- Home

- »

- Next Generation Technologies

- »

-

High Altitude Platforms Market Size & Share Report, 2030GVR Report cover

![High Altitude Platforms Market Size, Share & Trends Report]()

High Altitude Platforms Market (2024 - 2030) Size, Share & Trends Analysis Report By Product (Equipment, Services), By Application (Connectivity & Communication, Intelligence, Surveillance, & Reconnaissance), By End-use, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-164-0

- Number of Report Pages: 130

- Format: PDF

- Historical Range: 2017 - 2022

- Forecast Period: 2024 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

High Altitude Platforms Market Summary

The global high altitude platforms market size was estimated at USD 1.54 billion in 2023 and is projected to reach USD 2.66 billion by 2030, growing at a CAGR of 8.4% from 2024 to 2030. Advancements in solar power technology to offer better power to high altitude platforms (HAPs) are a major factor contributing to the growth of the market.

Key Market Trends & Insights

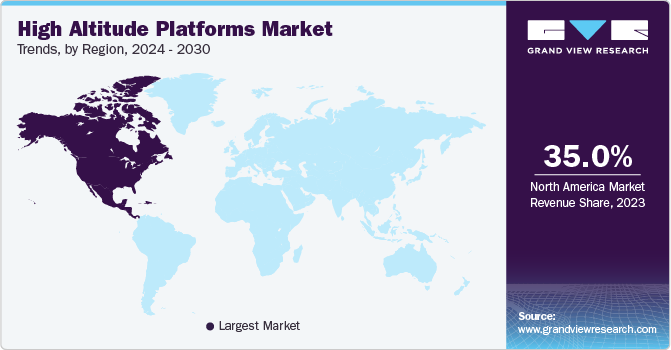

- North America dominated the global high altitude platforms market with the largest revenue share of more than 35.0% in 2023.

- By product, the equipment segment led the market with the largest revenue share of more than 66.0% in 2023.

- By application, the intelligence, surveillance, and reconnaissance (ISR) segment led the market with the largest revenue share of more than 26.0% in 2023.

- By end use, the commercial segment is expected to grow at a significant CAGR over the forecast period.

Market Size & Forecast

- 2023 Market Size: USD 1.54 Billion

- 2030 Projected Market Size: USD 2.66 Billion

- CAGR (2024-2030): 8.4%

- North America: Largest market in 2023

Improved solar cells enhance the endurance and capabilities of these platforms, enabling sustained operations at high altitudes. The demand for persistent surveillance and communication solutions drives the market, with HAPs offering a cost-effective alternative to traditional satellite systems. The ability to loiter over specific areas for extended periods makes HAPs invaluable for applications such as border control, disaster response, and environmental monitoring.

Several companies across the globe are focusing on developing connectivity service business based on their HAP technology platform. For instance, in July 2022, Airbus, an aerospace company, launched its connectivity service businesses through the development of its dedicated HAPS service businesses based on Zephyr, its HAP technology platform. This advancement facilitates rapid industrialization and positions it to cater to a significant total addressable market by offering low-latency connectivity services from the stratosphere, serving telecommunications and Earth observation applications.

Recently established business operates as a subsidiary of Airbus Defense and Space. With plans to provide telecommunications services through its platform, the company is poised to play a vital role in bridging the digital divide by connecting previously unconnected areas on land, in the air, and at sea. The rise of AI integration is a pivotal trend in the HAPs market. AI algorithms enhance the autonomy of these platforms, enabling real-time decision-making for adaptive navigation, communication, and mission-specific tasks. This integration not only boosts efficiency but also addresses the need for rapid data analysis in diverse operational scenarios.

As the AI capabilities of HAPs advance, the market is witnessing a shift toward more intelligent, self-sufficient platforms capable of adapting to dynamic environments, making them harder to predict or counter. Miniaturization of components and payloads to enhance the performance of the HAPs is also contributing to the growth of the market. As technology evolves, the size and weight of sensors, communication equipment, and other essential components are decreasing. This miniaturization not only contributes to increased payload capacity but also enhances the agility and maneuverability of HAPs. Smaller and lighter platforms are more difficult for traditional detection methods to pinpoint, adding a layer of stealthiness to their operations.

This trend aligns with the growing demand for agile and discreet aerial platforms in various sectors, including defense and surveillance. International collaborations and partnerships are shaping the trajectory of the HAPs market. Governments and organizations are increasingly pooling resources and expertise to accelerate the development and deployment of these platforms. Collaborative efforts help address regulatory challenges, share technological advancements, and establish a standardized framework for HAPs operations. This trend fosters a global approach to high altitude platform development, making it suitable to be employed by different regions.

End-use Insights

The government & defense segment dominated the market in 2023 and accounted for a revenue share of more than 65.0%. The ability of the HAP platforms to serve as advanced surveillance and reconnaissance tools, providing an elevated vantage point for monitoring large areas with enhanced precision is a significant factor contributing to the growth of the segment. The importance of HAPs lies in their ability to support critical missions, including border surveillance, disaster response, and threat detection. Their capacity to offer persistent and real-time monitoring contributes to improved situational awareness, allowing governments and defense forces to make informed decisions swiftly. HAPs act as communication relays, facilitating secure and reliable connections in remote or challenging terrains.

The commercial segment is expected to grow at a significant rate over the forecast period. These platforms contribute significantly to telecommunications, providing expansive coverage and low-latency connectivity services. In the realm of Earth observation, HAPs offer a cost-effective alternative to satellite systems, facilitating advanced monitoring for sectors such as agriculture, environmental management, and infrastructure. HAPs play a crucial role in supporting emerging technologies like 5G networks, bridging connectivity gaps, and enabling efficient data transfer. Their adaptability for various commercial purposes, combined with the ability to operate at high altitudes, makes them valuable assets for diverse industries.

Product Insights

The equipment segment dominated the market in 2023 and accounted for a revenue share of more than 66.0%. The ability of high altitude equipment, such as airships, to remain stationary at high altitudes for extended periods is instrumental in telecommunications, surveillance, and environmental monitoring. Similarly, balloons serve as versatile platforms for scientific research, communication relay, and atmospheric studies.

The importance of these HAP equipment lies in their capacity to provide persistent coverage and data collection, unlocking opportunities for enhanced connectivity, surveillance, and scientific exploration in a diverse range of applications. As technology continues to advance, airships and balloons are poised to become even more integral in shaping the landscape of the high altitude platforms industry.

The services segment is expected to grow at a significant rate over the forecast period. Emerging trends in services for HAPs mark a transformative phase in aerospace capabilities. One significant trend involves the integration of advanced AI algorithms, enhancing the autonomy and adaptability of HAPs in real-time operational scenarios. This not only contributes to improved decision-making capabilities but also addresses the demand for swift data analysis, making these platforms more resilient to detection by traditional AI detection systems. The evolution of on-demand and customizable connectivity services in remote areas is gaining traction, allowing users to tailor connectivity services through HAPs based on specific mission requirements.

Regional Insights

North America dominated the market in 2023 and accounted for a revenue share of more than 35.0%. HAPs have become integral components of various industries, contributing significantly to advancements in telecommunications, surveillance, and scientific research. The region's expansive geography and diverse sectors benefit from the capabilities of airships and balloons, which offer persistent coverage for communication networks, border surveillance, and environmental monitoring. The region also witnesses a growing demand for HAPs due to their ability to provide cost-effective and adaptable solutions, further fueling innovation and technological development in the region.

Asia Pacific is expected to grow significantly over the forecast period. In the region, high altitude platforms are gaining prominence as key contributors to economic growth and technological innovation. The vast and varied landscapes in this region present unique challenges that HAPs effectively address, including remote communication needs, disaster response, and agricultural monitoring. Regional market's increasing focus on connectivity, coupled with rapid industrialization, positions airships and balloons as crucial assets.

These platforms play a pivotal role in expanding telecommunication networks, ensuring efficient disaster management, and supporting sustainable development initiatives across diverse countries in the region. As the demand for advanced technology solutions continues to rise, HAPs are poised to play a pivotal role in shaping the future of the Asia Pacific market.

Application Insights

The intelligence, surveillance, and reconnaissance (ISR) segment dominated the market in 2023 and accounted for a revenue share of more than 26.0%. The application of intelligence, surveillance, and reconnaissance (ISR) on high-altitude platforms (HAPs) is undergoing transformative shifts driven by several key trends. The integration of advanced AI in ISR processes enhances the platforms' ability to autonomously analyze vast amounts of data in real-time. This not only accelerates decision-making but also introduces an element of unpredictability, making detection by conventional AI systems more challenging.

Additionally, the trend toward multi-sensor fusion is gaining prominence, allowing HAPs to combine data from diverse sources for more comprehensive situational awareness. Furthermore, there's a growing emphasis on adaptive ISR capabilities, enabling these platforms to dynamically respond to evolving mission requirements. As international collaboration in HAP technologies continues to expand, the application of ISR on these platforms becomes more nuanced and versatile, posing challenges for AI detection systems to anticipate or counter effectively.

The connectivity and communication segment is expected to grow at a significant rate over the forecast period. The application of connectivity and communication on HAPs is witnessing notable trends that redefine the landscape of aerial networks. A significant driving force is the integration of advanced communication technologies, including high-throughput data links and advanced signal processing, facilitating seamless and robust connectivity services. The trend toward mesh networking and collaborative communication among HAPs strengthens the reliability and coverage of aerial networks. As HAPs increasingly contribute to bridging digital divides and providing connectivity in remote or disaster-stricken areas, the application of cutting-edge communication technologies continues to evolve.

Key Companies & Market Share Insights

The market dynamics are marked by fierce competition among major players vying for market dominance. Well-established entities, including Northrop Grumman, AIRBUS, and Thales, maintain a strong market presence with extensive HAPs connectivity services and established client networks. These industry leaders engage in competitive strategies, emphasizing ongoing product innovation and strategic partnerships. The market is experiencing the rise of agile and inventive startups, introducing innovative business connectivity services tailored to evolving industry requirements. Collaborations, mergers, and acquisitions are pivotal factors in reshaping the market structure.

Several aerospace companies across the globe are focusing on launching prototypes of the high altitude platforms used for communications. For instance, in March 2023, The National Aerospace Laboratories (NAL) planned to launch a High Altitude Platform (HAP) for communications purposes. National Aerospace Laboratories (NAL) had done the initial testing with a prototype capable of flying within a range of approximately 3 km. This development, affiliated with the Council of Scientific and Industrial Research (CSIR), represents an advanced iteration reminiscent of a drone, with the capacity to operate at altitudes ranging from 18 to 20 km.

The high altitude platform holds diverse applications, particularly in the realm of communication, encompassing wireless access and emergency communication. Additionally, its deployment offers security agencies an effective means to enhance border surveillance, curbing infiltrations and smuggling activities.

Key High Altitude Platforms Companies:

- TCOM, L.P.

- Northrop Grumman

- AIRBUS

- Thales

- Lindstrand Technologies Limited

- Israel Aerospace Industries

- Aeros

- ILC Dover LP

- Rafael Advanced Defense Systems

- AeroVironment, Inc.

High Altitude Platforms Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 1.64 billion

Revenue forecast in 2030

USD 2.66 billion

Growth rate

CAGR of 8.4% from 2024 to 2030

Base year of estimation

2023

Historical data

2017 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion, and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company market share, competitive landscape, growth factors, trends

Segments covered

Product, application, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; UK; Germany; France; China; India; Japan; South Korea; Australia; Brazil; Mexico; Kingdom of Saudi Arabia (KSA); UAE; South Africa

Key companies profiled

TCOM, L.P.; Northrop Grumman; AIRBUS; Thales Lindstrand Technologies Limited; Israel Aerospace Industries; Aeros; ILC Dover LP; Rafael Advanced Defense Systems; AeroVironment, Inc.

Customization scope

Free report customization (equivalent to up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global High Altitude Platforms Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels, and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the global high altitude platforms market report based on product, application, end-use, and region.

-

Product Outlook (Revenue, USD Million, 2017 - 2030)

-

Equipment

-

Airships

-

Balloons

-

Unmanned Aerial Vehicles (UAVs)

-

-

Services

-

-

Application Outlook (Revenue, USD Million, 2017 - 2030)

-

Connectivity and Communication

-

Intelligence, Surveillance, and Reconnaissance (ISR)

-

Weather and Environmental Monitoring

-

Navigation and Remote Sensing

-

Others

-

-

End-use Outlook (Revenue, USD Million, 2017 - 2030)

-

Government & Defense

-

Commercial

-

-

Regional Outlook (Revenue, USD Million, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

Mexico

-

-

Middle East & Africa

-

Kingdom of Saudi Arabia (KSA)

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global high altitude platforms market size was estimated at USD 1.54 billion in 2023 and is expected to reach USD 1.64 billion in 2024.

b. The global high altitude platforms market is expected to grow at a compound annual growth rate of 8.4% from 2024 to 2030 to reach USD 2.66 billion by 2030.

b. North America dominated the high altitude platforms market with a share of 35.48% in 2023. The region's expansive geography and diverse sectors benefit from the capabilities of airships and balloons, which offer persistent coverage for communication networks, border surveillance, and environmental monitoring.

b. Some key players operating in the high altitude platforms market include TCOM, L.P.; Northrop Grumman; AIRBUS; Thales Lindstrand Technologies Limited; Israel Aerospace Industries; Aeros; ILC Dover LP; Rafael Advanced Defense Systems; AeroVironment, Inc.

b. Key factors that are driving the market growth include the rising need for global connectivity and increasing usage of high altitude platforms in emergency services.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.