- Home

- »

- Agrochemicals & Fertilizers

- »

-

Herbicide Safeners Market Size, Industry Report, 2030GVR Report cover

![Herbicide Safeners Market Size, Share & Trends Report]()

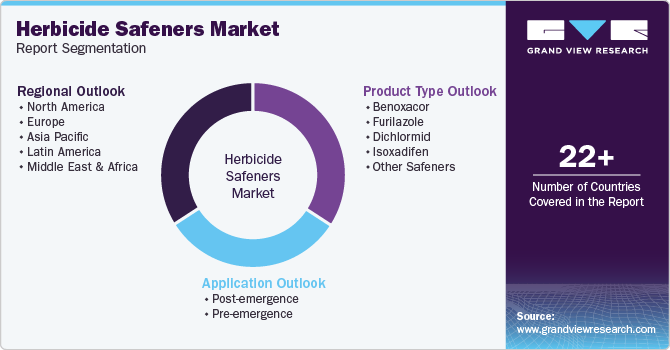

Herbicide Safeners Market (2025 - 2030) Size, Share & Trends Analysis Report By Product Type (Benoxacor, Furilazole, Dichlormid, Isoxadifen), By Application (Post-emergence, Pre-emergence), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-388-0

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Herbicide Safeners Market Size & Trends

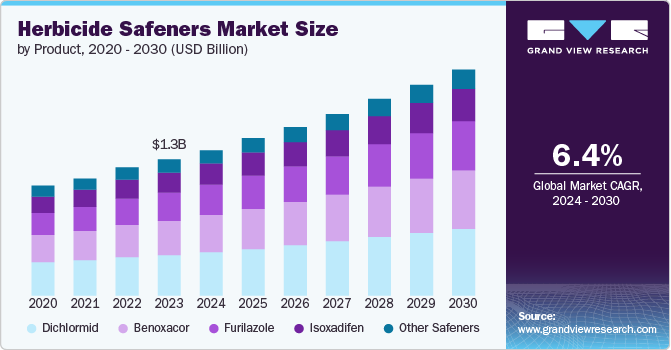

The global herbicide safeners market size was estimated at USD 1.45 billion in 2024 and is projected to grow at a CAGR of 7.5% from 2025 to 2030. This growth is attributed to the significant development of sustainable agricultural practices. As global food production needs to rise in response to the growing population, farmers are pressured to maximize crop yields while minimizing environmental impact. The product plays a critical role in effectively controlling weeds without harming crops. These enhanced weed control and crop protection properties make herbicide safeners essential to modern integrated pest management strategies.

Herbicides are widely used to control unwanted plants in agriculture due to their cost-effectiveness, but they can harm crops, soil microorganisms, and the environment, affecting livestock and human health. They also contribute to water contamination and affect soil fertility. Each year, approximately 1,300 million tons of weeds and crops are removed, and large amounts of agricultural waste, such as seeds and stems, are produced post-harvest. These issues are driving the demand for herbicide safeners to reduce herbicide damage while maintaining effective weed control. Educating farmers and agricultural professionals about the benefits and usage of safeners is key to their widespread adoption. Extension services and training programs help spread knowledge about new technologies and best practices, enabling their effective integration into weed management.

Innovations in chemical formulations are resulting in more effective safeners that can protect a broader range of crops against a variety of herbicides. These technological advancements improve the efficacy of safeners and expand their applicability to different types of herbicides, including those used in pre-emergence and post-emergence weed control. As a result, farmers are increasingly adopting these advanced safeners to enhance crop safety and yield, further fueling market growth.

Governments and regulatory bodies worldwide are implementing stringent regulations to reduce the environmental impact of agricultural chemicals. The product helps to achieve sustainability goals by reducing the amount of herbicide needed and preventing crop damage.

Furthermore, the rising adoption of herbicide-tolerant genetically modified (GM) crops further supports market growth. GM crops are engineered to withstand specific herbicides, allowing farmers to use these chemicals for effective weed control without damaging the crops. Herbicide safeners complement this technology by further enhancing the safety and effectiveness of herbicide applications. As the cultivation of GM crops increases, particularly in regions like North America and South America, the product demand is expected to grow correspondingly, contributing to the market's overall expansion.

Product Type Insights

Dichlormid dominated the herbicide safeners market and accounted for the highest revenue share of 29.8% in 2024. Dichlormid is extensively used to protect corn and other cereal crops from injury caused by herbicides such as thiocarbamates and acetanilides. The Food and Policy Research Institute estimates that to meet the growing global demand for grains, an additional 6 million ha of corn and 4 million ha of wheat, along with a 12% increase in yields, will be required to produce an extra 200 million tonnes of grain. This rising demand for corn and wheat, along with the need to improve yields efficiently, has driven the demand for herbicide safeners, such as Dichlormid, which help protect these crops while minimizing environmental damage.

The furilazole demand in the herbicide safeners market is estimated to grow at the fastest CAGR of 7.9% over the forecast period. The demand for furilazole in the herbicide safeners industry is driven by its common use in formulations with chloroacetamide herbicides. These herbicides are among the most widely used due to their exceptional effectiveness in controlling a variety of annual grass weeds. Recently, safeners such as benoxacor and furilazole were detected in surface waters of the Mid-Western U.S. at concentrations up to 190 ng/L. This detection, likely due to runoff from agricultural fields treated with chloroacetamide-based herbicides, highlights their extensive use in the U.S. on crops such as corn, soybean, and wheat.

Benoxacor is widely used for its efficacy in protecting corn crops from injury caused by chloroacetamide. The growth of the benoxacor market is driven by its high compatibility with a range of herbicides, ensuring effective weed control while safeguarding crop health. Moreover, ongoing research and development efforts aimed at enhancing the formulation and application methods of benoxacor are expected to support its market growth, catering to the evolving needs of modern agriculture. The versatility and effectiveness of is oxadifen in protecting a wide range of crops, including cereals, corn, and soybeans, are supporting its rising demand. The increasing adoption of precision agriculture practices, which emphasize using advanced and efficient crop protection solutions, boosts the demand for isoxadifen.

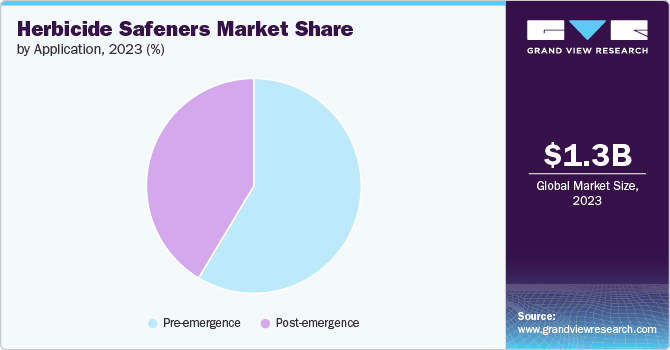

Application Insights

The pre-emergence segment in the herbicide safeners market led the market with the highest revenue share of 58.3% in 2024. Pre-emergences are applied to crops as these create a protective barrier shielding emerging seedlings from herbicides' phytotoxic effects. By applying safeners prior to seedling emergence, farmers can ensure that herbicides target weed seeds and seedlings without harming the crops. Adopting pre-emergence safeners is particularly prevalent in crops like corn, soybeans, and cereals. The pre-emergence often accelerates the crop’s ability to metabolize the herbicide into non-toxic compounds. This selective protection allows for more potent herbicides that effectively manage many weed species. Advances in safener chemistry continue to improve their compatibility with various herbicides and crop types, driving their increasing use in modern agriculture.

The post-emergence segment of the herbicide safeners industry is expected to grow at the fastest CAGR of 8.0% over the forecast period. These safeners are applied after the crop and weeds have emerged. Post-emergence weed control is crucial as weeds that emerge alongside or after the crops negatively impact the overall crop yields. Safeners used in post-emergence applications enable the use of effective herbicides during the growing season, ensuring that the herbicides selectively target weeds without damaging the crop plants. Furthermore, post-emergence often enhances the crop’s tolerance to herbicides through mechanisms such as induced metabolic detoxification or alteration of herbicide uptake and translocation within the plant. Applying herbicides safely during critical growth stages of the crop without causing phytotoxicity is a key advantage of post-emergence safeners. This flexibility allows farmers to maintain weed control throughout the growing season, leading to healthier crops and higher yields.

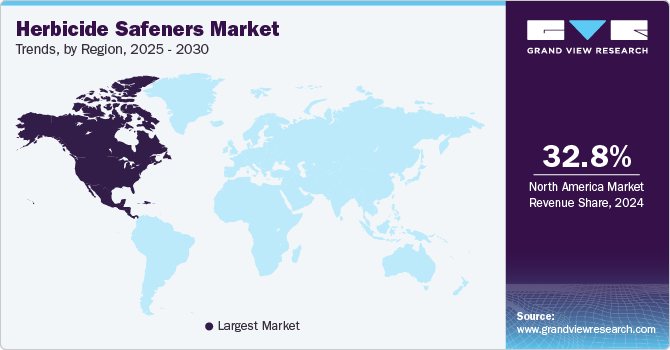

Regional Insights

North America herbicide safeners market dominated the global market, with the largest revenue share of 32.8% in 2024. The growing demand for herbicide safeners in North America can be attributed to the region's significant agricultural activities, with primary crops including grains, fruits, vegetables, and legumes. The organic farming sector in the region has also seen substantial growth, with 3.3 million hectares of land being managed organically, representing about 5% of global organic agricultural land. With the rapid expansion of the organic products market and a total of 23,957 organic producers, the need for effective herbicide safeners to protect crops while meeting organic standards has increased.

U.S. Herbicide Safeners Market Trends

The U.S. herbicide safeners market held the largest revenue share in 2024 in the North America market. The growing demand for herbicide safeners in the U.S. can be attributed to the rapid expansion of the organic product market, with approximately 18,000 organic producers in the U.S. Furthermore, the U.S. stands as a top producer of corn and soybean which also accelerates the need for agriculture protective measures. Additionally, safeners are classified as "inert" in the U.S., meaning they are not subject to the same stringent regulatory standards as herbicides, making them a more accessible option for protecting crops.

Europe Herbicide Safeners Market Trends

Europe herbicide safeners market is expected to grow at a CAGR of 7.7% over the forecast period. In Europe, there has been a growing focus on reducing the environmental impact of agricultural practices. The European Union has been working on proposals to regulate safeners and synergists, aiming to ensure their safe use and minimize potential risks. This regulatory attention reflects the importance placed on balancing effective crop protection with environmental sustainability, boosting its demand in the future. Additionally, the diverse agricultural landscape, encompassing a wide range of crops, is expected to drive the demand for versatile and effective safener solutions in the coming years.

The herbicide safeners market in Germany led the Europe market with the largest revenue share in 2024. Germany, one of Europe's largest agricultural producers, cultivates a variety of crops including spring and winter barley, grain maize, oats, winter rape, potatoes, rye, sugar beet, and winter wheat. These crops cover approximately 9.5 million hectares of land annually, accounting for over 80% of the country's arable land. The diverse and expansive agricultural landscape is a key factor driving the growth of herbicide safeners industry in Germany as farmers seek effective solutions to protect these crops from herbicide damage while maintaining optimal yields.

Asia Pacific Herbicide Safeners Market Trends

Asia Pacific herbicide safeners market accounted for a substantial market share in 2024. The rising need to boost agricultural productivity in countries such as China, India, and Australia contributes significantly to the increasing product demand. Furthermore, the region's diverse climatic conditions and crop varieties necessitate the development of specialized formulations of safeners to cater to specific agricultural needs. The Asia Pacific region, a global leader in agricultural production, plays a crucial role in the world's food supply, with rice being the most prominent crop. As rice serves as a staple food across Asia and the Pacific, the region's rapidly growing population, currently increasing at 1.8% annually and expected to continue growing well into the next century, is driving the need for efficient crop production and protection.

The herbicide safeners market in China accounted for the largest revenue share in the region in 2024. In 2024, China produced 706.5 million tons of grain, marking an increase of 1.6% compared to 2023. As one of the world's largest rice producers, China accounts for over 40% of global rice production. The extensive cultivation of this crop necessitates effective crop protection solutions, including herbicide safeners, to ensure high yields and quality. The emphasis of the government of China on sustainable agricultural practices and regulatory measures to minimize environmental impact is also encouraging the adoption of herbicide safeners.

Key Herbicide Safeners Company Insights

Some key herbicide safeners industry companies include DuPont, BASF, Bayer AG, and Syngenta AG. These companies stay competitive globally by investing in research and development to innovate safer and more effective products. They focus on expanding their product portfolios, collaborating with agricultural stakeholders, and ensuring compliance with global regulatory standards. Additionally, they leverage strategic partnerships, market expansion, and sustainability initiatives to meet increasing agricultural demands worldwide.

-

DuPont provides a wide range of agricultural solutions, including herbicide safeners. The company's focus on advanced chemical formulations and sustainable farming practices drives the development of safeners that protect crops from herbicide damage while enhancing overall yield. DuPont's extensive research and development capabilities ensure continuous innovation in crop protection technologies.

-

BASF SE is one of the world's largest chemical companies, offering comprehensive agricultural solutions. BASF's herbicide safeners are designed to improve crop safety and efficacy of herbicides, supporting sustainable farming practices. The company's strong emphasis on research and development enables the creation of innovative safener technologies that cater to diverse crop protection needs globally.

Key Herbicide Safeners Companies:

The following are the leading companies in the herbicide safeners market. These companies collectively hold the largest market share and dictate industry trends.

- DuPont

- BASF

- Bayer AG

- Syngenta AG

- Nufarm

- ADAMA

- Arysta LifeScience

- Drexel Chemical Company

- Land O'Lakes, Inc.

- Sipcam Oxon Spa

Recent Developments

-

In December 2024, Syngenta and Enko reached a milestone in their collaboration to discover novel weed control molecules using AI-driven research. The partnership focuses on identifying a new Mode of Action (MoA) to combat resistant weeds such as Palmer amaranth and blackgrass.

-

In July 2024, FMC Corporation announced that it had signed a definitive agreement to sell its Global Specialty Solutions business to Environmental Science US, LLC., an environmental science company. The agreement, worth USD 350.0 million, is expected to support Environmental Science US, LLC.’s growth strategy and offer pest management and turf ornamental industry products.

Herbicide Safeners Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 1.56 billion

Revenue forecast in 2030

USD 2.24 billion

Growth rate

CAGR of 7.5% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion, and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product type, application, region

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country scope

U.S., Canada, Mexico, UK, Germany, France, Italy, Spain, China, Japan, India, South Korea, Brazil, Argentina

Key companies profiled

DuPont; BASF; Bayer AG; Syngenta AG; Nufarm; ADAMA; Arysta LifeScience; Drexel Chemical Company; Land O'Lakes, Inc.; Sipcam Oxon Spa

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Herbicide Safeners Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global herbicide safeners market report based on product type, application, and region.

-

Product Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Benoxacor

-

Furilazole

-

Dichlormid

-

Isoxadifen

-

Other Safeners

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Post-emergence

-

Pre-emergence

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

Frequently Asked Questions About This Report

b. The global herbicide safeners market was estimated at USD 1.45 billion in 2024 and is expected to reach USD 1.56 billion in 2025.

b. The global herbicide safeners market was estimated at USD 2.24 billion in 2030 and is forecasted to grow at a CAGR of 7.5% over the forecast period.

b. Dichlormid dominated the market with a revenue share of over 30% in 2024. Dichlormid is extensively used to protect corn and other cereal crops from injury caused by herbicides such as thiocarbamates and acetanilides. The growth factors for dichlormid include its rising need for efficient weed management solutions in large-scale farming operations, especially in regions like North America and Europe.

b. Some prominent players in the herbicide safeners market include DuPont, BASF SE, Bayer AG, Syngenta AG, Nufarm Limited, Adama Agricultural Solutions, Arysta LifeScience, Drexel Chemical Company, Land O’Lakes, Sipcam-Oxon Group

b. The herbicide safeners market is driven by the robust growth for sustainable agricultural practices. As global food production needs rise in response to a growing population, farmers are under pressure to maximize crop yields while minimizing environmental impact.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.