High-Integrity Pressure Protection System Market Size, Share & Trends Analysis Report By Type (Electronics HIPPS, Hydraulic/Mechanical HIPPS), By Offering. By End Use, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-377-6

- Number of Report Pages: 150

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Advanced Materials

Market Size & Trends

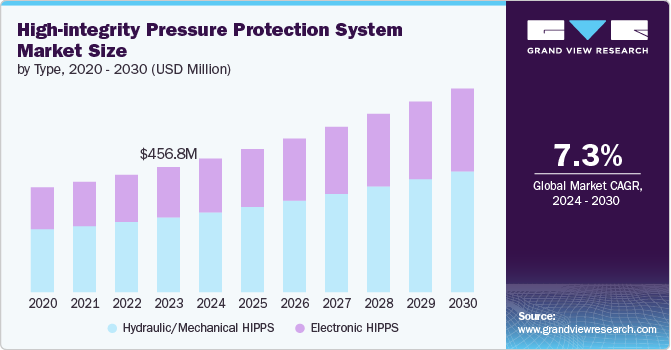

The global high-integrity pressure protection systems market size was estimated at USD 456.8 million in 2023 and is projected to reach at a CAGR of 7.3% from 2024 to 2030. The compelling organizations are investing in advanced safety systems like high-integrity pressure protection systems (HIPPS) due to stringent safety regulations and standards in sectors such as oil and gas, chemicals, and pharmaceuticals. These systems are designed to prevent overpressure incidents in critical process pipelines and equipment, thereby safeguarding personnel, the environment, and assets.

Technological advancements in automation and control systems are enhancing the capabilities and reliability of HIPPS. Modern HIPPS incorporates sophisticated sensors, actuators, and logic solvers that can detect pressure deviations swiftly and initiate rapid shutdown procedures. This level of automation not only minimizes human error but also enables faster response times, reducing the likelihood of equipment damage and operational downtime. Industries are thus drawn to HIPPS not only for their safety benefits but also for their potential to optimize operational efficiency and maintain continuous production.

Drivers, Opportunities & Restraints

The expansion of infrastructure and industrial projects in emerging economies is fueling market growth for HIPPS. Countries investing in new oil and gas developments, chemical processing facilities, and power generation plants are prioritizing safety infrastructure to comply with international standards and attract investment.

Despite its promising growth prospects cost considerations pose a significant hurdle for widespread adoption. The initial investment in HIPPS, including equipment, installation, and integration with existing infrastructure, can be substantial. This cost factor may deter smaller organizations or projects with constrained budgets from investing in HIPPS, especially in sectors where margins are tight, or capital expenditures are scrutinized.

The increasing emphasis on environmental sustainability and regulatory compliance offers a growth avenue for HIPPS in industries such as chemicals, pharmaceuticals, and wastewater treatment. HIPPS helps minimize emissions, reduce process waste, and optimize resource utilization by preventing overpressure incidents that could lead to environmental contamination or operational disruptions. As companies strive to meet stringent environmental standards and mitigate their carbon footprint, HIPPS solutions that enhance operational safety while supporting sustainable practices are poised to gain traction, particularly in regions with stringent regulatory frameworks.

Type Insights

“The demand for Electronic HIPPS is expected to grow at a significant CAGR of 7.5% from 2024 to 2030 in terms of revenue”

Hydraulic/Mechanical HIPPS accounted for 59.8% of the revenue share in 2023. This type of HIPPS caters to industries where robustness, simplicity, and reliability are vital considerations. These systems utilize mechanical or hydraulic mechanisms, such as pilot valves, check valves, and pressure relief valves, to achieve high-integrity pressure protection. Hydraulic/Mechanical HIPPS are preferred in applications where electronic components may be susceptible to environmental conditions, electromagnetic interference (EMI), or where a fail-safe mechanism is crucial for fail-close operations. Industries with harsh operating environments, including offshore oil and gas platforms, mining operations, and heavy manufacturing facilities, are driving the market demand for Hydraulic/Mechanical HIPPS for their durability, low maintenance requirements, and capability to operate independently of external power sources.

The demand for electronics HIPPS is primarily driven by advancements in automation and digitalization across industrial sectors. Electronics HIPPS utilizes sophisticated electronic components, including sensors, logic solvers, and programmable logic controllers (PLCs), to monitor and control pressure levels in critical process pipelines and equipment. These systems offer real-time monitoring capabilities and rapid response times, enabling proactive management of pressure deviations and potential overpressure scenarios. Industries such as oil and gas, chemical processing, and pharmaceuticals benefit significantly from Electronics HIPPS due to these features and are increasingly adopting them.

End use Insights

“The power generation segment is expected to grow at a rapid CAGR of 8.0% from 2024 to 2030 in terms of revenue”

The oil & gas segment accounted for 26.5% of the revenue share in 2023 and is expected to expand at a notable CAGR from 2024 to 2030. The complexity and scale of oil and gas operations drive the demand for robust and reliable safety systems such as HIPPS that can operate effectively in harsh and remote environments. HIPPS are engineered with advanced technologies including pressure sensors, control valves, logic solvers, and emergency shutdown systems (ESD) to ensure rapid response and fail-safe operation. This capability not only enhances operational safety but also minimizes downtime, reduces operational risks, and protects valuable assets from potential damage or loss.

The adoption of HIPPS in the power generation industry is driven primarily by end users in the industry prioritizing operational safety, reliability, and regulatory compliance. Power generation facilities, whether thermal, nuclear, or renewable, operate complex processes involving high-pressure steam, gases, and fluids. HIPPS play a crucial role in safeguarding these processes by ensuring that pressure levels within critical equipment and pipelines remain within safe operational limits. This proactive approach minimizes the risk of overpressure incidents that could lead to equipment failure, unplanned downtime, and potential safety hazards for personnel.

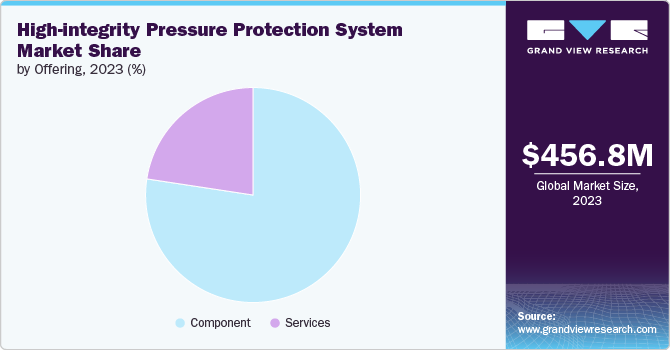

Offering Insights

“The demand for the component segment is expected to grow at a significant CAGR of 7.4% from 2024 to 2030 in terms of revenue”

The demand for HIPPS components is propelled by technological advancements in the field. Components such as pressure sensors, logic solvers, valves (including pilot valves and check valves), actuators, and controllers form the core infrastructure of HIPPS systems. These components are essential for monitoring, detecting, and controlling pressure levels in critical process pipelines and equipment. Innovation in sensor technology, microelectronics, and materials science has enhanced the performance, accuracy, and durability of HIPPS components. Advanced pressure sensors with high sensitivity and reliability enable precise pressure monitoring and detection, crucial for preemptive action against overpressure situations.

The service segment accounted for 22.6% of the Revenue share in 2023 and is expected to expand at a significant CAGR from 2024 to 2030, driven by end users hiring service provers to mitigate risks through maintenance, inspection, testing, and other services. Service providers offering risk assessment, safety audits, and reliability-centered maintenance services help mitigate these risks by ensuring HIPPS operates at optimal performance levels. Proactive maintenance programs, including predictive maintenance using data analytics and condition monitoring, minimize the likelihood of unexpected failures, thereby protecting valuable assets and optimizing operational continuity.

Regional Insights

“Asia Pacific to witness fastest market growth at 7.6% CAGR from 2024 to 2030”

The growth of the High Integrity Pressure Protection Systems (HIPPS) market in Asia Pacific is driven by several key factors that reflect both regional economic expansion and increasing industrial safety standards. Firstly, Asia Pacific is experiencing rapid industrialization and infrastructure development across sectors such as oil and gas, chemicals, power generation, and manufacturing. As these industries expand to meet growing domestic and international demand, the heightened emphasis on enhancing operational safety and reliability is driving market growth in the region.

Technological advancements and innovations in automation play a significant role in driving the growth of the HIPPS market in China. The integration of smart sensors, data analytics, and real-time monitoring capabilities enhances the performance and reliability of HIPPS systems, enabling proactive management of operational risks and predictive maintenance practices. Chinese industries are increasingly adopting Industry 4.0 principles and digital transformation strategies to optimize production processes, reduce downtime, and improve overall operational efficiency. HIPPS equipped with advanced technologies contribute to these objectives by enhancing safety standards and supporting sustainable industrial development

North America High-integrity Pressure Protection System Market Trends

Ongoing investments in infrastructure projects, including pipeline expansions, refineries, and petrochemical facilities, present significant growth opportunities for the market in North America. These projects require robust and reliable safety systems to ensure operational reliability and environmental stewardship. HIPPS providers offering scalable solutions, customization capabilities, and comprehensive service support are well-positioned to capitalize on these opportunities and address the evolving safety needs of industrial end-users across the region.

Europe High-integrity Pressure Protection System Market Trends

Europe's diverse industrial landscape, comprising sectors such as oil and gas, chemical processing, power generation, and pharmaceuticals, places a premium on operational safety and risk management. HIPPS are essential in these industries for preventing overpressure incidents in critical process equipment and pipelines, thereby safeguarding operations, protecting the environment, and ensuring the safety of personnel.

Key High-integrity Pressure Protection System Company Insights

Some key players operating in the market include SLB, HIMA, and L&T Valves Limited.

-

SLB. is a manufacturer and provider of high-integrity pressure protection systems, compressors, pumps, generators, power tools, and assembly systems, through multiple brands such as ABAC, AGRE, AIRnet, ALUP, Balma, and American Pneumatic Tools (APT) among others. The company has a direct presence in over 70 countries and sales in more than 180.

-

HIMAis a company primarily focusing on providing safety-related automation solutions catering to companies engaged in the process and rail industries. It is present in more than 75 countries across the globe and offers customized HIPPS solutions to its customers to cater to specific requirements.

- L&T Valves Limited. (LARSEN & TOUBRO LIMITED) is a company engaged in providing flow-control solutions for various industries, including oil & gas, refineries, petrochemicals, power, water, aerospace, defense, and other process industries. The company offers a range of customized SIL-3-capable HIPPS for over-pressure protection.

Key High-Integrity Pressure Protection System Companies:

The following are the leading companies in the high-integrity pressure protection system market. These companies collectively hold the largest market share and dictate industry trends.

- SLB.

- HIMA

- Siemens

- IMI

- L&T Valves Limited. (LARSEN & TOUBRO LIMITED)

- Ringo Válvulas (Samson AG group)

- Yokogawa Electric Corporation

- Maverick Valves (MV Nederland BV)

- Ampo

- Emerson Electric Co.

- Rockwell Automation

- Schneider Electric

- ABB

- Baker Hughes Company

- Mokveld Valves B.V.

Recent Developments

-

In May 2024, IMI developed a high-integrity pressure protection system (HIPPS) specifically designed to protect against overpressure during the hydrogen post-production process. The HIPPS system uses electronic transmitters and a logic solver to quickly detect and isolate the source of dangerous high pressure, rather than just relieving excess flow. As per the company, this HIPPS solution will be crucial for ensuring the safety of hydrogen production facilities as the industry grows to meet demand in hard-to-abate sectors such as heavy industry and long-distance transport.

-

In October 2021, Emerson's introduced the SIL 3-certified valve assemblies for High-integrity pressure protection systems (HIPPS), which signified a major advancement in industrial safety technology, ensuring a very high level of reliability and risk reduction. These valve assemblies meet stringent international standards, making them ideal for industries like oil and gas, chemicals, and pharmaceuticals that require robust safety measures to protect personnel and assets.

High-integrity Pressure Protection System Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2024 |

USD 488.1 million |

|

Revenue forecast in 2030 |

USD 743.6 million |

|

Growth rate |

CAGR of 7.3% from 2024 to 2030 |

|

Actual data |

2018 - 2023 |

|

Forecast period |

2024 - 2030 |

|

Quantitative units |

Revenue in USD million and CAGR from 2024 to 2030 |

|

Report coverage |

Revenue forecast, company market position analysis, competitive landscape, growth factors, and trends |

|

Segments covered |

Type, offering, end use, region |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; Middle East & Africa |

|

Country Scope |

U.S.; Canada; Mexico; Germany; France; Italy; UK; Spain; China; Japan; India; South Korea; Australia; Brazil; Argentina; South Africa; Saudi Arabia; UAE |

|

Key companies profiled |

SLB.; HIMA; Siemens; IMI; L&T Valves Limited. (LARSEN & TOUBRO LIMITED); Ringo Válvulas (Samson AG group); Yokogawa Electric Corporation; Maverick Valves (MV Nederland BV); Ampo; Emerson Electric Co.; Rockwell Automation; Schneider Electric; ABB; Baker Hughes Company; Mokveld Valves B.V. |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global High-integrity Pressure Protection System Market Report Segmentation

This report forecasts revenue growth at global, regional & country levels and provides an analysis on the industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the high-integrity pressure protection systems market based on type, offering, end use, and region.

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Electronic HIPPS

-

Hydraulic/Mechanical HIPPS

-

-

Offering Outlook (Revenue, USD Million, 2018 - 2030)

-

Component

-

Services

-

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Oil & Gas

-

Water & Wastewater

-

Food & Beverage

-

Chemicals

-

Food & Beverage

-

Pharmaceutical

-

Power Generation

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global high-integrity pressure protection systems market size was estimated at USD 456.8 million in 2023 and is expected to reach USD 456.8 million in 2024.

b. The high-integrity pressure protection systems market, in terms of revenue, is expected to grow at a compound annual growth rate of 7.5% from 2024 to 2030 to reach USD 743.6 million by 2030.

b. Asia Pacific dominated the high-integrity pressure protection systems market with a revenue share of 37.1% in 2023. The high-integrity pressure protection systems market in Asia Pacific is driven by the presence of an expanding oil ang gas industry in the region fostering a conducive environment for market growth.

b. Some of the key players operating in the high-integrity pressure protection systems market include SLB., HIMA , Siemens, IMI, L&T Valves Limited. (LARSEN & TOUBRO LIMITED), Ringo Válvulas (Samson AG group), Yokogawa Electric Corporation, Maverick Valves (MV Nederland BV), Ampo, Emerson Electric Co., Rockwell Automation, Schneider Electric, ABB, Baker Hughes Company, and Mokveld Valves B.V.

b. The high-integrity pressure protection systems market is experiencing robust growth driven by regulatory requirements mandating safety instrumented systems (SIS) for risk mitigation in industries such as oil and gas, chemicals, and power generation. Additionally, technological advancements in automation and sensor technologies enhance system reliability and operational safety, while the growing emphasis on operational efficiency and asset protection further boosts the demand for HIPPS globally.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."