- Home

- »

- Agrochemicals

- »

-

Herbicides Market Size, Share, Growth Analysis Report, 2030GVR Report cover

![Herbicides Market Size, Share & Trends Report]()

Herbicides Market (2024 - 2030) Size, Share & Trends Analysis Report, By Type, (Cereals & Grains, Oilseeds & Pulses), By Application Mode (Foliar, Soil), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-478-7

- Number of Report Pages: 98

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Specialty & Chemicals

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Herbicides Market Summary

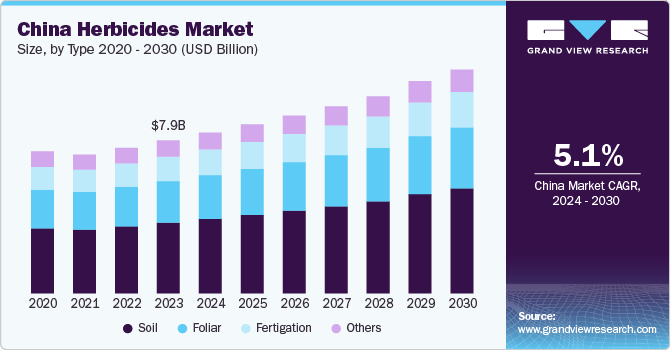

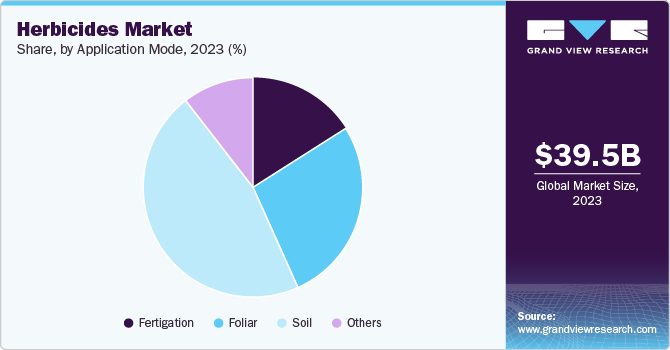

The global herbicides market size was estimated at USD 39.5 billion in 2023 and is projected to reach USD 55.8 billion by 2030, growing at a CAGR of 5.1% from 2024 to 2030. Several factors are driving the increased use of herbicides in agriculture, including the rise of genetically engineered crops, particularly those that are resistant to specific herbicides.

Key Market Trends & Insights

- Asia Pacific dominated the herbicides market due to the growing adoption of advanced agricultural practices.

- The China herbicides market is driven by the increasing adoption of genetically modified (GM) crops that are resistant to specific herbicides.

- Based on type, the cereals & grains type segment dominated the market with a revenue share of 46.27% in 2023.

- In terms of application mode, soil application mode dominated the market with a revenue share of 46.18% in 2023, owing to the soil application method being a widely used technique in the market.

- On the basis of application mode, fertigation has gained popularity as an efficient method for delivering nutrients and crop protection products directly to the plant's root zone through irrigation systems.

Market Size & Forecast

- 2023 Market Size: USD 39.5 billion

- 2030 Projected Market Size: USD 55.8 billion

- CAGR (2024-2030): 5.1%

- Asia Pacific: Largest market in 2023

This innovation allows farmers to apply herbicides like glyphosate without harming their crops, leading to more efficient weed control and higher productivity. The widespread adoption of herbicide-resistant varieties has transformed weed management practices, making herbicides a preferred choice for many farmers.

In China, the agricultural landscape has undergone significant transformation, driven by the need for enhanced productivity and efficiency. As the country strives to meet the demands of its growing population, farmers increasingly turn to chemical solutions to manage pests and weeds that threaten crop yields. This reliance on synthetic substances has become a critical component of modern farming practices, enabling farmers to maximize their output while minimizing losses from competition with unwanted plants.

In addition, economic considerations play a crucial role in herbicide adoption. Farmers often evaluate herbicides' cost-effectiveness compared to traditional weed control methods, such as manual weeding. The potential for increased yields and reduced labor costs makes herbicides attractive. Furthermore, advancements in agricultural technology, including precision farming techniques, have enhanced the efficiency of herbicide application, allowing for targeted use that minimizes environmental impact while maximizing effectiveness.

Several key factors contribute to the rising use of these chemical agents in Chinese agriculture. One major influence is the shift from subsistence farming to more commercialized agricultural practices, which has led to a greater emphasis on maximizing crop yields. Additionally, the introduction of genetically modified crops that are resistant to specific chemicals has facilitated their widespread application, allowing farmers to effectively control pests without damaging their crops. Economic pressures, including the need for higher productivity and profitability, further drive the adoption of these solutions across the agricultural sector.

Type Insights

The cereals & grains type segment dominated the market with a revenue share of 46.27% in 2023. The herbicides market is significantly influenced by the crop type, with the cereals and grains segment emerging as a dominant force. This segment includes major crops such as corn, rice, and wheat, which are staples in global food production. The demand for herbicides in this category is driven by the need for effective weed management to ensure high yields and quality of these essential crops.

In the cereals and grains sector, herbicides play a crucial role in ensuring that crops like corn and wheat can thrive without competition from weeds. The increasing global population and the corresponding rise in food demand have led farmers to adopt herbicides as a primary tool for weed control. This trend is further supported by the development of herbicide-resistant crop varieties, which allow for the safe application of specific herbicides without harming the crops themselves. As a result, cereals and grains continue to dominate the market, reflecting their importance in agricultural practices.

Similarly, the fruits and vegetables segment is also witnessing significant herbicide usage. The need for high-quality produce and the desire to minimize labor costs associated with manual weeding have driven farmers to rely on herbicides.

In addition, the oilseeds and pulses market, which includes crops like soybeans and sunflowers, is experiencing growth in herbicide application as farmers seek to optimize their yields and manage weed pressure effectively. Overall, the combined demand from these three segments underscores the critical role of herbicides in modern agriculture, ensuring that farmers can meet the challenges of food production efficiently.

Application Mode Insights

Soil application mode dominated the market with a revenue share of 46.18% in 2023 owing to the soil application method being a widely used technique in the market, particularly effective for controlling weeds before they emerge. This approach involves incorporating herbicides into the soil, where they can interact with the root systems of weeds. By applying these chemicals pre-emergence, farmers can create a protective barrier that inhibits weed germination and growth. This method is particularly beneficial in row-crop farming, where maintaining crop health and maximizing yield is essential. Soil application can be achieved through various means, including broadcasting, banding, or incorporating the herbicide into the soil during tillage.

In addition to soil application, fertigation has gained popularity as an efficient method for delivering nutrients and crop protection products directly to the plant's root zone through irrigation systems. This technique allows for precise application, reducing waste and ensuring that the active ingredients reach the target area effectively. Fertigation can enhance the efficacy of herbicides by ensuring that they are available to the plants when needed, particularly during critical growth stages. This method not only optimizes weed control but also improves overall crop health by providing essential nutrients simultaneously.

Another common method is foliar application, where herbicides are sprayed directly onto the leaves of plants. This technique is particularly effective for controlling existing weed populations, as it allows for quick absorption of the chemical through the foliage. Foliar application is often used in conjunction with soil application to provide comprehensive weed management throughout the growing season. By targeting both the soil and the plant surfaces, farmers can achieve a more robust control strategy, minimizing competition from weeds and promoting healthier crop growth.

Overall, the combination of soil application, fertigation, and foliar methods provides farmers with a versatile toolkit for managing weeds effectively. Each method has its advantages and can be tailored to specific crop types and growing conditions, ensuring that agricultural practices remain efficient and sustainable. As the market continues to evolve, these application techniques will play a crucial role in enhancing crop productivity and addressing the challenges posed by weed competition.

Regional Insights

One of the prominent trends in the North American herbicides market is the widespread adoption of genetically engineered (GE) crops. Currently, over 90% of U.S. corn, upland cotton, and soybeans are produced using GE varieties, which are often designed to be resistant to specific herbicides. This has led to an increase in the use of glyphosate and other herbicides that target weeds effectively while allowing for the cultivation of these modified crops.

Asia Pacific Herbicides Market Trends

One of the key trends in the Asia Pacific herbicides market is the growing adoption of advanced agricultural practices. Farmers are increasingly utilizing herbicides to enhance crop yields and manage weed resistance effectively. The introduction of herbicide-resistant crop varieties has further facilitated this trend, allowing for more efficient weed control without harming the crops. This shift towards modern farming techniques is essential for meeting the food demands of the region's rapidly growing population, which is projected to continue increasing in the coming years.

China herbicides market is driven by the increasing adoption of genetically modified (GM) crops that are resistant to specific herbicides. This development is expected to reshape the market structure, particularly for crops like corn and soybeans, as new herbicide formulations are introduced to complement these GM varieties.

Europe Herbicides Market Trends

One of the most notable trends in the herbicides market in Europe is the increased regulatory scrutiny surrounding pesticide use. The European Union has implemented stringent regulations aimed at reducing the environmental impact of agricultural chemicals.

Key Herbicides Company Insights

Some key players operating in the market include Nutrien, Bayer AG, BASF SE, DuPont, ICL Group, FMC Corporation, Nufarm, and Syngenta Group.

-

Nutrien Ltd. is a leading Canadian fertilizer company headquartered in Saskatoon, Saskatchewan. It stands as the largest producer of potash globally and ranks as the third largest producer of nitrogen fertilizers. The company plays a crucial role in the agricultural sector by producing and distributing approximately 26 million tonnes of essential nutrients, including potash, nitrogen, and phosphate products, catering to agricultural, industrial, and feed customers worldwide.

-

Bayer AG is a prominent German multinational corporation with a rich history spanning over 150 years. Founded in 1863 by Friedrich Bayer and Johann Friedrich Westcott, the company is headquartered in Leverkusen, Germany. Bayer operates primarily in the life sciences sector, focusing on two core areas: health care and agriculture.

Key Herbicides Companies:

The following are the leading companies in the herbicides market. These companies collectively hold the largest market share and dictate industry trends.

- Nutrien

- Bayer AG

- BASF SE

- DuPont

- ICL Group

- FMC Corporation

- Nufarm

- Syngenta Group

Recent Developments

-

In March 2023, BASF announced the launch of a novel corn herbicide named Surtain, which is set to be available for use in the United States in 2024. This innovative herbicide features solid encapsulation technology, marking it as the first of its kind in the industry.

-

In September 2023, American Water Chemicals (AWC) announced the launch of its European division, named Amaya Solutions Europe, SL. This strategic move marks a significant milestone in AWC's global expansion efforts, aimed at enhancing its presence in the European market

Herbicides Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 41.3 billion

Revenue forecast in 2030

USD 55.8 billion

Growth rate

CAGR of 5.1% from 2024 to 2030

Actual data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Volume in kilotons, revenue in USD million/ billion, and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, application mode, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; UK; Italy; France; Spain; China; India; Japan, South Korea; Brazil; Argentina; South Africa, Saudi Arabia

Key companies profiled

Nutrien; Bayer AG; BASF SE; DuPont; ICL Group; FMC Corporation; Nufarm; Syngenta Group

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Herbicides Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global herbicides market report based on type, application of mode & region.

-

Type Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Cereals & Grains

-

Fruits & Vegetables

-

Oilseeds & Pulses

-

Others

-

-

Application Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Fertigation

-

Foliar

-

Soil

-

Others

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East and Africa

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global herbicides market size was estimated at USD 39.5 billion in 2023 and is expected to reach USD 41.3 billion in 2024

b. The global herbicides market is expected to grow at a compound annual growth rate of 5.1% from 2024 to 2030 to reach USD 55.8 billion by 2030.

b. Asia Pacific dominated the herbicides market with a share of 48.5% in 2023. This is attributable to the growing adoption of advanced agricultural practices

b. Some key players operating in the herbicides market include Nutrien, Bayer AG, BASF SE, DuPont, ICL Group, FMC Corporation, Nufarm, and Syngenta Group

b. Key factors driving the market growth include the increased use of herbicides in agriculture and genetically engineered crops, particularly those that are resistant to specific herbicides.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.