive treatment methods like HIFU.

b. Some key players operating in the High Intensity Focused Ultrasound (HIFU) market include Focal One, Sonablate Corp. , Verasonics, Inc., Alpinion Medical Systems Co., Ltd., Theraclion, Chongqing Haifu Medical Technology Co., Ltd., Lynton Lasers Ltd, ULTRAISER, Profound Medical Inc.

b. Key factors that are driving the market growth include prevalence of cancer and other chronic disorders, growing prevalence of minimally invasive procedures, technological advancements and increasing adoption in non-oncological applications.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."