Hereditary Testing Market Size, Share & Trends Analysis Report By Disease Type (Hereditary Cancer Testing, Hereditary Non-cancer Testing), By Technology (Cytogenetic, Biochemical, Molecular Testing), By Region, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-4-68038-999-9

- Number of Report Pages: 270

- Format: PDF

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Healthcare

Hereditary Testing Market Size & Trends

The global hereditary testing market size was valued at USD 6.63 billion in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 8.4% from 2023 to 2030. The expanding reproductive genetic health space is one of the key market drivers. Key players such as Natera have reported a continuous increase in test volumes in women’s health genetic testing for inherited conditions. This reflects the growing acceptance of hereditary tests among the population, thereby accelerating revenue growth. COVID-19 had a detrimental impact on the market. For example, after the World Health Organization declared COVID-19 a pandemic, governments all around the world used lockdowns to compel social separation as a prophylactic measure. In every industry, this resulted in upheaval, constraints, challenges, and adjustments.

Similarly, the outbreak negatively impacted the inherited genetic analysis sector. This is due to the incapacity of genetic counselors to see clients in person, the failure of doctors to provide guidance, and the laboratory's inability to do the tests. Furthermore, because regulatory bodies such as the Centers for Medicaid Services (CMS) did not recognize genetic counselors as healthcare practitioners, they were prohibited from working during government shutdowns. Clinics also limited face-to-face diagnostic tests to help prevent the disease from spreading. Nonetheless, genetic testing behemoths such as GeneDx provided clinician-ordered genetic screening as a service. Clinics and healthcare practitioners as well as people used telemedicine to provide genetic counseling.

Furthermore, a consistent rise in demand for newborn screening has led to an increase in sales of DNA testing kits. Increasing penetration of newborn screening across the globe is further aiding in revenue growth. Reforms in genetic testing guidelines have led to the inclusion of multigene panel testing for hereditary cancer into clinical practice. The National Comprehensive Cancer Network (NCCN) Clinical Practice Guidelines in Oncology (NCCN Guidelines) for breast, ovarian, and colorectal cancers offer information on some of the cancer risk factors and management.

The need for genetic testing has increased, resulting in an increase in DNA screening kit purchases. The Virginia Department of General Services Division of Integrated Laboratory Facilities, for example, screened 7,867 newborns for over 31 genetic and metabolic illnesses in November 2019. Increased adoption of newborn screening throughout the world is also contributing to market expansion. The application of multigene panel screening in clinics for hereditary disorders has increased, which is due to the changes in the genetic testing procedures. Moreover, favorable initiatives undertaken by government bodies are further expected to drive the market growth. For instance, in March 2023 , the Ministry of Health, Welfare and Sport of Netherlands announced that the NIPT tests accessible to all pregnant women in the country starting from April 1st, 2023.This proactive measure is expected to significantly contribute to the expansion of the market.

The National Comprehensive Cancer Network offers information on numerous cancer risk factors as well as treatment guidelines for single and multiple genetic panels. Gradual improvements in distribution strategy are expected to benefit the inherited genetic testing business. By improving distribution services and expanding technical efficiency, technological providers are helping to expand the market. To make bioinformatics technologies available to other universities, companies are using a cloud-based distribution model. Around 14 licensees began actively marketing Non-invasive Prenatal Testing devices utilizing constellation software.

Although these hereditary tests have significant advantages over conventional tests, several industry experts cited the cost and security concerns faced by consumers pertaining to the test. Moreover, the lack of effective regulation of the tests is another key area that demands focused efforts. Despite these challenges, the genetic testing market is constantly expanding owing to the advantages of these innovative tests along with improved healthcare outcomes.

Disease Type Insights

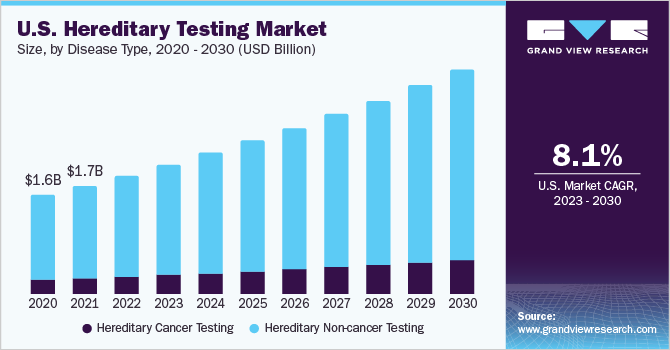

The hereditary non-cancer testing segment dominated the market with a revenue share of over 80.0% in 2022 and is expected to expand at a significant CAGR over the forecast period. Product and service offerings with regard to various hereditary cancer testing continue to expand. The entry of major players, such as Quest, in this segment in the recent past, has significantly driven the market. Considering breast cancer genetic testing as a lucrative source of revenue, companies are focusing on business strategies to enhance their presence in this segment.

One of the strategies is offering hereditary tests at a price lower than that offered by competitors. For instance, Color Genomics began selling its product for USD 259, whereas similar products offered by Myriad cost around USD 4,000. The increasing affordability of the tests is one of the key drivers of this segment. Furthermore, BRCA1 carriers have an 80% risk of developing breast cancer, which has also accelerated the developments in the hereditary cancer testing market.

Lung cancer is one of the major cancer forms that has relatively few products. This is because most cases of lung cancer are not related to inherited genetic mutations. Similarly, for cervical cancer, most of the cases are caused by Human Papilloma Virus (HPV) and not genetic mutations. The lack of effective evidence on the heritability of cervical cancer is driving the research activities in this market.

Prenatal testing, irrespective of the associated risks, is increasingly gaining popularity. The cell-free DNA (cfDNA)-based NIPT testing is considered medically necessary by Anthem Blue Cross and Blue Shield of California. Previously, these players promoted cfDNA-based NIPT testing for trisomy’s 21, 18, and 13 only in high-risk pregnancies as determined by maternal age and other factors.

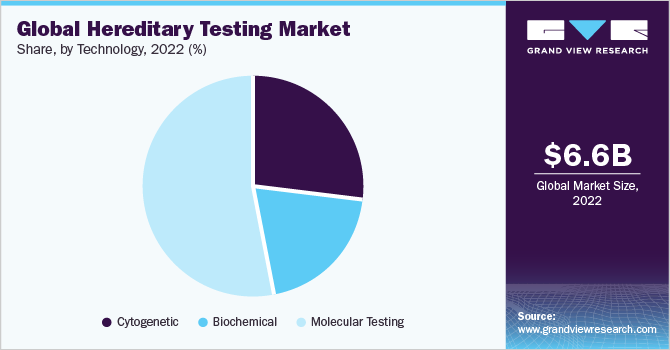

Technology Insights

The molecular testing segment dominated the market with a revenue share of 53.58 in 2022 and is expected to grow at the fastest rate over the forecast period. The rising adoption of molecular testing for genetic disease screening and diagnosis, along with strategic initiatives taken by market players is expected to drive the segment growth in the coming years. for instance, in September 2022, BillionToOne launched Unity, a noninvasive prenatal test for hemolytic disease in fetus and newborn.

Cytogenetic technology plays a crucial role in genetic testing, enabling the analysis of chromosomal abnormalities and structural variations in the genome. It is one of the promising technologies for hereditary testing market. Increasing adoption of these tests for cancer detection and cost effectiveness compared to other technologies are some of key factors driving the segment growth during the forecast period.

Regional Insights

Europe accounted for the largest revenue share of over 34.8% in 2022 and is likely to maintain its lead during the forecast period. This can be attributed to the presence of key players providing genetic tests, the high adoption of advanced treatments, and recommendations provided by government agencies to ensure the quality of hereditary testing services. Variations in regulatory frameworks pertaining to genetic tests across the world have significantly impacted the approval and commercialization of tests in the global market. Currently, a wide variety of genetic tests are being provided by several key companies in the U.S. as well as several countries in Europe, Asia Pacific, and other regions.

In January 2020, Quest Diagnostics, a supplier of diagnostic information services, announced the all-cash equity acquisition of Blueprint Genetics. Blueprint Genetics specializes in gene variant interpretation using next-generation sequencing (NGS) and proprietary bioinformatics. Quest and Blueprint Genetics will improve patient care and pharmaceutical medication research and development by increasing access to actionable insights into genetic and rare disorders. Such initiatives are expected to strengthen the genetic testing scenario for hereditary disorders in North America, thereby accelerating regional revenue generation.

Key Companies & Market Share Insights

Understanding the role of genetic mutation in disease occurrence has significantly accelerated the R&D in this market. Various retrospective studies are being carried out to understand the role of inherited mutations in disease pathology, which has led to key diagnostic developers, such as Quest Diagnostics, entering the market. Continuous authorizations and approvals of genetic tests by the government are expected to propel the organic revenue growth of operating companies. For instance, in February 2023, MedGenome launched its genetic test used for the diagnosis of Facioscapulohumeral Muscular Dystrophy in India. Furthermore, the expanding product portfolio is indicative of growing competition in the market. Each company is making focused efforts to offer products with a competitive advantage. For instance, in June 2021, Illumina and Next Generation Genomic partnered to launch VeriSeq™ NIPT Solution in Thailand. Similarly, cross-selling efforts by Natera helped the company witness lucrative revenue generation over the past years. The company promotes the collective use of Horizon and Panorama products for women who have not undergone carrier screening tests in their first trimester. Some prominent players in the global hereditary testing market include:

-

Myriad Genetics, Inc.

-

Invitae Corporation

-

Illumina, Inc.

-

Natera, Inc.

-

Laboratory Corporation of America Holdings

-

F. Hoffmann-La Roche Ltd.

-

Quest Diagnostics Incorporated

-

COOPERSURGICAL, INC.

-

Agilent Technologies, Inc.

-

Thermo Fisher Scientific, Inc.

-

Twist Bioscience

-

SOPHiA GENETICS

-

Fulgent Genetics

-

MedGenome

-

CENTOGENE N.V.

Hereditary Testing Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2023 |

USD 7.26 billion |

|

Revenue forecast in 2030 |

USD 12.73 billion |

|

Growth rate |

CAGR of 8.4% from 2023 to 2030 |

|

Base year for estimation |

2022 |

|

Historical data |

2018 - 2021 |

|

Forecast period |

2023 - 2030 |

|

Report updated |

May 2023 |

|

Quantitative units |

Revenue in USD million/billion, and CAGR from 2023 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Technology, disease type, region |

|

Regional scope |

North America; Europe; Asia Pacific; Latin America; MEA |

|

Country scope |

U.S.; Canada; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; China; India; Japan; South Korea; Australia; Thailand; Brazil; Mexico; Argentina; South Africa; UAE; Saudi Arabia; Kuwait |

|

Key companies profiled |

Myriad Genetics, Inc., Invitae Corporation, Illumina, Inc., Natera, Inc., Laboratory Corporation of America Holdings, F. Hoffmann-La Roche Ltd., Quest Diagnostics Incorporated, COOPERSURGICAL, INC., Agilent Technologies, Inc., Thermo Fisher Scientific, Inc., Twist Bioscience, SOPHiA GENETICS, Fulgent Genetics, MedGenome, CENTOGENE N.V. |

|

Customization scope |

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

Global Hereditary Testing Market Report Segmentation

This report forecasts revenue growth and provides an analysis on the latest trends in each of the sub-segments from 2018 to 2030. For the purpose of this report, Grand View Research has segmented the global hereditary testing market report on the basis of disease type, technology, and region.

-

Disease Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Hereditary Cancer Testing

-

Lung Cancer

-

Breast Cancer

-

Colorectal Cancer

-

Cervical Cancer

-

Ovarian Cancer

-

Prostate Cancer

-

Stomach/Gastric Cancer

-

Melanoma

-

Sarcoma

-

Uterine Cancer

-

Pancreatic Cancer

-

Others

-

-

Hereditary Non-cancer Testing

-

Genetic Tests

-

Cardiac Diseases

-

Rare Diseases

-

Other Diseases

-

-

Preimplantation Genetic Diagnosis & Screening

-

Non-invasive Prenatal Testing (NIPT) & Carrier Screening Tests

-

Newborn Genetic Screening

-

-

-

Technology Outlook (Revenue, USD Million, 2018 - 2030)

-

Cytogenetic

-

Biochemical

-

Molecular Testing

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

South Korea

-

Australia

-

Thailand

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

UAE

-

Saudi Arabia

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. Hereditary non-cancer testing dominated the hereditary testing market with a share of 80.0% in 2022. This is attributable to increasing acceptance and widespread implementation of preimplantation genetic diagnosis & screening and Non-invasive Prenatal Testing (NIPT).

b. Some key players operating in the hereditary testing market include Myriad Genetics, Inc.; Invitae Corporation; Illumina, Inc.; Natera, Inc.; Laboratory Corporation of America Holdings; F. Hoffmann-La Roche Ltd; Quest Diagnostics Incorporated; CooperSurgical, Inc.; Agilent Technologies, Inc.; and Thermo Fisher Scientific, Inc.

b. Key factors that are driving the hereditary testing market growth include raising awareness of women's reproductive health, the decline in sequencing cost, and the expansion of the genetic testing registry.

b. The global hereditary testing market size was estimated at USD 6.63 billion in 2022 and is expected to reach USD 7.26 billion in 2023.

b. The global hereditary testing market is expected to grow at a compound annual growth rate of 8.4% from 2023 to 2030 to reach USD 12.73 billion by 2030.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."