- Home

- »

- Plastics, Polymers & Resins

- »

-

High Barrier Packaging Films Market Size, Share Report 2030GVR Report cover

![High Barrier Packaging Films Market Size, Share & Trends Report]()

High Barrier Packaging Films Market (2025 - 2030) Size, Share & Trends Analysis Report By Material (Polyethylene, BOPET, Polypropylene), By Product (Bags & Pouches, Wrapping Films, Blister Packs), By Application, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-345-1

- Number of Report Pages: 182

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

High Barrier Packaging Films Market Trends

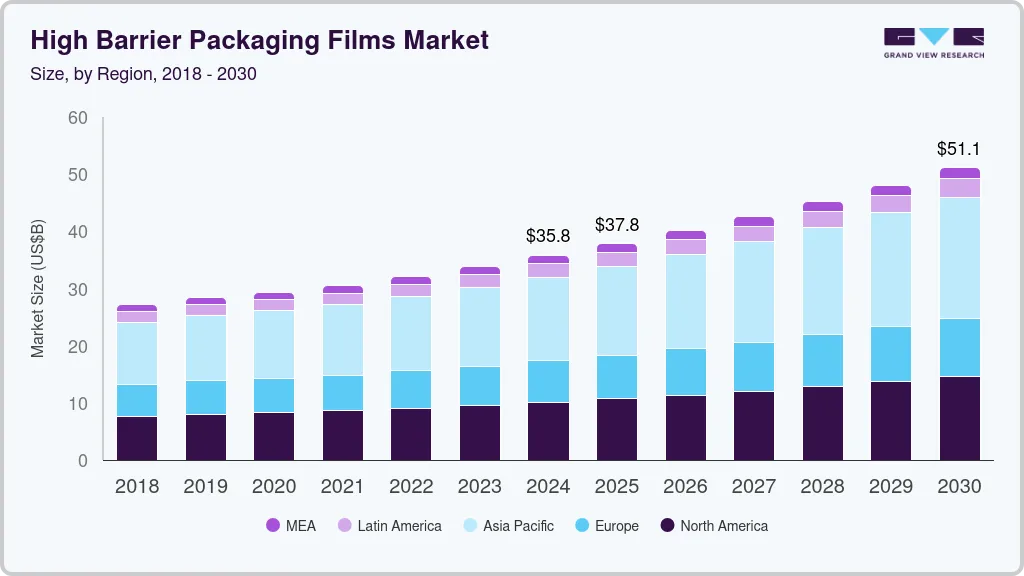

The global high barrier packaging films market size was estimated at USD 35,795.1 million in 2024 and expected to grow at a CAGR of 6.2% from 2025 to 2030. These films are essential for extending the shelf life of perishable products by providing a robust barrier against oxygen, moisture, and other external factors. The demand is primarily driven by the food and beverage industry, which seeks to preserve product freshness and prevent spoilage. Additionally, the pharmaceutical sector relies heavily on high barrier films to protect sensitive products from contamination and degradation. With the increasing global population and changing consumer lifestyles, the demand for convenient and long-lasting packaged goods is set to fuel the growth of this market.

Technological advancements have also played a crucial role in expanding the high barrier packaging films market. Innovations in materials, such as the development of multilayer films and the incorporation of nanotechnology, have significantly improved the barrier properties and mechanical strength of these films. As a result, they are now used in a wide range of applications, from food packaging to industrial uses. Moreover, growing environmental concerns have led to the development of biodegradable and recyclable barrier films, which are gaining popularity among environmentally conscious consumers and businesses.

Drivers, Opportunities & Restraints

The primary drivers of the high barrier packaging films market include the rising demand for packaged food and beverages, increasing consumer awareness regarding food safety, and the need for longer shelf life of products. The growth of the e-commerce sector has also contributed to the increased demand for protective packaging solutions to ensure products reach consumers in optimal condition. Furthermore, the pharmaceutical industry’s stringent regulations for product safety and quality have necessitated the use of high barrier films to protect medications and medical devices from contamination.

With growing environmental concerns and stringent regulations on plastic usage, there is a substantial demand for eco-friendly alternatives. Companies investing in research and development to create biodegradable and recyclable high barrier films are likely to gain a competitive edge. Additionally, emerging markets in Asia-Pacific and Latin America present lucrative opportunities due to the rapid urbanization, increasing disposable incomes, and changing consumer preferences towards packaged goods in these regions.

The high cost of raw materials and production can limit the adoption of these films, particularly among small and medium-sized enterprises. Additionally, the complex manufacturing process and the need for advanced technology can act as barriers for new entrants. Environmental concerns related to the disposal and recycling of plastic barrier films also pose challenges, necessitating significant investments in developing sustainable solutions and effective recycling infrastructure.

Material Insights

Based on material, Polyethylene (PE) held the market with the largest revenue share of 44.7% in 2023. Polyethylene is widely used due to its excellent moisture barrier properties, flexibility, and cost-effectiveness. It's commonly employed in applications requiring moisture resistance, such as food packaging. Biaxially Oriented Polyethylene Terephthalate (BOPET) is another critical material known for its superior strength, clarity, and barrier properties against gases and aromas. This makes it ideal for preserving the freshness of perishable goods and ensuring product integrity.

Polypropylene (PP) is appreciated for its versatility and resistance to chemical and physical stress, making it suitable for a range of packaging needs. Its ability to withstand high temperatures also makes it a preferred choice for microwaveable food packaging. Polyvinyl Chloride (PVC), though less favored due to environmental concerns, remains in use for its excellent clarity and barrier properties, particularly in applications requiring high visibility and contamination prevention, such as in pharmaceutical and medical packaging.

Product Insights

Based on product, bags and pouches held the market with the largest revenue share of 42.8% in 2023. Bags and pouches are popular due to their versatility and convenience. They are used for packaging a wide range of products, from snacks and pet foods to pharmaceuticals and personal care items. These packaging types offer excellent barrier properties, ensuring product freshness and extending shelf life.

Trays and lidding films are essential in applications requiring rigid packaging solutions, such as ready-to-eat meals and fresh produce. These films provide a high barrier against external contaminants while maintaining product visibility and integrity. Wrapping films are commonly used for bulk packaging and pallet wrapping, providing protection against moisture and physical damage during transportation and storage.

Blister packs are particularly prevalent in the pharmaceutical industry, offering a high level of protection for individual doses of medication. This type of packaging ensures that each dose remains uncontaminated and secure until it is used. Other types of high barrier packaging films, such as laminates and shrink films, serve specialized applications where tailored barrier properties and structural characteristics are essential.

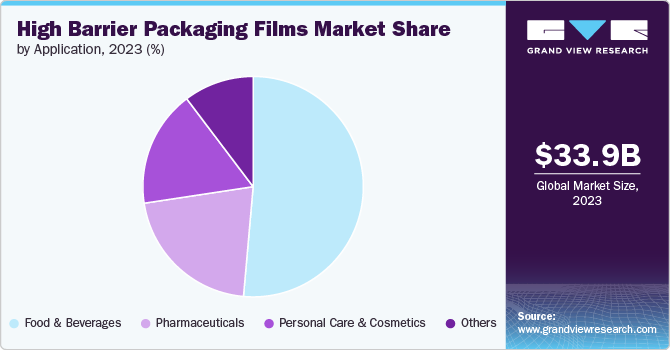

Application Insights

Based on application, food and beverage held the market with the largest revenue share of 51.4% in 2023. In the food and beverages sector, these films are critical for maintaining the freshness and quality of products. They are used to package everything from snacks and dairy products to beverages and frozen foods, providing a robust barrier against moisture, oxygen, and other contaminants.

The pharmaceutical industry relies heavily on high barrier packaging films to ensure the safety and efficacy of medications. These films protect sensitive pharmaceuticals from environmental factors such as light, moisture, and oxygen, which can degrade the active ingredients. This is crucial for maintaining the potency and shelf life of drugs, as well as ensuring patient safety.

In the personal care and cosmetics industry, high barrier packaging films are used to protect products from contamination and degradation. These films help maintain the integrity and efficacy of various cosmetic products, from lotions and creams to shampoos and conditioners. Other applications include industrial and household products, where high barrier films provide essential protection against environmental factors and physical damage, ensuring product quality, and longevity.

Regional Insights

North America is a significant market for high barrier packaging films, driven by the high consumption of packaged food and beverages, pharmaceuticals, and personal care products. The region's advanced manufacturing capabilities and technological innovations contribute to the development and adoption of high-performance packaging solutions. Additionally, stringent regulations concerning food safety and pharmaceutical packaging standards enhance the demand for high barrier films. Environmental concerns and the push for sustainable packaging solutions also influence market dynamics, leading to increased investment in recyclable and biodegradable films.

U.S. High Barrier Packaging Films Market Trends

The United States, being the largest market in North America, plays a crucial role in the high barrier packaging films industry. The United States market are witnessing robust growth due to their developed industries and consumer markets. The country's robust food and beverage sector, coupled with its significant pharmaceutical industry, drives substantial demand for these films. Innovation and consumer preference for convenience and sustainability are key factors propelling market growth.

Europe High Barrier Packaging Films Market Trends

Europe is a mature market for high barrier packaging films, characterized by its strong emphasis on sustainability and stringent regulatory standards. The region's well-established food and beverage industry and the growing pharmaceutical sector are primary drivers of market growth. Countries like Germany, France, and the United Kingdom lead in the adoption of advanced packaging technologies.

Asia Pacific High Barrier Packaging Films Market Trends

Asia Pacific dominated global high barrier packaging films market and accounted for largest revenue share of over 40.3% in 2023. The increasing demand for sustainable packaging solutions and advancements in packaging technologies are driving the market forward. The Asia-Pacific region is experiencing rapid growth due to the expanding food and beverage industry, rising urbanization, and increasing disposable incomes. Countries like China, India, and Japan are major contributors to this growth, with a significant demand for packaged food, pharmaceuticals, and personal care products. The region's large population base and evolving consumer lifestyles are key factors boosting market demand.

High Barrier Packaging Films Market Company Insights

Major companies such as Amcor plc, Berry Global Inc., Sealed Air Corporation, and Mondi Group hold significant market shares due to their extensive product portfolios, advanced technological capabilities, and strong distribution networks. These companies focus on continuous innovation and the development of sustainable and high-performance packaging solutions to meet evolving consumer demands and regulatory requirements. Strategic collaborations, mergers, and acquisitions are common strategies employed by these market leaders to enhance their market presence and expand their geographical reach.

Key High Barrier Packaging Films Companies:

The following are the leading companies in the high barrier packaging films market. These companies collectively hold the largest market share and dictate industry trends.

- Amcor plc

- Sealed air

- Huhtamaki

- Klockner pentaplast

- Mondi

- Constantia flexibles

- Berry global inc

- Coveris

- Sonoco product company

- Wipak

- Uflex limited

- Printpack

- Jindal poly films

- Cosmo films ltd.

Recent Developments

-

In April 2024, UFlex launched a series of new high barrier packaging films, designed to provide superior product protection and extended shelf life while enhancing sustainability. These advanced packaging solutions cater to the growing demand for high-performance, eco-friendly materials in the flexible packaging industry.

-

In March 2024, Toppan announced the launch of a new high barrier packaging film that combines recyclability with superior barrier performance, enhancing sustainability in the packaging industry.

-

In December 2023, Amcor introduced a new recyclable high barrier packaging film, designed to deliver exceptional product protection while supporting sustainability efforts.

High Barrier Packaging Films Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 37,821.1 million

Revenue forecast in 2030

USD 51,079.4 million

Growth rate

CAGR of 6.2% from 2025 to 2030

Historical data

2018 - 2023

Base Year

2024

Forecast period

2025 - 2030

Quantitative units

Volume in kilotons, revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, volume forecast, competitive landscape, growth factors and trends

Segments covered

Material, product, application, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country Scope

U.S.; Canada; Mexico; Germany; France; UK; Italy; Spain; China; India; Japan; South Korea; Australia; Brazil; Argentina; Saudi Arabia; South Africa

Key companies profiled

Amcor Plc.; Sealed Air; Huhtamaki; Klockner Pentaplast; Mondi; Constantia Flexibles; Berry Global Inc; Coveris; Sonoco Product Company; Wipak; Uflex limited; Printpack; Jindal Poly Films; Cosmo Films Ltd.

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global High Barrier Packaging Films Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented high barrier packaging films market report based on material, product, application, and region:

-

Material Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Polyethylene

-

BOPET

-

Polypropylene

-

Polyvinyl Chloride

-

-

Product Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Bags & Pouches

-

Trays Lidding Films

-

Wrapping Films

-

Blister Packs

-

Others

-

-

Application Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Food & Beverages

-

Pharmaceuticals

-

Personal Care & Cosmetics

-

Others

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

Italy

-

Spain

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global high barrier packaging films market size was estimated at USD 33.86 billion in 2023 and is expected to reach USD 35.80 billion in 2024.

b. The global high barrier packaging films market is expected to grow at a compound annual rate of 6.1% from 2024 to 2030, reaching USD 51.08 billion by 2030.

b. The bags and pouches segment led the global high barrier packaging films market, accounting for more than 42.84% of the global revenue in 2023.

b. Some of the major companies are Amcor plc, Sealed air, Huhtamaki, Klockner pentaplast, Mondi, Constantia flexibles, Berry global inc, Coveris, Sonoco product company, Wipak, Uflex limited, Printpack, Jindal poly films, and Cosmo films ltd.

b. The demand is primarily driven by the food and beverage industry, which seeks to preserve product freshness and prevent spoilage. Additionally, the pharmaceutical sector relies heavily on high barrier films to protect sensitive products from contamination and degradation.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.