- Home

- »

- Pharmaceuticals

- »

-

Herceptin Market Size, Share & Trends, Industry Report 2030GVR Report cover

![Herceptin Market Size, Share & Trends Report]()

Herceptin Market (2025 - 2030) Size, Share & Trends Analysis Report By Product (Biosimilar, Biologic) By Application (Breast Cancer, Stomach/Gastric Cancer), By Payer (Commercial/Private, Public), By Distribution Channel, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-540-6

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Herceptin Market Summary

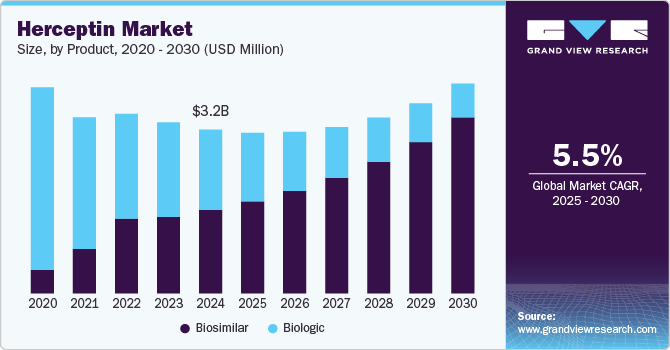

The global herceptin market size was estimated at USD 3,201.8 million in 2024 and is projected to reach USD 4,099.7 million by 2030, growing at a CAGR of 5.5% from 2025 to 2030. The market is primarily driven by the rising incidence of HER2-positive breast cancer and increasing global awareness of targeted cancer therapies.

Key Market Trends & Insights

- In terms of region, North America was the largest revenue generating market in 2024.

- Country-wise, India is expected to register the highest CAGR from 2025 to 2030.

- In terms of segment, biosimilar accounted for a revenue of USD 1,798.1 million in 2024.

- Biosimilar is the most lucrative product segment registering the fastest growth during the forecast period.

Market Size & Forecast

- 2024 Market Size: USD 3,201.8 Million

- 2030 Projected Market Size: USD 4,099.7 Million

- CAGR (2025-2030): 5.5%

- North America: Largest market in 2024

As a well-established biologic, Herceptin (trastuzumab) benefits from its proven efficacy and role in personalized medicine. Improved diagnostics, aging populations, and better healthcare infrastructure-especially in emerging markets-are boosting demand. However, the market faces growing pressure from biosimilars following Herceptin’s patent expiration. Despite this, ongoing research and expanded use in other cancers like gastric cancer help maintain its market relevance amidst evolving competition.

One of the major drivers propelling the Herceptin (trastuzumab) market is the increasing prevalence of HER2-positive breast cancer worldwide. This specific sub product of breast cancer is known to be more aggressive and less responsive to conventional chemotherapy, making targeted therapies like Herceptin an essential component of treatment. As cancer awareness campaigns grow and screening programs become more widespread, earlier and more accurate diagnosis of HER2-positive cases is becoming possible, leading to a greater demand for effective, tailored treatments. Additionally, advancements in molecular diagnostics have made it easier for clinicians to identify patients who would benefit most from Herceptin, further cementing its role in standard oncology care. The rise in breast cancer cases, particularly in aging populations and regions experiencing lifestyle shifts that increase cancer risk, is directly contributing to the expansion of the Herceptin market. As more patients become eligible for HER2-targeted therapies, the reliance on established treatments like Herceptin continues to grow, making the increasing incidence of HER2-positive breast cancer a significant and sustained market driver.

Herceptin (trastuzumab) holds a pivotal role in modern oncology, particularly in the treatment of HER2-positive breast and gastric cancers. Its mechanism of action-binding to the HER2 receptor and inhibiting cell proliferation-has made it a landmark in targeted cancer therapy. Clinical data underscores its effectiveness not only as monotherapy but also in combination with chemotherapy and other targeted agents, enhancing progression-free and overall survival in various cancer stages. The drug’s ability to address both early-stage and metastatic disease broadens its clinical utility, contributing to its widespread adoption in treatment protocols worldwide. Additionally, Herceptin has been studied extensively, creating a strong foundation of safety and efficacy data that supports its ongoing use despite the introduction of biosimilars. However, concerns like cardiotoxicity require careful patient monitoring, influencing how clinicians approach its long-term use. Overall, Herceptin's entrenched position in clinical practice, supported by decades of research and positive outcomes, continues to make it a vital therapeutic option in oncology.

FDA-Approved Indications For Herceptin (Trastuzumab)

Indication

Approval Date

Notes

Metastatic Breast Cancer

1998

First approval, as monotherapy or in combination with paclitaxel, for HER2-overexpressing metastatic breast cancer.

Adjuvant Breast Cancer

2006

For HER2-positive node-positive or node-negative (with certain risk factors) early-stage breast cancer, in combination with chemotherapy.

Metastatic Gastric or Gastroesophageal Junction Adenocarcinoma

2010

In combination with cisplatin and capecitabine or 5-FU for HER2-positive cases.

Extended Adjuvant Treatment (following chemo + trastuzumab)

2019

As Herceptin Hylecta (subcutaneous formulation).

HER2+ Breast Cancer (Subcutaneous formulation)

2019

Herceptin Hylecta approved as a fixed-dose injection.

Herceptin, Roche’s blockbuster anti-HER2 monoclonal antibody, has undergone significant shifts in its market position due to patent expirations and the entry of biosimilars across global markets.

Patent Expirations

-

Europe: Patent expired July 2014.

-

US: Patent expired June 2019.

These expirations triggered a biosimilar boom, especially in emerging markets like India, Brazil, Russia, and China, and later in regulated markets such as the US, EU, and Japan.

Biosimilar Landscape

The biosimilar landscape for trastuzumab has evolved into a highly competitive and diverse arena, driven largely by the expiration of key patents in Europe (2014) and the United States (2019). This development has opened the market to a range of biosimilars that are challenging the dominance of the originator, Herceptin. Companies across the globe-from established players like Amgen, Celltrion, and Pfizer to emerging manufacturers in countries such as China, Russia, and Iran-have introduced or are developing biosimilar versions of trastuzumab. These products are gaining traction in various regions as regulatory agencies, such as the EMA and FDA, enforce rigorous standards to ensure that biosimilars meet the same quality, safety, and efficacy benchmarks as their reference products. Despite some variability in regulatory pathways across different markets, early biosimilar entrants have capitalized on strategic partnerships and robust clinical data to secure approvals and market access. This competitive environment not only pressures pricing structures but also promises to improve patient access to life-saving therapies by offering more cost-effective treatment options in oncology care.

Key Approved Biosimilars

Company / Partners

Markets Approved

Kanjinti (ABP 980)

Amgen/Allergan

EMA, Health Canada, FDA

Ogivri / Herculez / Zedora

Biocon/Mylan

FDA, EMA, Brazil

Herzuma (CT-P6)

Celltrion/Teva

FDA, EMA, Korea, Japan, Australia

Ontruzant (SB3)

Samsung Bioepis/Biogen

FDA, EMA, Korea

Trazimera (PF-05280014)

Pfizer/Hospira

FDA, EMA, Japan, Australia

Zercepac (HLX02)

Shanghai Henlius

EMA (2020)

AryoTrust

AryoGen (Iran)

Iran

CanMab/Hertraz

Biocon (India)

India

Strategic And Regulatory Considerations

The regulatory environment for trastuzumab biosimilars is shaped by stringent approval processes in developed markets, especially under agencies like the FDA and EMA. These bodies require extensive analytical, preclinical, and clinical data demonstrating biosimilarity to Herceptin, including pharmacokinetics, immunogenicity, and efficacy endpoints. As a result, biosimilars approved in these markets often become benchmarks of quality for global distribution. However, the path to approval is not without hurdles-manufacturing consistency, compliance with Good Manufacturing Practice (GMP), and site inspections have delayed market entry for several companies, as seen with Biocon and Mylan's initial application to EMA. Strategic collaborations, such as those between Samsung Bioepis and Biogen or Celltrion and Teva, are becoming increasingly common, allowing firms to leverage regulatory expertise, manufacturing infrastructure, and commercial networks. Additionally, a new frontier is emerging with the development of subcutaneous (SC) formulations, which could offer differentiation through enhanced patient convenience and administration efficiency.

Market & Commercial Implications

The arrival of trastuzum« biosimilars has led to substantial shifts in the oncology market landscape, significantly impacting pricing and access dynamics. Herceptin, once a blockbuster product with annual sales exceeding $7 billion, is experiencing revenue pressure as biosimilars erode its market share. Health systems, especially in cost-sensitive markets, are increasingly prioritizing biosimilars to drive down biologics expenditure-creating a favorable climate for biosimilar adoption. Early entrants have enjoyed commercial advantages, securing formulary placements and payer agreements that boost uptake. Additionally, the push toward value-based healthcare is accelerating biosimilar acceptance, particularly where real-world data supports clinical interchangeability. However, the rapid influx of competitors is also leading to market fragmentation and pricing compression, making long-term profitability reliant on operational efficiencies and differentiation strategies, such as combination therapies or novel delivery formats.

Key Opportunities & Challenges

Opportunities in the trastuzumab biosimilar market are substantial, particularly in emerging economies with high disease burden and limited access to expensive biologics. Here, biosimilars are filling a critical affordability gap, often through alternative regulatory pathways with faster approvals. There is also growing interest in next-generation biosimilars that offer improved formulations, such as SC delivery or fixed-dose combinations, providing clinical and operational advantages. On the flip side, the market faces significant challenges. Regulatory disparities across regions create complexity for global rollouts, and achieving consistent quality in manufacturing remains a key risk factor. Moreover, despite regulatory approval, biosimilar uptake can be hampered by physician hesitancy, brand loyalty to originators, and limited education about biosimilar equivalence. To succeed, companies must balance competitive pricing with sustained investment in quality, education, and strategic partnerships that can support both regulatory navigation and commercial scalability.

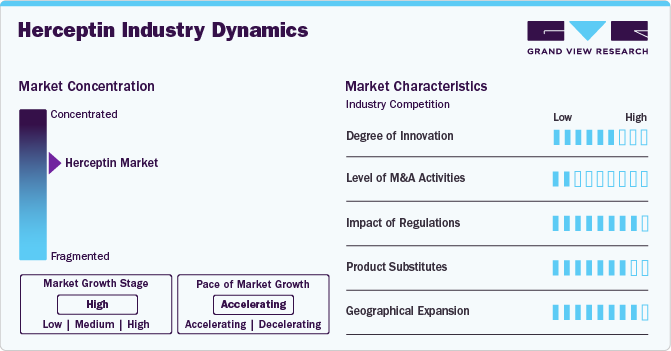

Market Concentration & Characteristics

The Herceptin market has witnessed a shift from product innovation to delivery optimization and biosimilar development. While the core monoclonal antibody therapy remains unchanged, recent innovations have centered around subcutaneous (SC) formulations for enhanced patient convenience and reduced infusion time, as seen with Herceptin Hylecta. Furthermore, the landscape is evolving with combination regimens involving trastuzumab and other agents (e.g., pertuzumab, chemotherapy, immune checkpoint inhibitors like pembrolizumab) to improve outcomes in HER2-positive cancers. The entry of biosimilars has also spurred innovation in manufacturing processes, formulation stability, and supply chain efficiency, with some companies pursuing novel SC biosimilars or fixed-dose combinations.

Mergers and acquisitions within the Herceptin space have primarily been driven by strategic positioning in the biosimilar and oncology segments. Large pharmaceutical players have acquired or partnered with biosimilar developers (e.g., Mylan, Biocon, Samsung Bioepis) to expand their oncology portfolios and secure market share post-Herceptin patent expiry. These alliances allow for technology transfers, co-development, and commercialization of trastuzumab biosimilars in key global markets. Industry-wide, M&A activity continues to support scale, biosimilar diversification, and pipeline enrichment as originator revenues decline and biosimilar competition intensifies.

Regulatory frameworks significantly shape the Herceptin market, particularly in biosimilar approval and market access. Stringent comparability requirements by the FDA, EMA, and other leading agencies demand robust analytical, clinical, and immunogenicity data. In contrast, emerging markets often have more flexible pathways, leading to faster but less standardized approvals. The intellectual property environment, including patents related to the SC formulation and manufacturing techniques, remains a strategic tool for originator companies like Roche to extend exclusivity. Meanwhile, pricing and reimbursement policies play a central role in biosimilar uptake, as cost savings for healthcare systems drive formulary inclusion and substitution incentives.

Herceptin faces competition from biosimilar trastuzumab products, other HER2-targeted therapies like Perjeta (pertuzumab) and Kadcyla (trastuzumab emtansine), and newer entrants like Enhertu (trastuzumab deruxtecan). Additionally, tyrosine kinase inhibitors (e.g., lapatinib, neratinib) and chemotherapy provide alternative treatment options, particularly in advanced disease settings. Despite this, Herceptin and its biosimilars remain foundational in early-stage and metastatic HER2+ breast and gastric cancers due to well-established efficacy, long-term safety data, and guideline inclusion. The rise of personalized medicine and companion diagnostics further supports its continued use in biomarker-driven treatment plans.

The Herceptin market has undergone significant global expansion, particularly through the proliferation of biosimilars in emerging regions. Countries in Asia-Pacific, Latin America, Eastern Europe, and the Middle East are increasingly adopting trastuzumab biosimilars to expand treatment access amid rising cancer incidence. In these regions, local manufacturers and multinational partnerships are key to navigating regulatory pathways, pricing pressures, and competition from domestic players. Roche and biosimilar developers alike are leveraging real-world evidence, provider education, and cost-effectiveness arguments to support broader market penetration. However, adoption remains sensitive to healthcare infrastructure, reimbursement capacity, and physician acceptance.

Product Insights

Biosimilars now dominate the Herceptin market, capturing a substantial 50.93% share in 2024. The surge in biosimilar uptake is largely attributed to patent expirations in major markets, increased demand for cost-effective oncology therapies, and growing acceptance of biosimilars by clinicians and payers. Regulatory approvals across North America, Europe, and emerging markets have facilitated broader market access, while competitive pricing has made biosimilars an attractive option for healthcare systems. Leading biosimilar manufacturers continue to invest in global commercialization and next-generation formulations, further consolidating this segment’s leadership.

In contrast, the biologic/originator segment is witnessing a steady decline in market share, despite maintaining a presence in high-income markets where brand loyalty and clinical familiarity persist. The biologic segment faces ongoing erosion due to aggressive biosimilar pricing, payer-driven substitution, and the increasing emphasis on value-based care. While Roche’s Herceptin continues to generate revenue in select markets, its competitive advantage is narrowing, particularly as hospitals and payers prioritize lower-cost alternatives without compromising efficacy.

Application Insights

Breast cancer remains the dominant application segment in the Herceptin market, accounting for the largest share of 57.68% in 2024. This stronghold is driven by Herceptin’s established role as the standard-of-care for HER2-positive breast cancer across early-stage, adjuvant, and metastatic settings. Extensive clinical evidence, guideline endorsements, and long-standing familiarity among oncologists contribute to its sustained leadership. The widespread adoption of both originator and biosimilar versions further broadens access, especially in regions with high HER2+ breast cancer prevalence. Continued research into combination regimens, particularly with pertuzumab and antibody-drug conjugates, also supports market resilience within this segment.

Stomach/gastric cancer represents the fastest-growing application segment in the Herceptin market. Though historically a smaller portion of the overall market, its growth is propelled by increasing recognition of HER2 overexpression in gastric and gastroesophageal junction cancers. Herceptin’s approval in combination with chemotherapy for HER2-positive advanced gastric cancer has opened new therapeutic avenues, particularly in Asia-Pacific, where gastric cancer incidence is high. Emerging clinical trials exploring new combinations and biomarkers, along with expanding treatment guidelines in this indication, are accelerating adoption and driving segment expansion.

Payer Insights

The commercial/private insurance segment leads the Herceptin market, accounting for 91.03% of the share in 2024. This dominance is attributed to comprehensive coverage policies for oncology biologics in developed healthcare systems, including the U.S., Japan, and parts of Europe. Commercial insurers support both originator and biosimilar versions of trastuzumab, ensuring treatment continuity and accessibility. Favorable reimbursement agreements, formulary inclusions, and value-based contracting are key enablers of this segment’s sustained leadership. The consistent demand for HER2-targeted therapies in breast and gastric cancers further reinforces commercial payer engagement.

The public insurance segment is the fastest-growing payer category, bolstered by expanding government-backed healthcare programs and oncology funding in both developed and developing markets. Public insurers, including Medicare, Medicaid, and national health systems, are increasingly covering biosimilar trastuzumab as part of cost-containment strategies. As biosimilars offer significant savings compared to originator biologics, health authorities are more inclined to include them in public formularies. However, pricing negotiations and health technology assessments remain critical factors influencing the pace of adoption and regional variations in market growth.

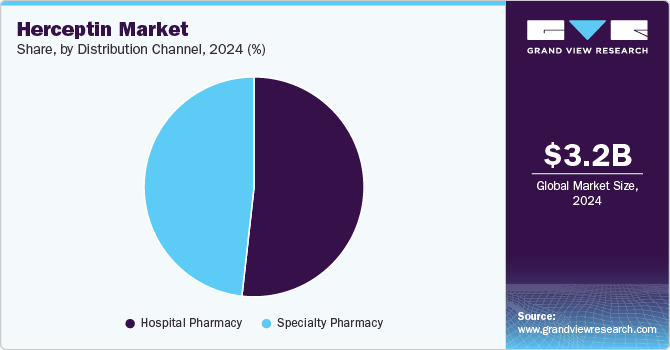

Distribution Channel Insights

Hospital pharmacies segment held the largest share of 51.77% in 2024, reflecting the centralized nature of oncology treatment delivery. Trastuzumab, whether administered intravenously or subcutaneously, is typically dispensed through hospital-based infusion centers. Hospital pharmacies manage inventory for high-cost biologics, coordinate with oncology departments, and ensure appropriate storage and handling, making them the primary distribution channel. The preference for hospital settings in managing complex cancers like HER2-positive breast and gastric tumors further drives this channel’s dominance.

Specialty pharmacies represent the fastest-growing distribution channel, driven by the expanding use of subcutaneous formulations and a shift toward outpatient cancer care. As biosimilar and SC versions of trastuzumab gain traction, specialty pharmacies are increasingly being utilized to streamline patient access, manage adherence, and reduce hospital burden. These pharmacies often work closely with payers and providers to facilitate reimbursement, patient support programs, and home-based care options-making them essential in improving the patient experience and supporting healthcare system efficiency.

Regional Insights

North America Herceptin market leads the global market, driven by high incidence rates of HER2-positive breast and gastric cancers, well-established oncology treatment infrastructure, and early adoption of biosimilars. The region benefits from robust healthcare expenditure, widespread access to both originator and biosimilar trastuzumab, and mature reimbursement frameworks. The U.S. continues to account for the largest revenue share due to high treatment volumes and rapid uptake of subcutaneous formulations and biosimilars. However, declining biologic sales and ongoing pricing pressures from biosimilar competition pose headwinds to long-term growth.

U.S. Herceptin Market Trends

The U.S. market is fueled by strong payer support for biosimilars, favorable insurance reimbursement, and Roche’s successful transition to Herceptin Hylecta (SC formulation). Continued adoption of biosimilars like Ogivri, Herzuma, and Kanjinti reflects shifting prescriber behavior and cost-efficiency mandates from private insurers. Despite its maturity, the market faces challenges including formulary pressures, Medicare price negotiations under the Inflation Reduction Act, and increasing competition from alternative HER2 therapies such as Kadcyla and Enhertu.

Europe Herceptin Market Trends

Europe’s Herceptin market is expanding, led by Germany, France, and the UK, supported by strong oncology research, favorable reimbursement policies, and regulatory approvals for new indications. The rising adoption of biomarker-driven treatment approaches is enhancing immunotherapy’s effectiveness. However, government-imposed drug pricing regulations, stringent reimbursement criteria, and competition from local manufacturers may limit growth potential.

UK Herceptin market benefits from NHS-driven biosimilar adoption strategies and NICE endorsements, making biosimilars the first-line option for most HER2-positive breast cancer cases. The use of trastuzumab in combination therapies continues to grow, especially in early-stage disease. However, budgetary constraints and preference for newer agents in select indications could limit the growth potential for traditional trastuzumab-based regimens.

Herceptin market in Germany remains robust due to a strong biotech ecosystem, early biosimilar approvals, and hospital-based cancer care delivery. Government efforts to reduce pharmaceutical spending have favored biosimilar uptake. Nonetheless, increasing use of newer HER2 therapies and a focus on value-based care may pressure further growth of traditional trastuzumab formulations.

France Herceptin market has integrated Herceptin biosimilars into public hospital formularies, driven by regulatory pressure to reduce oncology drug costs. Government-backed immunotherapy initiatives are expanding access, though uptake of originator trastuzumab continues to decline. The market remains highly sensitive to national pricing negotiations and the ongoing evaluation of therapeutic alternatives.

Asia-Pacific Herceptin Market Trends

Asia-Pacific is the fastest-growing regional market for Herceptin, led by China, Japan, and India. Rising cancer prevalence, improving diagnostic rates for HER2+ cancers, and increasing government investment in oncology infrastructure are accelerating adoption. The region is also seeing the emergence of local biosimilar manufacturers, which enhances affordability and access. However, disparities in healthcare coverage, regulatory complexity, and infrastructure limitations in rural areas present growth challenges.

Japan Herceptin market is supported by universal healthcare coverage, advanced oncology care, and approvals of both originator and biosimilar products. The aging population and high breast cancer awareness fuel steady demand. However, strict pricing regulations and growing use of next-generation therapies may curb market expansion.

Herceptin market in China has rapidly adopted trastuzumab biosimilars, supported by government incentives, local manufacturing capacity, and an increasing number of HER2+ cancer diagnoses. Regulatory reform has improved biosimilar approval timelines, and inclusion in the National Reimbursement Drug List (NRDL) has bolstered access. Nevertheless, domestic competition and aggressive price negotiations pose profitability challenges.

India Herceptin market is price-sensitive, with local biosimilars such as CanMab and Hervycta dominating due to affordability. While demand is rising, access remains uneven across urban and rural areas. The upcoming patent expirations of next-generation HER2 therapies may shift focus to combination regimens, but public reimbursement limitations continue to restrict broader adoption.

Latin America Herceptin Market Trends

Latin America is witnessing growing Herceptin adoption, particularly in Brazil and Mexico, driven by increased HER2 cancer awareness and improvements in public health infrastructure. Government initiatives and biosimilar approvals have enhanced affordability and access. However, economic instability, reimbursement delays, and uneven healthcare quality across countries constrain regional growth.

Brazil Herceptin market leads the region in biosimilar use, backed by public healthcare investments and domestic production. Herceptin is widely used in breast cancer treatment within SUS (Unified Health System), and biosimilars have improved patient reach. Still, reimbursement complexities and dependence on public sector budgets affect treatment continuity and innovation uptake.

Middle East & Africa Herceptin Market Trends

The Middle East & Africa region is experiencing gradual Herceptin market growth, fueled by rising cancer incidence, improving healthcare access, and increasing biosimilar availability. Markets like Saudi Arabia and the UAE are leading in terms of cancer care modernization. However, limited diagnostic infrastructure, affordability issues, and reimbursement delays hinder broader adoption across the region.

Saudi Arabia Herceptin market is expanding due to government-funded oncology programs, rising adoption of biosimilars, and the inclusion of HER2 testing in national cancer screening initiatives. Continued investment in healthcare infrastructure supports growth, though access to newer HER2-targeted agents and affordability of originator biologics remain key constraints.

Key Herceptin Company Insights

The Herceptin market is characterized by a mix of originator companies and a growing number of biosimilar manufacturers, contributing to a competitive and evolving landscape. Roche (Genentech), the original developer of Herceptin, continues to hold a significant share through its intravenous and subcutaneous formulations, particularly in high-income markets. However, the expiration of Herceptin’s key patents has opened the market to a wide array of biosimilar producers, intensifying price competition and expanding patient access globally.

Leading players in the Herceptin market include Roche, Pfizer Inc., Samsung Bioepis, Amgen Inc., Celltrion Healthcare, Biocon Ltd., and Mylan N.V. (now part of Viatris). These companies have established strong footholds in both developed and emerging markets by offering FDA- and EMA-approved trastuzumab biosimilars that demonstrate comparable efficacy and safety profiles to the originator.

Key Herceptin Companies:

The following are the leading companies in the herceptin market. These companies collectively hold the largest market share and dictate industry trends.

- Roche Holding AG (Genentech)

- Pfizer Inc.

- Samsung Bioepis Co., Ltd.

- Amgen Inc.

- Celltrion Healthcare Co., Ltd.

- Biocon Limited

- Mylan N.V. (Viatris)

- Prestige Biopharma

- Shanghai Henlius Biotech, Inc.

- AryoGen Pharmed

- Dr. Reddy’s Laboratories

Recent Developments

-

In August 2024, the European Commission approved the combination of Astellas' Padcev (enfortumab vedotin) with Herceptin (pembrolizumab) for the first-line treatment of adult patients with unresectable or metastatic urothelial cancer eligible for platinum-containing chemotherapy. This approval was based on the Phase 3 EV-302 clinical trial, which demonstrated that the combination significantly extended overall survival and progression-free survival compared to standard platinum-based chemotherapy.

-

In March 2024, the FDA granted standard approval to Herceptin (pembrolizumab) in combination with trastuzumab and chemotherapy for the first-line treatment of HER2-positive, PD-L1-expressing locally advanced or metastatic gastric or gastroesophageal junction (GEJ) adenocarcinoma. This decision follows the prior accelerated approval granted in May 2021. The combination therapy demonstrated significant clinical benefit in improving progression-free and overall survival, marking a major milestone in HER2-positive gastric cancer treatment. This approval underscores the strategic integration of checkpoint inhibitors with targeted therapies to enhance treatment efficacy in biomarker-driven oncology.

-

In March 2024, Accord BioPharma, Inc. announced that the FDA approved a new 420 mg strength of Hercessi (trastuzumab-strf), a biosimilar to Herceptin, for the treatment of HER2-overexpressing breast and gastric cancers. This new strength offers greater dosing flexibility and inventory efficiency for providers and patients, potentially reducing preparation time and waste.

-

In February 2024, Prestige Biopharma announced that its Herceptin biosimilar, Tuznue (trastuzumab biosimilar), received a positive opinion from the European Medicines Agency’s (EMA) Committee for Medicinal Products for Human Use (CHMP). The recommendation is for the treatment of HER2-overexpressing breast cancer and metastatic gastric cancer, aligning Tuznue with the reference product Herceptin.

-

In March 2024, Aurobindo Pharma announced that it had received marketing authorization in India for its trastuzumab biosimilar, developed by its subsidiary Curateq Biologics Pvt Ltd. Approved for the treatment of HER2-positive breast and metastatic gastric cancers, the biosimilar offers a cost-effective alternative to Herceptin in the Indian market.

Herceptin Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 3.14 billion

Revenue forecast in 2030

USD 4.10 billion

Growth rate

CAGR of 5.5% from 2025 to 2030

Actual data

2018 - 2024

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, trends

Segments covered

Product, application, payer, distribution channel, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; China; Japan; India; Australia; South Korea; Thailand; Brazil; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

Roche Holding AG (Genentech); Pfizer Inc.; Samsung Bioepis Co., Ltd.; Amgen Inc.; Celltrion Healthcare Co., Ltd.; Biocon Limited; Mylan N.V. (Viatris); Prestige Biopharma; Shanghai Henlius Biotech, Inc.; AryoGen Pharmed; Dr. Reddy’s Laboratories

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Herceptin Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global herceptin market report based on product, application, payer, distribution channel, and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Biologic

-

Biosimilar

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Breast Cancer

-

Stomach/Gastric Cancer

-

-

Payer Outlook (Revenue, USD Million, 2018 - 2030)

-

Commercial/Private

-

Public

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospital Pharmacy

-

Specialty Pharmacy

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global Herceptin market size was estimated at USD 3.20 billion in 2024 and is expected to reach USD 3.14 billion in 2025.

b. The global Herceptin market is expected to grow at a compound annual growth rate of 5.48% from 2025 to 2030 to reach USD 4.10 billion by 2030.

b. Based on product, the biosimilars segment dominated the Herceptin market with a revenue share of 50.93% in 2024. The surge in biosimilar uptake is largely attributed to patent expirations in major markets, increased demand for cost-effective oncology therapies, and growing acceptance of biosimilars by clinicians and payers.

b. Leading players in the Herceptin market include Roche, Pfizer Inc., Samsung Bioepis, Amgen Inc., Celltrion Healthcare, Biocon Ltd., and Mylan N.V. (now part of Viatris). These companies have established strong footholds in both developed and emerging markets by offering FDA- and EMA-approved trastuzumab biosimilars that demonstrate comparable efficacy and safety profiles to the originator.

b. The Herceptin market is primarily driven by the rising incidence of HER2-positive breast cancer and increasing global awareness of targeted cancer therapies. As a well-established biologic, Herceptin benefits from its proven efficacy and role in personalized medicine. Improved diagnostics, aging populations, and better healthcare infrastructure—especially in emerging markets—are boosting demand.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.