- Home

- »

- Plastics, Polymers & Resins

- »

-

Hermetic Packaging Market Share Analysis, Industry Report, 2025-2030GVR Report cover

![Hermetic Packaging Market Size, Share & Trends Report]()

Hermetic Packaging Market (2025 - 2030) Size, Share & Trends Analysis Report By Product (Ceramic To Metal Sealing, Glass To Metal Sealing, Transponder Glass), By Application, By Region, And Segment Forecasts

- Report ID: GVR-1-68038-852-7

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Hermetic Packaging Market Summary

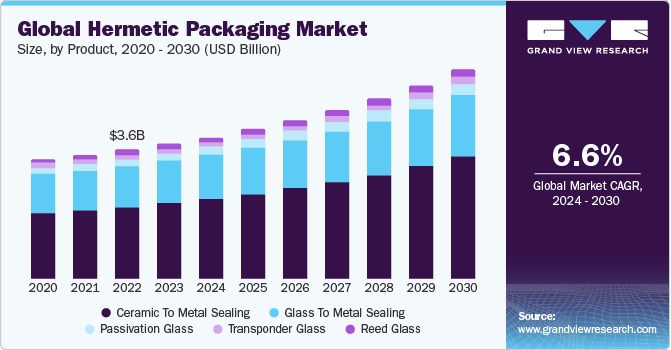

The global hermetic packaging market size was estimated at USD 4.01 billion in 2024 and is projected to reach USD 5.90 billion by 2030, growing at a CAGR of 6.9% from 2025 to 2030. In hermetic packaging, electronic systems are protected from environmental circumstances, including variations in atmospheric pressure and moisture that may damage sensitive electronic components or electrical connections.

Key Market Trends & Insights

- Asia Pacific accounted for the largest revenue share of over 45.0% in 2024.

- India is expected to register the highest CAGR from 2025 to 2030.

- By product, the ceramic to metal sealing was the largest product segment in the market with revenue share of over 56.0% in 2024.

- By Application, the military and defense segment dominated the market with a revenue share of over 32.0% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 4.01 Billion

- 2030 Projected Market Size: USD 5.90 Billion

- CAGR (2025-2030): 6.9%

- Asia Pacific: Largest market in 2024

Hermetic packaging has been increasingly in demand in the automotive industry due to its ability to protect critical components from environmental hazards such as moisture, dust, and gases. The automotive industry requires high-quality packaging solutions that ensure the reliability and longevity of their products. Some of the key components in the automotive industry that require hermetic packaging include sensors, microprocessors, and power modules. These components are critical for the proper functioning of modern automobiles and any failure can lead to significant safety hazards.

The increasing adoption of electric vehicles has further fueled the demand for hermetic packaging in the automotive industry. According to the EV volumes report, annual sales of EVs reached a new high of 10.2 million units globally in 2022, up 55% from the previous year. Electric vehicles have a higher number of sensitive electronic components, which require hermetic sealing to protect them from moisture and other environmental factors.

The demand for hermetic packaging in the automotive industry is expected to continue to grow as automakers increasingly focus on improving vehicle safety, reliability, and performance. As a result, the suppliers of hermetic packaging solutions are investing heavily in research and development activities to provide innovative and cost-effective solutions that meet the unique needs of the automotive industry.

Early technology adoption in North America, coupled with extensive R&D by key aerospace companies, is expected to augment the demand for ceramic to metal and glass to metal seals. However, the high cost of ceramic packaging as compared to its counterparts may hinder the market growth during the forecast period.

Demand for electronic devices is expected to increase owing to an increase in disposable income and an increase in internet usage among consumers. Governments globally are increasingly supporting digitalization, ultimately encouraging consumers to use various electronic devices, thus consequently augmenting the growth of the market.

Market Concentration & Characteristics

Hermetic packaging plays an important role in ensuring the reliability and longevity of electronic devices. It prevents corrosion and electrical shorts, along with other types of damage that can result in the failure of electronic devices by preventing the entry of moisture and other impurities in them. The demand for hermetic packaging is expected to grow in the future because of technological improvements and increasing demand of durable and flexible packaging solution in a variety of application for end-use sectors such as military & defense, healthcare, and aeronautics & space.

The global hermetic packaging market is consolidated with the presence of a significant number of manufacturers. Companies operational in this market space are focusing on mergers and acquisitions to maintain their market share. For instance, in May 2023, Micross Components acquired Technograph Microcircuits Ltd. It is a privately held electronics manufacturer located in Portsmouth, UK, and has established itself as a best-in-class supplier serving customers in the space, aerospace, defense, medical, automotive, telecommunications, and energy end markets with a leading portfolio of advanced electronic solutions for the most demanding operating environments.

In February 2023, Micross Components, Inc. acquired the High-Reliability DC-DC converter business of Infineon Technologies AG. Headquartered in San Jose, California with a facility in Copenhagen, Denmark, the Business provides high-reliability DC-DC converters, including hybrid and custom board-based power products for space, strategic defense, aerospace, and other high-reliability customers. The Business designs and manufactures proprietary power solutions operating in the harshest environments.

Product Insights

Ceramic to metal sealing was the largest product segment in the market for hermetic packaging and accounted for a revenue share of over 56.0% in 2024. Ceramic to metal seals facilitate long and durable hermetic sealing and offer better insulation from electrical signals as compared to glass to metal seals, expanding their application scope across various applications.

Ceramic to metal sealing is being increasingly utilized in implantable electronic devices such as pacemakers, cochlear implants, defibrillators, and neurostimulators. Additionally, the high corrosion resistance of ceramic to metal sealing is anticipated to drive their utilization in the healthcare industry.

The ceramic to metal seal market has witnessed significant growth in emerging economies such as China, India, and Brazil on account of the rising demand for electronics. In addition, the requirement in aircraft engines for hermetic seals that display strong resistance against vibrations and elevated temperatures is anticipated to bolster the market growth over the forecast period.

The transponder glass segment is expected to witness significant growth in Asia Pacific over the forecast period, due to the huge livestock market in the region. The increasing availability of technology, disposable income, and awareness across the region are facilitating the usage of RFID devices by farmers, thereby driving the demand for transponder glass-based hermetic packages.

Application Insights

The military and defense sector dominated the market with a revenue share of over 32.0% in 2024. Growing security threats, escalating defense budgets, and changing political dynamics are expected to drive investments in the defense sector, thereby driving the demand for hermetic packaging throughout the forecast period.

Growing government and private investment in space exploration is expected to drive growth of the market for hermetic packaging. Furthermore, low-cost carriers and regional airlines have revolutionized the airline business with their low-fare business models resulting in a significant increase in air passengers.

Hermetic connectors are used for the integrity of delicate electronics in flight data recorders. Moreover, fuel tanks and systems use hermetically sealed connectors so that their sensors can detect and prevent spills. Thus, with an increase in air freight and transportation, along with an increase in air passengers, the demand for hermetic packaging is expected to increase during the forecast period.

Increasing disposable income, urbanization, the resulting increase in the requirement for automobiles, and the increasing affordability of automobiles are anticipated to drive the market over the forecast period. The automotive industry's use of reed switches to ensure proper sensor functionality in rollover devices and airbag equipment is likely to positively impact the market growth.

Regional Insights

North America was the second-largest market for hermetic packaging in 2024 with aeronautics and space being one of the major applications of hermetic packaging in the region. The industry is expected to offer huge opportunities for the market growth on account of the presence of numerous aerospace companies in the U.S.

U.S. Hermetic Packaging Market Trends

The hermetic packaging market in the U.S.held the largest revenue share in 2023. Boeing and Airbus are the top leading aircraft manufacturers in the U.S. The surging demand for defense products and aircraft in the country has led to the requirement for integrated chips (ICs) and microcontrollers used to control them. Moreover, the consumer electronics industry in the U.S. is witnessing continuous growth. As hermetic packaging plays an important role to maintain the ideal environment for microcontrollers to work safely. These microcontrollers are very critical for controlling the aircraft, spacecraft, and defense equipment’s. Hence the demand for hermetic packaging is expected to rise in the coming years.

The Canada hermetic packaging market is expected to grow at the fastest CAGR during the forecast period.The healthcare expenditure in Canada reached USD 264.4 billion in 2023 and the health spending is further expected to increase in the near future. With hygiene of packaging and material handling products being paramount important, the demand for hermetic packaging for the healthcare industry in the country is expected to increase.

Asia Pacific Hermetic Packaging Market Trends

Asia Pacific accounted for the largest revenue share of over 45.0% in 2024. The proliferation of numerous electronic devices and component manufacturers, coupled with the increased government budget for the aerospace and defense sector, particularly in China, Japan, and India, has led to high demand for the product in the region.

The China hermetic packaging market is expected to grow during the forecast period. According to a report by People’s Republic of China state council information office published in March 2023, China’s defense budget is expected to rise by 7.2% in 2023. This spending will remain at about USD 224.79 billion. With this huge spending, China will remain in the second position globally in terms of defense budget. The country is investing heavily in the research & development of new defense equipment and technologies. To maintain its dominance in the south-China sea, the country is investing heavily, particularly in submarines, missile systems, and fighter aircraft. These developments have led to increased demand for hermetic packaging by domestic players. Moreover, China has been continuously investing in space operations and expeditions. The country has its International Space Station dedicated for space research.

The hermetic packaging market in India is expected to grow over the forecast period. According to the Press Information Bureau (PIB) February 2023 notification, the ministry of defense has been allocated a budget of USD 72 billion, which is 13.18% of the total budget for FY 2023-24. This new budget allocation for defense sector represents a total increase of 13% over the previous 2022-23 budget. The allocation is mostly focusing on defense equipment manufacturing MSMEs under the make in India initiative. These developments are expected to increase the demand for the hermetically packaged semiconductor components in the future, making the market lucrative for the product marketer.

Europe Hermetic Packaging Market Trends

Europe is home to some of the world's largest automotive manufacturers, which invest in electric cars and self-driving technology, which require high-performance engines. Thus, increasing research and development activities within the automotive space in the region are expected to drive the demand for hermetic packaging in the automotive industry.

The Germany hermetic packaging market held the largest revenue share in 2023. With growing demand for EV batteries in Germany and the start of the new battery cell manufacturing facilities, EV manufacturing, the need for hermetically packaged sensors, integrated chips, and microcontrollers is expected to rise in the near future, in order to adopt automation and robotics in EV manufacturing plants.

The UK hermetic packaging market is expected to grow in the upcoming years.The consumer electronics industry in the UK is showing rising demand because of the increased disposable income of consumers with average 0.7% per year between FY 2020 to 2022 and increasing innovations by product manufacturers, which has led to an increase in the demand for sensors and microcontrollers. Hence, with the growing demand for chips in the defense, aerospace, telecom, and consumer electronics sectors, the demand for hermetic packaging in the UK is expected to increase in the coming years.

Key Hermetic Packaging Company Insights

The market is characterized by the presence of established players. With the view to enhance their competitive edge in the market, some of the key product manufacturers have adopted several aggressive strategies, including product launches, expansion of capacity, and acquisitions.

-

In October 2024, CPS Technologies Corporation secured a USD 12 million contract with a longstanding multinational semiconductor manufacturer to supply power module components over the next year. This agreement marks a 50% increase in orders compared to the previous year and underscores the growing demand for CPS's aluminum silicon carbide products, particularly in sectors like high-speed rail, wind turbines, and electric/hybrid vehicles.

-

In March 2023, Schott AG launched the production of amber pharma glass in India to meet the increasing demand. This will increase the availability of borosilicate glass to manufacturers of the hermetic package industry in India.

Key Hermetic Packaging Companies:

The following are the leading companies in the hermetic packaging market. These companies collectively hold the largest market share and dictate industry trends.

- NGK Spark Plug Co., Ltd.

- Schott AG

- AMETEK, Inc.

- Amkor Technology

- Texas Instruments Incorporated

- Teledyne Microelectronic Technology

- Kyocera Corporation

- Materion Corporation

- Egide S.A.

- Micross Components, Inc.

Hermetic Packaging Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 4.23 billion

Revenue forecast in 2030

USD 5.90 billion

Growth rate

CAGR of 6.9% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, application, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; UK; Germany; France; Italy; Spain; Netherlands; UK; China; Japan; India; South Korea; Australia; Brazil; Saudi Arabia; UAE; South Africa

Key companies profiled

Schott AG, AMETEK, Inc.; NGK Spark Plug Co., Ltd.; Teledyne Microelectronic Technologies; Kyocera Corporation; Egide S.A.; Texas Instruments Incorporated; Teledyne Microelectronic Technology;Materion Corporation;Micross Components, Inc.

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Hermetic Packaging Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global hermetic packaging market report based on product, application, and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Ceramic To Metal Sealing

-

Glass To Metal Sealing

-

Transponder Glass

-

Reed Glass

-

Passivation Glass

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Aeronautics & Space

-

Military & Defense

-

Automotive

-

Healthcare

-

Telecom

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Netherlands

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

Saudi Arabia

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global hermetic packaging market size was estimated at USD 4.01 billion in 2024 and is expected to reach USD 4.23 billion in 2025.

b. The global hermetic packaging market is expected to grow at a compound annual growth rate of 6.9% from 2025 to 2030 to reach USD 5.90 billion by 2030.

b. Some of the key players in the market are Schott AG, Ametek, Inc.; NGK Spark Plug Co., Ltd., Teledyne Microelectronic Technologies, Kyocera Corporation, Egide S.A.; Legacy Technologies, Inc., Willow Technologies, SST International; Special Hermetic Products, Inc.; Sinclair Manufacturing Company; and Mackin Technologies

b. Some of the factors that are driving the growth of the hermetic packaging market include proliferating global demand for commercial aircraft, the rising development in the U.S. military & defense sector, and rising automotive sales in the Asia Pacific region.

b. The military and defense accounted for a 32% share in 2024. Changing political scenarios and increasing research and development activities in the military and defense industry have increased military spending, thereby increasing the demand for hermetic packaging.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.