- Home

- »

- Pharmaceuticals

- »

-

Herbal Supplements Market Size, Industry Report, 2033GVR Report cover

![Herbal Supplements Market Size, Share & Trends Report]()

Herbal Supplements Market (2025 - 2033) Size, Share & Trends Analysis Report By Product (Moringa), By Formulation (Tablets, Capsules), By Consumer (Pregnant Women), By Distribution Channel, By Region, And Segment Forecasts

- Report ID: GVR-2-68038-493-2

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2025 - 2033

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Herbal Supplements Market Summary

The global herbal supplements market size was estimated at USD 42.33 billion in 2024 and is anticipated to reach USD 90.24 billion in 2033, growing at a CAGR of 8.89% from 2025 to 2033. This growth is driven by rising consumer health consciousness, a growing preference for natural and plant-based remedies, and increasing awareness of preventive healthcare.

Key Market Trends & Insights

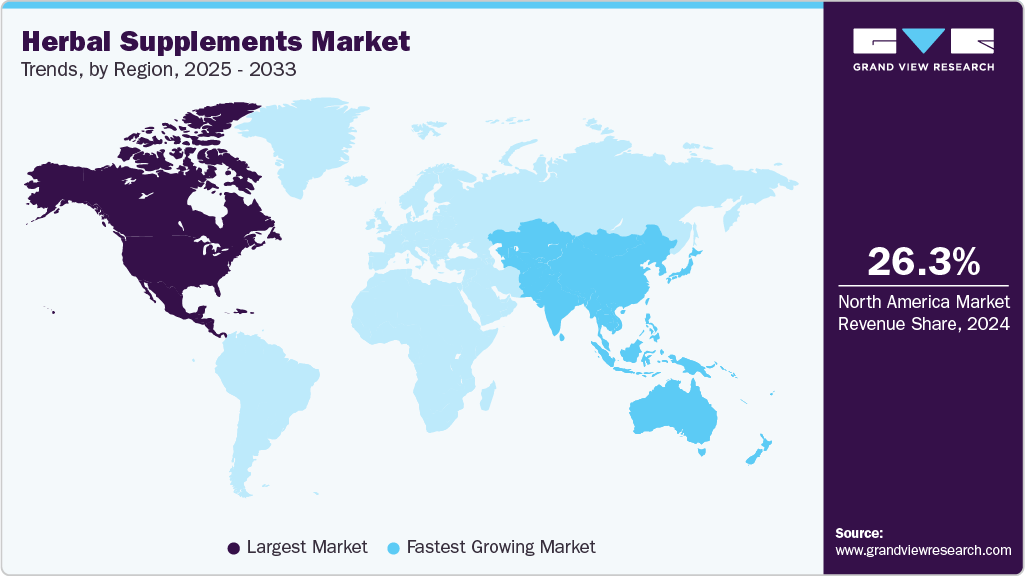

- The North America herbal supplements market held the largest share of 26.34% of the global market in 2024.

- The herbal supplements industry in the U.S. is expected to grow significantly over the forecast period.

- By product, the turmeric segment held the highest market share of 23.95% in 2024.

- Based on formulation, the capsules segment held the highest market share in 2024.

- By consumer, the adult segment held the highest market share in 2024.

Market Size & Forecast

- 2024 Market Size: USD 42.33 Billion

- 2033 Projected Market Size: USD 90.24 Billion

- CAGR (2025-2033): 8.89%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

Rising Health AwarenessA key driver of demand in the herbal supplements market is the growing global awareness of health, wellness, and preventive care. Consumers are becoming increasingly proactive about managing their health, opting for natural alternatives that support long-term well-being rather than relying solely on pharmaceutical treatments. This shift has fueled a surge in interest in herbal supplements, particularly those known for their functional benefits, such as boosting immunity, reducing stress, enhancing digestion, and improving sleep quality. For instance, echinacea, a popular herbal supplement, has gained significant traction due to its immune-boosting properties, especially after the recent pandemic.

This heightened health consciousness is particularly prominent among younger demographics such as Millennials and Gen Z, who actively research wellness topics online and gravitate toward holistic, plant-based products. The widespread availability of health information through social media, wellness influencers, and digital platforms has empowered consumers to make more informed choices. For instance, in November 2024, News18 India reported a significant demographic shift in Ayurveda's global appeal. Traditionally favored by older generations, the practice is now attracting a younger, health-conscious audience, particularly Millennials and Gen Z. These individuals are increasingly drawn to Ayurveda's holistic approach, emphasizing natural remedies, preventive care, and mind-body balance to counteract modern lifestyle stresses. Herbal supplements are increasingly viewed as a form of self-care and a lifestyle choice aligned with clean living and sustainability. As more consumers embrace natural health solutions, the demand for safe, transparent, and effective herbal supplements continues to grow, driving innovation and expansion within the market.

Growing Preferences of Clean-Label and Natural Products

Rising consumer preference for natural and clean-label products is another significant demand driver in the herbal supplements market. Today's health-conscious consumers are increasingly scrutinizing product labels and ingredients, seeking supplements free from synthetic chemicals, artificial additives, preservatives, and genetically modified organisms (GMOs). Herbal supplements, derived from plant-based sources, align with these preferences, as they are generally perceived as more natural, safer, and environmentally friendly. For instance, in July 2023, Herbalife launched Herbalife V, a plant-based supplement line in the United States and Puerto Rico. The range includes USDA Organic-certified protein shakes, greens boosters, and digestive and immune support products. The growing demand for transparency and simplicity in product formulation is pushing manufacturers to emphasize the purity and origin of their ingredients, offering products that meet consumer expectations for clean wellness solutions.

Many supplement brands are reformulating their products, highlighting organic certifications, non-GMO status, and allergen-free properties. For instance, herbal ingredients such as turmeric, ginger, moringa, and holy basil are increasingly marketed with minimal processing and eco-conscious packaging. As trust in natural products grows and skepticism toward synthetic ingredients continues, the clean-label trend is becoming a central pillar in consumers' purchasing decisions, further accelerating growth in the herbal supplements industry.

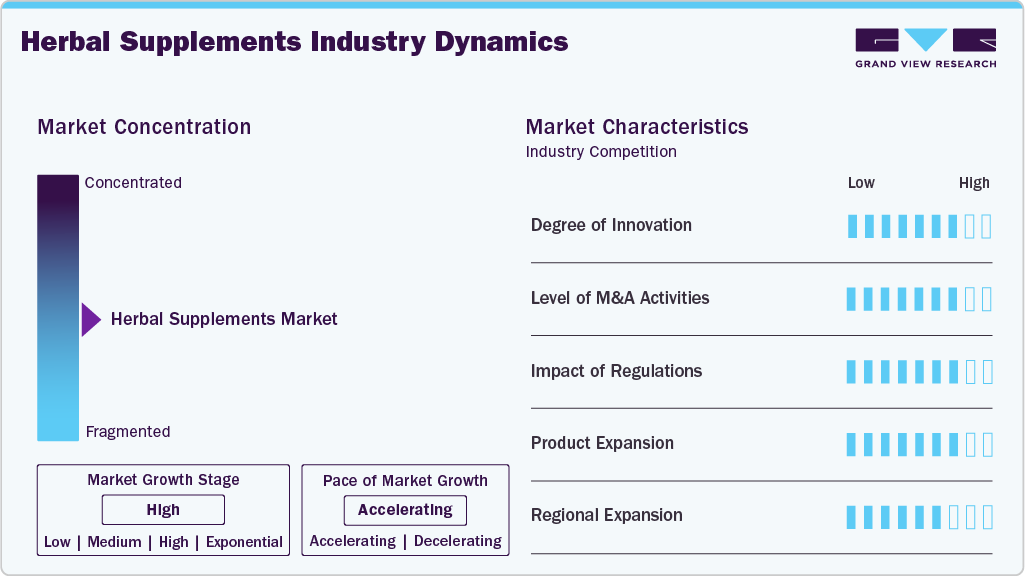

Market Concentration & Characteristics

The herbal supplements industry is experiencing a high degree of innovation, driven by advances in personalized nutrition, cutting-edge delivery technologies, and a growing focus on sustainability and transparency. Moreover, consumers are shifting towards clean-label products, eco-friendly packaging, and convenient formats like gummy vitamins. For instance, in December 2024, Himalaya Wellness launched a 28-count bottle of PartySmart supplement in the United States. PartySmart capsules are vegan, free from magnesium stearate, gluten, wheat, corn, soy, and dairy, and are non-GMO Project Verified. They are produced in a cGMP-certified facility and tested for identity, strength, and safety. Such innovations further personalize wellness strategies, making the market dynamic and rapidly evolving to meet modern demands for efficacy, safety, and environmental responsibility.

The level of mergers and acquisitions (M&A) activity in the herbal supplement industry is moderate and increasing, driven by rising consumer demand for natural health products and strategic moves by larger companies to expand their wellness portfolios. Major pharmaceutical, food, and nutraceutical firms are acquiring smaller, niche herbal brands to access loyal customer bases, innovative formulations, and new distribution channels. For instance, in February 2025, Gide's Warsaw office advised Farmaceutici Procemsa, an Italian company specializing in pharmaceutical and food supplement manufacturing, to acquire 100% of Laboratoria Natury, a leading Polish producer of dietary supplements and functional foods. The acquisition, finalized from Maabarot Products Ltd., enhances Procemsa's presence in Poland's contract development and manufacturing organization (CDMO) sector. M&A is a key strategy to accelerate growth, diversify product lines, and respond to the global shift toward preventive and holistic health.

Regulations significantly impact the herbal supplement industry, influencing everything from product formulation and labeling to marketing and international trade. In regions like the U.S. (under the FDA's DSHEA), Europe (regulated by EFSA), and Australia (TGA), regulatory frameworks aim to ensure safety and quality but often vary widely, creating challenges for global expansion. While some oversight helps build consumer trust and reduce risks of adulteration or false claims, inconsistent standards and slow regulatory updates can hinder innovation and delay product launches. For instance, in August 2024, the FDA India Office addressed regulatory challenges faced by Ayurvedic and herbal products exported from India to the U.S., highlighting concerns about heavy metal contamination and differing classifications under U.S. law. To improve safety and compliance, the FDA collaborated with Indian regulators and manufacturers to promote Good Agricultural and Manufacturing Practices, urging companies to seek expert guidance for navigating the complex U.S. regulatory landscape. Moreover, increasing regulatory requirements push companies toward greater transparency, third-party certifications, and evidence-based formulations.

Product expansion in the herbal supplement industry is robust and dynamic, driven by rising consumer interest in natural health solutions and preventive wellness. Companies are broadening their portfolios by introducing new product formats, targeting specific health concerns such as stress, immunity, sleep, and gut health. For instance, in August 2024, Denzour Nutrition expanded its product line to include organic herbal nutraceuticals to promote comprehensive wellness. The new range features eight products: Beetroot Extract, Denz-Oxy, Testo Booster, Sleep-Denz, Organic Moringa, Ashwagandha, Nano Curcumin, and Denz Detox. These products are designed to support various aspects of health, including energy levels, stress management, sleep quality, and detoxification. The diverse and health-conscious consumer base is fueling continuous innovation and diversification in product offerings.

Regional expansion in the herbal supplement industry is accelerating as companies seek growth beyond saturated domestic markets. North America and Europe remain mature markets with strong demand. Ayurveda and Traditional Chinese Medicine (TCM) offer strong consumer familiarity with herbs, rising disposable incomes, and expanding e-commerce access. Regional expansion strategies often include partnerships, joint ventures, and localized branding, allowing firms to navigate regulatory complexity and cultural differences while capturing emerging market opportunities.

Product Insights

The turmeric segment in the herbal supplements market dominated the global industry in 2024, accounting for 23.95% of total revenue. The surging demand is due to the increasing awareness of the health benefits associated with turmeric, particularly its active compound, curcumin. Curcumin is renowned for its potent anti-inflammatory and antioxidant properties that help consumers manage conditions such as skin treatment, arthritis, digestive issues, and overall immune support. For instance, in March 2024, Harvard Health reviewed the growing evidence around turmeric, particularly its active compound curcumin, highlighting its potential anti-inflammatory, antioxidant, and brain- and heart-supportive benefits. Experts recommend combining turmeric with black pepper or fats to enhance absorption and advise consulting healthcare providers before starting supplements, especially for individuals with existing health conditions. As scientific validation grows and consumer interest deepens, the turmeric segment is expected to maintain its leading position in the herbal supplements market.

Moringa is expected to register the fastest CAGR of 11.74% in the herbal supplements market over the forecast period. This rapid growth is driven by increasing global awareness of moringa's impressive nutritional profile and therapeutic potential. Often referred to as a superfood, moringa is rich in essential vitamins, minerals, antioxidants, and anti-inflammatory compounds, making it popular among health-conscious consumers. For instance, in January 2023, a study published in the International Journal of Molecular Science reviewed the role of Moringa oleifera in pharmacological activities, highlighting its potential in treating chronic diseases and its bioactive compounds. As demand for natural and plant-based health solutions continues to rise, moringa's versatility and efficacy position it as a key growth driver in the evolving herbal supplement market.

Formulation Insights

Capsules held the dominant market share of 31.52% in 2024 due to the wide availability of herbal supplements in capsule form that offer convenience and ease of consumption in pre-measured doses. Unlike other forms, such as powders or liquids, capsules are easy to swallow, have no taste, and can be taken on the go. This makes them a preferred choice for busy individuals who seek quick and hassle-free ways to incorporate supplements into their daily routines. For instance, in March 2021, Gaia Herbs, a leading herbal products brand in the United States, launched a new line of six mushroom capsule supplements designed to support whole-body health and maintain wellness. The product line includes Respiratory Mushroom Blend, Immune Mushroom Blend, Reishi Mushroom, Lion’s Mane Mushroom, Cordyceps Mushroom, and Turkey Tail Mushroom, each formulated to support various aspects of health such as lung, immune, heart, brain, and neurological health, as well as energy, stamina, stress, and liver function. These supplements are made with 100% organic mushroom fruiting bodies and are free from fillers, grains, and starches, further fueling the market expansion.

Powder form is projected to grow at the fastest CAGR of 11.27% during the forecast period in the herbal supplements market. This growth is primarily fueled by increasing consumer preference for customizable and easy-to-consume supplement formats. Powdered supplements offer greater flexibility in dosage, can be easily mixed into beverages or food, and often contain fewer additives than capsules or tablets. Moreover, the rise in fitness enthusiasts, smoothie culture, and demand for clean-label products further supports the popularity of powdered herbal supplements. For instance, in October 2024, Fruit d'Or, a Canadian leader in organic berry processing, unveiled Blue d'Or Vitality. This clean-label blend combines organic wild blueberry and cranberry powders to support vitality, recovery, and overall wellness. Designed for the sports nutrition and nutraceutical industries, the product is free from additives, preservatives, GMOs, and artificial agents, ensuring purity and quality. As consumers seek convenient, versatile, and health-focused solutions, the powder segment is expected to gain substantial traction across global markets.

Consumer Insights

The adult segment dominated the market in 2024 with a share of 64.38% owing to rising health consciousness. With a growing awareness of the benefits of preventive healthcare, many adults have turned to herbal supplements to maintain and improve their health. For instance, in December 2023, researchers at the University of Colorado, USA, published a study in the Journal of Pediatric and Adolescent Gynecology examining herbal supplement use among adolescent and young adult women in a family planning clinic. The study aimed to assess usage patterns within this demographic and found a notable prevalence of herbal supplement consumption. The findings underscore the importance of healthcare providers discussing supplement use with patients, especially in the context of reproductive health. The growing emphasis on holistic health and preventive care continues to drive the demand for herbal supplements, particularly among adults.

The geriatric segment is expected to emerge as the fastest-growing CAGR of 11.47% during the forecast period, driven by the increasing aging population and rising awareness of preventive healthcare among older adults. According to the World Health Organization (WHO), the proportion of the global population over 60 years is projected to nearly double from 12% in 2015 to 22% by 2050. With age-related health concerns such as arthritis, cardiovascular diseases, and cognitive decline becoming more prevalent, many seniors are turning to herbal supplements as a natural and holistic means of managing these conditions. Herbal products are often used as complementary treatments due to their therapeutic properties. For instance, Turmeric is valued for its anti-inflammatory benefits, while ginkgo biloba is commonly used to support cognitive function. This growing inclination toward natural remedies among older people is expected to boost demand for herbal supplements during the forecast period.

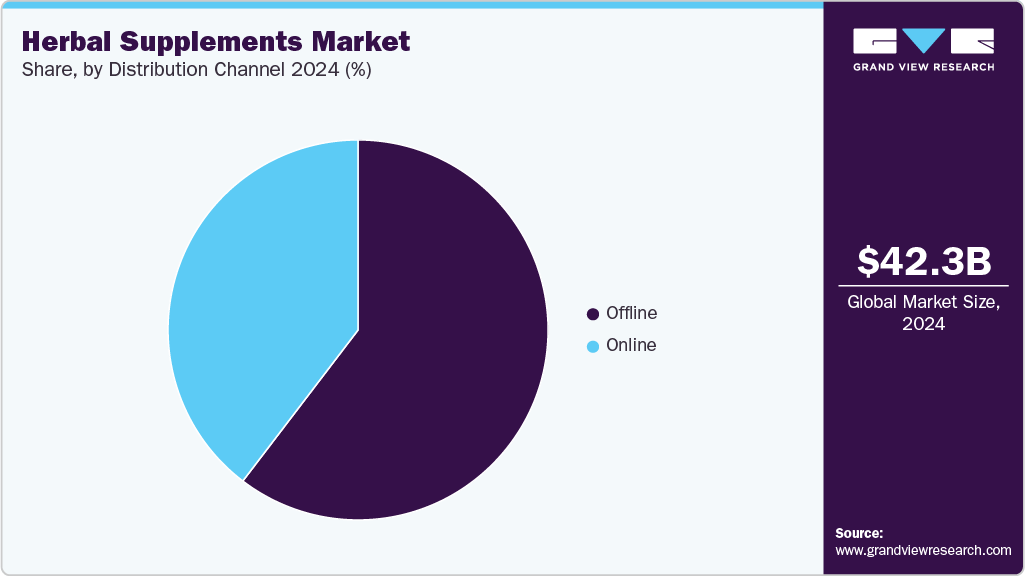

Distribution Channel Insights

The offline segment dominated the herbal supplements market with a share of 60.37% in 2024, primarily due to the wide availability of products through retail and wholesale outlets. Consumers continue to prefer offline channels for the convenience of in-person shopping, immediate product access, and the ability to assess product quality firsthand. Major companies have capitalized on this preference by investing heavily in offline marketing campaigns, utilizing eye-catching packaging, clean-label formulations, and in-store promotions to attract customers and enhance visibility. Moreover, well-established distribution networks among manufacturers, wholesalers, and retailers have facilitated efficient product flow and consistent market supply, further strengthening the dominance of the offline segment.

The online segment is expected to register the fastest CAGR of 9.97% over the forecast period, driven by the rapid adoption of digital platforms and the booming e-commerce industry. Consumers are increasingly shifting toward online shopping due to the convenience, variety, and accessibility it offers. As a result, major companies have enhanced their online presence by selling products through official websites and popular e-commerce platforms, enabling them to reach a broader, global consumer base. Online channels also empower customers to browse a wide range of herbal supplement products, compare prices, read reviews, and make informed purchasing decisions. This digital shift, supported by targeted online marketing and personalized shopping experiences, is set to significantly accelerate the growth of the online segment of the herbal supplements market.

Regional Insights

The herbal supplements market in North America registered a significant market share of 26.34% in 2024, owing to the increasing health consciousness among consumers. As more people become aware of the benefits of preventive healthcare, the market sees a growing shift in consumer preference for natural products, including herbal supplements, over synthetic alternatives. The heightened focus on maintaining health and managing age-related conditions further boosted the growth. Herbal supplements, known for their natural and therapeutic properties, have been increasingly favored by adults seeking to support joint health, cognitive function, and cardiovascular health.

U.S. Herbal Supplements Market Trends

The U.S. herbal supplements market was propelled by the growing number of consumers adopting natural and clean-label products. Consumers have become alarmingly aware of the benefits of preventive healthcare, resulting in an increasing preference for natural and plant-based products over synthetic alternatives. Moreover, the rise in chronic diseases and lifestyle-related health issues such as obesity, diabetes, and cardiovascular diseases has also driven the market growth to manage and mitigate these conditions. For instance, in August 2024, Eli Lilly launched single-dose vials of Zepbound (tirzepatide) in the U.S., offering 2.5 mg and 5 mg doses. The initiative aimed to enhance accessibility and affordability for adults living with obesity, addressing a significant unmet need in chronic weight management, which further drives the growth in the health supplements industry in the country.

Europe Herbal Supplements Market Trends

Europe’s herbal supplements market has emerged as a highly lucrative region, driven primarily by the growing geriatric population and increased demand for products supporting immunity and cognitive health. For instance, in November 2024, the European Medicines Agency’s Committee for Medicinal Products for Human Use (CHMP) recommended approval for eight new medicines, including Augtyro for advanced solid tumors and Gohibic for SARS-CoV-2-induced acute respiratory distress syndrome, while also endorsing four biosimilars, Baiama, Ahzantive, Obodence, and Xbryk, highlighting the region’s focus on advanced healthcare solutions. Moreover, expanding distribution channels, particularly through online retail, has greatly enhanced product accessibility, allowing consumers to explore various herbal supplements conveniently. This combination of demographic trends, regulatory progress, and enhanced distribution networks has significantly boosted regional sales and market penetration.

The UK herbal supplements market is expected to experience rapid growth, driven by a rising number of health-conscious consumers who prefer herbal products over supplements containing artificial ingredients. For instance, in November 2024, Bayer Consumer Health launched Berocca Mind in the UK, a cognitive health supplement enriched with Spanish sage extract. This product is designed to support memory and mental performance, meeting the increasing consumer demand for natural solutions focused on cognitive enhancement.

The German herbal supplements market is a leading market in Europe, known for its strong heritage in natural and botanical medicine. The country has a well-regulated environment for herbal products, which builds consumer trust. German consumers value clinically backed natural solutions, and there is a strong demand for organic, eco-labeled supplements. Products focusing on immunity, gut health, and anti-inflammation are particularly popular.

Asia Pacific Herbal Supplements Market Trends

The Asia Pacific herbal supplements market is expected to grow with the fastest CAGR of 10.33% throughout the forecast period, driven by the growing adoption of herbal products to improve physical and mental health. For instance, in April 2025, the Indian High Commissioner to Ghana announced plans for a Memorandum of Understanding (MoU) between India and Ghana to strengthen collaboration in herbal and alternative medicine. This initiative seeks to formalize institutional cooperation, focusing on traditional healing practices and herbal remedies approaches that are increasingly gaining popularity in both countries. With such regional collaborations and rising consumer awareness, the Asia Pacific market is poised for sustained growth and significant global contributions to the herbal supplements industry.

The herbal supplements market in China is projected to grow steadily over the forecast period, largely driven by the strong foundation of traditional Chinese medicine (TCM). Government initiatives promoting the integration of TCM into mainstream healthcare have significantly boosted demand for herbal supplements. Urban consumers increasingly opt for standardized, professionally packaged herbal products rather than raw herbs, with clean-label options gaining popularity, especially in major cities. For instance, in February 2025, Infinitus (China) Company received approval for its Sino-British Joint Laboratory on Health and Ageing. This initiative, part of China’s National Key R&D Program, represents a major step toward blending traditional Chinese herbal medicine with modern scientific research.

The herbal supplements market in Japan is experiencing significant growth, driven largely by the country’s aging population and the rising demand for natural solutions to manage age-related health issues such as joint pain, digestive health, and cognitive decline. Japanese consumers strongly emphasize product safety, quality, and scientifically backed efficacy, making clinical validation and transparent sourcing key factors for market success. For instance, in September 2024, Otsuka Pharmaceutical, through its subsidiary Bonafide Health, launched Thermella, a plant-based supplement formulated to relieve menopause symptoms such as hot flashes and night sweats. This focus on targeted, evidence-based herbal solutions continues to shape Japan’s evolving supplement landscape.

Middle East & Africa Herbal Supplements Market Trends

The MEA herbal supplements market is expected to grow exponentially over the forecast period, driven by rising consumer awareness of natural remedies, expanding urbanization, increased retail access, and strong traditional medicine roots. Countries like the UAE, Saudi Arabia, and South Africa are witnessing growing demand for herbal immunity boosters, digestive aids, and wellness products, supported by favorable regulatory developments and health-conscious consumer behavior.

The Kuwait herbal supplements market is projected to grow steadily, driven by increasing health awareness, rising demand for natural remedies, and a shift toward preventive wellness. The country's high disposable income and growing interest in clean-label, plant-based products fuel consumption across immunity, digestion, and stress-relief categories. Pharmacies, specialty wellness stores, and e-commerce platforms are expanding product availability. Additionally, Kuwait’s alignment with international quality standards encourages the entry of global herbal brands. This growth reflects a broader MEA trend where cultural affinity for herbal remedies and urban health consciousness shape market expansion.

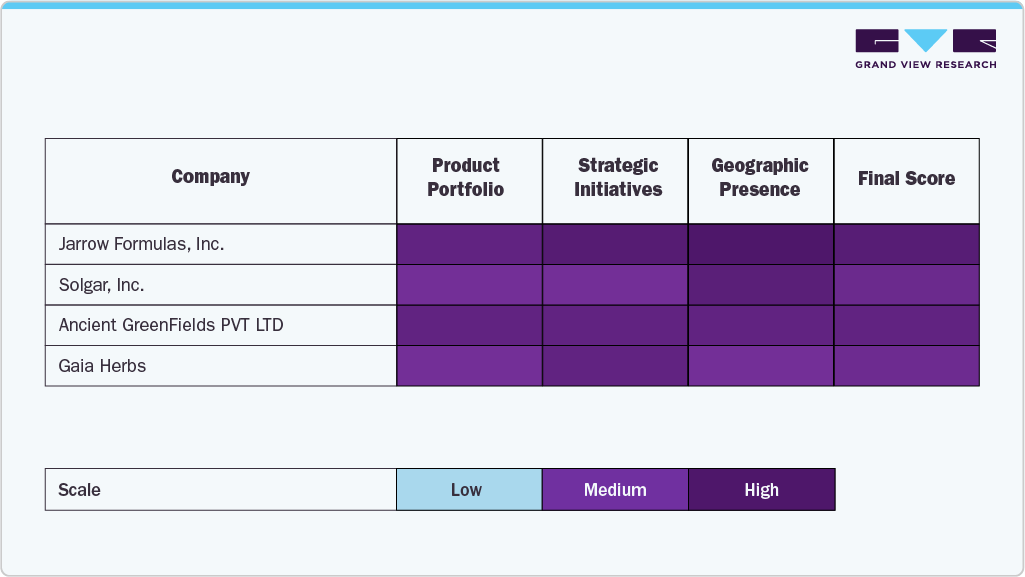

Key Herbal Supplements Company Insights

The herbal supplement market is characterized by a mix of well-established players and innovative newcomers that dominate through strong product portfolios, strategic partnerships, and continuous investments in research and development. Leading companies such as Jarrow Formulas, Inc., Solgar, Inc., Nature’s Bounty, Ancient GreenFields PVT LTD, Gaia Herbs, and NOW Foods have maintained significant market share due to their extensive range of high-quality herbal supplements, consumer trust, and strong distribution networks. These companies have solidified their positions by offering various products that cater to growing consumer demands for natural, plant-based wellness solutions.

Leading players like Jarrow Formulas, Inc., Gaia Herbs, and NOW Foods continue to dominate the herbal supplement market through their commitment to sustainability, quality, and innovation. Their product offerings range from traditional herbs to innovative combinations designed to support various health concerns, from immune health to digestive wellness and stress management. These companies also benefit from strong retail relationships, expanding e-commerce channels, and an increasing focus on product transparency and ingredient sourcing. Nature’s Bounty and Solgar, Inc. lead the market with their well-established brand reputation, robust research capabilities, and adherence to rigorous quality standards, which resonate strongly with consumers seeking safe and effective natural alternatives to conventional medicine.

The herbal supplement market is witnessing a dynamic interplay of established expertise and emerging innovations as new brands continue to carve a niche in the wellness industry. Increasing mergers and acquisitions (M&A), strategic collaborations, and consumer-driven trends like organic, non-GMO, and eco-conscious products drive heightened competition. Companies that successfully integrate scientific rigor with consumer-centric trends, such as personalized nutrition and sustainable sourcing, are well-positioned to create lasting value in this rapidly growing sector. As demand for natural health products continues to rise, the market will increasingly be shaped by affordability, accessibility, and ethical ingredient sourcing, ensuring the continued growth of the herbal supplement landscape.

Key Herbal Supplements Companies:

The following are the leading companies in the herbal supplements market. These companies collectively hold the largest market share and dictate industry trends.

- Jarrow Formulas, Inc.

- Solgar, Inc.

- Nature’s Bounty

- Ancient GreenFields PVT LTD

- Gaia Herbs

- NOW Foods

- Herbalife

- Swanson

- Nature's Way

- Amway

Recent Developments

-

In June 2023, Solgar partnered with the Great Run to promote health and wellness across the UK, aiming to encourage mass participation in fitness and nutrition initiatives.

-

In January 2022, Gaia Herbs announced its achievement of ISO certification for 24 in-house testing methods, enhancing its commitment to quality and sustainability in herb production across international markets.

Herbal Supplements Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 45.65 billion

Revenue forecast in 2033

USD 90.24 billion

Growth rate

CAGR of 8.89% from 2025 to 2033

Actual data

2021 - 2024

Forecast period

2025 - 2033

Report updated

June 2025

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, formulation, consumer, sales channel, and region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; India; China; Japan; Australia; South Korea; Thailand; Brazil; Argentina; Saudi Arabia; UAE; South Africa; Kuwait

Key companies profiled

Jarrow Formulas, Inc.; Solgar, Inc.; Nature’s Bounty; Ancient GreenFields PVT LTD; Gaia Herbs; NOW Foods; Herbalife; Swanson; Nature's Way; Amway

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Global Herbal Supplements Market Report Segmentation

This report forecasts revenue growth and provides an analysis on the latest trends in each of the sub-segments from 2021 to 2033. For this report, Grand View Research has segmented the herbal supplements market on the basis of product, formulation, consumer, sales channel, and region.

-

Product Outlook (Revenue, USD Million, 2021 - 2033)

-

Moringa

-

Echinacea

-

Flaxseeds

-

Turmeric

-

Ginger

-

Ginseng

-

Others

-

-

Formulation Outlook (Revenue, USD Million, 2021 - 2033)

-

Tablets

-

Capsules

-

Liquid

-

Powder

-

Soft Gels

-

Others

-

-

Consumer Outlook (Revenue, USD Million, 2021 - 2033)

-

Pregnant Women

-

Adults

-

Pediatric

-

Geriatric

-

-

Distribution Channel Outlook (Revenue, USD Million, 2021 - 2033)

-

Offline

-

Pharmacies & Drug Stores

-

Hypermarkets/Supermarkets

-

Others

-

-

Online

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa (MEA)

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global herbal supplements market size was estimated at USD 42.33 billion in 2024 and is expected to reach USD 45.65 billion in 2025.

b. The global herbal supplements market is expected to grow at a compound annual growth rate of 8.89% from 2025 to 2033 to reach USD 90.24 billion by 2033.

b. Turmeric segment dominated the herbal supplements market with a share of 23.95% in 2024. This is attributable to its proven anti-inflammatory benefits and rising demand across functional health products.

b. Some key players operating in the herbal supplements market include Jarrow Formulas, Inc.; Solgar, Inc.; Nature’s Bounty; Ancient GreenFields Pvt. Ltd.; Gaia Herbs; and Now Foods.

b. Key factors that are driving the market growth include rising inclination towards natural products, awareness regarding preventive healthcare, and surging spending on health and wellness.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.