Hexagonal Boron Nitride Market Size, Share & Trends Analysis Report By Application (Paints & Coatings, Composites, Lubricants, Personal Care & Cosmetics, Electrical Insulation), By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-400-9

- Number of Report Pages: 201

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Bulk Chemicals

Hexagonal Boron Nitride Market Trends

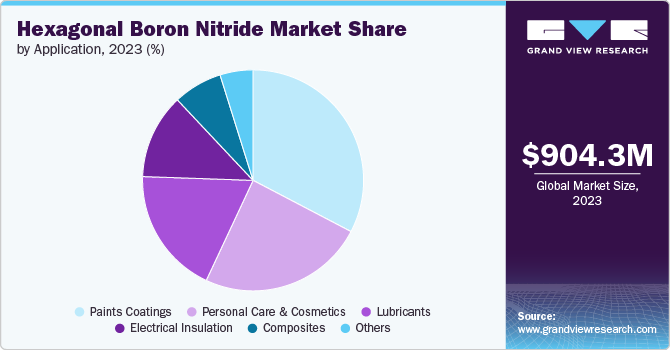

The global hexagonal boron nitride market size was estimated at USD 904.32 million in 2023 and is projected to grow at a CAGR of 5.1% in terms of revenue from 2024 to 2030. The market growth is driven by the unique properties of hexagonal boron nitride (h-BN) that make it highly valuable in various advanced technologies. h-BN, often referred to as "white graphene," exhibits exceptional thermal conductivity, high electrical resistivity, and excellent chemical stability. These characteristics make it an ideal material for use in electronics, such as in the production of high-performance insulators and thermal management components.

Hexagonal boron nitride (h-BN) is a synthetic material composed of boron and nitrogen atoms arranged in a hexagonal lattice, similar in structure to graphene. Often referred to as "white graphene," h-BN features a layered structure where the layers are held together by weak van der Waals forces. This structure gives h-BN unique physical and chemical properties that are highly desirable in various applications. Unlike graphene, h-BN is an electrical insulator, but it exhibits excellent thermal conductivity, making it suitable for use in high-temperature and high-performance applications.

Drivers, Restraints, And Opportunities Analysis

The demand for h-BN market is primarily driven by its unique properties and the increasing demand for advanced materials in high-tech industries. Hexagonal boron nitride’s exceptional thermal conductivity, electrical insulation, and chemical stability make it an attractive choice for applications in electronics, aerospace, and energy sectors. In electronics, it is used as a thermal management material in semiconductors and LED devices, enhancing performance and longevity. The burgeoning demand for high-performance electronic components, driven by the rise of technologies such as 5G and electric vehicles, has significantly contributed to the growing need for h-BN. Additionally, its use in lubricants and coatings further supports its market growth, as these industries seek more effective and durable materials.

Despite its promising advantages, the growth of h-BN is restrained by several factors, primarily related to its production and cost. The synthesis of high-purity h-BN involves complex and costly processes, such as chemical vapor deposition or high-temperature chemical reactions, which can be economically challenging. This high production cost can limit its widespread adoption, particularly in price-sensitive markets. Furthermore, the technical expertise required to manufacture and process h-BN at scale poses additional hurdles, potentially constraining its availability and affordability in the global market.

Looking ahead, future growth opportunities for h-BN at a global scale are substantial. As industries continue to advance, there will be increasing demand for materials that can withstand extreme conditions and provide superior performance. Emerging applications in quantum computing, advanced materials for energy storage, and high-temperature superconductors offer new avenues for h-BN utilization. Research and development efforts aimed at reducing production costs and improving manufacturing efficiency could further boost its adoption. Additionally, the expansion of industrial sectors in developing economies and the ongoing push for technological innovation worldwide create a robust foundation for the continued growth of h-BN, potentially driving significant advancements in various high-tech fields.

Application Insights & Trends

“Paints & Coatings to emerge as the fastest growing application with a CAGR of 5.4% from 2024 to 2030”

The paints & coatings segment dominated the market and accounted for a revenue share of approximately 32.67% in 2023. Hexagonal boron nitride has found a niche application in paints and coatings due to its unique properties, particularly its high thermal conductivity and chemical resistance. In recent years, h-BN has been incorporated into protective coatings for various industrial applications, such as aerospace and automotive industries, where thermal management is crucial.

For instance, h-BN-based coatings are used to protect components from extreme temperatures and oxidative environments, enhancing their durability and performance. A notable example is its use in high-temperature protective coatings for aerospace components, where h-BN's ability to dissipate heat and withstand harsh conditions ensures the longevity and reliability of critical parts. The material is also utilized in anti-corrosive coatings to provide additional protection against environmental damage, making it an invaluable component in ensuring the longevity and efficiency of industrial equipment.

In the personal care and cosmetics industry, hexagonal boron nitride is increasingly being used for its unique texture and functional properties. Its smooth and silky texture enhances the feel and application of cosmetic products. Recent innovations have seen h-BN incorporated into high-end skincare products and makeup formulations. For example, h-BN has been added to foundations and powders to improve their spreadability and adherence to the skin, providing a smoother and more refined finish.

Additionally, h-BN's chemical stability and inertness make it suitable for sensitive skin applications, reducing the risk of irritation. The material's ability to impart a soft-focus effect is particularly valued in high-performance cosmetics, where it contributes to a more polished and flawless appearance.

Hexagonal boron nitride's role in lubricants is gaining prominence due to its exceptional properties that enhance the performance of lubrication systems. h-BN is used as an additive in both industrial and automotive lubricants to improve their thermal stability and reduce friction. Recent advancements include the development of h-BN-enhanced lubricants for high-performance engines and machinery, where the material's high thermal conductivity helps in effective heat dissipation and minimizes wear and tear.

For instance, h-BN has been integrated into lubricants used in high-speed machining processes and precision engineering applications. This incorporation helps in maintaining the efficiency and extending the service life of equipment by reducing friction and wear. Furthermore, h-BN-based lubricants are increasingly being researched for use in extreme environments, such as in high-temperature and vacuum conditions, showcasing their versatility and effectiveness in demanding applications.

Regional Insights & Trends

In North America, hexagonal boron nitride is increasingly utilized across several high-tech industries, including aerospace, electronics, and automotive. The United States and Canada are prominent consumers of h-BN, leveraging its unique properties for advanced technological applications. A notable instance is the use of h-BN in aerospace coatings and thermal management systems. Companies in the aerospace sector are adopting h-BN-based materials to protect components from extreme temperatures and enhance performance. Additionally, North American manufacturers are integrating h-BN into high-performance lubricants used in precision engineering and automotive applications. The region's focus on innovation and high-performance materials drives the demand for h-BN, with ongoing investments in new technologies and applications contributing to its consumption.

Asia Pacific Hexagonal Boron Nitride Market Trends

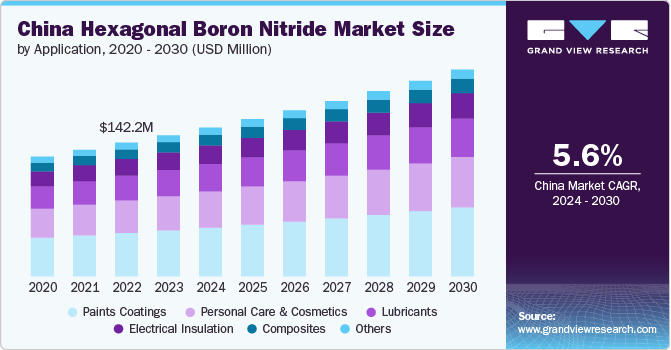

“Asia Pacific to emerge as the fastest growing market with a CAGR of 5.3% from 2024 - 2030”

Asia Pacific dominated the market and accounted for a 40.52% share in 2023. The Asia Pacific region is a major consumer of hexagonal boron nitride (h-BN), driven by the rapid industrialization and technological advancement in countries such as Japan, South Korea, and India. This region's strong growth in electronics, automotive, and aerospace industries fuels the demand for advanced materials like h-BN. Recent developments include the increasing use of h-BN in high-performance electronic devices and thermal management solutions within the semiconductor industry. For example, in Japan, leading semiconductor manufacturers are incorporating h-BN into their thermal interface materials to improve the efficiency of high-power electronic devices. Moreover, South Korea's advancements in electric vehicles (EVs) are driving demand for h-BN-based lubricants and coatings that enhance the performance and longevity of EV components. The region's significant investments in research and development further support the growing use of h-BN in various high-tech applications.

China is a major consumer of hexagonal boron nitride, reflecting its rapid industrial growth and increasing focus on technological advancement. The country's robust electronics and automotive sectors significantly contribute to the demand for h-BN. Recent developments include the incorporation of h-BN in thermal management solutions for electronic devices and in coatings for high-speed machinery. Chinese companies are also investing heavily in research and development to expand the applications of h-BN, including in advanced energy storage technologies and new semiconductor materials. For instance, h-BN is being used in high-performance electronic components produced by leading Chinese tech firms, enhancing the thermal management and reliability of these devices. China's emphasis on innovation and expansion in high-tech industries continues to drive substantial consumption of h-BN, positioning it as a key player in the global market.

Europe Hexagonal Boron Nitride Market Trends

Europe's consumption of hexagonal boron nitride is characterized by its integration into cutting-edge technologies and advanced manufacturing processes. Countries such as Germany, France, and the United Kingdom are leading in the adoption of h-BN for various applications, particularly in the electronics and automotive sectors. For example, German automotive manufacturers are using h-BN in advanced thermal management systems to improve the efficiency of electric vehicles and high-performance engines. Additionally, European research institutions are exploring new applications for h-BN in quantum computing and energy storage systems. The region's strong emphasis on sustainability and technological innovation drives the demand for h-BN, as it is used in high-performance coatings and lubricants that meet stringent environmental and performance standards.

Key Hexagonal Boron Nitride Company Insights

The global hexagonal boron nitride (h-BN) market is characterized by a fragmented competitive landscape, with numerous players ranging from established multinational corporations to specialized startups. This fragmentation is driven by the diverse applications of h-BN across industries such as electronics, aerospace, and automotive, which attract a variety of companies into the market. Major players like Momentive Performance Materials, Saint-Gobain, and H.C. Starck are actively engaged in strategic initiatives to strengthen their market presence.

For instance, Momentive Performance Materials has invested in expanding its production capabilities and R&D to enhance its product offerings and address the growing demand in electronics and aerospace sectors. Similarly, Saint-Gobain has been focused on developing innovative h-BN solutions and increasing its global footprint through strategic partnerships and acquisitions. Additionally, Denka Company Limited has made significant strides by advancing its h-BN technology and enhancing its market position through targeted investments in manufacturing and technology development. These strategic moves reflect the competitive nature of the market, where companies are continuously striving to innovate and capture a larger share of the expanding global demand for h-BN.

Some of the mature players of global hexagonal boron nitride market are 3M, Saint-Gobain, Yara International, and American Elements.

-

Yara International, a global leader in agricultural products and solutions, has ventured into the hexagonal boron nitride (h-BN) market through its subsidiary, Yara Industrial Chemicals. The company specializes in the production and supply of high-quality h-BN products, catering to applications in electronics, aerospace, and advanced materials. Yara International leverages its extensive expertise in chemicals and materials to offer innovative h-BN solutions that enhance thermal management and performance in high-tech industries, positioning itself as a key player in the global h-BN market.

-

3M is a prominent market player, leveraging its extensive expertise in advanced materials to produce high-quality h-BN products. 3M incorporates h-BN into its thermal management and insulation solutions, catering to sectors such as electronics, aerospace, and industrial applications. The company's innovations in h-BN enhance the performance and reliability of electronic devices and thermal interface materials, reflecting its commitment to technological advancement and high-performance materials.

-

Saint-Gobain is a key global supplier of hexagonal boron nitride, utilizing its broad materials science capabilities to offer advanced h-BN solutions. Saint-Gobain's h-BN products are used in various applications, including high-temperature coatings, electronics, and energy sectors. The company's focus on innovation and sustainability drives the development of cutting-edge h-BN materials that improve performance and durability, reinforcing its position as a significant player in the global h-BN market.

Groltex Inc,; ZYP Coatings, Inc.; and Henze-BNP, are some of the emerging market participants.

-

Groltex Inc. is a specialized producer of hexagonal boron nitride (h-BN) products, focusing on providing high-quality h-BN powders and coatings for advanced industrial applications. The company serves various sectors including electronics, aerospace, and energy, offering solutions that leverage h-BN's superior thermal conductivity and electrical insulation properties. Groltex's commitment to precision and innovation ensures that its h-BN products meet the stringent requirements of high-performance applications.

-

ZYP Coatings, Inc. is renowned for its expertise in applying hexagonal boron nitride in coating technologies. The company specializes in producing h-BN-based coatings that provide excellent thermal stability, lubrication, and resistance to oxidation. ZYP Coatings' h-BN products are utilized in a range of industries including electronics, metal processing, and high-temperature applications, enhancing the performance and longevity of critical components.

-

Henze-BNP focuses on the production and supply of high-quality hexagonal boron nitride materials, offering a range of h-BN powders and dispersions. The company's products are designed for use in electronics, ceramics, and high-temperature environments, where h-BN's thermal and chemical properties are critical. Henze-BNP's dedication to quality and technical innovation positions it as a significant player in providing advanced h-BN solutions for demanding industrial applications.

Key Hexagonal Boron Nitride Companies:

The following are the leading companies in the hexagonal boron nitride market. These companies collectively hold the largest market share and dictate industry trends.

- 3M

- American Elements

- Denka Company Limited

- Groltex Inc.

- Saint Gobain

- Yara International

- Showa Denko K.K.

- ZYP Coatings, Inc.

- Momentive

- Henze-BNP

Recent Developments

-

In September 2023, Saint-Gobain Boron Nitride and Haydale Group formalized a collaboration agreement aimed at advancing surface chemistries for boron nitride powders. This strategic partnership underscores the dedication of both organizations to technological innovation and to tackling the intricate challenges encountered by industries on a global scale.

-

In September 2022, HeBoFill LL-SP 060 represents a newly introduced boron nitride powder from Henze Boron Nitride Products, distinguished by its high purity and minimal agglomeration. This addition expands our product range by incorporating a new variant into the HeBoFill LUB LINE.

Hexagonal Boron Nitride Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2024 |

USD 949.41 million |

|

Revenue forecast in 2030 |

USD 1277.14 million |

|

Growth rate |

CAGR of 5.1% from 2024 to 2030 |

|

Base year for estimation |

2023 |

|

Historical data |

2018 - 2022 |

|

Forecast period |

2024 - 2030 |

|

Quantitative units |

Volume in kilotons, revenue in USD million, and CAGR from 2024 to 2030 |

|

Report coverage |

Volume and revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Application, region |

|

Regional scope |

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa |

|

Country scope |

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; China; India; Japan; South Korea; Brazil; Argentina; Saudi Arabia; South Africa |

|

Key companies profiled |

3M; American Elements; Denka Company Limited; Groltex Inc.; Saint-Gobain; Yara International; Showa Denko K.K.; ZYP Coatings, Inc.; Momentive; Henze-BNP |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Hexagonal Boron Nitride Market Report Segmentation

This report forecasts volume & revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global hexagonal boron nitride market report based on application and region:

-

Application Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Paints Coatings

-

Electrical Insulation

-

Composites

-

Lubricants

-

Personal Care & Cosmetics

-

Others

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East and Africa

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global hexagonal boron nitride market was valued at USD 904.32 in 2023 and is expected tp reach USD 949.41 million in 2024.

b. The global hexagonal boron nitride market is anticipated to witness a high CAGR of 5.1% from 2024 to reach USD 1277.14 million by 2030

b. Asia Pacific dominated the market and accounted for a 40.52% share in 2023. The Asia Pacific region is a major consumer of hexagonal boron nitride (h-BN), driven by the rapid industrialization and technological advancement in countries such as Japan, South Korea, and India.

b. The global hexagonal boron nitride (h-BN) market is characterized by a fragmented competitive landscape, with numerous players ranging from established multinational corporations to specialized startups. This fragmentation is driven by the diverse applications of h-BN across industries such as electronics, aerospace, and automotive, which attract a variety of companies into the market. Major players like Momentive Performance Materials, Saint-Gobain, and H.C. Starck are actively engaged in strategic initiatives to strengthen their market presence. For instance, Momentive Performance Materials has invested in expanding its production capabilities and R&D to enhance its product offerings and address the growing demand in electronics and aerospace sectors.

b. The market driven by its unique properties makes it highly valuable in various advanced technologies. h-BN, often referred to as "white graphene," exhibits exceptional thermal conductivity, high electrical resistivity, and excellent chemical stability. These characteristics make it an ideal material for use in electronics, such as in the production of high-performance insulators and thermal management components.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."