High Frequency Trading Market Size, Share & Trends Analysis Report By Product (Market Making, Others), By Deployment (Cloud, On-premise), By End Use (Investment Banks, Hedge Funds, Personal Investors), By Region, And Segment Forecasts, 2025 - 2030

- Report ID: GVR-4-68040-490-6

- Number of Report Pages: 130

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Technology

High Frequency Trading Market Trends

The global high frequency trading market size was valued at USD 10.36 billion in 2024 and is projected to grow at a CAGR of 7.7% from 2025 to 2030. High frequency trading (HFT) has revolutionized the modern financial markets. Unlike traditional trading strategies that focus on capturing significant gains from individual transactions, HFT focuses on gaining small profits from individual transactions, which adds up to significant gains due to a large number of transactions. HFT operates at a high pace, and many factors influence HFT's profitability, impacting the overall market ecosystem.

One of the most crucial concepts for driving profits in the HFT market is the concept of microscopic profits on large volumes. Unlike a long-term investor who seeks substantial returns on a few well-chosen investments, HFT strategies focus on extracting minuscule profits from a massive number of trades. Sophisticated algorithms play a critical role here, constantly scanning markets and identifying even the slightest price fluctuations. By capitalizing on these fleeting opportunities, HFT firms accumulate significant profits through sheer volume. For instance, a price difference of a fraction of a cent exists between the same security on two different exchanges. HFT algorithms can exploit this discrepancy by executing rapid buy and sell orders, pocketing a small profit on each trade. However, the number of such trades executed at fast speed can translate into substantial overall profit.

Moreover, in HFT, trading algorithms operate at a very high speed, meticulously scanning a multitude of markets and exchanges simultaneously. This ability to process vast amounts of data and identify arbitrage opportunities in real time is pivotal to the success of HFT strategies. By exploiting price discrepancies across different markets, HFT firms can capitalize on these inefficiencies and generate profits. However, achieving such speed requires significant investments in cutting-edge technology, including high-performance computing infrastructure and low-latency data feeds. This creates a barrier to entry, limiting the number of players in the HFT space.

Another important feature of HFT is its significant role in enhancing market liquidity. The high volume and rapid execution of trades by HFT firms act to narrow the bid-ask spread, which is the difference between the buying and selling price of an asset. A narrower bid-ask spread translates to a more efficient market with lower transaction costs for all participants, including long-term investors. Moreover, the constant presence of HFT firms can help reduce market volatility by quickly absorbing buy and sell orders, preventing large price swings. However, HFT can create a short-term focus within the market, with traders prioritizing fleeting arbitrage opportunities over long-term value investing.

Despite the benefits of speed and market liquidity, HFT also carries inherent risks. The fast-paced nature of HFT can exacerbate market volatility in certain scenarios, particularly during periods of high stress or uncertainty. Moreover, the reliance on complex algorithms raises concerns about potential technical glitches or manipulation. However, these risks can be mitigated through various strategies. Stop-loss orders, for instance, automatically exit positions when prices reach a predetermined level, thereby curbing potential losses in this fast-paced environment. Regulatory bodies are also continuously evaluating and refining rules to ensure fair and orderly practices in the high frequency trading industry.

Product Insights

The market making segment accounted for the largest share of 72.3% in 2024. Market making can be considered a critical segment of the industry. Firms such as Optiver, IMC, and Virtu Financial specialize in providing liquidity to the market by continuously offering buy and sell quotes, a practice that helps narrow bid-ask spreads and ensure smoother market operations. The competitive nature of market making drives these firms to invest heavily in ultra-low latency trading systems and advanced algorithms, allowing them to capitalize on minute price discrepancies. The increasing complexity of financial markets and the demand for liquidity across various asset classes are the key factors driving the growth of the segment in the high frequency trading industry.

The other segment is expected to grow at a significant CAGR during the forecast period. The segment encompasses diverse HFT strategies, such as momentum or trend following, arbitrage, and statistical arbitrage. Momentum trading capitalizes on short-term price trends, arbitrage exploits price differences across markets or instruments, and statistical arbitrage uses complex mathematical models to predict price movements. Firms such as DRW Holdings, Jump Trading, and Two Sigma Securities are actively in various HFT strategies, leveraging cutting-edge technologies and data analytics. The growing sophistication of trading algorithms and the availability of immense real-time market data are propelling the adoption of these strategies, enabling firms to achieve significant profits with minimal risk.

Deployment Insights

The on-premise segment held the largest market share in 2024. On-premises deployment remains vital for HFT firms eyeing ultra-low latency and high control over their trading environments. Firms, such as Tower Research Capital and Flow Traders, prefer on-premises solutions to minimize latency and optimize trading performance. Maintaining proprietary data centers allows these firms to customize their infrastructure to meet specific trading requirements and ensure data security.

The cloud segment is expected to register the fastest CAGR during the forecast period. The adoption of cloud-based solutions in HFT is on the rise, driven by the need for scalability, flexibility, and cost-efficiency. Cloud platforms enable HFT firms to access vast computational resources and storage without having to make any significant capital investment associated with typical on-premises infrastructure.

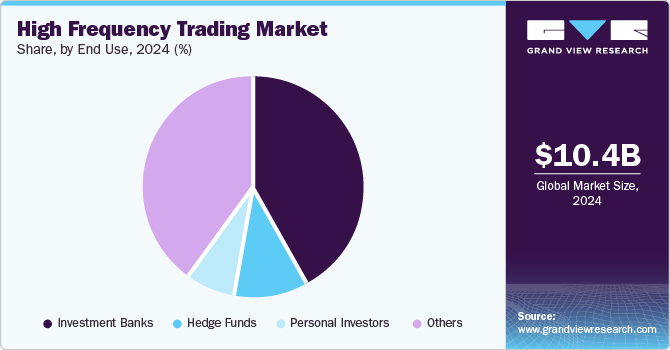

End Use Insights

The investment banks segment dominated the market in 2024. Investment banks can be considered prominent users of HFT strategies. Investment banks leverage HFT strategies to enhance trading performance and provide liquidity to the markets. Banks, such as Goldman Sachs and JPMorgan, employ HFT to optimize their market-making activities and execute large trades with minimal market impact. The integration of HFT into their trading operations allows these institutions to achieve better pricing, manage risks more effectively, and augment profitability.

The hedge funds segment is projected to grow at a significant CAGR over the forecast period. Hedge funds utilize various strategies to achieve high returns and can hence be considered significant players in the HFT market. Firms such as Renaissance Technologies and AQR Capital Management employ sophisticated quantitative models and high-speed trading systems to execute strategies, such as statistical arbitrage, momentum trading, and algorithmic market making. At a time when the competitive nature of the hedge fund industry continues to drive innovation in HFT methodologies, access to vast amounts of market data and advanced computational resources enables hedge funds to refine their trading strategies and maintain a competitive edge in the high frequency trading industry.

Regional Insights

North America high frequency trading market held a significant share of 32.3% in 2024. The HFT market in North America is poised for substantial growth, driven by the advanced financial infrastructure available and the concentration of leading HFT firms in the region. The U.S., home to major stock exchanges, such as NASDAQ and NYSE, has witnessed significant investments in HFT technologies, fostering a competitive environment. For instance, the adoption of ultra-low latency systems and the proximity to data centers have enhanced trading speeds, bolstering market efficiency.

U.S. High Frequency Trading Industry Trends

The HFT market in the U.S. held a dominant position in 2024 due to its highly developed financial ecosystem and the presence of numerous major market-making firms, such as Optiver, Virtu Financial, Hudson River Trading, and other leading stock exchanges, which have been pioneers in adopting low-latency trading technologies that can potentially facilitate the rapid execution of trades.

Europe High Frequency Trading Industry Trends

The HFT market in Europe is expected to experience robust growth, largely due to the evolving regulations and the presence of significant financial hubs, such as London, U.K.; Frankfurt, Germany; and Paris, France. The implementation of Markets in Financial Instruments Directive II (MiFID II) has increased transparency and reduced market fragmentation, thereby encouraging the adoption of HFT.

The U.K. high frequency trading market is expected to grow rapidly in the coming years. The U.K., particularly London, remains a crucial hub for HFT activities in Europe. Post Brexit, the U.K. has continued to attract significant investments in its financial sector, with firms, such as Flow Traders and IMC, leveraging London’s position as a global financial center. The London Stock Exchange (LSE) has been at the forefront of adopting advanced trading technologies, ensuring seamless HFT operations.

The high frequency trading market in Germany held a substantial market share in 2024 owing to the robust economic structure and advanced technological infrastructure. Deutsche Börse, based in Frankfurt, is a key player in the European financial market. Firms such as Tower Research Capital and Quantlab Financial have established a strong presence in the market by providing liquidity and improving market efficiency.

Asia Pacific High Frequency Trading Industry Trends

The HFT market in Asia Pacific is anticipated to grow significantly during the forecast period. The Asia Pacific regional HFT market is witnessing rapid growth, fueled by the modernization of financial markets and increasing foreign investments. Key financial centers, such as Hong Kong, Singapore, and Tokyo, Japan, are at the forefront of adopting HFT practices. For instance, the Tokyo Stock Exchange's Arrowhead system, known for its high-speed trading capabilities, has significantly boosted the high frequency trading industry.

Japan high frequency trading market is expected to grow rapidly in the coming years due to the advanced technological infrastructure and robust regulatory frameworks. The Tokyo Stock Exchange (TSE) has implemented the Arrowhead trading system, known for its ultra-low latency capabilities, attracting firms such as Jump Trading and IMC.

The high frequency trading market in China held a substantial market share in 2024 owing to the country's ambitious financial reforms and technological advancements. Major exchanges in China, such as the Shanghai Stock Exchange and Shenzhen Stock Exchange, are investing in high-speed trading technologies. Domestic and international HFT firms, such as Two Sigma Securities, are increasingly participating in the Chinese market. Such investments are expected to fuel the growth of the industry.

High Frequency Trading Company Insights

Some of the key companies in the high frequency trading market include Optiver, IMC, VIRTU Financial Inc., Flow Traders, and others. Organizations are focusing on increasing customer base to gain a competitive edge in the industry. Therefore, key players are taking several strategic initiatives, such as mergers and acquisitions and partnerships with other major companies.

-

Optiver is a proprietary trading firm that has provided liquidity to exchanges around the world. The company operates in five domains, namely trading, technology, research & data science, risk and control, and business operations. The company provides liquidity to institutional counterparts, trading a variety of products on more than 75 exchanges globally.

-

Flow Traders is a trading firm that provides institutional investing in equities, fixed income, digital assets, commodities, and foreign exchange. Flow Traders operates in three main trading hubs, namely Amsterdam, Hong Kong, and New York. The company has three reportable segments of its global trading business, namely Europe, the Americas, and Asia.

Key High Frequency Trading Companies:

The following are the leading companies in the high frequency trading market. These companies collectively hold the largest market share and dictate industry trends.

- Optiver

- IMC

- DRW Holdings, LLC

- Citadel Securities

- Hudson River Trading LLC

- Jane Street Group, LLC

- VIRTU Financial Inc.

- Flow Traders

- Two Sigma Investments, LP.

- Tower Research Capital LLC

Recent Developments

-

In August 2022, Citadel Securities announced the opening of a new office in Tokyo as part of its plans to launch its U.S. fixed-income offerings in Japan. With its expansion in Tokyo, the company now has a global footprint of 15 offices across North America, Europe, and Asia Pacific.

-

In May 2021, Flow Traders announced its geographic expansion by opening a new office in Paris, France. The company aimed to deepen its global footprint and have a physical presence in another EMEA market through the expansion.

High Frequency Trading Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2025 |

USD 11.05 billion |

|

Revenue forecast in 2030 |

USD 16.03 billion |

|

Growth Rate |

CAGR of 7.7% from 2025 to 2030 |

|

Base year for estimation |

2024 |

|

Historical data |

2018 - 2023 |

|

Forecast period |

2025 - 2030 |

|

Quantitative units |

Revenue in USD million/billion and CAGR from 2025 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Product, deployment, end use, region |

|

Regional scope |

North America, Europe, Asia Pacific, Latin America, MEA |

|

Country scope |

U.S., Canada, Mexico, Germany, U.K., France, China, Japan, India, South Korea, Australia, Brazil, KSA, UAE, and South Africa |

|

Key companies profiled |

Optiver; IMC; DRW Holdings, LLC; Citadel Securities; Hudson River Trading LLC; Jane Street Group, LLC; VIRTU Financial Inc.; Flow Traders; Two Sigma Investments, LP.; Tower Research Capital LLC |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global High Frequency Trading Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global high frequency trading market report based on product, deployment, end use, and region.

-

Product Outlook (Revenue, USD Billion, 2018 - 2030)

-

Market Making

-

Others

-

-

Deployment Outlook (Revenue, USD Billion, 2018 - 2030)

-

Cloud

-

On-premise

-

-

End Use Outlook (Revenue, USD Billion, 2018 - 2030)

-

Investment Banks

-

Hedge Funds

-

Personal Investors

-

Others

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East and Africa (MEA)

-

KSA

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global high frequency trading market size was estimated at USD 10.36 billion in 2024 and is expected to reach USD 11.05 billion in 2025.

b. The global high frequency trading market is expected to grow at a compound annual growth rate of 7.7% from 2025 to 2030 to reach USD 16.03 billion by 2030.

b. North America dominated the largest market with a share of 32.3% in 2024. This is attributable to rising FPGA based Technology coupled with cloud-based technologies acceptance and presence of leading vendors in the market.

b. Some key players operating in the high frequency trading market include Optiver; IMC; DRW Holdings, LLC; Citadel Securities; Hudson River Trading LLC; Jane Street Group, LLC; VIRTU Financial Inc.; Flow Traders; Two Sigma Investments, LP.; Tower Research Capital LLC.

b. Key factors that are driving the market growth include adoption of HFT in emerging market , increasing demand for high speed transaction and and increase in number of colocation services in financial markets.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."