High Electron Mobility Transistor Market Size, Share & Trends Analysis Report By Type (GaN, GaAs), By End-use (Consumer Electronics, Aerospace & Defense), By Region (Asia Pacific, North America), And Segment Forecasts, 2023 - 2030

- Report ID: GVR-4-68040-153-3

- Number of Report Pages: 130

- Format: PDF

- Historical Range: 2017 - 2021

- Forecast Period: 2023 - 2030

- Industry: Semiconductors & Electronics

Market Size & Trends

The global high electron mobility transistor market size was estimated at USD 5.60 billion in 2022 and is anticipated to expand at a compound annual growth rate (CAGR) of 7.8% from 2023 to 2030. High electron mobility transistor (HEMT) technology provides superior performance characteristics, making it an optimal choice for high-frequency and high-power applications. HEMTs exhibit excellent electron mobility, thus enabling faster switching speeds and lower power consumption when compared to conventional field-effect transistors (FETs). This boost in performance is especially required in the telecommunications and aerospace sectors, where the need for efficient and high-frequency devices is of the utmost importance. Advancements in high-frequency communication technologies, such as 5G networks, have encouraged the demand for HEMTs globally.

HEMTs have emerged as indispensable components in the 5G era due to their exceptional ability to handle high-frequency signals with minimal noise and high gain. This has made them critical for advanced radar systems, satellite technology, and 5G infrastructure, contributing significantly to the market's expansion. Moreover, the growing demand for HEMTs in the industrial space, particularly for high-frequency and high-power electronic components, is acting as a primary driver for the market's expansion. The deployment of advanced semiconductor materials, such as Indium Phosphide (InP) and Gallium Nitride (GaN), has created a strong demand for HEMTs. These materials enable superior electron mobility and thermal characteristics, making a perfect material for HEMT fabrication.

Moreover, the market is experiencing growth through diversified product applications in several industries. Its proficiency in high-frequency operation, low noise characteristics, and high gain render HEMTs invaluable for technologies, such as autonomous vehicles and advanced radar systems, among others. Significant investments and continuous R&D efforts undertaken by prominent players are propelling innovation and broadening HEMT applications. These investments play a pivotal role in enhancing HEMT performance and efficiency, serving as fundamental drivers behind the market's expansion. Moreover, the market is experiencing a surge in product launches by key players, a direct response to the heightened demand for HEMTs in high-speed switching applications.

Furthermore, HEMTs can operate at higher frequencies while consuming less power, aligning with the ongoing sustainability and carbon footprint reduction initiatives across various industries. While the market is poised for growth, it does face certain challenges. One significant challenge lies in the need for standardized techniques for the production and development of HEMT devices. Another one includes HEMTs operating in high-frequency and high-power environments. The heat dissipation becomes a concern, necessitating efficient thermal management solutions. Furthermore, competition from alternative semiconductor technologies and the availability of low-cost options pose challenges to market expansion.

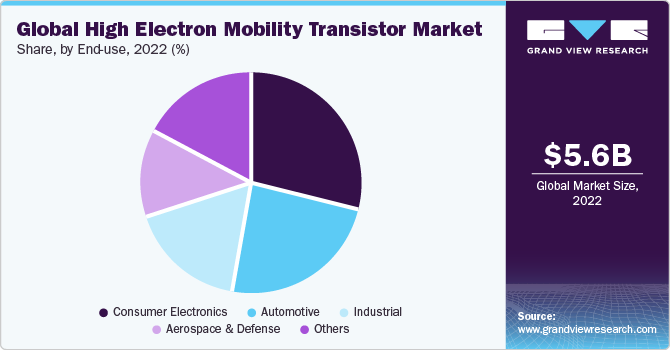

End-use Insights

The consumer electronics segment dominated the market and accounted for a revenue share of over 28.0% in 2022. This high demand can be attributed to the growing need for smaller, more efficient, and high-performance electronic equipment. HEMTs are leading this transformation, as they offer a novel blend of low power consumption, high-speed operation, and superior high-frequency performance. This makes them exceptionally suitable for their integration into several consumer electronics items, including tablets, smartphones, and wearable devices, as well as wireless communication equipment. With consumers continually seeking faster, more reliable, and more capable devices with extended battery life, HEMTs provide a solution by enabling the development of cutting-edge, power-efficient electronics that address these changing preferences.

The aerospace & defense segment is anticipated to register the fastest CAGR from 2023 to 2030 due to the crucial role played by HEMTs in advancing technology within the aerospace & defense industry. The remarkable capabilities of HEMTs, such as efficiently managing high-frequency and high-power operations, have made them indispensable assets for this sector. These HEMTs serve as integral components in the development of cutting-edge radar systems, sophisticated electronic warfare systems, and advanced communication equipment, among other vital applications.

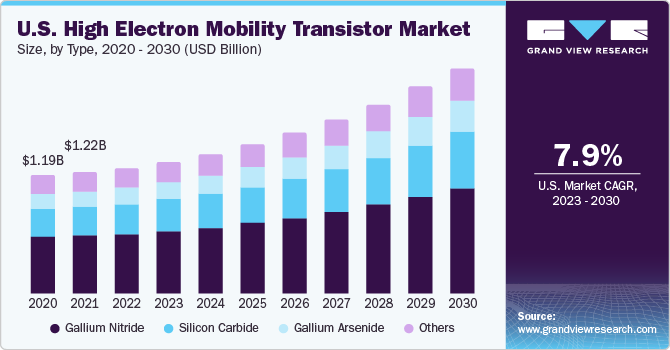

Type Insights

The Gallium Nitride (GaN) segment dominated the market in 2022 and accounted for a share of more than 47.0%. The segment growth can be attributed to exceptional performance characteristics and ability of GaN HEMTs to address the evolving needs of high-frequency and high-power applications. GaN HEMTs provide higher electron mobility and breakdown voltage compared to traditional silicon-based transistors. Thus, it decrypts improved power handling capability and greater efficiency of GaN HEMTs, which is ideal for applications in power amplifiers, radar systems, satellite communication, and 5G infrastructure.

The Gallium Arsenide (GaAs) segment is anticipated to register the fastest growth from 2023 to 2030 owing to unique material characteristics and diverse applications associated with GaAs HEMTs. These HEMTs, which rely on GaAs as their base material, showcase exceptional electron mobility and high carrier velocity, making them well-suited for applications requiring high-frequency and high-speed electronic devices. Furthermore, they are notably favored within the aerospace and defense sectors, where they hold a central role in the functioning of advanced radar and communication systems.

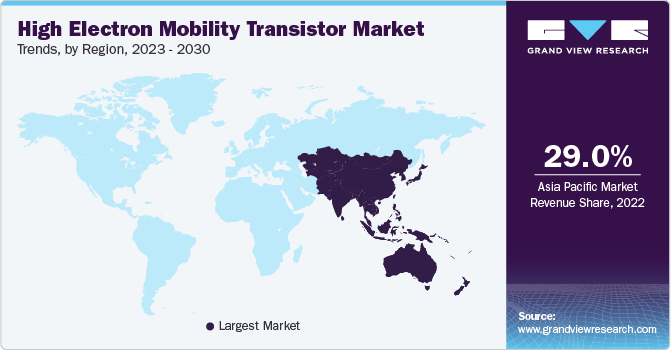

Regional Insights

Asia Pacific dominated the market and accounted for a share of over 29.0% in 2022. The increasing demand for high-frequency communication technologies, including the widespread deployment of 5G networks in countries, such as China and South Korea, is a major catalyst. HEMTs are vital components in 5G infrastructure, advanced radar systems, and satellite communication, making them integral to the region's technological advancement. Moreover, Asia Pacific is witnessing rapid industrialization, resulting in the growing need for high-power and high-frequency electronic components in various sectors, thereby boosting market growth.

North America is expected to expand at a significant CAGR during the projection period. The fast rate of deployment of advanced communication technologies, including the expansion of 5G networks across the regional economies of the U.S. and Canada, is a major growth driver. HEMTs play a pivotal role in enabling the high-frequency capabilities required for 5G infrastructure, as well as advanced radar systems. Additionally, the aerospace and defense industries in the region are a significant demand driver, aided by the growing requirement for cutting-edge radar and electronic warfare systems. Also, extensive investments in R&D initiatives by key market players are fueling innovation and pushing the boundaries of HEMT technology.

Key Companies & Market Share Insights

The market is moderately fragmented and highly competitive. Several key players are involved in strategic initiatives, such as partnerships & collaborations, acquisitions & mergers, and new product development, among others. For instance, in October 2023, IQE plc, a semiconductor company, announced a strategic partnership with VisIC Technologies, a GaN power semiconductor device manufacturer.

This partnership was aimed at developing GaN power products for its use in EV inverters. Similarly, in May 2023, Infineon Technologies AG, a semiconductor manufacturer, announced the launch of a portfolio of CoolGaN 600 V GIT HEMT. As a result of this launch, the company aimed at full supply delivery of exceptional performance and quality.

Key High Electron Mobility Transistor Companies:

- Qorvo

- Infineon Technologies AG

- Mouser Electronics, Inc.

- MACOM

- Wolfspeed

- RFHIC Corporation

- ST Microelectronics

- Texas Instruments

- Sumitomo Electric Industries, Ltd.

- Analog Devices, Inc.

High Electron Mobility Transistor Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2023 |

USD 5.86 billion |

|

Revenue forecast in 2030 |

USD 9.93 billion |

|

Growth rate |

CAGR of 7.8% from 2023 to 2030 |

|

Base year of estimation |

2022 |

|

Historical data |

2017 - 2021 |

|

Forecast period |

2023 - 2030 |

|

Quantitative units |

Revenue in USD billion and CAGR from 2023 to 2030 |

|

Report coverage |

Revenue forecast, company market share, competitive landscape, growth factors, and trends |

|

Segments covered |

Type, end-use, region |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; MEA |

|

Country scope |

U.S.; Canada; Germany; UK; France; China; India; Japan; South Korea; Australia; Brazil; Mexico; The Kingdom Of Saudi Arabia (KSA), UAE; South Africa |

|

Key companies profiled |

Qorvo; Infineon Technologies AG; Mouser Electronics, Inc.; MACOM; Wolfspeed; RFHIC Corp.; ST Microelectronics; Texas Instruments; Sumitomo Electric Industries, Ltd.; Analog Devices, Inc. |

|

Customization scope |

Free report customization (equivalent to up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

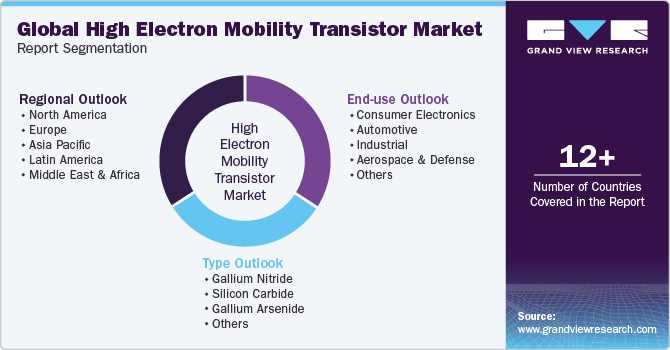

Global High Electron Mobility Transistor Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest trends in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the high electron mobility transistor market report based on type, end-use, and region:

-

Type Outlook (Revenue, USD Billion, 2017 - 2030)

-

Gallium Nitride (GaN)

-

Silicon Carbide (SiC)

-

Gallium Arsenide (GaAs)

-

Others

-

-

End-use Outlook (Revenue, USD Billion, 2017 - 2030)

-

Consumer Electronics

-

Automotive

-

Industrial

-

Aerospace & Defense

-

Others

-

-

Regional Outlook (Revenue, USD Billion, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

Germany

-

UK

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

Mexico

-

-

Middle East & Africa

-

The Kingdom Of Saudi Arabia (KSA)

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global high electron mobility transistor market size was estimated at USD 5.60 billion in 2022 and is expected to reach USD 5.86 billion in 2023.

b. The global high electron mobility transistor market is expected to grow at a compound annual growth rate of 7.8% from 2023 to 2030 to reach USD 9.93 billion by 2030.

b. Asia Pacific dominated the high electron mobility transistor market with a share of 29.18% in 2022. The increasing demand for high-frequency communication technologies, including the widespread deployment of 5G networks in countries such as China and South Korea, is a major catalyst.

b. Some key players operating in the high electron mobility transistor market include Qorvo; Infineon Technologies AG; Mouser Electronics, Inc.; MACOM; Wolfspeed; RFHIC Corporation; ST Microelectronics; Texas Instruments; Sumitomo Electric Industries, Ltd.; Analog Devices, Inc..

b. Key factors that are driving the market growth include the increasing demand for high-speed communication systems and the growing adoption of wireless devices. Moreover, the growing demand for cost-effective power systems is also contributing to the market growth.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."